Automotive Specialty Coatings Market Size, Share, Trends, Growth 2034

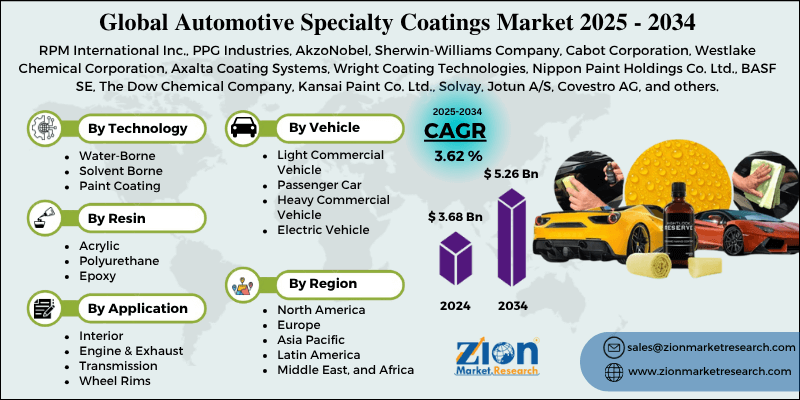

Automotive Specialty Coatings Market By Technology (Water-Borne, Solvent Borne, and Paint Coating), By Application (Interior, Engine & Exhaust, Transmission, Wheel Rims, and Others), By Resin Type (Acrylic, Polyurethane, Epoxy, and Others), By Vehicle Type (Light Commercial Vehicle, Passenger Car, Heavy Commercial Vehicle, and Electric Vehicle), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

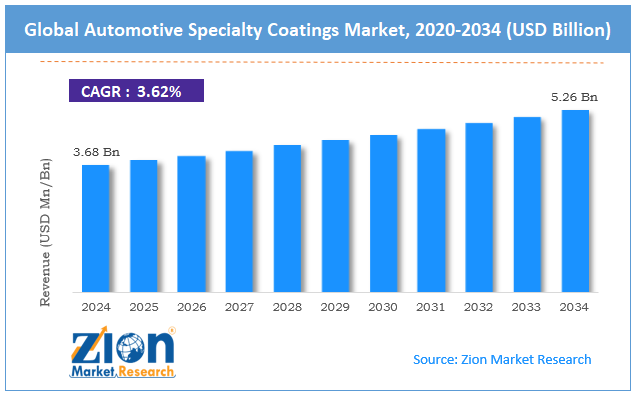

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.68 Billion | USD 5.26 Billion | 3.62% | 2024 |

Automotive Specialty Coatings Industry Perspective:

The global automotive specialty coatings market size was worth around USD 3.68 billion in 2024 and is predicted to grow to around USD 5.26 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.62% between 2025 and 2034.

Automotive Specialty Coatings Market: Overview

Automotive specialty coatings are innovative films or enamels designed to impart superior protection to the automotive. These specialty coatings not only improve the overall lifespan of a vehicle but also deliver several aesthetic-based advantages. Regular automotive coatings protect against common damaging elements such as ultraviolet rays, chemical stains, and scratches.

Specialty coatings, on the other hand, offer higher protection. They are used to produce a protective and hard layer over the initial regular paint. These coatings safeguard the vehicle against serious environmental hazards.

Specialty coatings are designed to withstand the harsh and ever-changing environmental conditions, allowing the vehicle to deliver as expected even after multiple years of use. The common benefits of automotive specialty coatings include enhanced appearance, superior protection, and easy maintenance.

During the projection period, the demand for automotive specialty coatings is expected to be led by increased sales of automobiles. Rising revenue in the used car sector will open new avenues for further growth in the industry, according to research.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive specialty coatings market is estimated to grow annually at a CAGR of around 3.62% over the forecast period (2025-2034)

- In terms of revenue, the global automotive specialty coatings market size was valued at around USD 3.68 billion in 2024 and is projected to reach USD 5.26 billion by 2034.

- The automotive specialty coatings market is projected to grow at a significant rate due to the rising demand for automotives across the globe.

- Based on the technology, the waterborne segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the resin type, the acrylic segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Automotive Specialty Coatings Market: Growth Drivers

Rising demand for automotives across the globe will fuel the market expansion rate

The global automotive specialty coatings market will be driven by the growing demand for automotives across the globe. Factors such as the increasing sale of passenger cars, rising disposable income, higher access to financial schemes such as monetary loans with a minimal down payment, and the emergence of ride-sharing businesses have fueled demand for fuel-efficient automotives.

In July 2025, Lyft, a US-based transportation company, announced the addition of a new feature in its application. The novel addition will allow ride-sharing seekers to be matched with licensed taxis if the vehicle can reach the location before ride-sharing vehicles.

On the other hand, emerging economies are registering higher sales of bikes and scooters since they allow easy navigation across dense traffic and narrow lanes. More than 20 million two-wheelers were sold in the Indian market in 2024. As the number of vehicles on the road increases, specialty coating makers will gain access to more customers and ultimately higher revenue.

Increasing demand for electric vehicles (EVs) to promote the development of new protective coatings

Electric vehicles (EVs) have managed to reshape the global automotive industry in the last few years. According to the International Energy Agency (IEA), electric car sales in the US were projected to increase by 20% in 2024 compared to the previous year.

Growing awareness about the environmental impact of internal combustion engine-powered vehicles, fluctuating fuel prices, and the increasing launch of affordable EVs is fueling revenue in the electric vehicle sector. The trend has given rise to a surge in the use of specialty coatings designed to promote the lifespan of EVs across environmental conditions.

For instance, in a recent event, Dow Inc. announced the launch of DOWSIL™ FC-2024 Battery Fire Protection Coating. It is a one-component silicone solution to protect EV batteries from hot particles. The coating can resist flames as high in temperature as 1200°C, thus benefiting the global automotive specialty coating market.

Automotive Specialty Coatings Market: Restraints

High cost of the protective layer to limit market expansion in the future

The global automotive specialty coatings industry is expected to be restricted due to the high cost of coating production and final application. For instance, the average price of using paint protection film on mirrors or bumpers can range between USD 500 and USD 1500.

The cost may vary depending on the type and extent of coating. The growing economic uncertainty across the globe can affect demand for automotive specialty coatings in the coming years.

Automotive Specialty Coatings Market: Opportunities

Consistent addition of new options in the market will generate higher growth opportunities

The global automotive specialty coatings market is anticipated to generate growth opportunities due to the consistent addition of new options. Increasing the launch of high-performance coatings for all vehicle types will significantly improve growth opportunities for the market players.

In April 2024, the coating division of BASF, one of the world’s most prominent chemical companies, announced the launch of a new range of eco-efficient clearcoats and undercoats. These solutions offer excellent productivity and quality and contribute to reduced carbon dioxide emissions. With this move, BASF plans to promote sustainability in the automotive specialty coatings sector.

In March 2025, AkzoNobel launched Sikkens Autowave Optima in the North American market. It is the next-generation one-stop application waterborne basecoat, allowing body shops across the region to deliver sustainable and productive coating solutions to their clients.

In April 2025, BASF took another step toward significantly improving the coating sector by launching new digital solutions for the automotive refinish industry. BASF has launched next-generation color scanning technology in the form of the spectrophotometer ScanR, which is expected to improve precise color identification and perfect matching for coating.

Automotive Specialty Coatings Market: Challenges

Supply chain disruption of raw materials to challenge market growth trends in the future

The global automotive specialty coatings industry is projected to be challenged by the ongoing concerns over supply chain disruption of raw materials and finished goods. The war between Russia and Ukraine and emerging tensions between the US and China may impact smooth operations in the global chemical industry, affecting the production of automotive specialty coatings.

Automotive Specialty Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Specialty Coatings Market |

| Market Size in 2024 | USD 3.68 Billion |

| Market Forecast in 2034 | USD 5.26 Billion |

| Growth Rate | CAGR of 3.62% |

| Number of Pages | 211 |

| Key Companies Covered | RPM International Inc., PPG Industries, AkzoNobel, Sherwin-Williams Company, Cabot Corporation, Westlake Chemical Corporation, Axalta Coating Systems, Wright Coating Technologies, Nippon Paint Holdings Co. Ltd., BASF SE, The Dow Chemical Company, Kansai Paint Co. Ltd., Solvay, Jotun A/S, Covestro AG, and others. |

| Segments Covered | By Technology, By Application, By Resin Type, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Specialty Coatings Market: Segmentation

The global automotive specialty coatings market is segmented based on technology, application, resin type, vehicle type, and region.

Based on the technology, the global market divisions are water-borne, solvent-borne, and paint-coating. In 2024, the highest revenue generator was the waterborne segment since these coatings are more environmentally friendly. Waterborne specialty coatings meet regulatory standards due to the presence of low volatile organic compounds (VOCs). In terms of formulation, water comprises 70% of the final weight of waterborne specialty coatings.

Based on application, the global automotive specialty coatings industry is divided into interior, engine & exhaust, transmission, wheel rims, and others.

Based on the resin type, the global market divisions are acrylic, polyurethane, epoxy, and others. In 2024, the industry was led by acrylic type of resins as they are used in almost all types of specialty coatings in the form of base coats and topcoats. Acrylic resins are highly resistant to UV rays and changing weather conditions. The average cost of coating-based acrylic resins can range between USD 3 and USD 9 per kg, according to research.

Based on vehicle type, the global market segments are light commercial vehicles, passenger cars, heavy commercial vehicles, and electric vehicles.

Automotive Specialty Coatings Market: Regional Analysis

Asia-Pacific is to be led by China during the forecast period, according to research

The global automotive specialty coatings market is projected to be led by Asia-Pacific during the projection period. China is expected to emerge as the highest regional market revenue generator. At present, China is home to one of the world’s most prominent chemical industries.

According to the Information Technology & Innovation Foundation (ITIF), around 44% of global chemical production in 2022 occurred in China. The country boasts a massive and robust chemical manufacturing infrastructure, with the availability of key raw materials and cost-effective labor. Additionally, China also leads the global automotive production rate.

In 2023, the country produced over 30 million motor vehicles according to official records. It is currently the world’s largest producer and exporter of electric vehicles of all types.

The growing disposable income and changing lifestyle of the regional population have created a demand for specialty coatings as vehicle owners seek novel ways to protect their vehicles from early deterioration. India, South Korea, and Japan will also contribute significantly to the regional market. The growing demand for used cars and the rising number of custom car shops will aid regional market expansion.

Automotive Specialty Coatings Market: Competitive Analysis

The global automotive specialty coatings market is led by players like:

- RPM International Inc.

- PPG Industries

- AkzoNobel

- Sherwin-Williams Company

- Cabot Corporation

- Westlake Chemical Corporation

- Axalta Coating Systems

- Wright Coating Technologies

- Nippon Paint Holdings Co. Ltd.

- BASF SE

- The Dow Chemical Company

- Kansai Paint Co. Ltd.

- Solvay

- Jotun A/S

- Covestro AG

The global automotive specialty coatings market is segmented as follows:

By Technology

- Water-Borne

- Solvent Borne

- Paint Coating

By Application

- Interior

- Engine & Exhaust

- Transmission

- Wheel Rims

- Others

By Resin Type

- Acrylic

- Polyurethane

- Epoxy

- Others

By Vehicle Type

- Light Commercial Vehicle

- Passenger Car

- Heavy Commercial Vehicle

- Electric Vehicle

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive specialty coatings are innovative films or enamels designed to impart superior protection to the automotive.

The global automotive specialty coatings market will be driven by the growing demand for automotives across the globe.

According to study, the global automotive specialty coatings market size was worth around USD 3.68 billion in 2024 and is predicted to grow to around USD 5.26 billion by 2034.

The CAGR value of the automotive specialty coatings market is expected to be around 3.62% during 2025-2034.

The global automotive specialty coatings market is projected to be led by Asia-Pacific during the projection period.

The global automotive specialty coatings market is led by players like RPM International Inc., PPG Industries, AkzoNobel, Sherwin-Williams Company, Cabot Corporation, Westlake Chemical Corporation, Axalta Coating Systems, Wright Coating Technologies, Nippon Paint Holdings Co., Ltd., BASF SE, The Dow Chemical Company, Kansai Paint Co., Ltd., Solvay, Jotun A/S, and Covestro AG.

The report explores crucial aspects of the automotive specialty coatings market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed