Automotive Electrical Products Market Size, Share, Trends, Growth & Forecast 2034

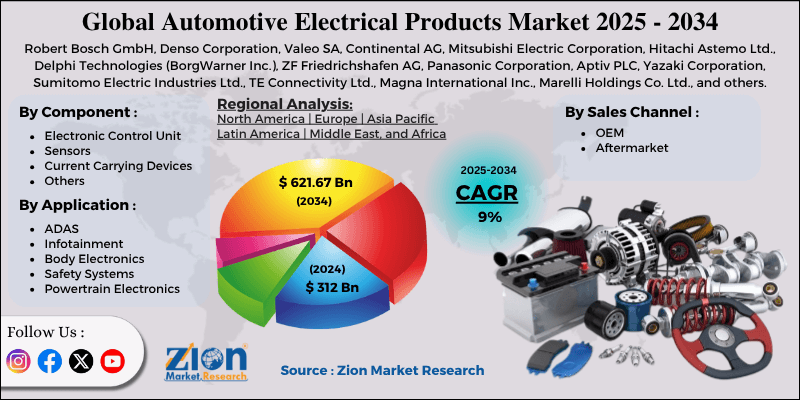

Automotive Electrical Products Market By Component (Electronic Control Unit, Sensors, Current Carrying Devices, and Others), By Application (ADAS, Infotainment, Body Electronics, Safety Systems, Powertrain Electronics), By Sales Channel (OEM, Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

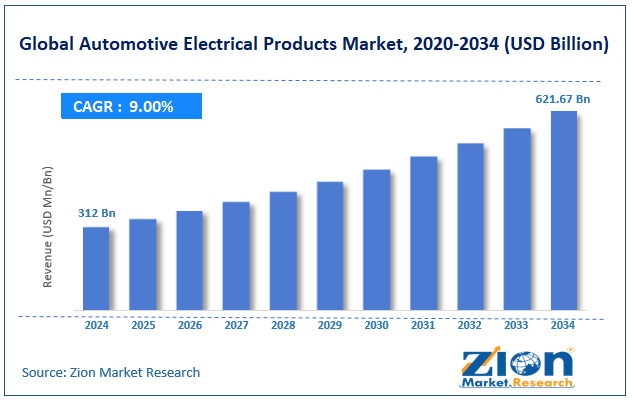

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 312 Billion | USD 621.67 Billion | 9% | 2024 |

Automotive Electrical Products Industry Perspective:

The global automotive electrical products market size was approximately USD 312 billion in 2024 and is projected to reach around USD 621.67 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive electrical products market is estimated to grow annually at a CAGR of around 9% over the forecast period (2025-2034)

- In terms of revenue, the global automotive electrical products market size was valued at around USD 312 billion in 2024 and is projected to reach USD 621.67 billion by 2034.

- The automotive electrical products market is projected to grow significantly due to the increasing demand for hybrid and electric vehicles, rising consumer preference for safety and comfort features, and stringent government regulations on emissions and fuel efficiency.

- Based on component, the electronic control unit segment is expected to lead the market, while the sensors segment is expected to grow considerably.

- Based on application, the powertrain electronics segment is the largest, while the ADAS segment is projected to experience substantial revenue growth over the forecast period.

- Based on sales channel, the OEM segment is expected to lead the market compared to the aftermarket segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Automotive Electrical Products Market: Overview

Automotive electrical products comprise a broader range of components that control and power the electrical systems of newer vehicles, including alternators, batteries, lighting systems, sensors, starter motors, wiring harnesses, and ECUs. These products are essential for providing effective power distribution, connectivity, and safety in both electric and conventional vehicles. The global automotive electrical products market is projected to experience substantial growth, driven by the increasing adoption of hybrid and electric cars, the rising integration of advanced electronics in vehicles, and a focus on vehicle safety and regulatory compliance. The surging shift towards hybrid and electric vehicles is driving demand for advanced electrical components, including inverters, batteries, and converters. This transformation is driving automakers to invest in high-performance electrical architectures that improve energy efficiency and sustainability.

Furthermore, newer vehicles are equipped with several sensors, electronic modules, and controllers for connectivity and automation. This rising electronic complexity fuels the demand for strong and reliable electrical systems. As vehicles evolve towards connected functionality and automation, electrical components are becoming essential to performance and design. Governments across the globe are mandating advanced safety systems like airbags, ESC, and adaptive lighting. These safety features heavily depend on precise control systems and electrical components. As automakers strive to meet regulatory needs, the demand for well-developed automotive electrical products continues to rise.

Despite the growth, the global market is hindered by factors such as the high initial cost of advanced electrical components and the complexity of electrical system architecture. Integrating advanced electrical systems significantly increases the cost of vehicle manufacturing. Components such as sensors and Li-ion batteries contribute to the production costs, making vehicles more expensive for end users. This cost factor hinders adoption in developing regions, where affordability is a crucial consideration. Likewise, modern vehicle architectures comprise vast networks of interconnected electrical components. Managing compatibility, system reliability, and design complexity becomes increasingly tricky. This results in longer development cycles and elevated costs for manufacturers.

Nonetheless, the global automotive electrical products industry stands to gain from several key opportunities, including the expansion of electric vehicle infrastructure and the growth of electrification in developing regions. Global investments in EV charging networks are creating ample opportunities for electrical component suppliers. Products such as converters, power controllers, and relays are experiencing increasing demand, and government incentives for EV infrastructure further enhance the industry's potential. Countries such as Indonesia, India, and Brazil are rapidly promoting electric mobility through policy incentives. This creates new markets for electrical systems, such as battery modules, sensors, and wiring harnesses. Local manufacturing initiatives improve affordability and accessibility.

Automotive Electrical Products Market Dynamics

Growth Drivers

How is the automotive electrical products market augmented by the surging demand for connected and smart vehicles?

The automotive sector is experiencing a rise in connected vehicle technology, which largely depends on advanced electrical infrastructure. Features such as in-car connectivity, over-the-air (OTA) updates, and real-time diagnostics require robust electronic and electrical systems. Prominent manufacturers such as Mercedes-Benz, Hyundai, and Ford are investing in intelligent electrical platforms that support cloud-based communication. The growth of 5G and IoT infrastructure is further fueling this demand, prompting OEMs to enhance the integration and design of their electrical systems.

How is the expansion of production of luxury and high-performance vehicles fueling the progress of the automotive electrical products market?

The worldwide growth in consumer preference for high-performance, luxury, and feature-rich vehicles is another key driver of growth for the automotive electrical products market. These vehicles integrate complex electrical systems for adaptive lighting, infotainment, automatic climate control, and electronic suspension. This trend drives the consumption of premium-grade electrical components. This heightened emphasis on safety, comfort, and performance is driving increased electrical load demands, thereby expanding the market's revenue potential.

Restraints

Complex design and integration challenges negatively impact the market growth

As vehicles become more digitally connected and electrified, integrating different electrical systems into a compact space presents significant challenges in terms of compatibility and design intricacies. The average number of ECUs in newer vehicles has exceeded 100 units, resulting in issues related to heat dissipation, software synchronization, and electromagnetic interference. Continental and Bosch (reports, 2024) noted that software-hardware integration complexity now accounts for nearly 25% of automotive development delays. Additionally, ensuring interoperability between systems from multiple suppliers complicates quality and production control.

Opportunities

How does the emergence of Software-Defined Vehicles (SDVs) offer advantageous conditions for the development of the automotive electrical products market?

The growth of software-defined vehicles, where vehicle functions are controlled through centralized electronic frameworks, creates significant opportunities for electrical product innovation. These vehicles depend on advanced electrical systems for real-time data communication, reconfiguration, and computing. Automakers such as Mercedes-Benz, BMW, and Hyundai have announced major SDV roadmaps that incorporate OTA updates and flexible ECU networks. This inclination requires new-generation wiring harnesses, power distribution units, and control modules, driving demand for well-developed electrical solutions and impacting the growth of the automotive electrical products industry.

Challenges

Dependence on Tier-1 suppliers and OEM consolidation challenge the market growth

The industry's dependency on a small number of Tier-1 suppliers, such as Continental, Denso, and Bosch, creates challenges for smaller players seeking to enter the supply chain. These dominant companies control advanced R&D and proprietary solutions, resulting in limited supplier diversity. According to the reports (2024), more than 70% of worldwide automotive electrical components are sourced from fewer than 15 companies. This consolidation results in higher bargaining power and pricing pressure for OEMs. It also exposes the supply chain to significant disturbances if major players experience operational setbacks or regional trade restrictions.

Automotive Electrical Products Market: Segmentation

The global automotive electrical products market is segmented based on component, application, sales channel, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on component, the global automotive electrical products industry is divided into electronic control units, sensors, current-carrying devices, and others. The electronic control unit segment registers a leading share in the market. ECUs play a crucial role as the vehicle’s brain, managing systems like infotainment, safety, engine control, and ADAS. Their rising integration in hybrid, electric, and connected vehicles fuels strong demand, backed by the growing digitalization and automation trends.

Based on application, the global automotive electrical products market is segmented into ADAS, infotainment, body electronics, safety systems, and powertrain electronics. The powertrain electronics segment held a dominant share in the market, as it forms the basis of vehicle performance and energy efficiency. These systems control vital functions, such as battery charging, engine management, and power distribution. The rising adoption of hybrid and electric vehicles further drives the demand for advanced powertrain electronics to enhance propulsion and reduce emissions.

Based on sales channel, the global market is segmented into OEM and aftermarket. The OEM segment holds a leadership position in the market, driven by the increasing integration of electrical systems in newer vehicles. Automakers are progressively equipping vehicles with advanced ECUs, wiring harnesses, and sensors during production to meet safety and efficiency standards. Continuous advancement in connected and electric cars further strengthens OEM demand across the globe.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Automotive Electrical Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Electrical Products Market |

| Market Size in 2024 | USD 312 Billion |

| Market Forecast in 2034 | USD 621.67 Billion |

| Growth Rate | CAGR of 9% |

| Number of Pages | 216 |

| Key Companies Covered | Robert Bosch GmbH, Denso Corporation, Valeo SA, Continental AG, Mitsubishi Electric Corporation, Hitachi Astemo Ltd., Delphi Technologies (BorgWarner Inc.), ZF Friedrichshafen AG, Panasonic Corporation, Aptiv PLC, Yazaki Corporation, Sumitomo Electric Industries Ltd., TE Connectivity Ltd., Magna International Inc., Marelli Holdings Co. Ltd., and others. |

| Segments Covered | By Component, By Application, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Electrical Products Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Automotive Electrical Products Market?

The Asia Pacific is likely to sustain its leadership in the automotive electrical products market due to the expanding automotive production base, rapid electrification and EV adoption, and the presence of leading component manufacturers. The Asia Pacific region holds a leading rank primarily due to its substantial vehicle production capacity. Economies such as South Korea, Japan, India, and China collectively account for more than 55% of global automobile manufacturing in 2024. This large-scale production fuels significant demand for electrical systems integrated into both commercial and passenger vehicles.

Moreover, the region leads in the growth of electric cars, backed by robust infrastructure investments and government incentives. China alone accounted for over 60% of global EV sales in 2024, according to the IEA. This growth in EV production majorly drives the need for batteries, sensors, ECUs, and other critical electrical products.

Furthermore, the region is home to prominent automotive electrical component manufacturers, including Hitachi Automotive Systems, Mitsubishi Electric, and Denso Corporation. These companies fuel continuous advancement and localize production to meet the regional demand. Their presence enhances supply chain efficiency and facilitates the adoption of next-generation electrical solutions.

Europe continues to hold the second-highest share in the automotive electrical products industry, thanks to its strong automotive manufacturing base, high adoption of hybrid and electric vehicles, and significant R&D investments and technological advancements. Europe registers a leading position in the market due to its strong automotive industry. Major automakers, including Mercedes-Benz, Volkswagen, BMW, and Stellantis, collectively account for more than 20% of global vehicle production. This strong manufacturing infrastructure fuels large-scale demand for high-class electrical systems integrated into advanced vehicle platforms.

Moreover, Europe is a forerunner in EV adoption, backed by stringent emission regulations and sustainability goals. This speedy electrification drives the demand for advanced electrical components, comprising battery management systems, sensors, and ECUs. Additionally, Europe invests substantially in automotive R&D, registering more than €60 billion every year in mobility advancements. Research institutes and companies collaborate on next-generation technologies, comprising connected systems and power electronics. This strong R&D focus backs the region's dominance in high-performance and premium electrical components.

Automotive Electrical Products Market: Competitive Analysis

The leading players in the global automotive electrical products market are:

- Robert Bosch GmbH

- Denso Corporation

- Valeo SA

- Continental AG

- Mitsubishi Electric Corporation

- Hitachi Astemo Ltd.

- Delphi Technologies (BorgWarner Inc.)

- ZF Friedrichshafen AG

- Panasonic Corporation

- Aptiv PLC

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- TE Connectivity Ltd.

- Magna International Inc.

- Marelli Holdings Co. Ltd.

Automotive Electrical Products Market: Key Market Trends

Growth of connected and smart vehicle technologies:

Connected vehicles are revolutionizing automotive electrical systems with cloud connectivity, IoT, and over-the-air updates. Electrical components now support data-driven functionalities, such as vehicle-to-everything (V2X) communication and predictive maintenance. This connectivity trend is transforming vehicle architecture, making electrical integration smarter and software-centric.

Rising integration of vehicle electrification systems:

A significant trend in the automotive electrical products sector is the broader integration of electrification technologies in all vehicle types. Automakers are investing heavily in high-voltage wiring, efficient battery management systems, and advanced alternators to enhance performance. This trend is driven by worldwide commitments to decrease emissions and phase out internal combustion engines by the 2030s.

The global automotive electrical products market is segmented as follows:

By Component

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

By Application

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive electrical products comprise a broader range of components that control and power the electrical systems of newer vehicles, including alternators, batteries, lighting systems, sensors, starter motors, wiring harnesses, and ECUs. These products are essential for providing effective power distribution, connectivity, and safety in both electric and conventional vehicles.

The global automotive electrical products market is projected to grow due to rising trends in vehicle electrification, advancements in automotive electronics and sensors, and rapid urbanization, as well as increased vehicle production.

According to study, the global automotive electrical products market size was worth around USD 312 billion in 2024 and is predicted to grow to around USD 621.67 billion by 2034.

The CAGR value of the automotive electrical products market is expected to be approximately 9% from 2025 to 2034.

Which application segment is expected to dominate the automotive electrical products market by 2034?

The Powertrain Electronics segment is expected to dominate the global market by 2034, driven by the accelerating adoption of hybrid and electric vehicles.

How will macroeconomic factors impact the automotive electrical products market in the coming years?

Macroeconomic factors, including government EV incentives, rising disposable incomes, and technological investments, will drive steady growth in the market over the coming years.

The Automotive Electrical Products Market is witnessing moderate price increases due to rising semiconductor and raw material costs, though technological advancements and mass production are helping stabilize overall component pricing.

Asia Pacific is expected to lead the global automotive electrical products market during the forecast period.

The key players profiled in the global automotive electrical products market include Robert Bosch GmbH, Denso Corporation, Valeo SA, Continental AG, Mitsubishi Electric Corporation, Hitachi Astemo, Ltd., Delphi Technologies (BorgWarner Inc.), ZF Friedrichshafen AG, Panasonic Corporation, Aptiv PLC, Yazaki Corporation, Sumitomo Electric Industries, Ltd., TE Connectivity Ltd., Magna International Inc., and Marelli Holdings Co., Ltd.

The report examines key aspects of the automotive electrical products market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed