Automated Feeding Systems Market Size, Share, Trends, Growth & Forecast 2034

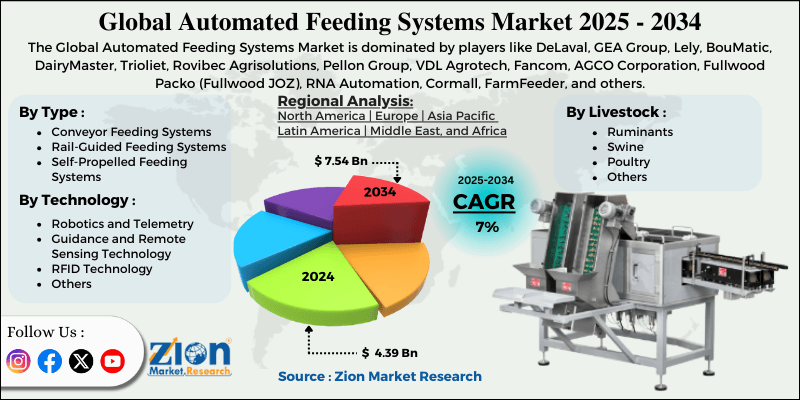

Automated Feeding Systems Market By Type (Conveyor Feeding Systems, Rail-Guided Feeding Systems, Self-Propelled Feeding Systems), By Livestock (Ruminants, Swine, Poultry, and Others), By Technology (Robotics and Telemetry, Guidance and Remote Sensing Technology, RFID Technology, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

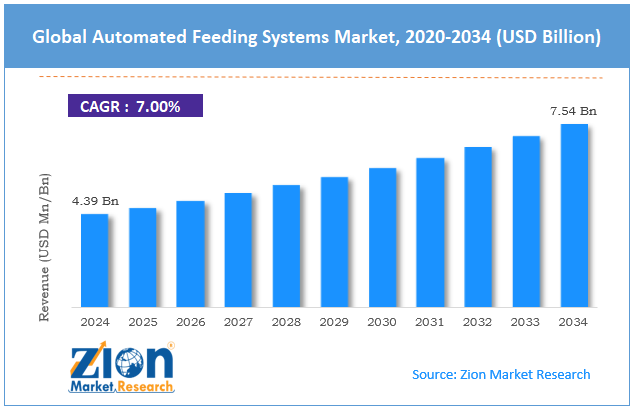

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.39 Billion | USD 7.54 Billion | 7.0% | 2024 |

Automated Feeding Systems Industry Perspective:

What will be the size of the automated feeding system market from 2025 to 2034?

The global automated feeding systems market size was around USD 4.39 billion in 2024 and is projected to reach USD 7.54 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automated feeding systems market is estimated to grow annually at a CAGR of around 7% over the forecast period (2025-2034)

- In terms of revenue, the global automated feeding systems market size was valued at around USD 4.39 billion in 2024 and is projected to reach USD 7.54 billion by 2034.

- The automated feeding systems market is projected to grow significantly, driven by the rising adoption of precision farming technologies, labor cost pressures in agriculture, and advancements in sensor and automation technologies.

- Based on type, the conveyor feeding systems segment is expected to lead the market, while the self-propelled feeding systems segment is expected to grow considerably.

- Among livestock, the ruminants segment is the dominant, while the poultry segment is projected to record sizeable revenue over the forecast period.

- Based on technology, the robotics and telemetry segment is expected to lead the market, followed by the guidance and remote sensing segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by the Asia Pacific.

Automated Feeding Systems Market: Overview

Automated feeding systems are dedicated technologies for delivering food to animals at scheduled times in the appropriate amounts with minimal human intervention. Commonly used in aquaculture and agriculture, these systems enhance efficacy by reducing labor, assuring consistent nutrition, and minimizing feed waste. The global automated feeding systems market is poised to expand rapidly, driven by surging demand for efficient food production, advances in smart farming technologies, and the growth of commercial livestock and aquaculture farms. The growing worldwide population increases demand for dairy, fish, and meat products. Automated feeding systems enhance productivity by providing optimized, consistent feeding. This results in elevated output with fewer resources.

Moreover, technologies like AI, IoT, and sensors improve feeding precision. These systems allow real-time monitoring and adaptive feeding tactics. This enhances animal health and feed efficacy. Furthermore, large-scale farms need reliable, scalable feeding solutions. automated systems support uniform in large populations. This maintains consistent quality and growth rates.

Despite growth, the global market is constrained by limited technical knowledge among growers, maintenance and repair challenges, and poor infrastructure in rural areas. Operating automated systems requires technical skills and training. The lack of expertise may lead to inefficient use. This demotivates farmers from adopting advanced solutions. Regular servicing is important for system reliability. Mechanical or software failures may hamper feeding schedules. Downtime may negatively impact animal health. Many farms lack internet connection and stable electricity. This limits the use of cloud-based and smart feeding systems. Infrastructure gaps slow industry penetration.

Nonetheless, the global automated feeding systems industry stands to benefit from several key opportunities, including the development of cost-effective feeding solutions, integration with precision agriculture, and AI-based predictive feeding systems. Affordable and modular systems can appeal to small-scale farmers. Streamlined designs reduce installation and maintenance costs. This widens the consumer base. Combining feeding systems with analytics and sensors enhances accuracy. Data-driven feeding optimizes animal health and growth, improving farm efficiency. Additionally, AI can precisely predict feed requirements. Predictive feeding enhances productivity and reduces waste. This adds substantial value to automated systems.

Automated Feeding Systems Market Dynamics

Growth Drivers

How is the growing demand for protein & dairy boosting the automated feeding systems market growth?

Worldwide consumption of dairy, meat, and eggs continues to climb as diets shift and populations grow. This compels producers to increase herd sizes and intensify production. Larger livestock operations need high-throughput, consistent feeding solutions that manual methods cannot provide. Automated feeders support this scale by delivering even nutrition, enhancing growth rates, and maintaining animal welfare at elevated volumes. As producers aim to meet market demand without proportionally raising costs or labor, automated feeding has become a strategic investment for competitive growth.

How are technological advances & smart integration significantly fueling the growth of the automated feeding systems market?

Improvements in AI, ML, IoT, and sensor networks are transforming feeding systems into data-driven, autonomous platforms that adjust feed delivery without manual input. Contemporary systems can detect changes in animal appetite, equipment status, and environmental conditions and automatically recalibrate delivery schedules. Several solutions now include remote control and real-time alerts via mobile applications and dashboards, improving responsiveness and reducing on-farm oversight pressure. This deepening tech integration is widening the appeal of automated feeders across both emerging and commercial farming environments, driving growth in the automated feeding systems market.

Restraints

Dependence on electricity and connectivity negatively impacts the market progress

Automated feeding systems need internet connectivity and stable electricity for AI-driven adjustments and remote monitoring. Rural farms in developing regions may experience weak network coverage or power outages. Interruptions may result in equipment malfunctions or operational inefficiencies. Reliance on external infrastructure makes systems less reliable in these regions. This constraint lowers adoption in areas with inadequate power and communication facilities.

Opportunities

How does integration with livestock management platforms offer favorable prospects for the expansion of the automated feeding systems market?

The surging adoption of digital farm management platforms offers major opportunities to integrate feeding systems with wider operations. Centralized monitoring allows farmers to enhance health, feed, and productivity simultaneously. Integration enhances operational efficacy and decision-making. Cross-platform compatibility may raise vendor adoption. This creates a robust opportunity in the automated feeding systems industry for technologically advanced solutions.

Challenges

Risk of system failures and downtime restricts the market growth

Automated feeding systems can be vulnerable to software bugs, sensor malfunctions, or hardware failures. Unplanned downtime may impact animal health and farm productivity. Backup systems or contingency plans are usually needed. Risk mitigation increases operational costs; managing these risks is a consistent challenge for both vendors and farmers.

Automated Feeding Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automated Feeding Systems Market |

| Market Size in 2024 | USD 4.39 Billion |

| Market Forecast in 2034 | USD 7.54 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 214 |

| Key Companies Covered | DeLaval, GEA Group, Lely, BouMatic, DairyMaster, Trioliet, Rovibec Agrisolutions, Pellon Group, VDL Agrotech, Fancom, AGCO Corporation, Fullwood Packo (Fullwood JOZ), RNA Automation, Cormall, FarmFeeder, and others. |

| Segments Covered | By Type, By Livestock, By Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automated Feeding Systems Market: Segmentation

The global automated feeding systems market is segmented based on type, livestock, technology, and region.

Based on type, the global automated feeding systems industry is divided into conveyor feeding systems, rail-guided feeding systems, and self-propelled feeding systems. The conveyor feeding systems segment holds a leading position, with nearly 50% market share, due to its efficiency and reliability. They can handle huge quantities of feed across various livestock operations. Their simple design makes maintenance and installation cost-efficient. This broader applicability keeps them at the forefront of the market segment.

On the other hand, the self-propelled feeding systems segment registers nearly 20-25% market share because these units offer layout flexibility and autonomous mobility. This allows them to navigate barns or feeding areas without fixed infrastructure or tracks.

Based on livestock, the global automated feeding systems market is segmented into ruminants, swine, poultry, and others. The ruminant segment holds a 46% market share due to high feed requirements and complex nutritional needs. Automated systems improve feed precision and consistency in large herds. This enhances weight gain, milk yield, and herd health while reducing labor, helping the segment dominate overall adoption.

Conversely, the poultry segment captures 28-29% market share, backed by the speedy adoption of automated feeding in layer houses and commercial broiler houses, where high stocking densities and frequent feeding schedules benefit sustainability from precision automation. Poultry’s surging demand and integration with health and climate monitoring systems drive its share, ranking it ahead of swine in total market value.

Based on technology, the global market is segmented into robotics and telemetry, guidance and remote sensing technology, RFID technology, and others. The robotics and telemetry segment holds nearly 40% market share due to its ability to deliver feed with high precision, provide automated feedback, and enable real-time monitoring, thereby enhancing feeding accuracy and lowering labor costs across a broad range of livestock operations.

Nonetheless, the guidance and remote sensing technology segment captures approximately 25-30% of the market share. It is widely adopted, as it enables precise navigation of feeding equipment and real-time sensing of animal and environmental conditions. This helps optimize feed distribution and animal diet management with the least direct supervision.

Automated Feeding Systems Market: Regional Analysis

What gives North America a competitive edge in the global Automated Feeding Systems Market?

North America is expected to retain its leading role in the global automated feeding systems market, with an 11.6% CAGR, driven by a large market, advanced adoption, established large-scale livestock operations, and technological advancements and integration. North America holds the leading market share, fueled by increased adoption of automated feeding technologies. The United States alone contributes a notable share of the revenue. Wider adoption on commercial farms strengthens the industry's dominance.

Moreover, the region has many large poultry, dairy, and cattle farms that benefit from automation. Automated systems enhance productivity and precision while reducing labor needs. Large-scale operations create sustained demand for these technologies. Furthermore, regional farms adopt advanced technologies like robotics, IoT, and smart sensors for precision feeding. Real-time monitoring optimizes feed efficacy and animal performance. This technological dominance boosts the market leadership.

Asia Pacific ranks as the second-largest region, with a 6.4% CAGR in the global automated feeding systems industry, driven by rapid growth in livestock production, increased technological adoption, and the expansion of large-scale and commercial farms. Asia Pacific has experienced rapid growth in poultry, aquaculture, and livestock farming. Surging demand for dairy, fish, and meat fuels investment in efficient feeding solutions. This growing production base drives robust adoption of automated feeding systems.

Moreover, regional farmers are steadily embracing modern farming technologies, comprising smart systems and automation. Affordable sensors and mobile connectivity make automation more accessible. This technological move drives the uptake of automated feeders. Additionally, economies like India, China, and Southeast Asian countries are moving from smallholdings to large commercial farms. Larger operations need scalable and effective feeding solutions to remain competitive. This move supports industry growth and the deployment of technology.

Automated Feeding Systems Market: Competitive Analysis

The leading players in the global automated feeding systems market are:

- DeLaval

- GEA Group

- Lely

- BouMatic

- DairyMaster

- Trioliet

- Rovibec Agrisolutions

- Pellon Group

- VDL Agrotech

- Fancom

- AGCO Corporation

- Fullwood Packo (Fullwood JOZ)

- RNA Automation

- Cormall

- FarmFeeder

Automated Feeding Systems Market: Key Market Trends

Development of modular and scalable systems:

Farms are moving toward modular feeding solutions that can scale with herd size and operational growth. These flexible designs allow producers to invest incrementally, thereby increasing access for smaller and mid-sized operations. Scalability drives adoption beyond large commercial farms.

Precision nutrition and individualized feeding:

Modern automated systems support precision nutrition by tailoring feed amounts and formulations to specific groups or individual animals. This trend reduces overfeeding, improves production and growth outcomes, and reduces waste. Precision feeding is increasingly important for sustainability and profitability.

The global automated feeding systems market is segmented as follows:

By Type

- Conveyor Feeding Systems

- Rail-Guided Feeding Systems

- Self-Propelled Feeding Systems

By Livestock

- Ruminants

- Swine

- Poultry

- Others

By Technology

- Robotics and Telemetry

- Guidance and Remote Sensing Technology

- RFID Technology

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed