Alcohol Ingredients Market Size, Share, Growth, Trends, and Forecast 2032

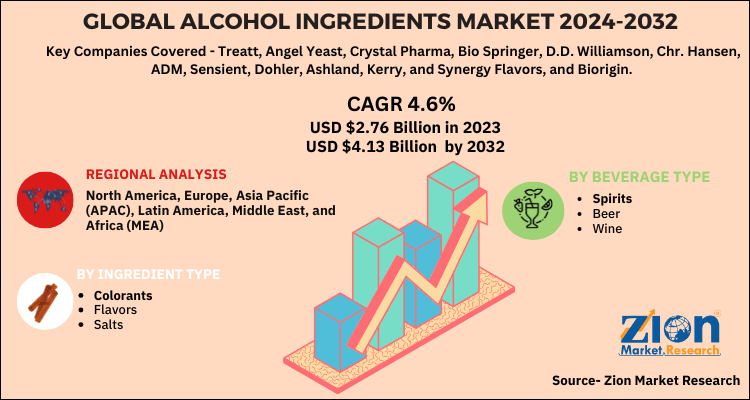

Alcohol Ingredients Market - By Ingredient Type (Colorants, And Flavors, and Salts), By Beverage Type (Spirits, Beer, and Wine), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.76 Billion | USD 4.13 Billion | 4.6% | 2023 |

Alcohol Ingredients Market Insights

According to a report from Zion Market Research, the global Alcohol Ingredients Market was valued at USD 2.76 Billion in 2023 and is projected to hit USD 4.13 Billion by 2032, with a compound annual growth rate (CAGR) of 4.6% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, aqnd the future prospects that may emerge in the Alcohol Ingredients industry over the next decade.

Global Alcohol Ingredients Market: Overview

Alcoholic beverages are drinks that consist of a significant amount of ethanol. It is depressant in nature, whereas the low amount of alcohol may cause sociability, euphoria, and reduced anxiety. However, higher doses may cause unconsciousness and intoxication. In addition, long-term drinking can lead to alcoholism, alcohol abuse, and physical dependence. These beverages include flavors, yeast, colorants, and enzymes. They are widely accepted recreational drugs globally. Alcohol drinking is found to be important in many social cultures. However, the government in several countries monitors the production, consumption, and sale of alcohol carefully.

What are the Market Dynamics of Alcohol Ingredients?

Growth Drivers

The primary growth drivers in the alcohol ingredients market include the surging global demand for craft and premium alcoholic beverages, which necessitates innovative and high-quality ingredients for unique flavor profiles and improved fermentation processes. Advancements in biotechnology and enzyme applications have enabled more efficient production, reducing costs and enhancing product consistency, while the rise in disposable incomes in emerging economies has boosted consumption of sophisticated drinks. Additionally, the trend towards health-conscious alternatives, such as low-alcohol beverages, drives the need for natural ingredients that maintain taste without compromising quality, further propelled by regulatory support for sustainable sourcing.

Restraints

Key restraints impacting the alcohol ingredients market involve stringent government regulations and public health policies aimed at curbing alcohol consumption, including high excise taxes and restrictions on advertising, which can reduce overall demand and hinder market expansion. Fluctuations in raw material prices, particularly for agricultural inputs like grains, hops, and botanicals, due to climate change and geopolitical issues, increase production costs and create supply chain vulnerabilities. Moreover, the growing popularity of non-alcoholic beverages poses a competitive threat, diverting consumer preferences away from traditional alcohol ingredients and challenging manufacturers to adapt.

Opportunities

Opportunities in the alcohol ingredients market are abundant with the increasing focus on sustainability and natural formulations, allowing companies to capitalize on consumer preferences for eco-friendly and clean-label products through innovations like botanical infusions and organic yeasts. Expansion into emerging markets such as Asia-Pacific, where urbanization and a burgeoning middle class drive demand for premium spirits and flavored drinks, presents significant growth potential. Furthermore, the rise of ready-to-drink cocktails and functional beverages opens avenues for specialized ingredients that enhance health benefits, such as low-sodium salts or probiotic enzymes, fostering partnerships and R&D investments.

Challenges

Challenges facing the alcohol ingredients market include supply chain disruptions from environmental factors like droughts affecting crop yields for key inputs such as barley and grapes, leading to price volatility and shortages. Intense competition from synthetic alternatives and non-alcoholic substitutes requires continuous innovation to maintain market share, while navigating diverse regional regulations on ingredient safety and labeling adds complexity to global operations. Additionally, shifting consumer behaviors towards healthier lifestyles demand rapid adaptation, posing risks for companies slow to invest in R&D for low-calorie or allergen-free options.

Global Alcohol Ingredients Market: Segmentation

The global alcohol ingredients market is categorized based on ingredient type as colorants, and flavors, and salts. Of these, the flavors and salts segment is the dominating segment in the global market. These flavors are added to the beverages in order to prevent loss of taste throughout food processing.

These flavors can be artificial or natural. Flavored alcoholic beverages such as beers, spirits, and wines are getting more popular across the world. They have become an integral part of the alcoholic beverages sector.

Based on beverage type, the global market is bifurcated as spirits, beer, and wine. Of these, beer is the leading beverage type segment in the global alcohol ingredients market owing to increasing demand for cider beer, beer made from fruit juice, and craft beer, which may propel the global market growth in the future.

Region-wise, the global market is segregated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Alcohol Ingredients Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Alcohol Ingredients Market |

| Market Size in 2023 | USD 2.76 Billion |

| Market Forecast in 2032 | USD 4.13 Billion |

| Growth Rate | CAGR of 4.6% |

| Number of Pages | 110 |

| Key Companies Covered | Treatt, Angel Yeast, Crystal Pharma, Bio Springer, D.D. Williamson, Chr. Hansen, ADM, Sensient, Dohler, Ashland, Kerry, and Synergy Flavors, and Biorigin. Other major players influencing the global market are Kothari Fermentation and Biochem, Koninklijke DSM, Suboneyo Chemicals Pharmaceuticals, and Chaitanya |

| Segments Covered | By Ingredient Type, By Beverage Type And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

How is the Regional Analysis of Alcohol Ingredients Market Conducted?

Europe to dominate the global market.

Europe holds the largest share at approximately 40%, driven by its rich brewing and distilling heritage, stringent quality regulations, and high consumption rates; Germany leads as the dominating country with significant beer production exceeding 8.8 billion liters annually, supported by demand for specialty malts and hops, while the United Kingdom excels in whisky and gin exports valued at billions, fostering ingredient innovation and sustainable practices across the region.

Asia-Pacific is the fastest-growing region with a projected CAGR of 7.3%, fueled by urbanization, rising middle-class incomes, and increasing preference for premium and flavored beverages; China dominates with annual ethanol production of 190 million liters for beverage applications, alongside India and Japan, where imports of high-ABV alcohols reach hundreds of millions, driving demand for natural flavors and enzymes in craft spirits and RTD cocktails.

North America accounts for a substantial share, led by the United States with a 121% rise in spirits production over the past decade, reaching 2.83 billion pounds, and Canada with spirits sales of 184.9 million liters; this region emphasizes functional and natural ingredients in craft beers and low-alcohol options, supported by regulatory compliance and consumer trends towards premiumization.

Latin America shows moderate growth, with Brazil and Mexico as key countries due to sugarcane-based ethanol production and expanding tequila and rum markets, where ingredients like botanicals and yeasts are vital for export-oriented premium products amid rising domestic consumption.

The Middle East and Africa exhibit emerging potential, particularly in South Africa with wine production and UAE's growing spirits imports, though restrained by cultural and regulatory factors; Israel and GCC countries contribute through demand for imported premium ingredients in hospitality sectors.

Global Alcohol Ingredients Market: Competitive Players

Key players in the global alcohol ingredients market are-

- Treatt

- Angel Yeast

- Crystal Pharma

- Bio Springer

- D.D. Williamson

- Chr. Hansen

- ADM

- Sensient

- Dohler

- Ashland

- Kerry

- Synergy Flavors

- Biorigin.

- Kothari Fermentation and Biochem

- Koninklijke DSM

- Suboneyo Chemicals Pharmaceuticals

- Chaitanya.

Alcohol Ingredients Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Alcoholic beverages are drinks that consist of a significant amount of ethanol. It is depressant in nature, whereas the low amount of alcohol may cause sociability, euphoria, and reduced anxiety. However, higher doses may cause unconsciousness and intoxication. In addition, long-term drinking can lead to alcoholism, alcohol abuse, and physical dependence.

global Alcohol Ingredients Market was valued at USD 2.76 Billion in 2023 and is projected to hit USD 4.13 Billion by 2032, with a compound annual growth rate (CAGR) of 4.6% during the forecast period 2024-2032.

Europe is the dominating region for alcohol ingredients and this demand is expected to increase in the near future, due to growth in the beverage manufacturing activities. North America is considered a mature market for alcoholic beverages, owing to increasing food and beverage industries. Companies focus in this region is to occupy other regions as well.

Key players in the global alcohol ingredients market are Treatt, Angel Yeast, Crystal Pharma, Bio Springer, D.D. Williamson, Chr. Hansen, ADM, Sensient, Dohler, Ashland, Kerry, and Synergy Flavors, and Biorigin. Other major players influencing the global market are Kothari Fermentation and Biochem, Koninklijke DSM, Suboneyo Chemicals Pharmaceuticals, and Chaitanya.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed