Global Beer Market Size, Share, Growth Analysis Report - Forecast 2034

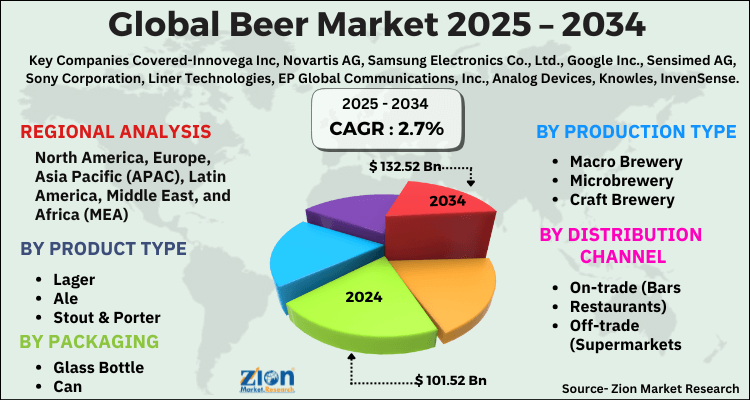

Beer Market By Product Type (Lager, Ale, Stout & Porter, Malt, Others), By Packaging (Glass Bottle, Can, Draught), By Production Type (Macro Brewery, Microbrewery, Craft Brewery), By Distribution Channel (On-trade (Bars, Restaurants), Off-trade (Supermarkets, Online, Liquor Stores)), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

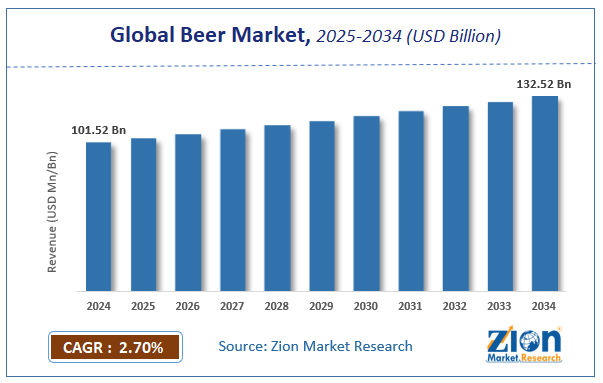

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 101.52 Billion | USD 132.52 Billion | 2.7% | 2024 |

Global Beer Market: Industry Perspective

The global beer market size was worth around USD 101.52 Billion in 2024 and is predicted to grow to around USD 132.52 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 2.7% between 2025 and 2034. The report analyzes the global beer market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the beer industry.

Global Beer Market: Overview

The beer market refers to the global industry involved in the production, distribution, and sale of beer, one of the most widely consumed alcoholic beverages worldwide. It encompasses various segments based on product type (lager, ale, stout, pilsner, etc.), category (premium, super premium, and regular), and distribution channels (on-trade and off-trade). The market is driven by factors such as changing consumer lifestyles, the rising popularity of craft and flavored beers, increasing social consumption among millennials, and expanding urbanization. Additionally, innovations in brewing techniques, the growth of microbreweries, and increasing demand for low- and non-alcoholic beer are shaping the market dynamics. Key regions include North America, Europe, Asia-Pacific, and Latin America, with Asia-Pacific emerging as a major growth hub due to rising disposable incomes and shifting consumer preferences.

Global Beer Market: Growth Drivers

Due to increased exposure and digitization, consumers' preferences and lifestyle choices have transformed in recent years. Alcohol has become a component of social relations as a result of urbanization and shifts in cultural viewpoints, as well as technical improvements. Due to a rise in disposable money and a demand for low-alcohol beverages, the beer business has gained popularity and social acceptance in recent years. The introduction of low- and no-alcohol beer variants, as well as online availability and convenience of delivery to doorsteps in some areas, are all moving the market forward. All these variables have played a crucial role in product diversity, clearing the path for low-alcoholic beverages to arise.

Restraints

Beer is an alcoholic beverage and if drank in excess, alcoholic beverages are known to be addicting as well as harmful to one's health. The rise in the number of people addicted to alcohol has been a major source of concern for governments across the world. As a result, several countries have enacted strict laws governing the sale and distribution of these items. Furthermore, advertising and promotion of such items are restricted, limiting the marketing tactics accessible to producers. Furthermore, several governments back campaigns and non-governmental organizations (NGOs) that oppose the consumption of such beverages. These variables will operate as key roadblocks to market expansion.

Opportunities

Major players are investing heavily in the development of craft beers that have different flavors and aromas to expand their consumer base and maintain a strong position in the market. With growing demand from millennials for such products, the market is expected to have beneficial opportunities for the growth of the global beer market during the forecast period.

Challenges.

The beverage sector is continually undergoing huge transformations, especially with the rise of healthier parts of alcohol. Because consumers are becoming more aware of the considerable health concerns connected with alcohol usage, beverages that are low in alcohol content or devoid of alcohol are becoming more popular than typical alcoholic drinks. Non-alcoholic drinks are growing increasingly popular across the world, which is in line with shifting consumer attitudes toward alcohol usage.

Recent Developments

- In April 2024, B9 Beverages, the Indian company behind the Bira 91 beer brand, announced the launch of a slew of new beers as well as the re-launch of numerous existing ones.

- In March 2024, BrewDog, the world-famous Scottish beer brand, opens its first outlet in India.

Key Insights

- As per the analysis shared by our research analyst, the global beer market is estimated to grow annually at a CAGR of around 2.7% over the forecast period (2025-2034).

- Regarding revenue, the global beer market size was valued at around USD 101.52 Billion in 2024 and is projected to reach USD 132.52 Billion by 2034.

- The beer market is projected to grow at a significant rate due to Growing youth population and demand for craft and premium beer varieties.

- Based on Product Type, the Lager segment is expected to lead the global market.

- On the basis of Packaging, the Glass Bottle segment is growing at a high rate and will continue to dominate the global market.

- Based on the Production Type, the Macro Brewery segment is projected to swipe the largest market share.

- By Distribution Channel, the On-trade (Bars segment is expected to dominate the global market.

- Based on region, Europe is predicted to dominate the global market during the forecast period.

Global Beer Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Beer Market |

| Market Size in 2024 | USD 101.52 Billion |

| Market Forecast in 2034 | USD 132.52 Billion |

| Growth Rate | CAGR of 2.7% |

| Number of Pages | 180 |

| Key Companies Covered | Innovega Inc, Novartis AG, Samsung Electronics Co., Ltd., Google Inc., Sensimed AG, Sony Corporation, Liner Technologies, EP Global Communications, Inc., Analog Devices, Knowles, InvenSense, NXP Semiconductor, Rockwell Automation, Banner Engineering, Atmel, Murata Manufacturing, Nanomix, Hitachi, TOWA, STMicroelectronics, and Texas Instruments., and others. |

| Segments Covered | By Product Type, By Packaging, By Production Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Beer Market: Segmentation Analysis

The global beer market is segmented based on Product Type, Packaging, Production Type, Distribution Channel, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on Product Type, the global beer market is divided into Lager, Ale, Stout & Porter, Malt, Others.

On the basis of Packaging, the global beer market is bifurcated into Glass Bottle, Can, Draught.

By Production Type, the global beer market is split into Macro Brewery, Microbrewery, Craft Brewery.

In terms of Distribution Channel, the global beer market is categorized into On-trade (Bars, Restaurants), Off-trade (Supermarkets, Online, Liquor Stores).

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Beer Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the beer market on a global and regional basis.

The global beer market is dominated by players like:

- Innovega Inc

- Novartis AG

- Samsung Electronics Co. Ltd.

- Google Inc.

- Sensimed AG

- Sony Corporation

- Liner Technologies

- EP Global Communications Inc.

- Analog Devices

- Knowles

- InvenSense

- NXP Semiconductor

- Rockwell Automation

- Banner Engineering

- Atmel

- Murata Manufacturing

- Nanomix

- Hitachi

- TOWA

- STMicroelectronics

- Texas Instruments.

Global Beer Market: Segmentation Analysis

The global beer market is segmented as follows;

By Product Type

- Lager

- Ale

- Stout & Porter

- Malt

- Others

By Packaging

- Glass Bottle

- Can

- Draught

By Production Type

- Macro Brewery

- Microbrewery

- Craft Brewery

By Distribution Channel

- On-trade (Bars

- Restaurants)

- Off-trade (Supermarkets

- Online

- Liquor Stores)

Global Beer Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The beer market refers to the global industry involved in the production, distribution, and sale of beer, one of the most widely consumed alcoholic beverages worldwide. It encompasses various segments based on product type (lager, ale, stout, pilsner, etc.), category (premium, super premium, and regular), and distribution channels (on-trade and off-trade). The market is driven by factors such as changing consumer lifestyles, the rising popularity of craft and flavored beers, increasing social consumption among millennials, and expanding urbanization. Additionally, innovations in brewing techniques, the growth of microbreweries, and increasing demand for low- and non-alcoholic beer are shaping the market dynamics. Key regions include North America, Europe, Asia-Pacific, and Latin America, with Asia-Pacific emerging as a major growth hub due to rising disposable incomes and shifting consumer preferences.

The global beer market is expected to grow due to Growing youth population and demand for craft and premium beer varieties.

According to a study, the global beer market size was worth around USD 101.52 Billion in 2024 and is expected to reach USD 132.52 Billion by 2034.

The global beer market is expected to grow at a CAGR of 2.7% during the forecast period.

Europe is expected to dominate the beer market over the forecast period.

Leading players in the global beer market include Innovega Inc, Novartis AG, Samsung Electronics Co., Ltd., Google Inc., Sensimed AG, Sony Corporation, Liner Technologies, EP Global Communications, Inc., Analog Devices, Knowles, InvenSense, NXP Semiconductor, Rockwell Automation, Banner Engineering, Atmel, Murata Manufacturing, Nanomix, Hitachi, TOWA, STMicroelectronics, and Texas Instruments., among others.

The report explores crucial aspects of the beer market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed