Aircraft Sequencing System Market Size, Share, Trends, Growth and Forecast 2034

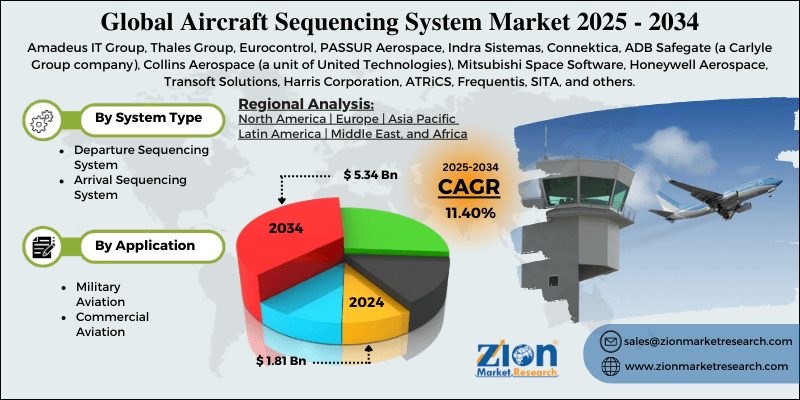

Aircraft Sequencing System Market By System Type (Departure Sequencing System and Arrival Sequencing System), By Application (Military Aviation and Commercial Aviation), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

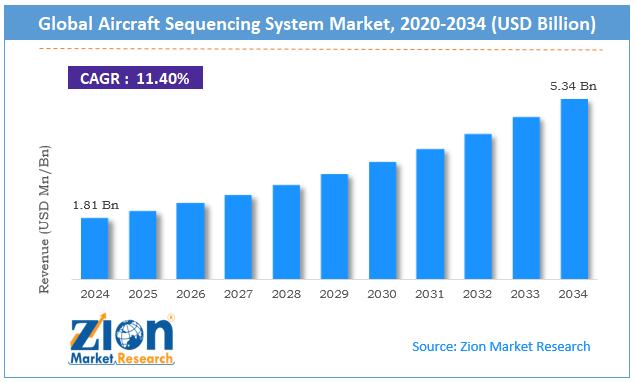

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.81 Billion | USD 5.34 Billion | 11.40% | 2024 |

Aircraft Sequencing System Industry Perspective:

The global aircraft sequencing system market size was worth around USD 1.81 billion in 2024 and is predicted to grow to around USD 5.34 billion by 2034, with a compound annual growth rate (CAGR) of roughly 11.40% between 2025 and 2034.

Aircraft Sequencing System Market: Overview

An aircraft sequencing system is an air traffic management solution designed to optimize runway operations at airports. Air sequencing systems (ASS) are also known as departure sequencing systems or arrival sequencing systems.

ASS is considered a crucial aspect of air traffic management (ATM) and it is essential to plan and execute the landing and take-off of aircrafts at airports. The main advantages of an efficient aircraft sequencing system include improved flight safety, enhanced runway efficiency, and reduced delays.

An aircraft sequencing system performs its functions by leveraging real-time information on aircraft position & speed, environmental factors, availability of runway, and estimated time of departure or arrival. At present, aircraft sequencing systems are available in three types, including decision-support, semi-automated, and fully automated, for controllers.

Some of the common aircraft sequencing systems used across the globe include the Traffic Flow Management System in the US, Arrival Manager (AMAN) in Europe, and National Airspace System (NAS) tools in Federal Aviation Administration (FAA) operations.

During the forecast period, the revenue in the aircraft sequencing system industry is expected to grow at a steady pace, driven by the increasing construction of new airports and the expansion of existing facilities. However, the higher cost of initial investment may emerge as the most dominant growth inhibitor for the market players.

Key Insights:

- As per the analysis shared by our research analyst, the global aircraft sequencing system market is estimated to grow annually at a CAGR of around 11.40% over the forecast period (2025-2034)

- In terms of revenue, the global aircraft sequencing system market size was valued at around USD 1.81 billion in 2024 and is projected to reach USD 5.34 billion by 2034.

- The aircraft sequencing system market is projected to grow at a significant rate due to the rising investments in the expansion and development of airport infrastructure.

- Based on the system type, the departure sequencing system and arrival sequencing system segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the commercial aviation segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Aircraft Sequencing System Market: Growth Drivers

Rising investments in expansion and development of airport infrastructure to promote market growth

The global aircraft sequencing system market is expected to grow due to the rising investments in the expansion of airport infrastructure worldwide. According to market research, the air traffic rate has been growing exponentially in the last few years.

Since the COVID-19 travel restrictions have been lifted across the globe, the number of domestic and international travelers worldwide has soared at an unprecedented rate.

As per recent findings, more than 34.9% of the global value of goods is traded through the air medium. Essential goods such as electronic commodities, perishables, and pharmaceutical items are regularly transported through air channels. These factors have led to an increased investment in the development of new airports and the expansion of existing infrastructure.

For instance, the Mumbai region of India is expected to witness the official launch of operations at the new airport being built in the Navi Mumbai area in May 2025. The airport is built using an investment of USD 2.1 billion and will work in tandem with the existing Chhatrapati Shivaji Maharaj International Airport.

On the other hand, Middle Eastern countries are registering soaring investments in the development of mega airports in Dubai and Saudi Arabia. The former is investing nearly USD 35 billion in the development of the world’s largest airport terminal.

Increased focus on improving air traffic safety to push market revenue toward new heights

In the last few years, the number of aircraft-related accidents has increased considerably. According to the International Air Transport Association (IATA) 2024 safety report, around 7 fatal accidents were reported worldwide, leading to 244 onboard fatalities. These numbers have called for an improvement in safety standards for aviation, leading to increased revenue in the global aircraft sequencing system market.

In January 2025, the European Aviation Safety Agency announced the launch of the new edition of the European Plan for Aviation Safety, focusing on identifying the main challenges and risks and drawing actionable plans to mitigate these challenges.

Aircraft Sequencing System Market: Restraints

High cost of initial investment to limit the market’s expansion rate

The global aircraft sequencing system industry is expected to be restricted by the high cost of initial investment required to install and deploy the solutions. Aircraft sequencing systems are highly complex and advanced tools that use real-time data processing capabilities. Deployment of these solutions at a large scale leads to significant increases in overall costs. Furthermore, aircraft sequencing systems must meet regional aviation standards. Obtaining necessary certifications can be a resource-consuming task, leading to increased final expense when installing aircraft sequencing systems.

Aircraft Sequencing System Market: Opportunities

Integration of next-generation technologies in ASS to create growth opportunities

The global aircraft sequencing system market is expected to generate growth opportunities due to the rising integration of next-generation technologies in ASS. Market players are increasingly focusing on integrating advanced sensor technologies, data processing capabilities, artificial intelligence (AI), machine learning (ML), and cloud solutions to enhance the overall performance of aircraft sequencing systems. The next-generation data collection and processing solutions can improve the enhanced performance of aircraft sequencing systems.

Growing pressure on the aerospace industry to optimize fuel consumption will open new avenues for growth

One of the major advantages of using aircraft sequencing systems is optimized fuel consumption. ASS is used to reduce holding patterns in the air and promote continuous descent of aircrafts instead of the step-down method. The latter is known to cause higher fuel consumption.

The aerospace industry is one of the largest fuel consumers. It has witnessed heavy scrutiny from environmental and government agencies to optimize its fuel usage, resulting in higher use of efficient aircraft sequencing systems.

Aircraft Sequencing System Market: Challenges

Difficulties in seamless integration with existing systems to challenge market expansion

The global aircraft sequencing system industry is expected to be challenged by the difficulties observed in the seamless integration of novel solutions with legacy infrastructure. Existing technologies may be incompatible with modern aircraft sequencing systems, posing a major threat to solution providers. Furthermore, regulatory hurdles and changing global economic conditions continue to affect the final revenue generated in the industry.

Aircraft Sequencing System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Sequencing System Market |

| Market Size in 2024 | USD 1.81 Billion |

| Market Forecast in 2034 | USD 5.34 Billion |

| Growth Rate | CAGR of 11.40% |

| Number of Pages | 216 |

| Key Companies Covered | Amadeus IT Group, Thales Group, Eurocontrol, PASSUR Aerospace, Indra Sistemas, Connektica, ADB Safegate (a Carlyle Group company), Collins Aerospace (a unit of United Technologies), Mitsubishi Space Software, Honeywell Aerospace, Transoft Solutions, Harris Corporation, ATRiCS, Frequentis, SITA, and others. |

| Segments Covered | By System Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Sequencing System Market: Segmentation

The global aircraft sequencing system market is segmented based on system type, application, and region.

Based on the system type, the global market segments are departure sequencing system and arrival sequencing system. In 2024, both segments contributed significantly to the overall market revenue. Arrival sequencing systems mainly focus on optimizing the sequence of arriving flights. Departure-based solutions are used to improve the operational efficiency of airports in managing departing flights. Both segments are critical components of the overall aircraft sequencing system. The Dubai International Airport (DXB) is known to host more than 2000 flights every day.

Based on the application, the aircraft sequencing system industry divisions are military aviation and commercial aviation. In 2024, the highest revenue was listed in the commercial segment. The growing rate of air traffic worldwide will fuel segmental revenue in the coming years. In 2024, more than 700 million international tourists visited Europe, according to official data. Moreover, surging investments in air freight will hold a pivotal space in segment growth over the forecast period.

Aircraft Sequencing System Market: Regional Analysis

North America to be led by the US during the projection period

The global aircraft sequencing system market will be led by North America during the forecast period. The US is expected to emerge as the highest revenue generator, led by the presence of several crucial players in the region.

The US is home to companies such as United Technologies, Carlyle Group, and Harris, among others. These organizations are among the top aircraft sequencing system producers worldwide. In addition to this, the US hosts several high-traffic airports with tourists from around the world.

In January 2025, reports emerged suggesting that the John Glenn International Airport in Ohio will undergo a renovation worth USD 2 billion to replace its current terminal and overhaul the aerodrome. Airport infrastructure in North America is undergoing rapid digital transformation in a bid to improve aircraft safety and seamless operations at airport terminals.

Europe is a growing market with exceptional growth performance. Countries such as Germany, France, Belgium, and Spain will lead the regional market expansion. Rapidly growing air freight across European countries, along with a higher number of domestic and international flights in Europe, is fueling the regional expansion rate. European aircraft sequencing system providers are actively investing in AI and cloud systems to develop and launch more effective solutions.

Aircraft Sequencing System Market: Competitive Analysis

The global aircraft sequencing system market is led by players like:

- Amadeus IT Group

- Thales Group

- Eurocontrol

- PASSUR Aerospace

- Indra Sistemas

- Connektica

- ADB Safegate (a Carlyle Group company)

- Collins Aerospace (a unit of United Technologies)

- Mitsubishi Space Software

- Honeywell Aerospace

- Transoft Solutions

- Harris Corporation

- ATRiCS

- Frequentis

- SITA

The global aircraft sequencing system market is segmented as follows:

By System Type

- Departure Sequencing System

- Arrival Sequencing System

By Application

- Military Aviation

- Commercial Aviation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An aircraft sequencing system is an air traffic management solution designed to optimize runway operations at airports.

The global aircraft sequencing system market is expected to grow due to the rising investments in the expansion of airport infrastructure worldwide.

According to study, the global aircraft sequencing system market size was worth around USD 1.81 billion in 2024 and is predicted to grow to around USD 5.34 billion by 2034.

The CAGR value of the aircraft sequencing system market is expected to be around 11.40% during 2025-2034.

The global aircraft sequencing system market will be led by North America during the forecast period.

The global aircraft sequencing system market is led by players like Amadeus IT Group, Thales Group, Eurocontrol, PASSUR Aerospace, Indra Sistemas, Connektica, ADB Safegate (a Carlyle Group company), Collins Aerospace (a unit of United Technologies), Mitsubishi Space Software, Honeywell Aerospace, Transoft Solutions, Harris Corporation, ATRiCS, Frequentis, and SITA.

The report explores crucial aspects of the aircraft sequencing system market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed