Aircraft Engine MRO Market Size, Share, Trends Forecast 2034

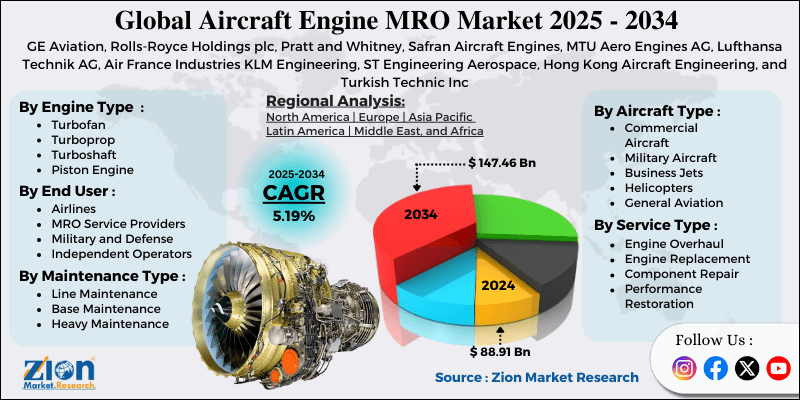

Aircraft Engine MRO Market By Engine Type (Turbofan, Turboprop, Turboshaft, Piston Engine), By Aircraft Type (Commercial Aircraft, Military Aircraft, Business Jets, Helicopters, General Aviation), By Service Type (Engine Overhaul, Engine Replacement, Component Repair, Performance Restoration), By End-User (Airlines, MRO Service Providers, Military and Defense, Independent Operators), By Maintenance Type (Line Maintenance, Base Maintenance, Heavy Maintenance), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

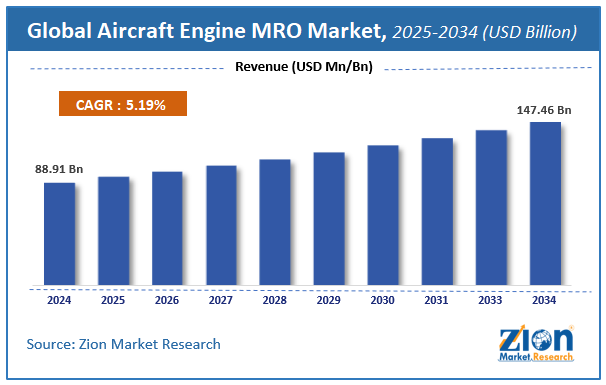

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 88.91 Billion | USD 147.46 Billion | 5.19% | 2024 |

Aircraft Engine MRO Industry Prospective

The global aircraft engine MRO market size was worth approximately USD 88.91 billion in 2024 and is projected to grow to around USD 147.46 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.19% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global aircraft engine MRO market is estimated to grow annually at a CAGR of around 5.19% over the forecast period (2025-2034).

- In terms of revenue, the global aircraft engine MRO market size was valued at approximately USD 88.91 billion in 2024 and is projected to reach USD 147.46 billion by 2034.

- The aircraft engine MRO market is projected to grow significantly due to the increasing global aircraft fleet, rising air passenger traffic, aging aircraft requiring more maintenance, and growing adoption of predictive maintenance technologies.

- Based on engine type, the turbofan segment is expected to lead the aircraft engine MRO market, while the turboprop segment is anticipated to experience significant growth.

- Based on aircraft type, the commercial aircraft segment is expected to lead the aircraft engine MRO market, while the business jets segment is anticipated to witness notable growth.

- Based on service type, the engine overhaul segment is the dominating segment, while the component repair segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the airlines segment is expected to lead the market compared to the independent operators segment.

- Based on maintenance type, the heavy maintenance segment is expected to witness the largest market share during the forecast period.

- Based on region, North America is projected to dominate the global aircraft engine MRO market during the estimated period, followed by the Asia Pacific.

Aircraft Engine MRO Market: Overview

Aircraft engine maintenance, repair, and overhaul (MRO) refers to all activities required to keep an aircraft’s engines safe, reliable, and efficient throughout their long operating life. These services include scheduled inspections to check engine condition, repairs to fix issues found during operation, performance restoration to bring engines back to their required power levels, and full overhauls involving complete disassembly and replacement of worn parts. Line maintenance takes place at airport gates between flights, where mechanics perform quick checks and minor fixes to keep engines ready for the next journey.

Base maintenance occurs in hangars during planned downtime, allowing deeper inspections and repairs without removing the engine from the aircraft. Shop visits involve removing the engine and sending it to specialized facilities for complete teardown, inspection, rebuild, and testing. Modern engines contain thousands of precision components that require specialized care, while predictive maintenance uses sensor data and analysis to detect early problems. Manufacturers and independent MRO providers offer various service programs to help operators manage costs, improve performance, and maintain safety as aircraft fleets age and new engines enter service.

The growing global aircraft fleet and increasing flight hours are expected to drive growth in the aircraft engine MRO market throughout the forecast period.

Aircraft Engine MRO Market Dynamics

Growth Drivers

How are fleet expansion and the aging of aircraft driving growth in the aircraft engine MRO market?

The aircraft engine MRO market is growing quickly as global air travel expands and airlines add new aircraft while older fleets require more frequent service. New commercial aircraft deliveries remain high because Boeing and Airbus produce large volumes each year, and every aircraft enters service with engines needing structured maintenance plans. Aging fleets create strong demand for inspections, part replacements, and performance restoration services that help engines maintain efficiency over long operating periods.

Rapid airline growth in the Asia Pacific and Middle East increases aircraft purchases, lifting global fleet size and pushing steady growth in engine maintenance needs. Low-cost carriers operate aircraft for long daily hours, which increases engine wear and raises shop visit requirements across their networks. Freighter conversions extend service life for retired passenger aircraft and create additional demand for full engine overhauls supporting cargo operations. Engine life extension programs help operators reduce capital costs by adding shop visits instead of investing in new engines during the late-life stage.

Technology advancement and predictive maintenance adoption

The global aircraft engine MRO market is expanding as digital technologies and data-driven methods improve engine reliability and help airlines manage maintenance costs more effectively. Engine health monitoring systems send real-time performance information from aircraft to analytics platforms, allowing early detection of issues before major disruptions occur. Vibration analysis identifies bearing wear, blade damage, and rotor imbalance, enabling proactive replacement during scheduled service instead of unplanned removal.

Oil analysis programs detect metal particles in lubricating oil, offering clear insight into internal wear and supporting timely maintenance decisions. Borescope inspections use fiber optic cameras to view internal components without full engine disassembly, reducing inspection time while maintaining accuracy. 3D printing supports faster and more affordable production of selected spare parts, improving availability and shortening engine shop visits. Advanced materials, such as ceramic matrix composites, tolerate higher temperatures, thereby improving fuel efficiency, but they also require specialized repair skills.

Restraints

High capital requirements and skilled labor shortages are limiting capacity

The aircraft engine MRO market faces major challenges because large investments in facilities, equipment, tooling, and training create barriers, while global shortages of skilled technicians limit industry capacity. Engine overhaul centers require expensive test cells, precision measurement systems, advanced cleaning units, and specialized assembly fixtures, which smaller operators find difficult to purchase. Tooling demands for various engine models increase financial pressure, as each engine type needs unique stands, lifting systems, and dedicated tools that restrict economical service options.

Certification by aviation authorities requires extensive documentation, strict quality systems, and capability demonstrations, thereby incurring high costs for each approved engine program. Training expenses rise as modern engines use advanced technologies requiring mechanics to attend manufacturer programs, earn certifications, and maintain updated knowledge through ongoing education. Technician shortages across the industry are worsening as experienced personnel retire, while fewer young workers enter aviation trades requiring long apprenticeships. Wage pressure increases as MRO providers compete for available talent, raising compensation to secure workers with essential skills.

Opportunities

How is the aviation expansion creating new opportunities for the growth of the aircraft engine MRO market?

The aircraft engine MRO industry is creating strong growth opportunities as aviation expansion in developing regions increases maintenance demand while governments support domestic MRO development. Chinese aviation growth generates large maintenance requirements because the country operates a rapidly expanding commercial fleet requiring significant engine service capacity. Indian aviation expansion is encouraging new MRO investments, as airlines and government programs focus on developing local infrastructure to serve the region’s growing aircraft fleet. Southeast Asian markets, including Indonesia, Thailand, Vietnam, and the Philippines, generate steady demand for engine maintenance, supported by regional providers that offer competitive pricing and convenient service locations.

Middle Eastern aviation centers in the UAE, Qatar, and Saudi Arabia invest heavily in advanced MRO facilities positioned to serve airlines across Europe, Asia, and Africa due to strong geographic connectivity. African aviation growth remains early but shows promising potential as expanding economies and tourism increase aircraft acquisitions, requiring dependable engine service. Latin American markets, led by Brazil and Mexico, record consistent MRO growth supporting commercial and business aviation customers across the region.

Challenges

How is technology complexity and regulatory compliance creating challenges for the aircraft engine MRO industry?

The aircraft engine MRO industry faces growing challenges as advanced engine technologies require new repair skills while strict regulations increase operational complexity across global facilities. Next-generation engines, including geared turbofans, use advanced materials that demand novel repair methods, pushing mechanics to learn specialized procedures supported by high-cost equipment. Composite structures in fan blades and engine components require different repair techniques compared to metals, creating ongoing training needs and capacity upgrades for maintenance shops.

Regulatory compliance requires robust quality systems, detailed documentation, and full traceability of parts, placing a significant administrative burden on smaller MRO providers. Counterfeit part risks require strict supply chain checks, prompting facilities to use verification systems ensuring full component authenticity during procurement and installation. Environmental regulations governing waste handling, chemical use, and emissions impose additional operating costs on facilities that manage hazardous materials safely.

Aircraft Engine MRO Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Engine MRO Market |

| Market Size in 2024 | USD 88.91 Billion |

| Market Forecast in 2034 | USD 147.46 Billion |

| Growth Rate | CAGR of 5.19% |

| Number of Pages | 260 |

| Key Companies Covered | GE Aviation, Rolls-Royce Holdings plc, Pratt and Whitney, Safran Aircraft Engines, MTU Aero Engines AG, Lufthansa Technik AG, Air France Industries KLM Engineering, ST Engineering Aerospace, Hong Kong Aircraft Engineering, and Turkish Technic Inc |

| Segments Covered | By Engine Type, By Aircraft Type, By Service Type, By End User, By Maintenance Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Engine MRO Market: Segmentation

The global aircraft engine MRO market is segmented based on engine type, aircraft type, service type, end-user, maintenance type, and region.

Based on engine type, the global market is classified into turbofan, turboprop, turboshaft, and piston engines. Turbofan leads the market due to its dominance in commercial aviation, a large installed base requiring maintenance, and high-value service content per engine compared to other types.

Based on aircraft type, the industry is divided into commercial aircraft, military aircraft, business jets, helicopters, and general aviation. Commercial aircraft are expected to lead the market during the forecast period due to massive global fleet size, high utilization rates, and regulatory requirements mandating scheduled maintenance intervals.

Based on service type, the global aircraft engine MRO market is segregated into engine overhaul, engine replacement, component repair, and performance restoration. Engine overhaul holds the largest market share due to its comprehensive nature, involving complete disassembly, and its high service value per event.

Based on end-user, the global aircraft engine MRO industry is segmented into airlines, MRO service providers, military and defense, and independent operators. Airlines hold the largest market share due to operating the majority of commercial aircraft engines, direct purchasing power, and internal maintenance capabilities supplemented by outsourced services.

Based on maintenance type, the global market is categorized into line maintenance, base maintenance, and heavy maintenance. Heavy maintenance holds the largest market share due to the comprehensive scope, including engine removal, extensive service requirements, and high revenue per maintenance event.

Aircraft Engine MRO Market: Regional Analysis

What factors are contributing to North America's dominance in the global aircraft engine MRO market?

North America held an estimated 35% share of the aircraft engine MRO market in 2025, driven by its large fleet and strong MRO infrastructure. North America leads the aircraft engine MRO market because the region operates a large commercial fleet, supported by strong infrastructure, major engine manufacturers, and a highly developed aviation industry, which together create consistent maintenance demand. The United States manages the world’s largest group of commercial aircraft, producing heavy engine service requirements across national carriers and regional operators with extensive daily flight activity.

MRO capacity includes major service centers from GE Aviation, Pratt and Whitney, and Rolls-Royce, working alongside many independent companies offering reliable and cost-effective maintenance solutions for airlines. Military aviation activity adds significant demand because the Air Force, Navy, and Marine Corps fleets operate thousands of engines across fighter jets, transport aircraft, and training platforms needing continuous support. Business aviation facilities handle large volumes of corporate and private jet engines, creating a steady flow of maintenance work across premium service networks. Freight operators, including FedEx, UPS, and major cargo airlines, run high-utilization schedules producing intensive engine maintenance cycles supporting operational reliability.

Engine manufacturers maintain extensive North American operations that provide advanced technical knowledge, access to tooling, and engineering support, thereby benefiting regional MRO providers. Regulatory oversight from the FAA establishes strict safety standards, while certification programs enable qualified facilities to deliver engine services trusted by airlines across global markets. The region also benefits from strong investment in digital maintenance technologies, a large skilled workforce, and long-term aviation growth, which further strengthen North America’s leadership and create sustained demand for engine overhaul, repair, and inspection services across all aircraft segments.

Asia Pacific demonstrates rapid market expansion.

Asia Pacific held an estimated 28% share of the aircraft engine MRO market in 2025, supported by rapid aviation growth and expanding regional maintenance investments. Asia Pacific shows strong aircraft engine MRO market growth as rapid aviation expansion, fleet upgrades, and government-backed maintenance programs support rising investment across the region. China is building large-scale MRO capabilities serving domestic airlines while expanding its service reach to international customers through competitive pricing and strategic geographic access. India increases maintenance capacity through new infrastructure, supported by national policies promoting domestic MRO development aimed at reducing dependence on overseas facilities. Singapore maintains a leading regional position with world-class service centers supporting airlines across Southeast Asia, Australia, and wider global networks using highly efficient operations.

Japan operates advanced MRO capabilities that support major domestic carriers while delivering high-quality engine overhaul services recognized across international aviation markets. Australia provides reliable support to South Pacific aviation customers through experienced MRO providers that offer maintenance for commercial aircraft and military engine platforms across regional fleets, thereby strengthening overall regional service capacity and long-term industry growth. Asia Pacific benefits further from rising demand for modern engine overhaul solutions, driven by growing low-cost carrier networks and expanding cross-border aviation activity. Increasing adoption of digital maintenance tools improves inspection accuracy and reduces engine downtime across the region. Strong investment in skilled workforce development also enhances long-term MRO capability and competitiveness.

Recent Market Developments

- In September 2025, GE Aerospace announced a planned US$75 million investment in Asia-Pacific MRO and component repair facilities to expand engine maintenance capacity and enhance service performance in a fast-growing market.

- In November 2025, Pratt & Whitney awarded its first GTF MRO Network Awards to MTU Maintenance Hannover and Eagle Services Asia, recognizing their excellence in supporting its geared turbofan engine maintenance and service network.

Aircraft Engine MRO Market: Competitive Analysis

The leading players in the global aircraft engine MRO market are-

- GE Aviation

- Rolls-Royce Holdings plc

- Pratt and Whitney (RTX Corporation)

- Safran Aircraft Engines

- MTU Aero Engines AG

- Lufthansa Technik AG

- Air France Industries KLM Engineering and Maintenance

- ST Engineering Aerospace

- Hong Kong Aircraft Engineering Company Limited

- Turkish Technic Inc.

The global aircraft engine MRO market is segmented as follows:

By Engine Type

- Turbofan

- Turboprop

- Turboshaft

- Piston Engine

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Business Jets

- Helicopters

- General Aviation

By Service Type

- Engine Overhaul

- Engine Replacement

- Component Repair

- Performance Restoration

By End User

- Airlines

- MRO Service Providers

- Military and Defense

- Independent Operators

By Maintenance Type

- Line Maintenance

- Base Maintenance

- Heavy Maintenance

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed