Advanced Apparel Manufacturing Market Size, Share, Trends, Growth 2034

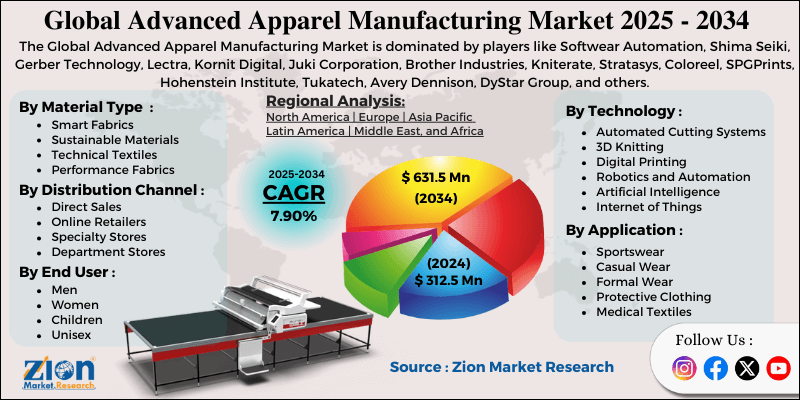

Advanced Apparel Manufacturing Market By Technology (Automated Cutting Systems, 3D Knitting, Digital Printing, Robotics and Automation, Artificial Intelligence, Internet of Things, and Others), By Material Type (Smart Fabrics, Sustainable Materials, Technical Textiles, Performance Fabrics, and Others), By Application (Sportswear, Casual Wear, Formal Wear, Protective Clothing, Medical Textiles, and Others), By End-User (Men, Women, Children, and Unisex), By Distribution Channel (Direct Sales, Online Retailers, Specialty Stores, Department Stores, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

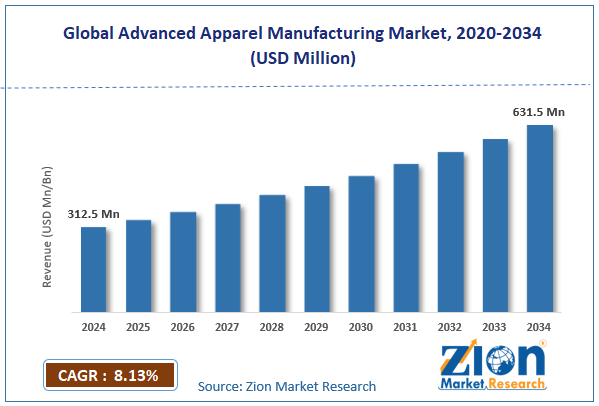

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 312.5 Million | USD 631.5 Million | 8.13% | 2024 |

Advanced Apparel Manufacturing Industry Perspective:

The global advanced apparel manufacturing market size was worth approximately USD 312.5 million in 2024 and is projected to grow to around USD 631.5 million by 2034, with a compound annual growth rate (CAGR) of roughly 8.13% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global advanced apparel manufacturing market is estimated to grow annually at a CAGR of around 8.13% over the forecast period (2025-2034).

- In terms of revenue, the global advanced apparel manufacturing market size was valued at approximately USD 312.5 million in 2024 and is projected to reach USD 631.5 million by 2034.

- The advanced apparel manufacturing market is projected to grow significantly due to rising labor costs in traditional manufacturing regions, increasing demand for sustainable and eco-friendly production methods, growing consumer expectations for customization and fast delivery, and technological advancements in automation and digitalization.

- Based on technology, the robotics and automation segment is expected to lead the advanced apparel manufacturing market, while the artificial intelligence segment is anticipated to experience significant growth.

- Based on material type, the performance fabrics segment is expected to lead the advanced apparel manufacturing market, while the sustainable materials segment is anticipated to witness notable growth.

- Based on application, the sportswear segment is the dominating segment, while the protective clothing segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the women segment is expected to lead the market compared to the men segment.

- Based on the distribution channel, the online retailers segment is expected to lead the market during the forecast period.

- Based on region, Asia Pacific is projected to dominate the global advanced apparel manufacturing market during the estimated period, followed by Europe.

Advanced Apparel Manufacturing Market: Overview

Advanced apparel manufacturing is the use of modern technologies, new materials, and automated machines to make clothes and textiles in a faster, smarter, and more efficient way than traditional methods. It combines digital tools, such as computer-aided design, automated cutting and sewing systems, and data analysis, to improve production efficiency and reduce mistakes. Robots and automated systems handle repetitive work like cutting, stitching, and assembling garments with high accuracy. Three-dimensional knitting machines can make seamless clothes directly from digital designs, reducing waste. Digital printing allows detailed patterns to be printed directly on fabric, making customization easier.

Smart manufacturing connects machines and sensors through the Internet of Things to monitor quality and performance in real time. Artificial intelligence studies production data to improve speed, quality, and maintenance. Advanced materials like smart fabrics, temperature-control textiles, and eco-friendly fibers increase comfort and sustainability. These innovations help create personalized garments quickly, use fewer resources, and reduce environmental impact. Overall, advanced apparel manufacturing makes clothing production faster, cleaner, and more flexible to meet modern consumer demands.

The increasing adoption of automation technologies and growing demand for sustainable manufacturing practices are expected to drive growth in the advanced apparel manufacturing market throughout the forecast period.

Advanced Apparel Manufacturing Market Dynamics

Growth Drivers

Rising labor costs and workforce challenges

The advanced apparel manufacturing market is growing fast as traditional methods face many workforce challenges. Countries like China, Bangladesh, and Vietnam are seeing higher wages as living standards improve and workers seek better pay. Many young people prefer service jobs instead of factory work, making it harder to find sewing staff. Older workers are retiring, and new workers take time to learn proper skills, slowing production. Frequent employee turnover adds more costs for hiring and training. Labor laws improving safety and limiting overtime reduce the flexibility factories once had to meet tight deadlines.

Rising minimum wages make it difficult for manufacturers to keep profits steady. Bringing factories closer to consumer markets increases expenses, making automation more important. Changing demand during different seasons also causes staffing problems. Automation and smart machines improve speed, quality, and consistency, while also helping to reduce labor costs and production risks.

How are sustainability goals and circular economy adoption driving automation in the advanced apparel manufacturing market?

The global advanced apparel manufacturing market is growing quickly as the fashion industry moves toward sustainable production and circular systems. Concerns about pollution, waste, and climate impact are driving major changes in how clothes are made. Fast fashion creates huge amounts of waste and faces strong criticism from consumers who want responsible brands. Water shortages in textile regions push the need for new methods that use less water during dyeing and finishing. Chemical pollution from traditional processes harms workers and communities, increasing demand for cleaner technologies. The release of microplastics from synthetic fabrics raises awareness about the importance of making better material choices.

Governments are enforcing rules for recycling and waste management, leading companies to invest in reusable and eco-friendly materials. Brands are setting goals to reduce carbon emissions using renewable energy and efficient processes. New materials like recycled polyester, lyocell, and plant-based leather need updated production systems. On-demand production, digital printing, and waterless dyeing reduce waste and support sustainability.

Restraints

High capital investment requirements and technical complexity

The advanced apparel manufacturing market faces major challenges due to the high cost and complexity of adopting new technologies. Modern machines like automated sewing systems, 3D knitting equipment, and robotic material handlers require very large investments. Digital printing machines also need high setup costs, along with regular spending on inks and maintenance. Many factories must upgrade their power systems, air control systems, and layouts before installing this new equipment. Small manufacturers often struggle to afford these changes or wait years to recover costs.

Many companies hesitate to invest because of uncertain returns and fast-changing technology. Integrating new machines with old systems creates more technical difficulties. Skilled workers are needed to operate and maintain advanced tools, but training them takes time and money. Hiring consultants or software experts adds to the total cost. Lack of standard processes in apparel design and materials makes automation harder, slowing down progress for many manufacturers.

Opportunities

How is the growing demand for mass customization and personalized products creating opportunities in the advanced apparel manufacturing market?

The advanced apparel manufacturing industry is growing with rising demand for personalized clothing that matches individual style and body measurements. Modern digital tools make customization affordable by removing setup costs and large order requirements. Body scanning through smartphones or in-store scanners helps capture accurate measurements for a perfect fit and fewer returns. Online configurators allow customers to choose fabrics, colors, and design features for unique garments.

Artificial intelligence suggests styles based on customer preferences, shopping history, and body data. Made-to-order production reduces waste, prevents excess inventory, and offers higher profits through premium pricing. Personalized athletic wear fits better since body shapes vary widely across people. Adaptive clothing and medical garments benefit from precise customization options. Custom-made garments also support sustainability by reducing overproduction. Brands offering personalization stand out in the market, improve customer loyalty, and earn better margins through direct sales.

Challenges

How is addressing supply chain complexity and technology integration creating restraints for the advanced apparel manufacturing market?

The advanced apparel manufacturing market faces big challenges in managing complex global supply chains and connecting different technologies into smooth production systems. Clothing production involves many players, such as fiber producers, fabric mills, manufacturers, and retailers, each using different tools and methods. For digital systems to work well, all partners need compatible technologies and data sharing, but many lack the funds or motivation to upgrade. Differences in data formats and measurements make standardization hard across regions. Real-time tracking is challenging due to the missing information between suppliers and factories. Older machines often cannot connect with new automated systems.

Cybersecurity threats rise as factories share data online, while brands worry about protecting design information. Quality control becomes tricky since machines must learn to spot defects in varied fabrics and styles. Adapting to new technology can be challenging for many teams, and setup delays often slow down production schedules.

Advanced Apparel Manufacturing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Advanced Apparel Manufacturing Market |

| Market Size in 2024 | USD 312.5 Million |

| Market Forecast in 2034 | USD 631.5 Million |

| Growth Rate | CAGR of 8.13% |

| Number of Pages | 212 |

| Key Companies Covered | Softwear Automation, Shima Seiki, Gerber Technology, Lectra, Kornit Digital, Juki Corporation, Brother Industries, Kniterate, Stratasys, Coloreel, SPGPrints, Hohenstein Institute, Tukatech, Avery Dennison, DyStar Group, and others. |

| Segments Covered | By Technology, By Material Type, By Application, By End User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Advanced Apparel Manufacturing Market: Segmentation

The global advanced apparel manufacturing market is segmented based on technology, material type, application, end-user, distribution channel, and region.

Based on technology, the global advanced apparel manufacturing industry is categorized into automated cutting systems, three-dimensional knitting, digital printing, robotics and automation, artificial intelligence, Internet of Things, and others. Robotics and automation lead the market due to their broad applicability across multiple production processes and significant labor cost savings that justify investment despite high initial capital requirements.

Based on material type, the industry is segregated into smart fabrics, sustainable materials, technical textiles, performance fabrics, and others. Performance fabrics lead the market due to strong demand from athletic and outdoor apparel segments, where functional benefits command premium pricing and justify advanced manufacturing investments.

Based on application, the global advanced apparel manufacturing market is divided into sportswear, casual wear, formal wear, protective clothing, medical textiles, and others. Sportswear is expected to lead the market during the forecast period due to high-performance requirements, rapid innovation cycles, and consumer willingness to pay premium prices for advanced features and superior fit.

Based on end-user, the global market is segmented into men, women, children, and unisex. Women hold the largest market share due to higher apparel consumption rates, a greater variety of styles and fits that benefit from customization, and a larger overall market size in most apparel categories.

Based on distribution channel, the global market is classified into direct sales, online retailers, specialty stores, department stores, and others. Online retailers hold the largest market share due to natural alignment with digital manufacturing capabilities, the ability to offer extensive customization options, and growing consumer preference for convenient online shopping experiences.

Advanced Apparel Manufacturing Market: Regional Analysis

Why does Asia Pacific lead the advanced apparel manufacturing market in terms of manufacturing concentration and technology adoption?

The Asia Pacific leads the advanced apparel manufacturing market, as it produces the majority of the world’s apparel and continues to invest in automation to stay competitive despite rising labor costs. China remains the largest apparel producer and is rapidly adopting robotics and automation to maintain its dominance. Government programs such as Made in China 2025 offer strong financial support and incentives for upgrading textile manufacturing technology. Bangladesh, the world's second-largest apparel exporter, faces growing labor issues that are encouraging larger manufacturers to automate their production processes. Vietnam attracts heavy foreign investment in new factories designed with advanced technologies from the start. India’s strong textile base and skilled engineering workforce make it a key player in developing and adopting modern apparel manufacturing technologies.

Japan and South Korea contribute to innovation in robotics, materials, and digital production systems. Countries such as Indonesia, Thailand, and Malaysia compete by combining affordable labor with efficient, modern manufacturing. Local machinery producers across the region offer customized, cost-effective equipment suited to regional production needs. Technical institutions in China and India supply the engineers and technicians required to operate advanced systems.

Free trade agreements across the Asia Pacific enhance the flow of raw materials and finished goods, thereby supporting interconnected supply chains. The region’s proximity to major consumer markets, including Asia and Australia, helps reduce shipping times and logistics costs. Smart factory projects across the region set new global benchmarks in efficient production. Growing e-commerce markets in Asia also drive the need for fast, flexible manufacturing that can meet personalized and on-demand retail trends.

Europe’s continued innovation strengthens its position as the second leading region

Europe is experiencing steady growth in the advanced apparel manufacturing market, leveraging its strong technology base, sustainability focus, and premium brand positioning to modernize traditional textile industries. European fashion brands that sell at higher prices can invest in advanced systems to deliver better quality, personalized products, and eco-friendly production. The reshoring of manufacturing from Asia back to Europe depends on automation to balance higher labor costs while offering faster delivery and more flexible supply chains. Strict environmental rules across Europe drive the use of cleaner and more sustainable production technologies.

Circular economy policies encourage recycling, repair, and resale programs supported by modern manufacturing methods. Germany, Switzerland, and other nations lead the way in technical textiles, developing advanced materials and processes. Luxury brands in Italy and France mix craftsmanship with technology for made-to-measure fashion. Sportswear leaders like Adidas and Puma develop 3D printing and automated production systems.

European universities and research centers explore smart textiles and wearable technology. Textile machinery makers across Europe produce top-quality, innovative equipment used worldwide. Design expertise across European fashion drives global trends and demands faster, high-quality manufacturing solutions. High labor costs push Western European producers to focus on speed, precision, and value. Industry 4.0 programs extend to apparel production, building smart factories, and connected systems. Many small and mid-sized manufacturers adopt flexible automation for short runs and frequent design changes.

Recent Market Developments:

- In August 2025, Softwear Automation announced a $20 million Series B1 funding round led by BESTSELLER (the Danish fashion group behind JACK & JONES and VERO MODA) to accelerate deployment of its autonomous sewing “SEWBOT®” lines in global apparel manufacturing.

- In September 2025, the Swedish Textile Machinery Association (TMAS) announced its member companies will introduce sensor-based automation and resource-saving textile machinery at the ITMA ASIA + CITME 2025 event in Singapore, emphasizing the shift of apparel production equipment toward smart manufacturing and reducing dependence on manual tasks.

Advanced Apparel Manufacturing Market: Competitive Analysis

The leading players in the global advanced apparel manufacturing market are:

- Softwear Automation

- Shima Seiki

- Gerber Technology

- Lectra

- Kornit Digital

- Juki Corporation

- Brother Industries

- Kniterate

- Stratasys

- Coloreel

- SPGPrints

- Hohenstein Institute

- Tukatech

- Avery Dennison

- DyStar Group

The global advanced apparel manufacturing market is segmented as follows:

By Technology

- Automated Cutting Systems

- 3D Knitting

- Digital Printing

- Robotics and Automation

- Artificial Intelligence

- Internet of Things

- Others

By Material Type

- Smart Fabrics

- Sustainable Materials

- Technical Textiles

- Performance Fabrics

- Others

By Application

- Sportswear

- Casual Wear

- Formal Wear

- Protective Clothing

- Medical Textiles

- Others

By End User

- Men

- Women

- Children

- Unisex

By Distribution Channel

- Direct Sales

- Online Retailers

- Specialty Stores

- Department Stores

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Advanced apparel manufacturing is the use of modern technologies, new materials, and automated machines to make clothes and textiles in a faster, smarter, and more efficient way than traditional methods.

The global advanced apparel manufacturing market is projected to grow due to rising labor costs in traditional manufacturing regions, increasing demand for sustainable and environmentally friendly production methods, growing consumer expectations for customization and fast delivery, technological advancements in automation and digitalization, and reshoring trends bringing production closer to consumer markets.

According to a study, the global advanced apparel manufacturing market size was worth around USD 312.5 million in 2024 and is predicted to grow to around USD 631.5 million by 2034.

The CAGR value of the advanced apparel manufacturing market is expected to be around 8.13% during 2025-2034.

Asia Pacific is expected to lead the global advanced apparel manufacturing market during the forecast period.

The major players profiled in the global advanced apparel manufacturing market include Softwear Automation, Shima Seiki, Gerber Technology, Lectra, Kornit Digital, Juki Corporation, Brother Industries, Kniterate, Stratasys, Coloreel, SPGPrints, Hohenstein Institute, Tukatech, Avery Dennison, and DyStar Group.

The report examines key aspects of the advanced apparel manufacturing market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

The advanced apparel manufacturing market will see strong growth in sportswear, protective clothing, and medical textiles, driven by rising demand for performance-enhancing materials, customized designs, and sustainable production methods that meet evolving consumer and industry needs.

The advanced apparel manufacturing market offers strong opportunities in developing industry-specific automation solutions, partnerships between technology providers and major apparel brands for pilot programs, collaborations with educational institutions for workforce development, as well as joint ventures combining textile expertise with robotics and artificial intelligence capabilities to create comprehensive solutions.

Stakeholders in the advanced apparel manufacturing market should focus on affordable automation for small manufacturers, offer training and financing support, promote compatible technologies, and showcase proven returns through pilot programs.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed