Global Absorbent Dressings Market Size, Share, Report 2034

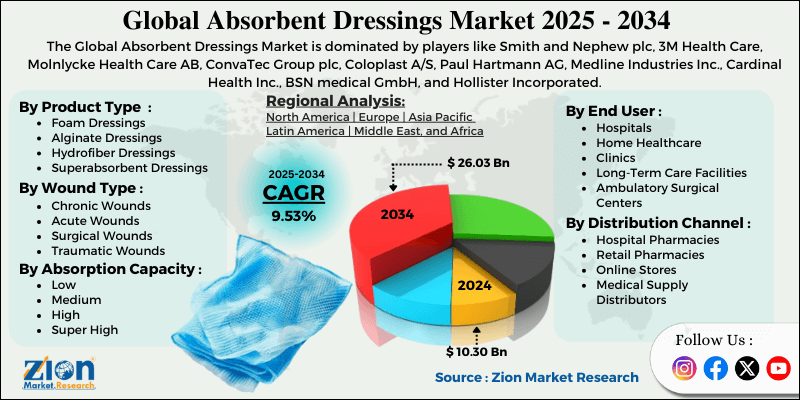

Absorbent Dressings Market By Product Type (Foam Dressings, Alginate Dressings, Hydrofiber Dressings, Superabsorbent Dressings, Non-Adherent Dressings, and Others), By Wound Type (Chronic Wounds, Acute Wounds, Surgical Wounds, Traumatic Wounds and Burn Wounds), By End User (Hospitals, Home Healthcare, Clinics, Long-Term Care Facilities and Ambulatory Surgical Centers), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Stores and Medical Supply Distributors), By Absorption Capacity (Low, Medium, High and Super High), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

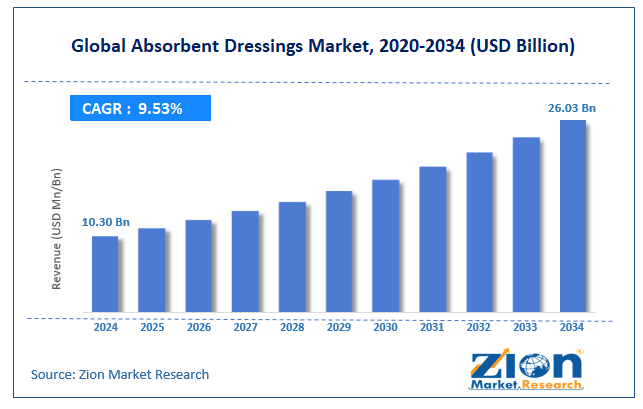

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.30 Billion | USD 26.03 Billion | 9.53% | 2024 |

Absorbent Dressings Industry Perspective

The global absorbent dressings market size was worth approximately USD 10.30 billion in 2024 and is projected to grow to around USD 26.03 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.53% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global absorbent dressings market is estimated to grow annually at a CAGR of around 9.53 % over the forecast period (2025-2034).

- In terms of revenue, the global absorbent dressings market size was valued at approximately USD 10.30 billion in 2024 and is projected to reach USD 26.03 billion by 2034.

- The absorbent dressings market is projected to grow significantly due to the rising incidence of chronic wounds, increasing diabetic population, growing elderly demographics, and expanding awareness of advanced wound management techniques.

- Based on product type, the foam dressings segment is expected to lead the absorbent dressings market, while the superabsorbent dressings segment is anticipated to grow rapidly.

- Based on wound type, the chronic wounds segment is expected to lead the absorbent dressings market, while the burn wounds segment is anticipated to witness notable growth.

- Based on end user, the hospitals segment is the dominating segment, while the home healthcare segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the hospital pharmacies segment is expected to lead the market compared to the online stores segment.

- Based on absorption capacity, the medium absorption segment holds the largest market share.

- Based on region, North America is projected to dominate the global absorbent dressings market during the estimated period, followed by Europe.

Absorbent Dressings Market: Overview

Absorbent dressings are wound care materials designed to capture excess fluid from wounds while keeping the healing area moist to support faster and safer recovery. These dressings pull moisture away from the wound surface through simple wicking, capillary movement, or polymers that trap fluid inside the dressing and help protect nearby skin from becoming overly soft. Healthcare professionals choose dressing types based on wound size, depth, drainage level, infection concerns, and the stage of healing to improve comfort and recovery. Foam dressings offer soft protection and absorb moderate to heavy fluid, alginate dressings made from seaweed form a gentle gel that fits uneven wounds, hydrofiber dressings move fluid upward to avoid pooling, and superabsorbent dressings hold very large amounts of liquid for heavily draining wounds.

Non-adherent options prevent sticking and reduce pain during removal, and many modern dressings combine absorption, antimicrobial action, odor control, and visibility to support care for ulcers, burns, pressure injuries, and surgical wounds in clinical and home settings. The growing prevalence of chronic wounds and increasing awareness of advanced wound care are expected to drive growth in the absorbent dressings market throughout the forecast period.

Absorbent Dressings Market Dynamics

Growth Drivers

How is the increasing prevalence of chronic wounds driving market growth?

The absorbent dressings market is growing quickly because chronic wound conditions affect many people worldwide, creating steady demand for simple products supporting safe and effective healing. Diabetic foot ulcers are a major driver because diabetes affects large global populations, and many patients develop ulcers needing long-term and careful wound care. Pressure ulcers form in immobile patients in hospitals and homes, and these painful wounds require absorbent materials supporting clean and consistent healing. Venous leg ulcers often impact older adults and people with circulation issues, and these wounds may persist for long periods, requiring regular dressing changes.

Arterial ulcers caused by poor blood flow create difficult wounds needing moisture control supplied by absorbent dressings supporting healing. Surgical site infections create draining wounds in many post-operative patients, and these wounds need absorbent dressings to control moisture and reduce infection risks. Traumatic injuries from accidents and burns create sudden wounds needing supportive dressings, preventing complications during recovery. Obesity-related skin breakdown forms in skin folds where moisture and friction create wounds needing absorbent protection supporting gradual healing.

Growing awareness and adoption of advanced wound care practices

The global absorbent dressings industry is growing strongly because healthcare professionals understand modern moist healing supports faster recovery and improved comfort compared to older dry gauze approaches used in past practices. Clinical studies show that optimal moisture balance supports cell movement, encourages natural growth activity, and prevents surface dryness, slowing natural healing in many wound types. Education programs from nursing groups and wound care societies train providers in correct dressing selection, application methods, and monitoring steps supporting safer outcomes. Professional guidelines recommend specific absorbent dressing options for different wounds, helping standardize care and support better product use across many facilities.

Wound care specialists promote advanced dressing technologies and influence hospital purchasing decisions through clinical experience and proven results. Quality improvement programs show that suitable absorbent dressings reduce healing complications and overall costs, even when individual products are more expensive. Patient satisfaction initiatives highlight comfortable dressings, reducing pain and odor, and also lowering change frequency, supporting daily comfort. Home healthcare services help chronic wound patients receive proper care, where long-wear dressings support extended intervals between visits from professionals. Telemedicine services support remote wound assessments where providers guide patients or caregivers through safe dressing use and simple application steps.

Restraints

High product costs and reimbursement limitations affecting market access

Cost remains a major challenge for the absorbent dressings industry because advanced products are far more expensive than simple gauze options used in many care settings. Facilities with limited budgets struggle because foam dressings, hydrofiber products, and superabsorbent materials cost much more per piece and increase overall supply expenses. Reimbursement rules from public programs and private insurers limit coverage for many dressing types and restrict quantities, creating financial pressure for patients and providers. Prior authorization steps require detailed paperwork before approval, creating delays and added work that may affect wound care safety in some situations.

Hospital formularies limit dressing choices to contracted items, reducing access to suitable products needed for specific patient conditions. Patients without strong insurance coverage face high out-of-pocket costs that make advanced dressings difficult to afford, encouraging the use of cheaper options that slow healing. Developing countries face even greater barriers because limited resources prevent widespread access to modern wound care despite growing disease burdens. Home care challenges appear when patients leave hospitals using premium dressings they cannot buy for continued recovery at home due to cost limits.

Opportunities

How is the expansion of home healthcare creating new opportunities?

The absorbent dressings market is gaining strong growth as healthcare continues shifting toward home-based care, where patients receive wound support in simple residential environments. Chronic disease care increasingly occurs at home, where diabetic ulcers, pressure injuries, and venous leg ulcers are managed with dressings suitable for comfortable multi-day wear. Aging in place programs help older adults remain in homes, creating a steady demand for user-friendly absorbent dressings that patients or caregivers can apply with confidence. Post-surgical recovery in home settings needs reliable dressings protecting incisions while controlling drainage to reduce repeat visits and support safe healing.

Palliative home care for terminally ill patients benefits from gentle absorbent dressings, reducing odor and lowering dressing frequency to support dignity and comfort. Rural communities with limited access to medical facilities rely on extended-wear dressings, easing travel needs and reducing burdens for routine assessments. Telemedicine supports remote care because patients share wound images through dressings designed with viewing features to support safe monitoring. Patient preference studies show strong interest in home care, encouraging health systems to supply suitable dressings for simple, unsupervised use.

Challenges

How is product selection complexity and wound care variability creating challenges for the industry?

The absorbent dressings market faces major challenges because the large range of products creates confusion for providers who must match dressings to specific wound needs. Clinicians struggle to compare many dressing options promoted with performance claims that make selection difficult in daily situations. Wound assessment requires review of wound depth, drainage levels, tissue condition, infection risk, and surrounding skin, with each factor influencing dressing choice. Many products lack strong clinical studies, forcing providers to rely on experience, manufacturer information, or facility routines when selecting suitable options. Limited training leaves many professionals unsure about modern absorbent materials and proper use across patient groups.

Hospitals frequently change suppliers, requiring staff to learn new products and adjust techniques during routine care. Patient needs vary widely because allergies, skin sensitivity, wound location, and mobility influence dressing characteristics. Cost comparisons remain difficult because premium dressings cost more but may lower long-term expenses through quicker healing. Practice variation persists across settings, and administrative tasks increase workload while reducing careful evaluation. Care transitions also create challenges that affect healing consistency.

Absorbent Dressings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Absorbent Dressings Market |

| Market Size in 2024 | USD 10.30 Billion |

| Market Forecast in 2034 | USD 26.03 Billion |

| Growth Rate | CAGR of 9.53% |

| Number of Pages | 270 |

| Key Companies Covered | Smith and Nephew plc, 3M Health Care, Molnlycke Health Care AB, ConvaTec Group plc, Coloplast A/S, Paul Hartmann AG, Medline Industries Inc., Cardinal Health Inc., BSN medical GmbH, and Hollister Incorporated. |

| Segments Covered | By Product Type, By Wound Type, By End User, By Distribution Channel, By Absorption Capacity, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Absorbent Dressings Market: Segmentation

The global absorbent dressings market is segmented based on product type, wound type, end user, distribution channel, absorption capacity, and region.

Based on product type, the global absorbent dressings market is divided into foam dressings, alginate dressings, hydrofiber dressings, superabsorbent dressings, non-adherent dressings, and others. Foam dressings lead the market due to their versatility across wound types, comfortable cushioning properties, and ease of application and removal.

Based on wound type, the industry is segregated into chronic wounds, acute wounds, surgical wounds, traumatic wounds, and burn wounds. Chronic wounds are expected to lead the market during the forecast period due to the prolonged treatment durations requiring sustained dressing use, and the growing prevalence of diabetes and vascular diseases causing chronic wounds.

Based on end user, the global absorbent dressings market is categorized into hospitals, home healthcare, clinics, long-term care facilities, and ambulatory surgical centers. Hospitals hold the largest market share due to the concentration of acute and complex wounds requiring professional care, and the substantial purchasing power of hospital systems.

Based on distribution channel, the global absorbent dressings industry is classified into hospital pharmacies, retail pharmacies, online stores, and medical supply distributors. Hospital pharmacies hold the largest market share due to the direct supply relationships with hospitals and the integration with institutional formularies and procurement systems.

Based on absorption capacity, the global market is segmented into low, medium, high, and super high. Medium absorption capacity holds the largest market share due to the suitability for most common wound types with moderate exudate levels, and the balance between performance and cost-effectiveness.

Absorbent Dressings Market: Regional Analysis

What factors are contributing to North America's dominance in the global market?

North America leads the absorbent dressings market because of high rates of chronic wounds, strong medical systems, and wide use of evidence-based care, supporting steady growth across the region. The United States has a large number of people living with diabetes, and many develop foot ulcers that require absorbent dressings for long healing periods in hospitals and at home. High obesity levels increase risks for pressure ulcers, surgical infections, and moisture-related skin problems, which raises demand for absorbent products that manage drainage and protect fragile skin. An aging population contributes to more chronic wounds because older adults heal slowly and face higher risks for pressure injuries in daily care routines.

Advanced wound care centers across the region use structured methods and updated absorbent technologies to support safer healing and better comfort for patients. Home healthcare services offer skilled nursing care for people with long-term wounds, creating strong demand for dressings that allow secure multi-day wear at home. Private insurance also supports advanced absorbent products, improving availability in hospitals and community settings. Professional guidelines help clinicians choose suitable dressings and follow safe care routines. Research by regional manufacturers drives new product development and clinical testing.

Education programs and certification courses help clinicians understand modern absorbent dressing options. Quality tracking by healthcare systems encourages the use of effective dressings by linking better outcomes with faster healing. Regional partnerships between hospitals and industry groups also support continuous improvement in absorbent dressing technologies. These combined strengths ensure North America remains a leading force in advancing high-quality absorbent dressing solutions across both clinical and home-based wound care settings.

Europe maintains a substantial market presence

Europe is the second leading region in the absorbent dressings market because it has strong healthcare systems, an aging population, and a high focus on safe and effective wound care. Many European countries use modern medical practices, and this supports the steady adoption of advanced absorbent dressings in hospitals, clinics, and home care. Germany plays a major role in the region because it has highly developed healthcare facilities, skilled wound care teams, and strong insurance systems that help patients access suitable dressings.

France also contributes to regional growth through its well-organized home healthcare services, where visiting nurses care for patients with chronic wounds using dressings designed for comfortable and long-lasting wear. The United Kingdom has a large population of older adults who require regular wound care, and its national health system uses structured guidelines to choose effective absorbent dressings while maintaining cost control. Italy supports growth through strong nursing traditions and active wound care associations that promote modern dressing technologies in both community and hospital care.

In addition to this, Europe benefits from active research partnerships between universities, hospitals, and medical companies that work together to develop new dressing technologies. These combined factors make Europe a major and steadily growing region in the global absorbent dressings market. As innovation, collaboration, and healthcare modernization continue, Europe is expected to remain a key driver of advanced wound care adoption worldwide.

Recent Developments

- In October 2025, Smith & Nephew announced new clinical data showing that the ALLEVYN COMPLETE CARE Foam Dressing absorbs and dissipates up to 93% of mechanical energy, including shear and friction forces, helping reduce the risk of pressure injuries in at-risk patients.

Absorbent Dressings Market: Competitive Analysis

The leading players in the global absorbent dressings market are-

- Smith and Nephew plc

- 3M Health Care

- Molnlycke Health Care AB

- ConvaTec Group plc

- Coloplast A/S

- Paul Hartmann AG

- Medline Industries Inc.

- Cardinal Health Inc.

- BSN medical GmbH

- Hollister Incorporated.

The global absorbent dressings market is segmented as follows:

By Product Type

- Foam Dressings

- Alginate Dressings

- Hydrofiber Dressings

- Superabsorbent Dressings

- Non-Adherent Dressings

- Others

By Wound Type

- Chronic Wounds

- Acute Wounds

- Surgical Wounds

- Traumatic Wounds

- Burn Wounds

By End User

- Hospitals

- Home Healthcare

- Clinics

- Long-Term Care Facilities

- Ambulatory Surgical Centers

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Stores

- Medical Supply Distributors

By Absorption Capacity

- Low

- Medium

- High

- Super High

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed