Wireless Vibration Sensor Market Size, Share, Trends, Growth and Forecast 2034

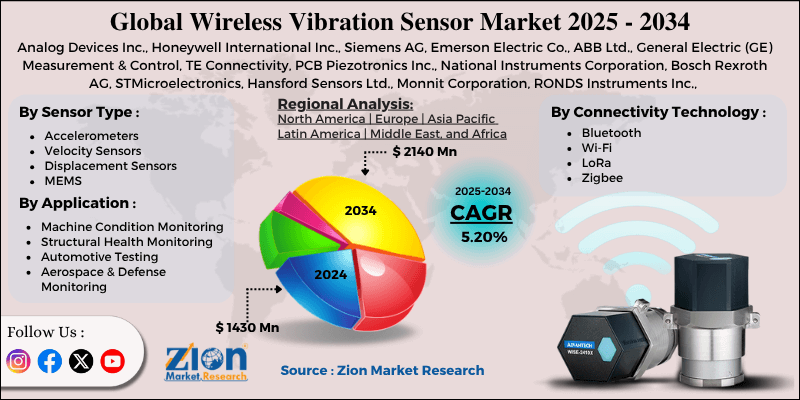

Wireless Vibration Sensor Market By Sensor Type (Accelerometers, Velocity Sensors, Displacement Sensors, MEMS), By Connectivity Technology (Bluetooth, Wi-Fi, LoRa, Zigbee), By Application (Machine Condition Monitoring, Structural Health Monitoring, Automotive Testing, Aerospace & Defense Monitoring, Predictive Maintenance), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

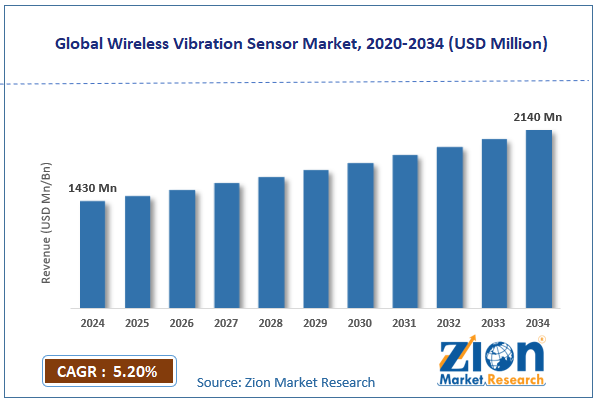

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1430 Million | USD 2140 Million | 5.20% | 2024 |

Wireless Vibration Sensor Industry Perspective:

The global wireless vibration sensor market size was worth around USD 1430 million in 2024 and is predicted to grow to around USD 2140 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.20% between 2025 and 2034.

Wireless Vibration Sensor Market: Overview

Wireless vibration sensors are battery-powered, compact devices designed to monitor and transmit vibration data from structures and machines without the need for physical wiring. They play a vital role in predictive maintenance by detecting anomalies, such as misalignment, bearing failures, and imbalance, in real time. These sensors utilize wireless communication protocols, such as LoRa, Bluetooth, and Wi-Fi, to transmit data to monitoring systems or cloud platforms.

The key drivers of the wireless vibration sensor market include surging demand for predictive maintenance, cost reduction in sensor development, and growing investments in smart manufacturing. Industries are heavily investing in predictive maintenance to avoid sudden machine failures.

Wireless vibration sensors enable real-time condition monitoring without disturbing operations. This inclination is fueling the broader adoption in industrial and manufacturing sectors.

Moreover, wireless sensors eliminate the need for costly infrastructure and cabling, thereby decreasing maintenance and installation expenditures. Their plug-and-play nature increases their suitability for retrofitting outdated machinery. Their cost-efficacy amplifies industry penetration, mainly in medium-sized industries.

Additionally, corporations and governments worldwide are investing in digital transformation and smart factories. Wireless vibration sensors are critical components of machine-level intelligence. Economies like Germany, China, and the United States are leading these programs.

Nevertheless, the global market is facing barriers due to power and battery life restrictions, as well as concerns over data privacy and security. Despite improvements, wireless sensors are still dependent on finite battery life. Repetitive battery replacements lead to increased maintenance and downtime, particularly in isolated and remote areas. This restricts their adoption in a few high-demand industrial settings.

Furthermore, wireless networks are susceptible to data breaches and cyberattacks. Industries may be hesitant to deploy these sensors due to concerns about tampering and unauthorized access. The need for strong cybersecurity increases the complexity of deployment.

Still, the global wireless vibration sensor industry benefits from favorable factors like growth in remote monitoring applications and increased use in smart buildings. Industries such as mining, oil and gas, and wind energy require monitoring of hazardous, remote, and inaccessible locations. Wireless vibration sensors offer an efficient and safe solution. Remote diagnostics reduce downtime, risk, and travel.

Moreover, these sensors are gaining prominence in smart building applications. They efficiently monitor escalators, HVAC systems, and mechanical infrastructure for signs of wear. This reduces service costs and improves efficiency.

Key Insights:

- As per the analysis shared by our research analyst, the global wireless vibration sensor market is estimated to grow annually at a CAGR of around 5.20% over the forecast period (2025-2034)

- In terms of revenue, the global wireless vibration sensor market size was valued at around USD 1430 million in 2024 and is projected to reach USD 2140 million by 2034.

- The wireless vibration sensor market is projected to grow significantly owing to the surging adoption of predictive maintenance, cost reduction in sensor deployment, and growth in smart grid deployment and renewable energy.

- Based on sensor type, the accelerometers segment is expected to lead the market, while the MEMS segment is expected to grow considerably.

- Based on connectivity technology, the Wi-Fi is the dominant segment, while the Bluetooth segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the predictive maintenance segment is expected to lead the market compared to the machine condition monitoring segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Wireless Vibration Sensor Market: Growth Drivers

Surging demand from the aerospace and automotive industries drives market growth

The aerospace and automotive sectors are actively accepting wireless vibration sensors to ensure machine maintenance, meet strict quality control standards, and enhance product quality. In the automotive industry, sensor-based vibration analysis detects faults and imbalances in robotic arms, drive systems, and assembly lines.

In the aerospace industry, wireless vibration sensors are applied in engine health monitoring, predictive diagnostics, and airframe inspections for ground support equipment. Airbus and Boeing have expressed interest in expanding sensor-based maintenance platforms, while small aviation maintenance companies are integrating wireless solutions to enhance aircraft reliability and safety.

The growth of digital twin technologies and smart factories considerably fuels the market

The rising development of digital twin technology and smart factories is another key propellant in the wireless vibration sensor market. Wireless vibration sensors generate datasets that feed into digital twins, enabling plant managers to simulate behavior, optimize asset performance, and predict issues in real time.

Siemens joined hands with an electronics conglomerate in South Korea in January 2025 to deploy an extensive sensor-based digital twin platform in five manufacturing sites. Boosting the acceptance of wireless condition-monitoring tools.

Wireless Vibration Sensor Market: Restraints

Network reliability issues and data transmission latency hinder the market progress

Wireless systems are susceptible to signal interference, data latency, and reliability issues, particularly in industrial environments that are heavily affected by electromagnetic interference (EMI) from nearby heavy machinery. Signal degradation may lead to incomplete data capture or delayed alerts, thereby compromising the value of real-time monitoring.

Industries such as pharmaceuticals and aerospace manufacturing, which require continuous and ultra-reliable monitoring, are, hence, hesitant to completely shift towards wireless systems.

Wireless Vibration Sensor Market: Opportunities

Mounting demand for worker safety solutions and remote monitoring favorably impacts the market progress

Industrial strategies following COVID-19 continue to prioritize worker safety and remote monitoring, particularly in high-risk environments such as oil and gas, mining, and chemical processing. Wireless vibration sensors enable remote fault detection, reducing the need for human intervention in hazardous areas.

Some of the latest case studies in Australia's mining industry demonstrated that sensor-based safety protocols resulted in a 35% drop in maintenance-associated injuries. This dual utility for both safety and operational enhancements expands the potential applications and consumer base for sensor-based solutions, thereby influencing the advancement of the wireless vibration sensor industry.

Wireless Vibration Sensor Market: Challenges

The lack of global standards and a fragmented ecosystem challenge the market growth

The fragmented nature of the global market, with different communication protocols and proprietary platforms, hinders unified integration between vendors and devices. This lack of standardization offers compatibility issues, restricted interoperability, and vendor lock-in among systems.

As of 2025, only 12 percent of producers worldwide have adopted an interoperable IoT architecture, according to the Industrial Internet of Things Consortium. The remaining run in siloed environments, which limits centralized scaling and data analytics in multisite operations.

Wireless Vibration Sensor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wireless Vibration Sensor Market |

| Market Size in 2024 | USD 1430 Million |

| Market Forecast in 2034 | USD 2140 Million |

| Growth Rate | CAGR of 5.20% |

| Number of Pages | 211 |

| Key Companies Covered | Analog Devices Inc., Honeywell International Inc., Siemens AG, Emerson Electric Co., ABB Ltd., General Electric (GE) Measurement & Control, TE Connectivity, PCB Piezotronics Inc., National Instruments Corporation, Bosch Rexroth AG, STMicroelectronics, Hansford Sensors Ltd., Monnit Corporation, RONDS Instruments Inc., Wilcoxon Sensing Technologies, and others. |

| Segments Covered | By Sensor Type, By Connectivity Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wireless Vibration Sensor Market: Segmentation

The global wireless vibration sensor market is segmented based on sensor type, connectivity technology, application, and region.

Based on sensor type, the global wireless vibration sensor industry is divided into accelerometers, velocity sensors, displacement sensors, and MEMS. The accelerometers segment is the dominating segment in the worldwide market due to their ability to detect a broader spectrum of vibration amplitudes and frequencies. They measure acceleration forces, which makes them the best fit for detecting early signals of imbalance, bearing wear, structural fatigue, and misalignment. This responsiveness and high sensitivity increase their suitability for rotating equipment and high-speed machinery. Their broader use encompasses industries such as aerospace, manufacturing, automotive, and energy, where early fault identification is crucial to prevent sudden and catastrophic failures.

Based on connectivity technology, the global wireless vibration sensor market is segmented as Bluetooth, Wi-Fi, LoRa, and Zigbee. The Wi-Fi segment leads in the market due to its high data transmission capacity, compatibility, and stable connectivity with the existing industrial ecosystem. It enables real-time data streaming and integration with cloud monitoring systems, which is crucial for maintaining facilities consistently and effectively. It holds key applications in energy, manufacturing, and aerospace, where large volumes need to be gathered, analyzed, and acted upon immediately.

Based on application, the global market is segmented as machine condition monitoring, structural health monitoring, automotive testing, aerospace & defense monitoring, and predictive maintenance. The predictive maintenance segment leads the global market, driven by the need to reduce unplanned downtime, extend equipment lifespan, and lower maintenance costs. Wireless vibration sensors play a crucial role in detecting early signs of failure before a breakdown occurs.

With the growth of data-driven operations and Industry 4.0, predictive maintenance is becoming a strategic priority in sectors such as transportation, energy, and manufacturing. The segment benefits from the widespread deployment of wireless sensor networks assimilated with AI diagnostics and cloud analytics.

Wireless Vibration Sensor Market: Regional Analysis

North America to witness significant growth over the forecast period

North America continues to lead the wireless vibration sensor market due to the early adoption of predictive maintenance, a strong industrial base, significant investment in innovative factory technologies and Industrial Internet of Things (IIoT), and advanced technological infrastructure.

North America, particularly the United States, boasts a well-developed industrial ecosystem with a strong presence of heavy equipment in the manufacturing, aerospace, oil and gas, and energy sectors. These industries are early adopters of predictive maintenance solutions to decrease sudden downtime and enhance asset performance. The region also leads in the adoption of IIoT, which directly facilitates the incorporation of wireless vibration sensors.

Companies are embracing wireless sensors for real-time machine analytics, enabling operational efficiency and smart manufacturing. North America also benefits from a highly professional and well-trained workforce, as well as superior R&D institutions that aid in the incorporation of machine learning, AI, and wireless sensing.

With nearly 70% of U.S. manufacturers utilizing some form of digital monitoring, the network is poised for growth in wireless vibration sensors. This propels the advancement and deployment of predictive analytics.

Europe holds a second-leading position in the wireless vibration sensor industry, driven by the surging adoption of smart factories and Industry 4.0, as well as expanding infrastructure monitoring, renewable energy, and government-backed funding initiatives.

European countries are implementing Industry 4.0 strategies to enable real-time condition monitoring and the development of smart factories. Wireless vibration sensors are vital components of these intelligent systems, feeding on-premise analytics or real-time data in cloud-based systems for predictive insights.

Europe is expanding its renewable energy ecosystem, primarily in the hydro and wind sectors, which require continuous vibration monitoring for rotating equipment and turbines. The region invested €70 billion in renewables in 2024, thereby driving significant demand for sensors. European governments and the European Union provide more extensive funding for smart and digital infrastructure.

Initiatives such as the Digital Europe Program and Horizon Europe give financial support to projects that utilize advanced monitoring methods. These initiatives motivate large enterprises and SMEs to adopt condition-monitoring systems.

Wireless Vibration Sensor Market: Competitive Analysis

The key operating players in the global wireless vibration sensor market are:

- Analog Devices Inc.

- Honeywell International Inc.

- Siemens AG

- Emerson Electric Co.

- ABB Ltd.

- General Electric (GE) Measurement & Control

- TE Connectivity

- PCB Piezotronics Inc.

- National Instruments Corporation

- Bosch Rexroth AG

- STMicroelectronics

- Hansford Sensors Ltd.

- Monnit Corporation

- RONDS Instruments Inc.

- Wilcoxon Sensing Technologies

Wireless Vibration Sensor Market: Key Market Trends

Rise of MEMS-based compact sensors:

The market is experiencing the speedy adoption of MEMS sensors due to their low power consumption, miniaturization, and low cost. These sensors are highly suitable for battery-powered vibration monitoring devices and portable devices in different industries. MEMS improvements are driving the growth of application cases in smart tools and wearables.

Surging demand for AI-driven predictive maintenance:

AI and ML are increasingly used to analyze vibration data for predictive diagnostics and automated fault detection. Companies are integrating artificial intelligence engines in wireless engine infrastructure to detect anomalies, recommend maintenance actions, and track asset health. This trend aids cost savings, enhances operational efficiency, and reduces downtime in industries.

The global wireless vibration sensor market is segmented as follows:

By Sensor Type

- Accelerometers

- Velocity Sensors

- Displacement Sensors

- MEMS

By Connectivity Technology

- Bluetooth

- Wi-Fi

- LoRa

- Zigbee

By Application

- Machine Condition Monitoring

- Structural Health Monitoring

- Automotive Testing

- Aerospace & Defense Monitoring

- Predictive Maintenance

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Wireless vibration sensors are battery-powered, compact devices designed to monitor and transmit vibration data from structures and machines without the need for physical wiring. They play a vital role in predictive maintenance by detecting anomalies, such as misalignment, bearing failures, and imbalance, in real time. These sensors utilize wireless communication protocols, such as LoRa, Bluetooth, and Wi-Fi, to transmit data to monitoring systems or cloud platforms.

The global wireless vibration sensor market is projected to grow due to the rising adoption of Industry 4.0, the progress of IIoT, and the increasing focus on equipment and worker safety.

According to study, the global wireless vibration sensor market size was worth around USD 1430 million in 2024 and is predicted to grow to around USD 2140 million by 2034.

The CAGR value of the wireless vibration sensor market is expected to be approximately 5.20% from 2025 to 2034.

North America is expected to lead the global wireless vibration sensor market during the forecast period.

The key players profiled in the global wireless vibration sensor market include Analog Devices Inc., Honeywell International Inc., Siemens AG, Emerson Electric Co., ABB Ltd., General Electric (GE) Measurement & Control, TE Connectivity, PCB Piezotronics Inc., National Instruments Corporation, Bosch Rexroth AG, STMicroelectronics, Hansford Sensors Ltd., Monnit Corporation, RONDS Instruments Inc., and Wilcoxon Sensing Technologies.

The report examines key aspects of the wireless vibration sensor market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed