Wireless Health Market Size, Share, Trends, Growth and Forecast 2034

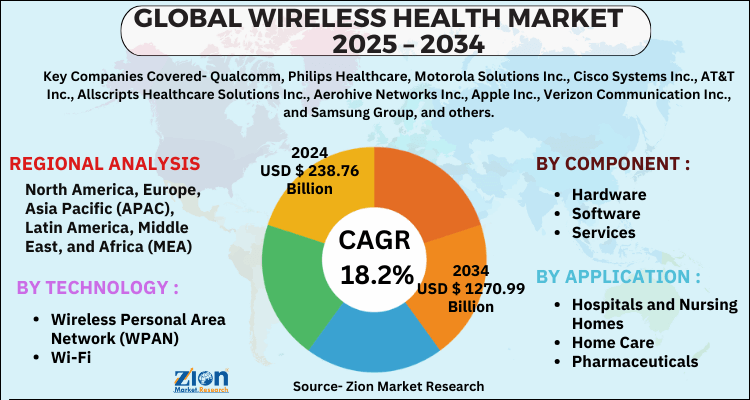

Wireless Health Market By Technology (Wireless Personal Area Network (WPAN), Wi-Fi, Worldwide Interoperability for Microwave Access (WiMAX), and Wireless Wide Area Network (WWAN)), By Component (Hardware, Software, and Services), By Application (Hospitals & Nursing Homes, Home Care, and Pharmaceuticals), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

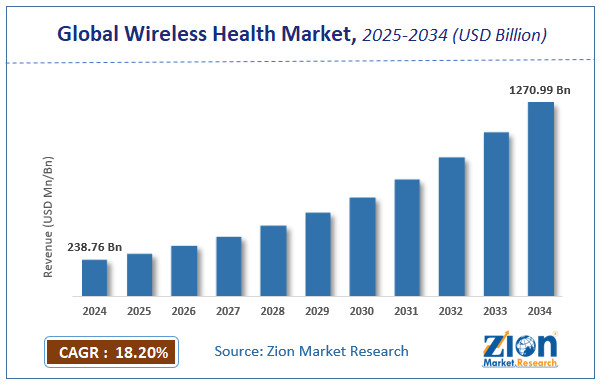

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 238.76 Billion | USD 1270.99 Billion | 18.2% | 2024 |

Wireless Health Market Industry Perspective:

The global wireless health market was worth around USD 238.76 Billion in 2024 and is estimated to grow to about USD 1270.99 Billion by 2034, with a compound annual growth rate (CAGR) of approximately 18.2% between 2025 and 2034. The report analyzes the wireless health market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the wireless health market.

Wireless Health Market: Overview

Wireless health is a cutting-edge practice that combines conventional health with wireless technology to treat, diagnose, and monitor patients, as well as to improve their overall well-being. It is mostly used for telemedicine, which is utilized to treat patients who are digitally linked to a doctor via video conferencing and who live in places where healthcare services are not readily available. Medical care is connected to suppliers of a sensor, wireless network service providers, hardware systems, enterprise data management groups, and technology developers through wireless health. Wearable gadgets, for example, are applications of wireless health that focus on rehab, early illness identification, and personal health status.

Wireless Health market is expected to witness a significant growth owing to its applications to improve the delivery, quality, timeliness, and availability, as well as to reduce the total or life cycle costs of health care. These costs are being driven by the combination of aging populations and rising demands for the use of increasingly expensive technology, as well as the spread of chronic conditions such as diabetes and cardiovascular diseases. For example, as per the Population Health Management; diabetes will remain a major health crisis in America, in spite of medical advances and prevention efforts. The prevalence of diabetes (type 2 diabetes and type 1 diabetes) will increase by 54% to more than 54.9 million Americans between 2015 and 2030; annual deaths attributed to diabetes will climb by 38% to 385,800; and total annual medical and societal costs related to diabetes will increase 53% to more than $622 billion by 2030. The major advantage of the wireless health is to promote the extension of care beyond hospitals, clinics and doctors’ offices to patients’ homes and other locations for the better connectivity and communication between patients and their care providers. Another capability of growing interest for wireless medical devices is image transfer. Applications such as remote monitoring, remote supervision of surgical operations, and point-of-care solutions require high integrity transmission of still and video images, intelligent compression algorithms and techniques to identify the useful data and avoidance of unwanted, i.e. misleading artifacts.

With the increasing number of geriatric population coupled with the need of continuous health monitoring is the major driving factor for the demand of wireless health. In addition, innovative advancements in wireless communication technologies and increasing adoption of the utilization of wireless connected devices in the management of chronic diseases are also expected to supplement the growth in this market within the forecast period. Furthermore, increasing penetration of internet is also expected to boost the growth in wireless health market. However, the high initial cost of wearable health devices, dearth of well trained & skilled professionals and Tortuous and expensive paths for introducing wireless innovations into healthcare products and services, such as those involving FDA approval can hamper the growth in this market within the forecast period. In spite of these restraints, technological advancements to develop new innovative wireless health devices can be an opportunity in this market within the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global wireless health market is estimated to grow annually at a CAGR of around 18.2% over the forecast period (2025-2034).

- Regarding revenue, the global wireless health market size was valued at around USD 238.76 Billion in 2024 and is projected to reach USD 1270.99 Billion by 2034.

- The wireless health market is projected to grow at a significant rate due to increasing adoption of remote patient monitoring, connected medical devices, and the expansion of iot in healthcare.

- Based on Technology, the Wireless Personal Area Network (WPAN) segment is expected to lead the global market.

- On the basis of Component, the Hardware segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Hospitals & Nursing Homes segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Wireless Health Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wireless Health Market |

| Market Size in 2024 | USD 238.76 Billion |

| Market Forecast in 2034 | USD 1270.99 Billion |

| Growth Rate | CAGR of 18.2% |

| Number of Pages | 110 |

| Key Companies Covered | Qualcomm, Philips Healthcare, Motorola Solutions Inc., Cisco Systems Inc., AT&T Inc., Allscripts Healthcare Solutions Inc., Aerohive Networks Inc., Apple Inc., Verizon Communication Inc., and Samsung Group, and others. |

| Segments Covered | By Technology, By Component, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wireless Health Market: Growth Drivers

Wireless Health Market: Penetration of internet and wireless communication technology is driving the market growth

Increased use of the smartphone has changed the perspective of healthcare professionals. Instead of being distracted by time-consuming administrative procedures, healthcare providers in a connected hospital employ wireless medical devices to offer the highest quality of care to patients. Doctors and nurses can readily access up-to-date patient information, allowing them to make treatment decisions based on real-time medical data, resulting in better patient outcomes. The market is also driven by wearable devices for continuous monitoring. Medical equipment and diagnostic centers are experimenting with body-worn sensors that can monitor vital signs and send them in real-time to an internet platform that can be accessed remotely, thanks to the spread of smartphones and the acceptance of wearable gadgets.

Wireless Health Market: Restraints

Wireless Health Market: Concerns about data privacy and cybersecurity may limit the market expansion.

Nearly millions of patients are using wireless health to obtain rapid results remotely. However, such vast data with patient history, treatment, and outcomes are volatile to data piracy. Because large volumes of healthcare data are collected over the course of treatment in medical institutions such as hospitals and clinics, data theft might jeopardize patients' privacy. Cyberattacks are the biggest threat for any wireless applications as they can be hacked and used by unauthorized firms or groups, which is also contributing to the slow growth of the market.

Wireless Health Market: Opportunities

Wireless Health Market: IoT in the healthcare sector to increase usage of wireless health.

Internet of Things has the potential to transform the sector significantly, as its applications are easy to adopt and understand. Like many other industries, the Internet of Things (IoT) has aided the expansion of healthcare IT, which has necessitated the creation of a connected medical environment. In the event of unavailability, wireless network solutions aid the healthcare business by allowing physicians to access data offsite to direct diagnostics.

Wireless Health Market: Challenges.

Wireless Health Market: 24/7 operational medical sector with no downtime for network maintenance poses the biggest challenge for market.

Continuous patient flow and emergency treatments push the medical sector to function 24/7. It is important that the wireless functions remain operative during critical care. However, this could cause less attention to network maintenance and result in a shutdown of wireless operations.

Wireless Health Market: Segmentation

The global wireless health market is segregated based on component, technology, application, and region.

The component segment of the market is categorized into software, hardware, and services. Among these, the software segment contributes a major revenue share of about 41 percent.

Based on technology, the market is bifurcated into Wireless Wide Area Network (WWAN), Worldwide Interoperability for Microwave Access (WiMAX), Wi-Fi, and Wireless Personal Area Network (WPAN).

The application segment is divided into pharmaceuticals, home care, and hospitals & nursing homes. The home care segment is likely to register the highest CAGR by the projected period.

Recent Developments

- In December 2021, AT&T, Qure4u, and Samsung formed an alliance to provide remote patient monitoring for high-risk patients using FirstNet®.

- In March 2021, General Electric announced the release of Vscan Air, new wireless, hand-held ultrasound gadget designed to help the corporation gain a competitive edge in the booming market.

Regional Landscape

North America holds the dominant share of 40 % in the global wireless health market. This is attributed to a well-established healthcare infrastructure, a large number of smartphone users, and increasing adoption of remote healthcare. Increased awareness and adoption of remote/telehealth in the United States contribute to the largest share of the country in the regional market. The Healthcare sector in Canada is one of the best in the world; also it is rapidly adopting newer technologies. Due to this, the country is expected to grow at a rapid rate in the regional market. The Asia Pacific is one of the largest healthcare markets in the world and is expected to offer excellent growth opportunities for the wireless health market.

The regional segmentation includes the present and forecast demand for North America, Europe, Asia Pacific, Latin America and the Middle East and Africa with its further bifurcation into major countries including China, Japan, India, U.S. Germany, France, UK, and Brazil. North America has accounted for largest share of this market in 2016 and is expected to witness the fastest growth in global wireless health market in coming five years. Major driving factors of this market in this region are government initiatives such as the Affordable Care Act.

Europe is expected to attribute for the second largest position in this market within the forecast period due to the more inclination towards developing new innovative healthcare technologies. Asia Pacific is expected to be one of the attractive markets for wireless health within the forecast period owing to the increasing awareness about wireless devices and improving healthcare infrastructure. Latin America and Middle East and Africa are expected to show a positive growth in this market in the coming five years.

Wireless Health Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the wireless health market on a global and regional basis.

Competitive Landscape

- Qualcomm

- Philips Healthcare

- Motorola Solutions Inc.

- Cisco Systems Inc.

- AT&T Inc.

- Allscripts Healthcare Solutions Inc.

- Aerohive Networks Inc.

- Apple Inc.

- Verizon Communication Inc.

- Samsung Group

are some of the major players that are operating in the global wireless health market.

The global wireless health market is segmented as follows:

Global Wireless Health Market By Technology

- Wireless Personal Area Network (WPAN)

- Wi-Fi

- Worldwide Interoperability for Microwave Access (WiMAX)

- Wireless Wide Area Network (WWAN)

By Component

- Hardware

- Software

- Services

By Application

- Hospitals and Nursing Homes

- Home Care

- Pharmaceuticals

- Other

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Wireless Health (or mHealth - Mobile Health) refers to the use of wireless communication technologies, such as Wi-Fi, Bluetooth, 5G, and IoT (Internet of Things), to deliver healthcare services, monitor patients remotely, and improve medical outcomes. It enables real-time data collection, telemedicine, and personalized care without the need for physical hospital visits.

The global wireless health market is expected to grow due to increasing adoption of remote patient monitoring, growing use of mobile health applications, and advancements in wearable health devices.

According to a study, the global wireless health market size was worth around USD 238.76 Billion in 2024 and is expected to reach USD 1270.99 Billion by 2034.

The global wireless health market is expected to grow at a CAGR of 18.2% during the forecast period.

North America is expected to dominate the wireless health market over the forecast period.

Leading players in the global wireless health market include Qualcomm, Philips Healthcare, Motorola Solutions Inc., Cisco Systems Inc., AT&T Inc., Allscripts Healthcare Solutions Inc., Aerohive Networks Inc., Apple Inc., Verizon Communication Inc., and Samsung Group, among others.

The report explores crucial aspects of the wireless health market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed