Wind Energy Market Size, Share, Trends, Growth & Forecast 2034

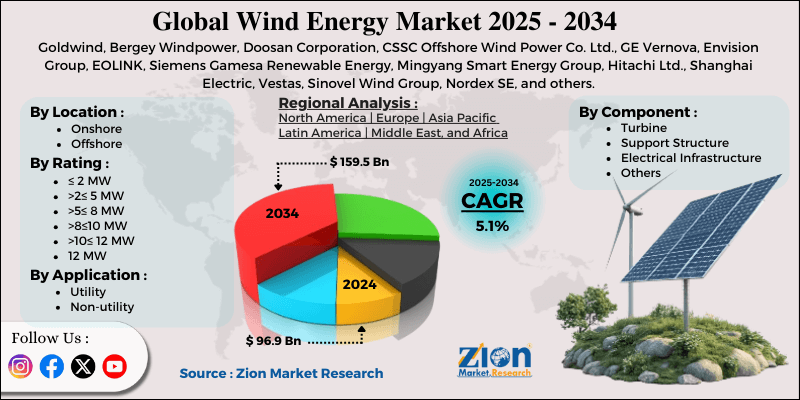

Wind Energy Market By Location (Onshore and Offshore), By Component (Turbine, Support Structure, Electrical Infrastructure, and Others), By Application (Utility and Non-utility), By Rating (≤ 2 MW, >2≤ 5 MW, >5≤ 8 MW, >8≤10 MW, >10≤ 12 MW, and 12 MW), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034-

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 96.9 Billion | USD 159.5 Billion | 5.1% | 2024 |

Wind Energy Industry Perspective:

What will be the size of the global wind energy market during the forecast period?

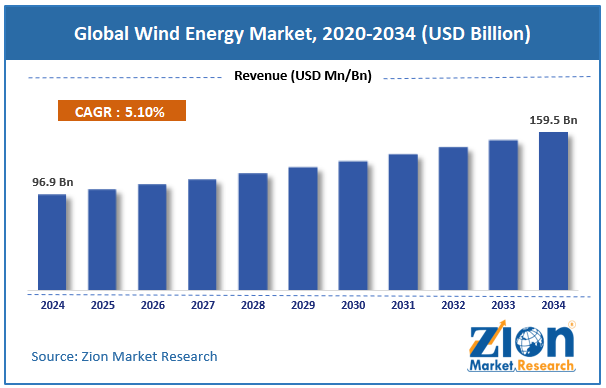

The global wind energy market size was worth around USD 96.9 billion in 2024 and is predicted to grow to around USD 159.5 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.1% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global wind energy market is estimated to grow annually at a CAGR of around 5.1% over the forecast period (2025-2034).

- In terms of revenue, the global wind energy market size was valued at around USD 96.9 billion in 2024 and is projected to reach USD 159.5 billion by 2034.

- The growing shift towards renewable energy source acting as a significant driver for the global wind energy market.

- Based on the location, the onshore segment is expected to dominate the market in 2024, with more than 70% revenue share.

- Based on the component, the turbine segment is expected to dominate the market over the projected period.

- Based on the application, the utility segment held the largest revenue share in 2024 and is expected to continue the same pattern during the projected period.

- Based on the rating, the >8≤10 MW segment is expected to hold the dominant position in the market.

- Based on region, Asia Pacific leads the market, generating over 40% of revenue in 2024.

Wind Energy Market: Overview

Wind energy is a renewable energy source that produces electrical power through wind turbines, which convert wind movement into electricity. The wind flows through turbine blades, which turn to drive a generator that creates electrical power. Wind energy can be captured through onshore wind farms, which operate on land, and offshore wind farms, which operate in coastal or deep-sea areas with stronger, more reliable wind conditions. Wind energy is an environmentally sustainable energy source because it produces electricity without burning fuel and emits no greenhouse gases during power generation. The worldwide increase in demand for clean energy is driving wind energy expansion as nations seek to reduce carbon emissions while combating climate change. Governments that establish strict emission-reduction targets alongside net-zero objectives create a need for utilities and independent power producers to implement renewable energy sources, such as wind power, rather than fossil-fuel-based electricity generation. The government provides financial backing for wind power projects through multiple mechanisms, including feed-in tariffs, renewable energy auctions, tax incentives, and renewable purchase obligations, thereby improving the economic feasibility of these projects.

The wind energy market faces several challenges that limit its growth potential, despite strong government backing and rising demand for environmentally friendly energy solutions. The wind resource challenge arises because electricity generation depends on unpredictable wind patterns. The project expenses increase because the system requires additional investments in energy storage facilities, backup generators, and sophisticated grid control systems, which compromise grid reliability.

Wind Energy Market: Dynamics

Growth Drivers

How does the increasing electricity demand act as a major catalyst for the wind energy market expansion?

The growing demand for electricity is a major driver of wind energy market growth because it creates an urgent need for new, reliable, and scalable power-generating capacity, thereby accelerating investment in energy infrastructure. The world's power use is rising because more people are moving to cities, more industries are growing, and more people are using electricity-intensive technologies such as electric cars, data centers, and digital infrastructure. Utilities and governments must continue to increase generation capacity to meet this growing demand. This opens up many opportunities for large-scale energy projects. Environmental restrictions and agreements to cut carbon emissions make it harder to build traditional fossil-fuel power plants. This shifts new capacity expansions to renewable energy sources, especially wind energy, which can be delivered at utility scale and has minimal operating costs after installation. Wind power is a more attractive option as electricity demand grows because it provides a steady supply of energy over time without the risk of fuel price changes or pollution fines.

In addition, higher electricity demand drives grid expansion and upgrades, making it easier to connect large wind farms to national power systems. Utilities and large industrial users sign long-term power purchase agreements (PPAs) that help wind energy providers by providing a steady cash flow. As a result, increased demand for power immediately drives greater capacity, investment, and technological advances. This is a key driver of growth in the wind energy sector.

For instance, according to the International Energy Agency, global electricity demand is expected to grow at an average annual rate of 3.3% in 2025 and 3.7% in 2026.

Restraints

Grid infrastructure limitations pose a major restraint on industry growth

Grid infrastructure constraints make it difficult for wind farms to transmit and distribute the power they generate, slowing the growth of the wind energy sector. Many good wind power sites are in remote or rural areas, far from large demand centers. In these areas, transmission networks are either underdeveloped or too small. As more wind farms are built, current networks often can't handle the changing, decentralized nature of wind power, leading to congestion, curtailment, and energy losses.

In addition, integrating large amounts of wind energy into the grid requires modifications to infrastructure such as high-voltage transmission lines, smart grid systems, and advanced forecasting and balancing technologies. All of these things will take a lot of money and time to create. Delays in expanding or modernizing the grid can make it harder to start wind projects, increase worker risks, and lower project profits. As a result, poor grid infrastructure remains a major obstacle to the large-scale deployment of wind energy, especially in developing countries. This limits the industry's overall growth potential.

Opportunities

Does the integration of AI offer a potential opportunity for growth in the wind energy market?

The use of artificial intelligence (AI) in the wind energy industry is a significant opportunity for growth, as it makes the entire value chain more efficient, reliable, and cost-effective. AI-based analytics provide grid operators with improved wind forecasts and power output predictions, helping them better balance supply and demand and reduce curtailment losses. Better forecasting also helps incorporate wind energy more effectively into current electricity systems, which is one of the industry's main challenges. AI also has a significant impact on asset management and predictive maintenance. AI systems can detect early signs of wear or failure in turbine parts by analyzing real-time data from turbine sensors. This lets operators plan maintenance in advance. This reduces unplanned downtime, extends turbine life, and lowers the cost of running and maintaining them, making the project more profitable.

For instance, in January 2026, Envision Energy connected its first AI wind turbine prototype to the grid in Australia. This action supports Fortescue's Nullagine Wind Project by delivering cleaner energy through renewable wind power, increasing operational efficiency with AI-driven performance, and reducing carbon emissions. This milestone makes Fortescue's first operational wind development a key step toward the Real Zero strategy. The achievement also marks progress for Envision in Australia's renewable energy sector and demonstrates how physical AI systems help decarbonize large-scale industries nationwide.

Challenges

Does the reliance on policy support pose a major challenge to the expansion of the wind energy market?

The wind energy sector's expansion is being held back by its reliance on government support, since the economic viability of many wind projects is closely tied to government incentives and rules. Feed-in tariffs, tax credits, renewable energy certificates, and auction-based pricing have all played a significant role in minimizing project risk and increasing returns for developers. When these kinds of actions are put off, cut back, or stopped altogether, investors may lose faith, which could lead to project cancellations or slower capacity growth.

Wind energy companies and investors also have a hard time preparing for the long term because policies and rules change often and are not always clear. Changes to tariff structures, delays in subsidy payments, and changes to renewable energy targets can all make it harder to secure funding, raise project costs, and disrupt supply chains. Because of this dependence on stable policies, the market is highly sensitive to political and economic changes, especially in emerging markets. This makes it hard for the wind energy industry to grow in a predictable, long-term way.

Wind Energy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wind Energy Market |

| Market Size in 2024 | USD 96.9 Billion |

| Market Forecast in 2034 | USD 159.5 Billion |

| Growth Rate | CAGR of 5.1% |

| Number of Pages | 212 |

| Key Companies Covered | Goldwind, Bergey Windpower, Doosan Corporation, CSSC Offshore Wind Power Co. Ltd., GE Vernova, Envision Group, EOLINK, Siemens Gamesa Renewable Energy, Mingyang Smart Energy Group, Hitachi Ltd., Shanghai Electric, Vestas, Sinovel Wind Group, Nordex SE, and others. |

| Segments Covered | By Location, By Component, By Application, By Rating, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wind Energy Market: Segmentation

Location Insights

The onshore segment is expected to dominate the market in 2024, accounting for more than 70% of revenue. Onshore wind power has become the most popular renewable energy source in the area because it is cheaper than offshore wind, easier to install, and produces fewer greenhouse gas (GHG) emissions. The cost of building onshore and offshore wind power projects has fallen worldwide and is expected to continue to decline over the next few years, helping the market flourish.

Component Insights

The turbine segment is expected to dominate the market over the projected period. The growth of wind power installations is currently being fueled by the rapid development of land- and sea-based wind energy projects worldwide. Increasing investments in renewable energy capacity to meet national decarbonization targets and growing electricity demand directly increase the market demand for wind turbines, which are needed for both utility-scale and commercial operations. The market for turbine procurement has become an essential component of overall revenue generation, as countries now focus their resources on developing extensive clean energy systems.

Application Insights

The utility segment held the largest revenue share in 2024 and is expected to continue the same pattern during the projected period. The increasing number of product launches and growing awareness of renewable energy sources are major catalysts that have influenced industry expansion.

For instance, in January 2026, ABB delivered its first wind power converter to India after purchasing Gamesa Electric's power electronics business in December 2025. The milestone delivery to a wind turbine OEM was produced and dispatched from ABB's advanced manufacturing plant in Bengaluru, India. The delivery demonstrates ABB's increased dedication to renewable energy and wind power development throughout India and the rest of the world.

Rating Insights

The >8≤10 MW segment is expected to hold the dominant position in the market. Offshore wind project growth is primarily driven by the adoption of high-capacity turbines. The development industry selects these turbines because they generate more electricity than standard units, enabling developers to install fewer turbines. This approach benefits manufacturers by increasing revenue, reducing balance-of-plant expenses, maximizing use of seabed space, and enhancing overall project performance.

Regional Insights

What major factor will cause the Asia Pacific to be in a leading position in the wind energy market?

Asia Pacific leads the market, generating over 40% of revenue in 2024. The region's rapidly expanding economies are driving robust energy demand, as governments launch targeted initiatives to boost renewable energy adoption. This growth stems from these catalysts. China and India are leading the way, investing heavily in onshore and offshore wind to harness substantial wind resources. The area enforces strict policies, including targeted subsidies and binding mandates, clearly demonstrating a commitment to reducing greenhouse gas emissions and fighting climate change.

Moreover, the growing deployment of wind energy by international players in countries such as India is driving industry growth. For instance, in September 2025, Serentica Renewables, a leading renewable energy company in India, selected Envision Energy India, a leading OEM, to supply Wind Turbine Generators (WTGs) for its 560 MW Wind Project in India. The project will feature advanced Envision Smart WTGs, each with a 5MW rated capacity. The project's delivery is expected to commence in February 2026, marking a significant milestone in Serentica’s commitment to providing reliable, round-the-clock green power across India.

Wind Energy Market: Competitive Analysis

The global wind energy market is dominated by players like:

- Goldwind

- Bergey Windpower

- Doosan Corporation

- CSSC Offshore Wind Power Co. Ltd.

- GE Vernova

- Envision Group

- EOLINK

- Siemens Gamesa Renewable Energy

- Mingyang Smart Energy Group

- Hitachi Ltd.

- Shanghai Electric

- Vestas

- Sinovel Wind Group

- Nordex SE

The global wind energy market is segmented as follows:

By Location

- Onshore

- Offshore

By Component

- Turbine

- Support Structure

- Electrical Infrastructure

- Others

By Application

- Utility

- Non-utility

By Rating

- ≤ 2 MW

- >2≤ 5 MW

- >5≤ 8 MW

- >8≤10 MW

- >10≤ 12 MW

- 12 MW

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed