Well Intervention Services Market Size, Share, Trends, Growth and Forecast 2034

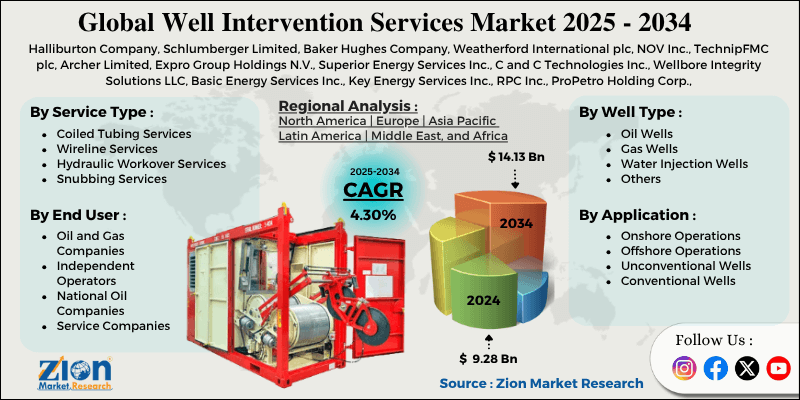

Well Intervention Services Market By Service Type (Coiled Tubing Services, Wireline Services, Hydraulic Workover Services, Snubbing Services, and Others), By Application (Onshore Operations, Offshore Operations, Unconventional Wells, and Conventional Wells), By Well Type (Oil Wells, Gas Wells, Water Injection Wells, and Others), By End-User (Oil and Gas Companies, Independent Operators, National Oil Companies, and Service Companies), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

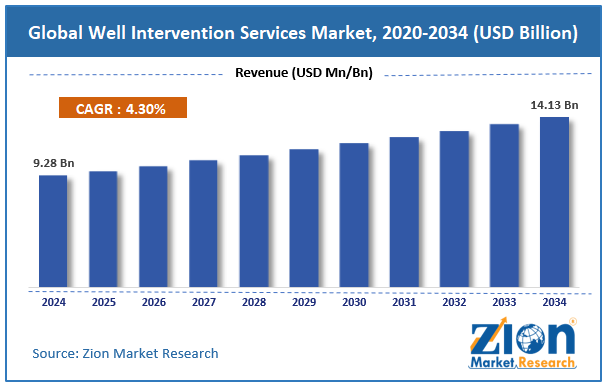

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.28 Billion | USD 14.13 Billion | 4.30% | 2024 |

Well Intervention Services Industry Perspective:

The global well intervention services market was valued at approximately USD 9.28 billion in 2024 and is expected to reach around USD 14.13 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 4.30% between 2025 and 2034.

Well Intervention Services Market: Overview

Well intervention services are specialized operations on oil and gas wells to increase production, maintain well integrity, and extend life cycles through various technical procedures and equipment deployment. These services include coiled tubing, wireline, hydraulic workover, and snubbing services to address production optimization, well completion, remediation, and maintenance requirements.

The well intervention services market serves upstream oil and gas operators, including major integrated companies, independent producers, and national oil companies, who seek to maximize production from existing wells.

The increasing focus on maximizing production from mature oil fields, growing unconventional resource development, and the need for cost-effective production optimization is expected to drive substantial growth in the global well intervention services industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global well intervention services market is estimated to grow annually at a CAGR of around 4.30% over the forecast period (2025-2034)

- In terms of revenue, the global well intervention services market size was valued at around USD 9.28 billion in 2024 and is projected to reach USD 14.13 billion by 2034.

- The well intervention services market is projected to grow significantly due to the increasing number of aging wells requiring maintenance, expansion of unconventional drilling activities, and technological advancements in intervention equipment and techniques.

- Based on service type, coiled tubing services lead the segment and will continue to dominate the global market.

- Based on the application, onshore operations are expected to lead the market.

- Based on the well type, oil wells are anticipated to command the largest market share.

- Based on end-users, oil and gas companies are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Well Intervention Services Market: Growth Drivers

Mature field optimization

The global well intervention services market is growing as oil and gas companies are focusing on maximizing production from existing mature fields rather than investing heavily in new exploration and development projects.

Mature wells decline in production due to mechanical issues and formation damage, requiring special intervention services to restore and boost productivity.

Intervention can increase production by 20-50% in mature wells through stimulation, cleanout, and remedial work. Companies are investing in intervention services as they get faster returns on investment compared to new wells and extend the life of existing assets.

Unconventional resource development

The well intervention services market is growing due to the continued development of unconventional oil and gas sources, such as shale and tight reservoirs. These wells need specialized services to improve completion designs and keep production steady.

Unconventional wells often require frequent interventions due to their complex structures and rapid production decline. Horizontal wells with multiple hydraulic stimulation stages require specialized tools to address issues and enhance production.

As companies focus on maximizing production from existing wells through methods like refracturing, the demand for skilled service providers is increasing.

Well Intervention Services Market: Restraints

High operational costs and economic sensitivity

Despite the growing demand, the well intervention services market is facing challenges of high operational costs and oil and gas price sensitivity, which can impact operator spending on discretionary interventions. Complex interventions require specialized equipment, skilled personnel, and extensive safety protocols, which add to the cost.

The economic downturn in the oil and gas industry means operators will cut back on capital spent on interventions as they focus on the essentials only.

The cost-benefit analysis for interventions becomes more stringent during periods of low commodity prices, which may delay or cancel interventions.

Well Intervention Services Market: Opportunities

Rising Shift to Digital Transformation and Data Analytics

The well intervention services market presents opportunities through the utilization of digital tools, automation, and smart systems, which help improve efficiency, reduce costs, and enhance safety. By leveraging advanced data analytics, real-time monitoring, and predictive maintenance, companies can plan and execute interventions with greater accuracy. Digital systems help connect intervention work with overall field strategies and production goals.

Remote monitoring and automated tools reduce the need for workers in risky areas while making operations more consistent and reliable. Adding artificial intelligence and machine learning to planning and execution creates new chances for faster and more effective services.

Well Intervention Services Market: Challenges

Environmental regulations and sustainability requirements

The well intervention services industry is facing challenges due to strict environmental rules, emission limits, and sustainability goals that affect how operations are done and what equipment is used. Meeting tougher environmental standards makes operations complex and expensive, often requiring investment in cleaner tools and processes.

Managing water use, handling waste, and controlling emissions during interventions requires special equipment and steps that increase costs. As companies focus on being environmentally responsible, they are choosing service providers who meet these standards.

Well Intervention Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Well Intervention Services Market |

| Market Size in 2024 | USD 9.28 Billion |

| Market Forecast in 2034 | USD 14.13 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 214 |

| Key Companies Covered | Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International plc, NOV Inc., TechnipFMC plc, Archer Limited, Expro Group Holdings N.V., Superior Energy Services Inc., C and C Technologies Inc., Wellbore Integrity Solutions LLC, Basic Energy Services Inc., Key Energy Services Inc., RPC Inc., ProPetro Holding Corp., CNPC Chuanqing Drilling Engineering Company Limited, Cudd Energy Services, Trican Well Service Ltd., Calfrac Well Services Ltd., Nine Energy Service Inc., and others. |

| Segments Covered | By Service Type, By Application, By Well Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Well Intervention Services Market: Segmentation

The global well intervention services market is segmented into service type, application, well type, end-user, and region.

Based on service type, the market is segregated into coiled tubing services, wireline services, hydraulic workover services, snubbing services, and others. Coiled tubing services lead the market due to their effectiveness in unconventional wells and their ability to perform operations under pressure without killing the well.

Based on application, the well intervention services industry is classified into onshore operations, offshore operations, unconventional wells, and conventional wells. Onshore operations hold the largest market share due to the extensive onshore well inventory, lower operational costs compared to offshore operations, and easier access to intervention equipment and personnel.

Based on the well type, the well intervention services market is divided into oil wells, gas wells, water injection wells, and others. Oil wells are expected to lead the market during the forecast period due to the global emphasis on oil production optimization, higher intervention frequency requirements, and substantial mature oil field inventory requiring ongoing maintenance.

Based on the end-user, the market is segmented into oil and gas companies, independent operators, national oil companies, and service companies. Oil and gas companies lead the market due to ongoing production optimization requirements and substantial capital investment in intervention services to maximize asset value.

Well Intervention Services Market: Regional Analysis

North America to lead the market

North America leads the global well intervention services market due to its large unconventional oil and gas development, older conventional fields, and the use of advanced technologies. The region accounts for approximately 40% of the global market, with the U.S. being the largest user of these services.

The region's advanced oilfield service infrastructure provides intervention capabilities, including specialized equipment, skilled personnel, and technical expertise. Technology innovation and early adoption of advanced intervention techniques position North America as a leader in intervention service development and application.

Supportive regulatory frameworks and favorable energy policies further strengthen market growth across the region. Ongoing investments in digital oilfield technologies and automation are also boosting efficiency and expanding service capabilities in the region.

The Middle East is expected to show steady growth.

The Middle East is seeing steady growth in the well intervention services market as countries work to maintain output from large conventional oil fields, improve recovery from aging reservoirs, and boost production efficiency.

The push to maximize the potential of existing fields aligns well with the services offered by intervention services, such as well maintenance and production improvements.

National oil companies in the region are investing in these services to keep their fields productive for longer and extract more oil from their large reserves.

New intervention techniques are being used to solve production problems in harsh reservoir conditions and very high temperatures. The region’s goal of staying a global oil leader is driving constant investment in these services and the technologies behind them.

Recent Market Developments:

- In March 2025, Halliburton Company introduced advanced coiled tubing intervention systems designed for high-pressure, high-temperature well conditions, featuring enhanced safety features and improved operational efficiency.

- In January 2025, Schlumberger introduced digital intervention planning software that integrates real-time data analytics with intervention operation optimization to improve decision-making and reduce costs.

Well Intervention Services Market: Competitive Analysis

The global well intervention services market is led by players like:

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

- Weatherford International plc

- NOV Inc.

- TechnipFMC plc

- Archer Limited

- Expro Group Holdings N.V.

- Superior Energy Services Inc.

- C and C Technologies Inc.

- Wellbore Integrity Solutions LLC

- Basic Energy Services Inc.

- Key Energy Services Inc.

- RPC Inc.

- ProPetro Holding Corp.

- CNPC Chuanqing Drilling Engineering Company Limited

- Cudd Energy Services

- Trican Well Service Ltd.

- Calfrac Well Services Ltd.

- Nine Energy Service Inc.

The global well intervention services market is segmented as follows:

By Service Type

- Coiled Tubing Services

- Wireline Services

- Hydraulic Workover Services

- Snubbing Services

By Application

- Onshore Operations

- Offshore Operations

- Unconventional Wells

- Conventional Wells

By Well Type

- Oil Wells

- Gas Wells

- Water Injection Wells

- Others

By End User

- Oil and Gas Companies

- Independent Operators

- National Oil Companies

- Service Companies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Well intervention services are specialized operations on oil and gas wells to increase production, maintain well integrity, and extend life cycles through various technical procedures and equipment deployment.

The well intervention services market is expected to be driven by the need for mature field optimization, unconventional resource development, aging well inventory requiring maintenance, technological advancements in intervention equipment, and an increasing focus on maximizing production from existing assets.

According to our study, the global well intervention services market was worth around USD 9.28 billion in 2024 and is predicted to grow to around USD 14.13 billion by 2034.

The CAGR value of the well intervention services market is expected to be around 4.30% during 2025-2034.

The global well intervention services market will register the highest revenue contribution from North America during the forecast period.

Key players in the well intervention services market include Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International plc, NOV Inc., TechnipFMC plc, Archer Limited, Expro Group Holdings N.V., Superior Energy Services Inc., C and C Technologies Inc., Wellbore Integrity Solutions LLC, Basic Energy Services Inc., Key Energy Services Inc., RPC Inc., ProPetro Holding Corp., CNPC Chuanqing Drilling Engineering Company Limited, Cudd Energy Services, Trican Well Service Ltd., Calfrac Well Services Ltd., and Nine Energy Service Inc.

The report provides a comprehensive analysis of the well intervention services market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, technological innovations, service delivery strategies, and operator preferences that shape the upstream oil and gas services market ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed