Wax Market Size, Share, Growth Report 2032

Wax Market By Product (Synthetic (Paraffin And Microcrystalline) And Natural (Animal, Vegetable, And Mineral)), By Application (Candles, Packaging, Wood & Fire Logs, Rubber, Adhesive, Cosmetics, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

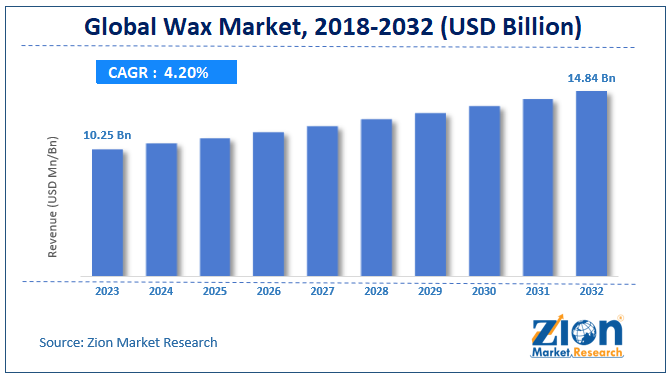

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.25 Billion | USD 14.84 Billion | 4.20% | 2023 |

Wax Industry Perspective:

The global wax market size was worth around USD 10.25 billion in 2023 and is predicted to grow to around USD 14.84 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.20% between 2024 and 2032. The report covers forecast and analysis for the wax market on a global and regional level. The study provides historic data of 2018-2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints for the wax market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the wax market on a global level.

Key Insights

- As per the analysis shared by our research analyst, the wax market is anticipated to grow at a CAGR of 4.20% during the forecast period.

- The global wax market was estimated to be worth approximately USD 10.25 billion in 2023 and is projected to reach a value of USD 14.84 billion by 2032.

- The growth of the wax market is being driven by increasing demand for waxes in applications such as packaging, cosmetics, candles, rubber, adhesives, and coatings.

- Based on the product, the synthetic segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the candles segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Wax Market: Overview

Wax is a material that has certain specific properties such as it is buffable under normal pressure. Its has melting point is above 40°C degree centigrade and has a low viscosity above the melting point. with a melting point above 40-degree centigrade without decomposing exists in solid form, and is solid at 20 °Cdegrees centigrade. Wax emulsions and wax -based additives are extensively consumed for optimizing the final performance of inks and coatings by controlling surface properties.

Paraffin wax is used widely for coating food products such as citrus fruits, cheese, etc. It is even consumed utilized in the production of gum- base based products production that is a vital ingredient in such as it is a vital ingredient in the chewing gums. Highly palatable and nutritious characteristics of cheese make it suitable to be used in numerous products. It is even rich in calcium, fat, essential minerals, protein, and other nutrients. Additionally, its related health benefits such as healthy heart, stronger bones & teeth, prevention of osteoporosis, will maintain its demand for food products. Paraffin wax is extensively used to produce cheese, thus the high production of cheese would also boost the global wax market.

This report offers a comprehensive analysis of the global wax market along with the market trends, drivers, and restraints of the wax market. This report includes a detailed competitive scenario and product portfolio of key vendors. To understand the competitive landscape in the market, an analysis of Porter’s five forces model for the market has also been included. The study encompasses a market attractiveness analysis, wherein all segments are benchmarked based on their market size, growth rate, and general attractiveness. This report is prepared using data sourced from in-house databases, secondary, and the primary research team of industry experts.

Wax Market: Segmenatation

The study provides a decisive view on the wax market by segmenting the market based on product, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2018 to 2024.

Based on product, the segmentation of wax market includes synthetic and natural. Synthetic or petroleum wax is obtained as a byproduct in the base oil production process. It has a wide range of physical properties that can be altered during the refining process.

Based on application; the segmentation of wax market includes candles, packaging, wood & fire logs, rubber, adhesive, cosmetics, and others. The adhesive is projected to gain maximum share in the forecast period owing to its usage in hot melt adhesive and Polyvinyl polyvinyl chloride processing, and conversion of polyolefin. GTL wax is used in hot melt adhesive due to its properties of hardness, high- temperature resistance, and low viscosity.

Wax Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wax Market Research Report |

| Market Size in 2023 | USD 10.25 Billion |

| Market Forecast in 2032 | USD 14.84 Billion |

| Growth Rate | CAGR of 4.20% |

| Number of Pages | 110 |

| Key Companies Covered | Petróleos de Venezuela, SA, Total Petrochemicals, Lukoil, Royal Dutch Shell Plc, Sinopec Limited, Exxon Mobil Corporation, International Group Inc, and China National Petroleum Corporation. |

| Segments Covered | By Product, By Application , And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wax Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Each region has been further segmented into countries such as the U.S., UK, France, Germany, China, India, Japan, and Brazil. The Asia Pacific will account for a substantial market share in the global wax market till 2024. Robust growth in the packaging industry in the region, especially in China, India, and Japan plays a vital role in fueling product demand in near future. Furthermore, increasing adhesive and cosmetics industry in the Asia Pacific and Latin America will propel the product demand during the forecast years.

Wax Market: Competitive Outlook

The report covers detailed competitive outlook including the market share and company profiles of the key participants operating in the global wax market such as:

- Petróleos de Venezuela SA

- Total Petrochemicals

- Lukoil

- Royal Dutch Shell Plc

- Sinopec Limited

- Exxon Mobil Corporation

- International Group Inc.

- China National Petroleum Corporation.

The global wax market segmented as follows:

By Product

- Synthetic

- Paraffin

- Microcrystalline

- Natural

- Animal

- Vegetable

- Mineral

By Application

- Candles

- Packaging

- Wood & fire logs

- Rubber

- Adhesive

- Cosmetics

- Others

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Wax is a material that has certain specific properties such as it is buffable under normal pressure. Its has melting point is above 40°C degree centigrade and has a low viscosity above the melting point.

According to study, the global wax market size was worth around USD 10.25 billion in 2023 and is predicted to grow to around USD 14.84 billion by 2032.

The CAGR value of wax market is expected to be around 4.20% during 2024-2032.

Asia Pacific has been leading the global wax market and is anticipated to continue on the dominant position in the years to come.

The global wax market is led by players like Petróleos de Venezuela, SA, Total Petrochemicals, Lukoil, Royal Dutch Shell Plc, Sinopec Limited, Exxon Mobil Corporation, International Group, Inc, and China National Petroleum Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed