Waterproof Tapes Market Size, Share, Growth Report 2032

Waterproof Tapes Market By Adhesive (Silicone, Acrylic, Butyl, And Others), By Substrate (Plastics, Metals, Rubber, And Others), By End User (Automotive, Building & Construction, Healthcare, Electrical & Electronics, Packaging, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.85 Billion | USD 27.98 Billion | 6.52% | 2023 |

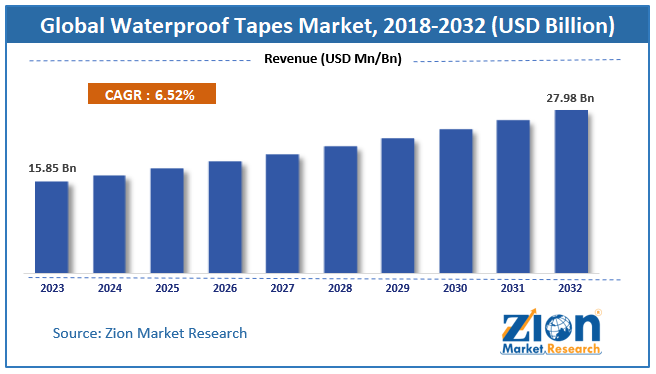

The global waterproof tapes market size was worth around USD 15.85 billion in 2023 and is predicted to grow to around USD 27.98 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.52% between 2024 and 2032.

The report covers forecast and analysis for the waterproof tapes market on a global and regional level. The study provides historic data for 2018 and 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion) and volume (Units). The study includes drivers and restraints for the waterproof tapes market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities and threats witnessed across waterproof tapes market on a global level.

Waterproof Tapes Market Overview

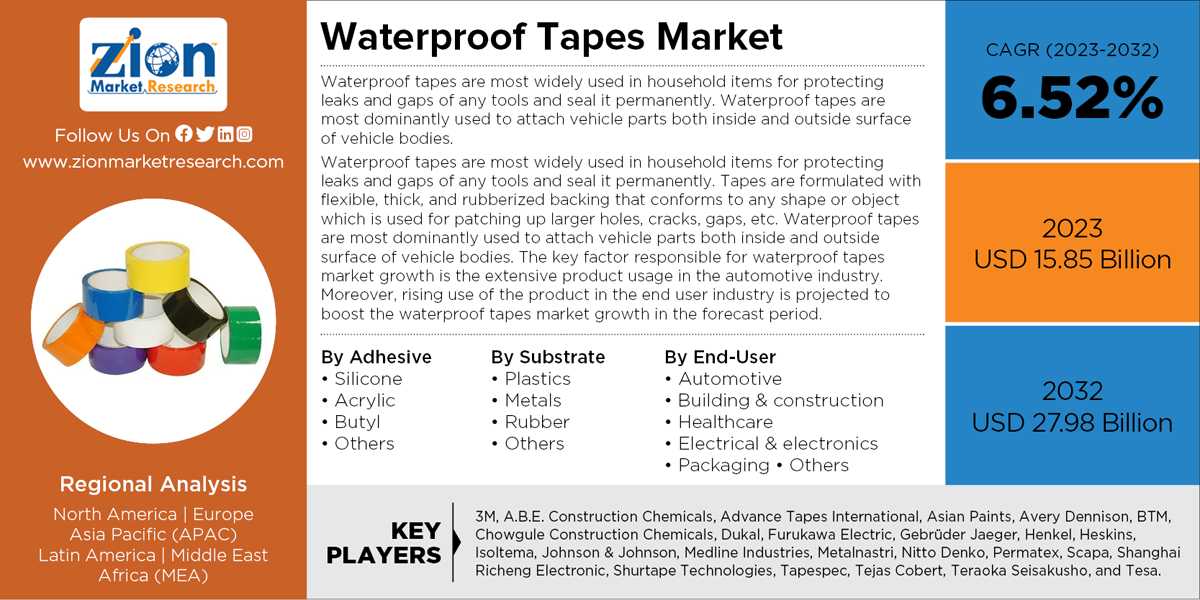

Waterproof tapes are most widely used in household items for protecting leaks and gaps of any tools and seal it permanently. Tapes are formulated with flexible, thick, and rubberized backing that conforms to any shape or object which is used for patching up larger holes, cracks, gaps, etc. Waterproof tapes are most dominantly used to attach vehicle parts both inside and outside surface of vehicle bodies. The key factor responsible for waterproof tapes market growth is the extensive product usage in the automotive industry. Moreover, rising use of the product in the end user industry is projected to boost the waterproof tapes market growth in the forecast period.

To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the waterproof tapes market has also been included. The study encompasses a market attractiveness analysis, wherein adhesive segments and end-user segments are benchmarked based on their market size, growth rate, and general attractiveness.

Waterproof Tapes Market Segmentation

The study provides a decisive view on the waterproof tapes market by segmenting the market based on adhesive, substrate, end users, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on adhesive, the global waterproof tapes market is segmented into silicone, acrylic, butyl, and others.

Based on the substrate, the waterproof tapes market is segmented into plastics, metals, rubber, and others.

Based on the end user, the waterproof tapes market is further segmented into automotive, building & construction, healthcare, electrical & electronics, packaging, and others.

Waterproof Tapes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Waterproof Tapes Market Research Report |

| Market Size in 2023 | USD 15.85 Billion |

| Market Forecast in 2032 | USD 27.98 Billion |

| Growth Rate | CAGR of 6.52% |

| Number of Pages | 110 |

| Key Companies Covered | 3M, A.B.E. Construction Chemicals, Advance Tapes International, Asian Paints, Avery Dennison, BTM, Chowgule Construction Chemicals, Dukal, Furukawa Electric, Gebrüder Jaeger, Henkel, Heskins, Isoltema, Johnson & Johnson, Medline Industries, Metalnastri, Nitto Denko, Permatex, Scapa, Shanghai Richeng Electronic, Shurtape Technologies, Tapespec, Tejas Cobert, Teraoka Seisakusho, and Tesa. |

| Segments Covered | By Adhesive, By Substrate, By End User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Waterproof Tapes Market Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with it further divided into major countries including the U.S., Germany, France, the UK, China, Japan, India, and Brazil. Asia Pacific waterproof tapes market is expected to be the highest growing region, owing to the rise in the construction activities witnessed across the region. In addition, the growth can be attributed to the rising demand for tapes from emerging economies such as China and India. North America holds the prominent market share, due to growing building and construction activities witnessed in the region. The rapid infrastructural development and increase in the commercial buildings in the Middle East and Africa raise the waterproof tapes adoption in the region in the coming period.

Waterproof Tapes Market Competitive Analysis

The report also includes detailed profiles including company overview, key developments, business strategies, financial overview, etc. of key players operating in the global waterproof tapes market such as:

- 3M

- A.B.E. Construction Chemicals

- Advance Tapes International

- Asian Paints

- Avery Dennison

- BTM

- Chowgule Construction Chemicals

- Dukal

- Furukawa Electric

- Gebrüder Jaeger

- Henkel

- Heskins

- Isoltema

- Johnson & Johnson

- Medline Industries

- Metalnastri

- Nitto Denko

- Permatex

- Scapa

- Shanghai Richeng Electronic

- Shurtape Technologies

- Tapespec

- Tejas Cobert

- Teraoka Seisakusho

- Tesa

The global waterproof tapes market segmented as follows:

By Adhesive

- Silicone

- Acrylic

- Butyl

- Others

By Substrate

- Plastics

- Metals

- Rubber

- Others

By End-User

- Automotive

- Building & construction

- Healthcare

- Electrical & electronics

- Packaging

- Others

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Waterproof tapes are most widely used in household items for protecting leaks and gaps of any tools and seal it permanently. Waterproof tapes are most dominantly used to attach vehicle parts both inside and outside surface of vehicle bodies.

According to study, the global Waterproof Tapes market size was worth around USD 15.85 billion in 2023 and is predicted to grow to around USD 27.98 billion by 2032.

The CAGR value of Waterproof Tapes market is expected to be around 6.52% during 2024-2032.

Asia Pacific has been leading the global Waterproof Tapes market and is anticipated to continue on the dominant position in the years to come.

The global Waterproof Tapes market is led by players like 3M, A.B.E. Construction Chemicals, Advance Tapes International, Asian Paints, Avery Dennison, BTM, Chowgule Construction Chemicals, Dukal, Furukawa Electric, Gebrüder Jaeger, Henkel, Heskins, Isoltema, Johnson & Johnson, Medline Industries, Metalnastri, Nitto Denko, Permatex, Scapa, Shanghai Richeng Electronic, Shurtape Technologies, Tapespec, Tejas Cobert, Teraoka Seisakusho, and Tesa.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed