Waterborne Adhesives Market Size, Share, And Growth Report 2032

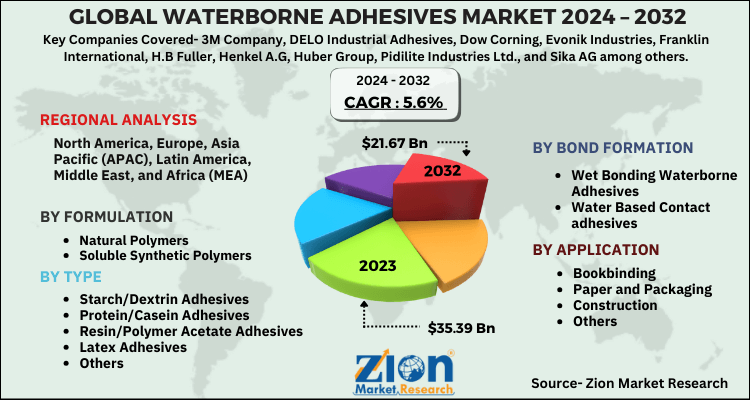

Waterborne Adhesives Market by Formulation (Natural Polymers and Soluble Synthetic Polymers), by Type (Starch/Dextrin Adhesives, Protein/Casein Adhesives, Resin/Polymer Acetate Adhesives, Latex Adhesives and Others), by Bond Formation (Wet Bonding Waterborne Adhesives and Water Based Contact adhesives), by Application (Bookbinding, Paper and Packaging, Construction, and Others), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

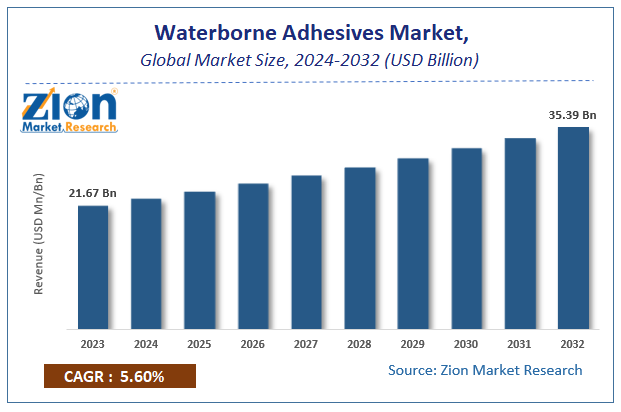

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.67 Billion | USD 35.39 Billion | 5.6% | 2023 |

Waterborne Adhesives Market Size

Zion Market Research has published a report on the global Waterborne Adhesives Market, estimating its value at USD 21.67 Billion in 2023, with projections indicating that it will reach USD 35.39 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.6% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Waterborne Adhesives Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Waterborne Adhesives Market: Overview

Waterborne adhesives, also known as water-based adhesives, use water as a diluents rather than a volatile organic solvent. They are used as a cost-effective and environmentally friendly alternative to solvent-based adhesives. Waterborne adhesives are designed specifically to provide an effective combination of fast, heat-resistant bonding, high ultimate strength, and repositionability. High demand from industries like paper and packaging, woodworking, building and construction, and automotive and transportation coupled with the increasing demand for environmental friendly product, are driving growth for waterborne adhesives. The shift toward more sustainable products has provided the manufacturers with significant growth opportunities. Adoption of new technologies for the formulation of innovative solutions of adhesives gives an opportunity for the development of green and sustainable adhesive solutions.

Waterborne Adhesives Market: Growth Factors

Waterborne adhesives are derived from renewable materials, such as plants, and have no petroleum derivatives in their formulations. This increases their demand as environmentally friendly substitutes over solvent based adhesives.

In addition to a decreased carbon footprint, they further enhance overall sustainability content for many applications including case and carton sealing, paper lamination, etc. This has resulted in the increased use of waterborne adhesives in activities that have applications in the packaging and logistics sectors.

Waterborne Adhesives Market: Segmentation

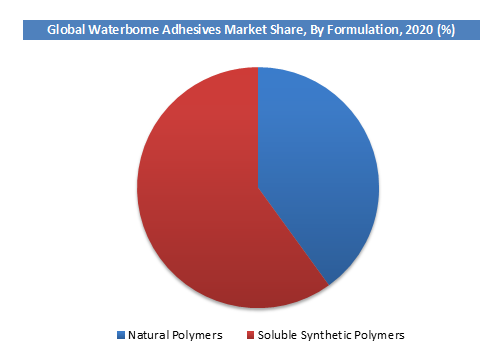

Formulation Segment Analysis Preview

Water-based adhesives formulated using natural polymers segment held a share of around 40% in 2023. This can be attributed to their increased application in paper and packaging, bottle labeling, wallpaper pasting, etc applications. Natural Polymers include Dextrin, Starch, Casein, and Natural Rubber Latex. These adhesives are typically rolled or brushed. They work very well when the materials being bonded are paper. When it comes to sheet laminations, dextrin and starches are particularly useful. These materials can be designed to have excellent lay-flat and repositionability, which are important characteristics for larger laminations. They are also safer to use and better for the environment than solvent alternatives.

Application Segment Analysis Preview

The paper and packaging segment will grow at a CAGR of around xx% from 2024 to 2032. This is attributable to the increased use of adhesives in a variety of paper bonding applications. Corrugated box construction and the lamination of written sheaths are just a few of the applications in packaging. These applications involve everything from corrugated box manufacturing and printed sheet lamination to consumer product packaging to the development of massive industrial tubes and cores used by roll goods and other commodity manufacturers.

Waterborne Adhesives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Waterborne Adhesives Market |

| Market Size in 2023 | USD 21.67 Billion |

| Market Forecast in 2032 | USD 35.39 Billion |

| Growth Rate | CAGR of 5.6% |

| Number of Pages | 120 |

| Key Companies Covered | 3M Company, DELO Industrial Adhesives, Dow Corning, Evonik Industries, Franklin International, H.B Fuller, Henkel A.G, Huber Group, Pidilite Industries Ltd., and Sika AG among others. |

| Segments Covered | By Formulation, By Type, By Bond Formation, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Waterborne Adhesives Market: Regional Analysis

The European region held a share of over 20% in 2020. This is attributable to the demand for water-based adhesives in Europe, led by the United Kingdom, Germany, Spain, and France, is expected to rise strongly due to increased demand in the manufacturing, vehicle, and military sectors. The increase in urban population and the number of refugees has boosted business demand even further. The increasing growth of the furniture industry in the United Kingdom as a result of low-cost, high-quality furniture being sold to consumers have accelerated the growth of the water-based adhesive market.

Asia Pacific region is projected to grow at a CAGR of around 5% over the forecast period. This is attributable to the industrialization in the emerging economies like India, South Korea, and China. The growing demand for environmentally friendly products, as well as the presence of major players in packaging, construction, and electronics, has driven the growth of water-based adhesive market in the region.

Waterborne Adhesives Market: Competitive Players

Some of key players in waterborne adhesives market are:

- 3M Company

- DELO Industrial Adhesives

- Dow Corning

- Evonik Industries

- Franklin International

- H.B Fuller

- Henkel A.G

- Huber Group

- Pidilite Industries Ltd.

- Sika AG

- Among others

Many adhesive of these players are using Internet of Things (IoT) technology to connect equipment and mobile devices in order to gain real-time insights and identify manufacturing process shortcomings. Plant managers and senior management process, analyze, and evaluate the data in order to maximize productivity and reach optimal output levels.

Pidilite Industries, an Indian adhesives manufacturer, purchased Huntsman Corporation for USD 285.7 Million in November 2020. This purchase will contribute to Pidilite Industries already strong adhesives and sealants range, as well as compliment Pidilite Industries' market offerings. Huntsman Corporation is a chemical component producer and marketer based in the United States.

The global waterborne adhesives market is segmented as follows:

By Formulation

- Natural Polymers

- Soluble Synthetic Polymers

By Type

- Starch/Dextrin Adhesives

- Protein/Casein Adhesives

- Resin/Polymer Acetate Adhesives

- Latex Adhesives

- Others

By Bond Formation

- Wet Bonding Waterborne Adhesives

- Water Based Contact adhesives

By Application

- Bookbinding

- Paper and Packaging

- Construction

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Waterborne adhesives are adhesive formulations that use water as the primary solvent or carrier for bonding materials. They are eco-friendly, low in volatile organic compounds (VOCs), and commonly used in industries like packaging, woodworking, and textiles for applications requiring strong, durable, and non-toxic bonding.

According to study, the Waterborne Adhesives Market size was worth around USD 21.67 billion in 2023 and is predicted to grow to around USD 35.39 billion by 2032.

The CAGR value of Waterborne Adhesives Market is expected to be around 5.6% during 2024-2032.

Europe has been leading the Waterborne Adhesives Market and is anticipated to continue on the dominant position in the years to come.

The Waterborne Adhesives Market is led by players like 3M Company, DELO Industrial Adhesives, Dow Corning, Evonik Industries, Franklin International, H.B Fuller, Henkel A.G, Huber Group, Pidilite Industries Ltd., and Sika AG among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed