Global Water Conductivity Sensor Market Size, Share, Report 2034

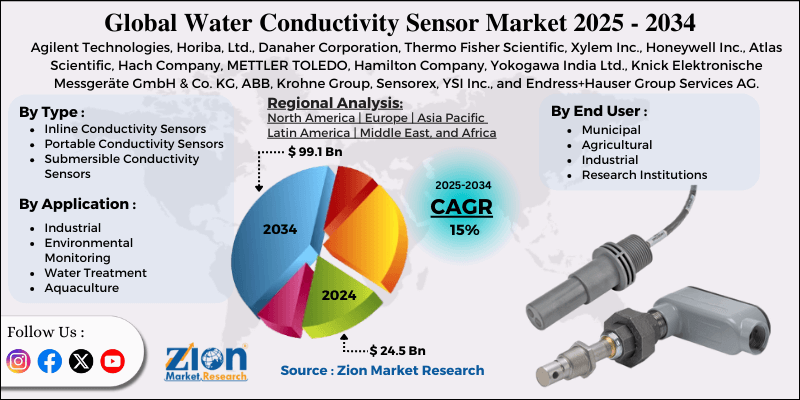

Water Conductivity Sensor Market By Type (Inline Conductivity Sensors, Portable Conductivity Sensors, and Submersible Conductivity Sensors), By Application (Industrial, Environmental Monitoring, Water Treatment, Aquaculture, and Others), By End-User (Municipal, Agricultural, Industrial, and Research Institutions), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

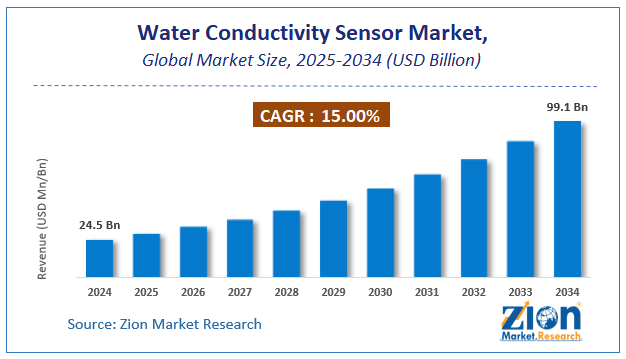

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.5 Billion | USD 99.1 Billion | 15% | 2024 |

Water Conductivity Sensor Industry Prospective:

The global water conductivity sensor market size was worth around USD 24.5 billion in 2024 and is predicted to grow to around USD 99.1 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.0% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global water conductivity sensor market is estimated to grow annually at a CAGR of around 15.0% over the forecast period (2025-2034).

- In terms of revenue, the global water conductivity sensor market size was valued at around USD 24.5 billion in 2024 and is projected to reach USD 99.1 billion by 2034.

- Increasing demand from the end-use industry is expected to drive the water conductivity sensor market over the forecast period.

- Based on the type, the inline conductivity sensors segment is expected to capture the largest market share over the projected period.

- Based on the application, the industrial segment is expected to capture the largest market share over the projected period.

- Based on the end-user, the municipal segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Water Conductivity Sensor Market: Overview

A water conductivity sensor is an electronic device that measures how well water or other liquids conduct electricity. This shows the number of dissolved ions, including salts, minerals, and contaminants, in the water. These sensors work by using Ohm's Law. When electrodes are placed in water, and a voltage is applied, ions (cations and anions) move, generating a measurable electric current. More ions yield higher conductivity, which is typically measured in microsiemens per centimeter (µS/cm) or millisiemens per centimeter (mS/cm). The water conductivity sensor market is driven by several factors, including the growing need for water quality monitoring & environmental safety, expanding applications across sectors, technological advancements, and regulatory pressure & sustainability goals. However, the high initial cost of advanced sensors is hampering the industry expansion.

Water Conductivity Sensor Market Dynamics

Growth Drivers

How does the growing need for water quality monitoring & environmental safety drive the water conductivity sensor industry growth?

The water conductivity sensor market is growing as demand increases for monitoring water quality and environmental safety. These sensors can detect dissolved ions, salinity, and contaminants in real time, thereby supporting ecosystem health and ensuring compliance with strict regulations. Because of the growing contamination of water from farming, industry, and urbanization, as well as the global water crisis, this requirement has led to extensive use in wastewater treatment, drinking water purification, and industrial processing. To safeguard public health and reduce pollution, governments worldwide have strict restrictions (for example, on salinity, pH, and total dissolved solids). These rules need to be checked regularly, which conductivity sensors can do accurately. Noncompliance can lead to fines and operational shutdowns, which is why industries such as pharmaceuticals, food processing, and chemicals use these sensors to regulate effluent and improve processes.

For instance, the United States Environmental Protection Agency sets regulatory limits on more than 90 pollutants found in drinking water. The regulatory limit for a contaminant is the highest level that is safe for people, and that water systems can reach with the most advanced technology available. The EPA also sets rules for how and when water systems must test their water.

Restraints

Why is the high initial cost of advanced sensors hampering the water conductivity sensor industry growth?

The high initial costs of advanced water conductivity sensors do not encourage market growth; instead, they constitute a significant barrier to adoption, especially among small and medium-sized enterprises (SMEs) and in developing nations. Compared with basic versions, premium materials (such as platinum electrodes), built-in IoT capabilities, downsizing, and temperature-adjustment technologies all increase prices. This makes it more difficult for individuals to purchase them, even when the law requires it.

Opportunities

Do novel product launches offer a potential opportunity for the water conductivity sensor market’s growth?

The water conductivity sensor market is expected to grow as new products are released, offering advanced solutions that address long-standing challenges in accuracy, maintenance, and integration. New products include compact MEMS-based sensors, optical and nanosensors that work even when they're dirty, and wireless models that work with the Internet of Things (IoT) and can calibrate themselves and connect to the cloud. This enables real-time monitoring in harsh or remote environments, such as wastewater or aquaculture systems.

These new technologies reduce operational costs, improve data accuracy to parts-per-billion levels, and promote compliance with environmental laws. This speeds up their use in pharmaceuticals, water treatment, and smart cities. For instance, ifm released the new LDL101 conductivity sensor in May 2022. The new LDL101 conductivity sensor from ifm electronic can accurately measure conductivity levels as low as 0.04 µS/cm. It also has high resolution, which makes it easy to detect small differences relative to target values. Because of these features, the LDL101 is an excellent option for checking water quality when complete purity is required. The sensors have been approved by EHEDG for hygiene, and 3A certification is in progress.

Challenges

Competition from alternative measurement methods poses a major challenge to market expansion

The water conductivity sensor market is struggling to grow because other measurement methods, such as optical sensors (e.g., UV absorbance or fluorescence), ion-selective electrodes (ISEs), and advanced spectroscopic techniques (e.g., Raman or NIR spectroscopy), can perform just as well or better in certain situations. This is causing the market share to shrink in niche applications. These competitors don't use total dissolved solids (TDS) to directly measure conductivity. Instead, they focus on selective ion detection or organic pollutants with more accuracy and less interference from temperature or non-ionic substances. This makes them attractive to industries that need high accuracy, such as pharmaceuticals and environmental labs, where a broad-spectrum approach to conductivity doesn't work as well.

Water Conductivity Sensor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Water Conductivity Sensor Market |

| Market Size in 2024 | USD 24.5 Billion |

| Market Forecast in 2034 | USD 99.1 Billion |

| Growth Rate | CAGR of 15% |

| Number of Pages | 290 |

| Key Companies Covered | Agilent Technologies, Horiba, Ltd., Danaher Corporation, Thermo Fisher Scientific, Xylem Inc., Honeywell Inc., Atlas Scientific, Hach Company, METTLER TOLEDO, Hamilton Company, Yokogawa India Ltd., Knick Elektronische Messgeräte GmbH & Co. KG, ABB, Krohne Group, Sensorex, YSI Inc., and Endress+Hauser Group Services AG, among others. |

| Segments Covered | By Type, By Application, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America ,The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Water Conductivity Sensor Market: Segmentation

Type Insights

The inline conductivity sensors segment dominates the market, capturing over 45% of the market share. Inline models offer smooth IoT connectivity for remote analytics, predictive maintenance, and scalability in smart factories, helping businesses make money by charging more for designs that last longer, require minimal upkeep, and resist fouling. Emerging markets in the Asia-Pacific region, where urbanization and investment in water infrastructure are increasing, will drive growth. This will make the segment the largest in a market growing at 6–8% per year.

Application Insights

The industrial sector is driving revenue growth in the water conductivity sensor market, which is expected to develop at a 9.5% CAGR through 2034. This is because there is a growing need for real-time process control, regulatory compliance, and more efficient business operations in high-stakes manufacturing environments. The pharmaceutical, chemical, food and drink, and power generation industries must comply with stringent global rules (including the EPA and the EU Water Framework Directive) that require continuous monitoring of ion levels to prevent contamination, scaling, or effluent breaches. If they don't, they could have to pay millions of dollars in fines every year. Conductivity sensors immediately measure TDS and salinity, enabling automatic adjustment of ultrapure water systems or wastewater discharge. This means more individuals will use the systems, and maintenance contracts will generate additional revenue.

End-User Insights

The municipal segment is expected to grow rapidly. Municipal end users are primarily concerned with the quality of drinking water and the management of wastewater systems. Conductivity sensors help municipalities monitor water quality in real-time, ensuring compliance with health and safety regulations and protecting public health.

Water Conductivity Sensor Market: Regional Analysis

North America dominates the water conductivity sensor market with more than 35% over the projected period. The regional dominance is owing to the stringent environmental regulations and a strong focus on water quality monitoring across various sectors, including municipal water systems and industrial applications. The presence of advanced technology and significant investments in research and development further boost this region's growth. North American utilities have relatively high adoption of SCADA, PLCs, and remote telemetry. Ongoing upgrades to smart water networks and digital water platforms integrate multi-parameter sensors (including conductivity) for real-time analytics.

Will the strict government regulation and technological innovation drive the water conductivity sensor market in the US?

The Clean Water Act and other EPA rules, as well as state-level requirements for real-time effluent monitoring, require industries to use inline conductivity sensors. This is especially true in the US, where companies that don't follow the rules can be fined $50,000 per day, which drives demand in the food and beverage and chemical processing sectors. Canada's focus on protecting the Great Lakes and Mexico's industrial growth under the USMCA assist the economy to grow.

North America is the leader in fouling-resistant 4-electrode and digital versions. In addition, U.S.-based companies like Emerson, Honeywell, and YSI are leading the way in IoT-integrated sensors with cloud analytics. This enables predictive maintenance in power plants and wastewater facilities. They also spend more than $200 million a year on research and development to make smaller, easier-to-maintain designs. North America's maturity, on the other hand, makes it well-positioned to dominate in the long run, even as cities grow and sustainability efforts, such as the Bipartisan Infrastructure Law's $50 billion in water investments, unfold.

Water Conductivity Sensor Market: Competitive Analysis

The water conductivity sensor market is moderately consolidated, with established multinational corporations specializing in industrial instrumentation and water analytics capturing more than 60% of the market through innovation, global distribution, and strategic acquisitions.

The global water conductivity sensor market is dominated by players like-

- Agilent Technologies

- Horiba

- Danaher Corporation

- Thermo Fisher Scientific

- Xylem Inc.

- Honeywell Inc.

- Atlas Scientific

- Hach Company

- METTLER TOLEDO

- Hamilton Company

- Yokogawa India Ltd.

- Knick Elektronische Messgeräte GmbH & Co. KG

- ABB

- Krohne Group

- Sensorex

- YSI Inc.

- Endress+Hauser Group Services AG

- among others.

The global water conductivity sensor market is segmented as follows:

By Type

- Inline Conductivity Sensors

- Portable Conductivity Sensors

- Submersible Conductivity Sensors

By Application

- Industrial

- Environmental Monitoring

- Water Treatment

- Aquaculture

- Others

By End User

- Municipal

- Agricultural

- Industrial

- Research Institutions

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed