Virtual Reality Market Size, Share, Industry Analysis, Trends, Growth, 2032

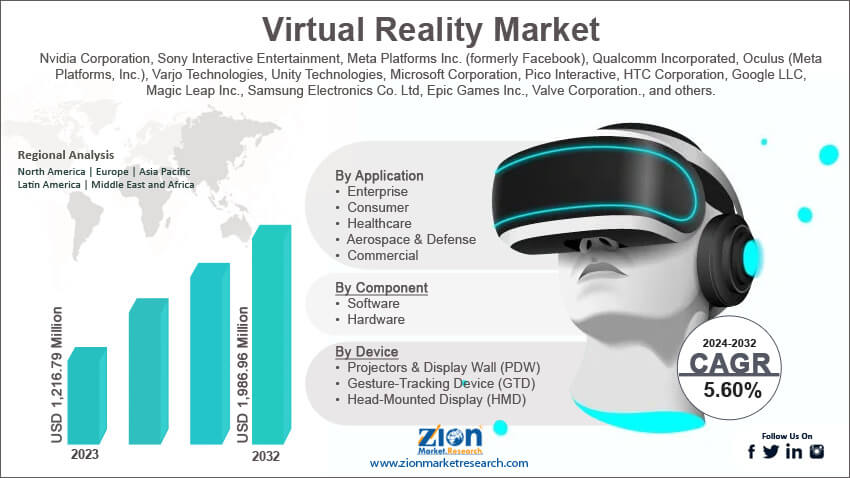

Virtual Reality Market By Application (Enterprise, Consumer, Healthcare, Aerospace & Defense, Commercial, and Others), By Component (Software and Hardware), By Device (Projectors & Display Wall (PDW), Gesture-Tracking Device (GTD), and Head-Mounted Display (HMD), By Technology (Non-Immersive and Semi & Fully Immersive), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

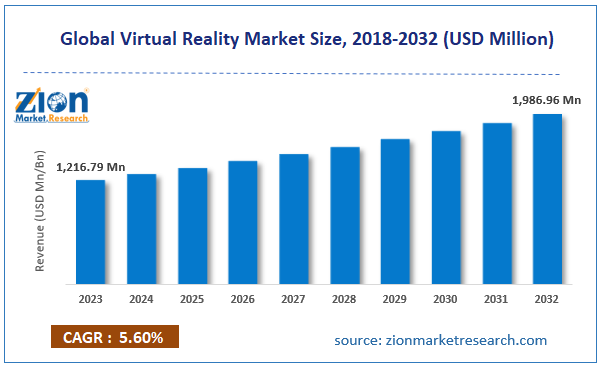

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,216.79 Million | USD 1,986.96 Million | 5.60% | 2023 |

Virtual Reality Industry Perspective:

The global virtual reality market size was worth around USD 1,216.79 million in 2023 and is predicted to grow to around USD 1,986.96 million by 2032 with a compound annual growth rate (CAGR) of roughly 5.60% between 2024 and 2032.

Virtual Reality Market: Overview

Virtual reality (VR) offers a simulation-based experience. It leverages next-generation technologies including pose tracking and 3-dimensional near-eye displays to provide the user with an immersive experience of a digital world. Virtual reality since its inception has undergone several advancements and end-user applications. Primarily consumer-oriented virtual reality systems were developed for the gaming industry as video game developers first launched VR systems for gamers. However, since then 3D technology has been adopted in other sectors including aerospace, defense, and healthcare. Virtual reality is a part of the reality-virtuality continuum and hence offers significantly different features from other such technologies such as augmented reality and augmented virtuality. A user experiencing virtual reality can move in the digital world just like in the real world. They can also interact with the objects and other entities in the virtual reality. This is achieved with the help of a VR headset that consists of a small display screen in front of the eyes and motion-detecting gears. Advanced virtual reality tools may offer additional features such as haptic technology. VR is essentially categorized into 5 categories including fully immersive, semi-immersive, non-immersive, collaborative VR, and mixed reality. Virtual reality is sometimes used in collaboration with augmented reality for improved experience.

Key Insights:

- As per the analysis shared by our research analyst, the global virtual reality market is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2024-2032)

- In terms of revenue, the global virtual reality market size was valued at around USD 1,216.79 million in 2023 and is projected to reach USD 1,986.96 million, by 2032.

- The virtual reality market is projected to grow at a significant rate due to the rising demand for VR in the gaming sector

- Based on the application, the commercial segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the device, the head-mounted display segment is anticipated to command the largest market share

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period

Virtual Reality Market: Growth Drivers

Rising demand for VR in the gaming sector continues to drive the market expansion rate

The global virtual reality market is expected to grow due to the growing demand for VR solutions in the video gaming industry. The VR technology was first launched by video game companies to deliver innovative gaming solutions to the players. Steadily, the technology has become more commercial. The increased adoption of VR-equipped games is also facilitated by heightened consumer awareness and curiosity. The addition of new players offering a wide range of VR games has also helped the prices to relatively decline thus becoming more affordable as compared to their prices a decade ago. Companies offering VR games are increasingly experimenting with new simulated environments to cater to the needs and preferences of a wide audience group. Moreover, the escalating technological development of virtual reality games also works in the favor of the market players. For instance, in March 2024, AEXLAB, a gaming company, launched its flagship game VAIL VR after 7 years of development. The game is available on the Meta Quest store. AEXLAB offers state-of-the-art software leveraging VR for an unmatched combat game. Similarly, as per market reports, Maze Theory, a London-based XR firm that has developed some of the most popular and award-winning games, will be launching its much-awaited Infinite Inside mixed reality game in July 2024. While the number of VR games continues to grow in the industry, devices facilitating the games are also witnessing a rising trend of technological growth. Meta Quest 3, a VR headset owned by Reality Labs, a segment of the Meta company, is equipped with 5 sensors that include 2 tracking sensors and 3 front sensors. It also offers an extensive gaming catalog housing around 500 VR games and applications.

Growing investments in furthering VR technology will generate comprehensive growth opportunities

The global virtual reality industry has several potential applications that require more research and exploration. The surging investments in extended applications of VR across industries an evidence of the market’s growth potential. For instance, AutoVRse, a virtual reality startup, secured funding of USD 2 million. The financing was led by Lumikai. The company will direct the fund toward upgrading its enterprise product VRseBuilder along with expanding into new regions and strengthening the human resource team.

Virtual Reality Market: Restraints

Higher expenses associated with technology implementation will limit the industry’s growth rate

The global industry for virtual reality is projected to be restricted due to the high expense associated with developing and implementing virtual reality. Advanced VR-based technologies are created using sophisticated engineering solutions. For instance, premium VR gaming headsets can cost between USD 800 to USD 1000 depending on the brand and the features offered. The average development cost of a VR application ranges between USD 50000 to USD 100000 and the actual price may depend on several external factors. Furthermore, ensuring compatibility between legacy systems and VR technology can pose additional threats to the market players.

Virtual Reality Market: Opportunities

Growing use of VR in healthcare can generate massive expansion possibilities

The global virtual reality market has tremendous growth potential in the healthcare industry. VR is regarded as an innovative tool in the medical care industry that can be used for treating patients and delivering optimal medical care. The interactive attribute of VR can be leveraged to create user-friendly solutions that can help patients get a better understanding of their bodies and medical conditions. It can be used for treating several medical problems and conducting surgeries. VR is essentially used for generating a simulated medical environment and training medical professionals before they practically implement the solution on a live patient. Healthcare facilities are also experimenting with using VR to treat patients with addiction issues. Several studies indicate that VR has been effective in generating cravings in people with behavioral addiction and substance use disorder. The emerging segment of telemedicine may benefit from the VR industry. In April 2024, the US Food & Drugs Administration (FDA) authority launched Home as a Health Care Hub, a novel initiative. It focuses on using VR and AR to enhance healthcare. This is achieved by reimagining home environments in the healthcare system.

Virtual Reality Market: Challenges

Concerns over the negative impact of VR may challenge the market expansion trends

The global virtual reality industry is projected to be challenged by the growing concerns over the harmful impact of excessive use of VR. Continuous use of virtual reality systems can induce health problems as concluded by several studies. It can lead to medical issues such as headaches, eye strain, tiredness, and shoulder & neck pain. Additionally, VR poses the threat of causing another form of addiction that is used irresponsibly. Users of VR may suffer from desensitization to violence and emotionally triggering real-life experiences.

Virtual Reality Market: Segmentation

The global virtual reality market is segmented based on application, component, device, technology, and region.

Based on the application, the global market segments are enterprise, consumer, healthcare, aerospace & defense, commercial, and others. In 2023, the highest growth was witnessed in the commercial segment. It held control over 55% of the total market share. The increasing use of VR technologies across commercial sectors including gaming, real estate, entertainment centers, and vehicle showrooms is driving the segmental demand. The healthcare industry is expected to emerge as a significant revenue generator during the projection period, especially driven by the use of VR for training and surgical simulation purposes.

Based on components, the global virtual reality industry is divided into software and hardware.

Based on the device, the global market divisions are projectors & display walls (PDW), gesture-tracking devices (GTD), and head-mounted displays (HMD). In 2023, the highest revenue was generated in the head-mounted display segment. It recorded a revenue share of around 62% in 2023. The growing number of options in terms of HMD solutions fitted with advanced features is the primary segmental driver. Additionally, HMDs have extensive applications across industries including healthcare and aerospace & defense.

Based on technology, the global market segments are non-immersive and semi-fully immersive.

Virtual Reality Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Virtual Reality Market |

| Market Size in 2023 | USD 1,216.79 Million |

| Market Forecast in 2032 | USD 1,986.96 Million |

| Growth Rate | CAGR of 5.60% |

| Number of Pages | 219 |

| Key Companies Covered | Nvidia Corporation, Sony Interactive Entertainment, Meta Platforms Inc. (formerly Facebook), Qualcomm Incorporated, Oculus (Meta Platforms, Inc.), Varjo Technologies, Unity Technologies, Microsoft Corporation, Pico Interactive, HTC Corporation, Google LLC, Magic Leap Inc., Samsung Electronics Co. Ltd, Epic Games Inc., Valve Corporation., and others. |

| Segments Covered | By Application, By Component, By Device, By Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Virtual Reality Market: Regional Analysis

Asia-Pacific to develop the highest growth rate during the projection period

The global virtual reality market is expected to witness high growth in Asia-Pacific. The region dominated nearly 39.1% of the global market share in 2023. China is the world’s leading producer and consumer of virtual reality. The presence of a robust manufacturing sector is an essential competitive advantage that China has over other countries. The region is known to mass-produce and export electronic items including VR accessories. In addition to this, the end-use applications of VR across Chinese industries have been growing at a rapid rate. Research indicates that consumers in China are avid enthusiasts of novel technologies and they show early adoption of advanced engineering marvels such as VR. Moreover, virtual reality in Asia-Pacific has made a mark in the real-estate business along with the monumental gaming sector. Countries such as Japan, China, and India are witnessing a sharp rise in urban video gamers inclining toward VR systems.

North America is projected to register significant growth in the US. The ongoing efforts to introduce VR in the regional healthcare sector will fuel higher revenue in the US. Market research suggests that over 75% of healthcare facilities in the US have implemented VR for training medical professionals. Virtual reality technology developed by Meta was being implemented by hospital surgeons for conducting surgeries in a simulated environment as of 2023.

Virtual Reality Market: Competitive Analysis

The global virtual reality market is led by players like:

- Nvidia Corporation

- Sony Interactive Entertainment

- Meta Platforms Inc. (formerly Facebook)

- Qualcomm Incorporated

- Oculus (Meta Platforms Inc.)

- Varjo Technologies

- Unity Technologies

- Microsoft Corporation

- Pico Interactive

- HTC Corporation

- Google LLC

- Magic Leap Inc.

- Samsung Electronics Co. Ltd

- Epic Games Inc.

- Valve Corporation.

The global virtual reality market is segmented as follows:

By Application

- Enterprise

- Consumer

- Healthcare

- Aerospace & Defense

- Commercial

By Component

- Software

- Hardware

By Device

- Projectors & Display Wall (PDW)

- Gesture-Tracking Device (GTD)

- Head-Mounted Display (HMD)

By Technology

- Non-Immersive

- Semi & Fully Immersive

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Virtual reality (VR) offers a simulation-based experience. It leverages next-generation technologies including pose tracking and 3-dimensional near-eye displays to provide the user with an immersive experience of a digital world.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed