Vegetarian Capsules Market Size, Share, Report Scope & Forecast 2032

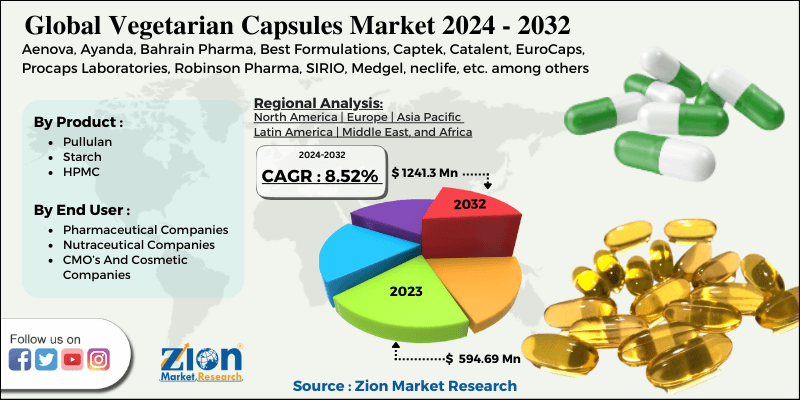

Vegetarian Capsules Market By Product Type (Pullulan, Starch, HPMC), By End User Industry (Pharmaceutical Companies, Nutraceutical Companies, CMOs And Cosmetic Companies), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

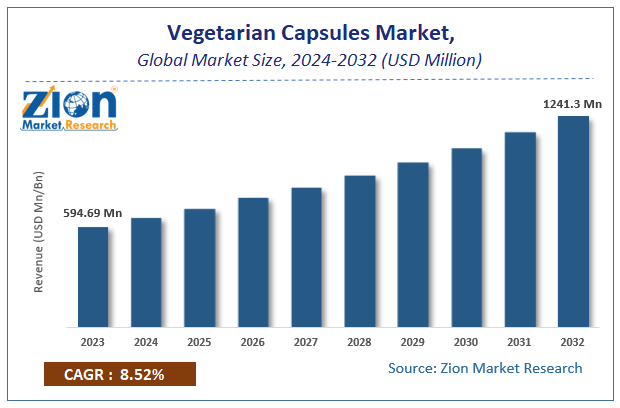

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 594.69 Million | USD 1241.3 Million | 8.52% | 2023 |

Vegetarian Capsules Market Insights

Zion Market Research has published a report on the global Vegetarian Capsules Market, estimating its value at USD 594.69 Million in 2023, with projections indicating that it will reach USD 1241.3 Million by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 8.52% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Vegetarian Capsules Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Vegetarian Capsules Market: Overview

Capsules are two piece enclosures commonly made of gelatin. Vegetarian capsules are which contain plant-based compounds and free of animal derivatives of any kind. Vegetarian capsules are free of any modified sugar form and contain vegetable cellulose forms if needed. Vegetarian capsules are the preferred supplement over animal supplements by those who do not prefer animal products.

The growing concern for a healthy body is one of the key market drivers. These capsules are rapidly absorbed by our digestive system. Vegetarian capsules are takes as supplement for vital mineral or vitamins which our day to day lifestyle fails to provide. These capsules are said to be free of any carcinogenic substance as they are plant based. These capsules are used by sports persons, bodybuilders, athletes, etc. Increase in adaption of vegetarian lifestyle is also one of the key market drivers.

COVID-19 Impact Analysis

The global vegetarian capsules market has witnessed an increase in the sales for short term owing to the urgent need of vitamins and minerals to lower the fatality rate due to COVID. Supplement of Vitamins sales were rocketed due spread of news that these help you recover faster if COVID positive. Thaw the manufacturing was hampered during early lockdown phase but was later allowed due to its growing demand. The restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the world markets are slowly opening to their full potential and theirs a surge in demand of Vegetarian Capsules. The market would remain bullish in upcoming year.

Vegetarian Capsules Market: Growth Factors

Vegetarian capsules improve immune system to fight against any foreign object in our body which is why people are attracted towards it. More people are adapting healthy lifestyle and these capsules help them with essential vitamins and minerals. These capsules are recommended by medical professionals, nutritionist experts to their clients to fulfill body requirements. Vegan people are one of the key market drivers.

Vegetarian capsules do not have many side effects compared to animals based supplement. Absence of accessibility to good and essential variety of food which provides basic need for smooth functioning of the human body has lead people to look out for cheaper options to aid themselves for these capsules. Uses of Vegetarian based products are extensive in medicine research. Cosmetics are also prepared using Vegetarian based products.

Vegetarian Capsules Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Vegetarian Capsules Market |

| Market Size in 2023 | USD 594.69 Million |

| Market Forecast in 2032 | USD 1241.3 Million |

| Growth Rate | CAGR of 8.52% |

| Number of Pages | 110 |

| Key Companies Covered | Aenova, Ayanda, Bahrain Pharma, Best Formulations, Captek, Catalent, EuroCaps, Procaps Laboratories, Robinson Pharma, SIRIO, Medgel, neclife, etc. among others |

| Segments Covered | By Product Type, By End User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vegetarian Capsules Market: Segment Analysis

The vegetarian capsules market: is segmented by product type, end user industry, and region.

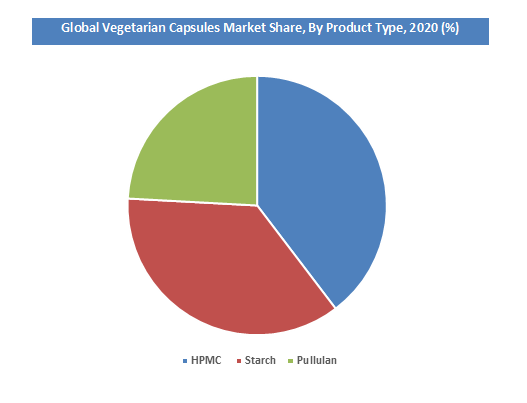

By Product Type Segment Analysis Preview

HPMC (Hydroxypropyl methylcellulose) segment held a share of around 36.95% in 2020. HPMC is the most common vegetable cellulose and have trace amount is most of Vegetarian capsules. HPMC is extracted mainly from bark of some tree like pine or spruce tree. Vegetarian capsules are pure as they do not contain even trace amount of animal byproducts, it’s solely plant based therefore it is preferred by many. This segments growth is attributable to the significant increase in demand for such products for consumption. This segment is going to see largest increase because of above factor.

Pullulan is another important component of vegetarian capsule. It is chemical compound obtained from water extracted from fungi that grow on starch substances. This is also pure and no other chemicals are added in the process.

By End User Industry Segment Analysis Preview

Pharmaceutical Companies in end use segment will grow at a CAGR of over 9.6% from 2021 to 2028. This is attributable to the number of products launched by various companies in order to lure more and more customers. Pharmaceutical Companies is the largest purchaser of Vegetarian cellulose as they use them in other medicine making process.

Nutraceutical are any substances that are part of food that provide medicinal or health benefits. Most of the Pharmaceutical Companies use plant based nutraceutical to either prevent of treat a disease.

Cosmetic making companies use these plant based nutraceutical to make different products because its rich in chemical compounds which are useful in making various type of cosmetic products. Thaw they are mixed with animal byproducts but some products offer solely plant based cosmetic products.

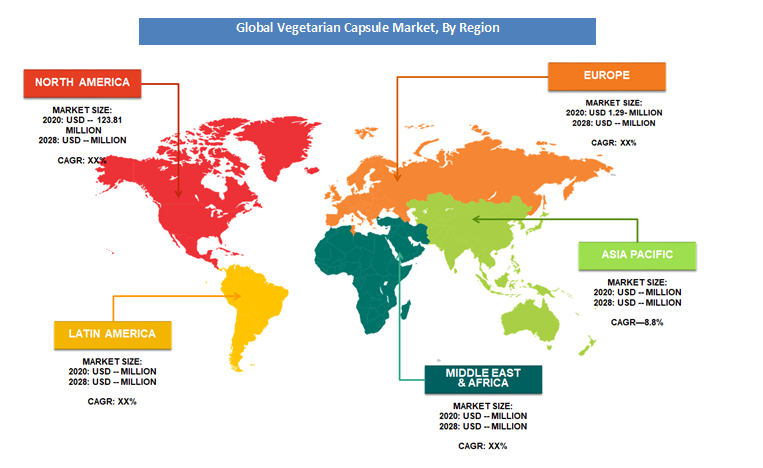

Vegetarian Capsules Market: Regional Analysis Preview

The North American region held a share of about 31.21% in 2020. This is attributable to the presence of top companies such as Aenova, Ayanda, Captek, Catalent, EuroCaps among others. Moreover, the increasing usage of vegetarian capsule expected to generate huge demand for the market in this region. North America is the largest market for vegetarian capsule. This is due to their advanced researches and application in this field.

The Asia Pacific region is projected to grow at a CAGR of 8.8% over the forecast period. This surge is due to the increasing awareness among common people regarding the benefits of using vegetarian capsule. APAC region is also one of the major markets of vegetarian capsule as the huge population has to be feed and basic needs of people in country like India, China are not fissile for everybody, so they use these capsules to aid for the vitamins and mineral needs.

Vegetarian Capsules Market: Competitive Landscape

Some of key players in vegetarian capsule market are-

- Aenova

- Ayanda

- Bahrain Pharma

- Best Formulations

- Captek

- Catalent

- EuroCaps

- Procaps Laboratories

- Robinson Pharma

- SIRIO

- Medgel

- neclife

- among others.

In April 2021, smartypants announced new Multi Capsule products to provide most innovative and nutritionally comprehensive supplements.

The global vegetarian capsule market is segmented as follows:

By Product Type

- Pullulan

- Starch

- HPMC

By End User Industry

- Pharmaceutical Companies

- Nutraceutical Companies

- CMO’s And Cosmetic Companies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Vegetarian Capsules Market market size valued at US$ 594.69 Million in 202

Vegetarian Capsules Market market size valued at US$ 594.69 Million in 2023, set to reach US$ 1241.3 Million by 2032 at a CAGR of about 8.52% from 2024 to 2032

Some of the key factors driving the global vegetarian capsules market growth are capsules are rapidly absorbed by our digestive system. Vegetarian capsules are takes as supplement for vital mineral or vitamins which our day to day lifestyle fails to provide.

North America region held a substantial share of the vegetarian capsules market in 2020. This is attributable to increasing usage of Vegetarian capsule expected to generate huge demand for the market in this region. North America is the largest market for Vegetarian capsule. This is due to their advanced researches and application in this field.

Some of the major companies operating in the vegetarian capsules market are Aenova, Ayanda, Bahrain Pharma, Best Formulations, Captek, Catalent, EuroCaps, Procaps Laboratories, Robinson Pharma, SIRIO, Medgel, neclife, etc. among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed