Vacuum Interrupters Market Share, Growth, Trends Report 2034

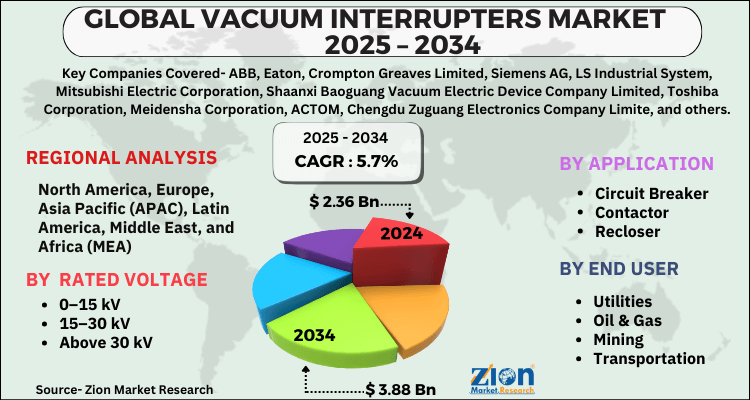

Vacuum Interrupters Market By Rated Voltage (0-15 kV, 15-30 kV, Above 30 kV), By Application (Circuit Breaker, Contactor, Recloser, Load Break Switch, & Tap Changer), By End User (Oil & Gas, Mining, Utilities & Transportation), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

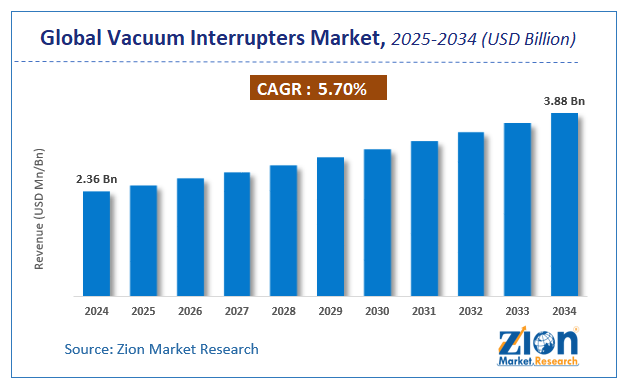

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.36 Billion | USD 3.88 Billion | 5.7% | 2024 |

Vacuum Interrupters Industry Perspective:

The global vacuum interrupters market achieved revenue of USD 2.36 Billion in 2024 and is projected to reach around USD 3.88 Billion by 2034, the market is expected to grow with a compound annual growth rate (CAGR) of roughly 5.7% between 2025 and 2034. The report encompasses a detailed analysis of the vacuum interrupters market’s drivers, restraints, and challenges, along with their impact on the demands over the estimated period. Furthermore, the report also offers a detailed study of the potential opportunities that can boost market growth.

Vacuum Interrupters Market: Overview

A vacuum interrupter is a switch that employs electrical contacts in a vacuum in electrical engineering. It is the key element in generator circuit breakers, medium-voltage circuit breakers, and high-voltage circuit breakers. When electrical contacts separate, a metal vapor arc forms, which is soon extinguished. In utility power transmission networks, power production units, and power-distribution systems for trains, industrial facilities, and arc furnace applications, vacuum interrupters are commonly utilized.

Key Insights

- As per the analysis shared by our research analyst, the global vacuum interrupters market is estimated to grow annually at a CAGR of around 5.7% over the forecast period (2025-2034).

- Regarding revenue, the global vacuum interrupters market size was valued at around USD 2.36 Billion in 2024 and is projected to reach USD 3.88 Billion by 2034.

- The vacuum interrupters market is projected to grow at a significant rate due to increasing demand for reliable and efficient power transmission and distribution, growing investments in renewable energy infrastructure, and the rising need for safe and compact circuit protection solutions.

- Based on Rated Voltage, the 0-15 kV segment is expected to lead the global market.

- On the basis of Application, the Circuit Breaker segment is growing at a high rate and will continue to dominate the global market.

- Based on the End User, the Oil & Gas segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Vacuum Interrupters Market: Growth Drivers

Rapid expansion of distribution and transmission can boost the market growth.

In the future years, transportation and other related industries are likely to see a massive increase in electrification. This would result in a massive rise in the energy demand and, as a result, its generation, necessitating a billion-dollar investment in transmission over the following decade. The electrical transmission and distribution industry might attract more than USD 600 bn in investment. The electric car category is likely to get the majority of this investment. In addition to this expenditure, the existing transmission infrastructure must be maintained and integrated with power generated from renewable sources to fulfill the current electrical demand.

According to research, a trade organization lobbying for transmission investment, the amount of investment by 2030 is estimated to be similar to USD 4 to 7 bn per year, which is a 25 to 50 percent increase over the previous decade. All of this is likely to be driven largely by two primary factors: connecting more renewables to the grid and maintaining system reliability as peak load grows. All of these factors are likely to drive the growth of the global vacuum interpreters market.

Vacuum Interrupters Market: Restraints

Dearth of explicit government policies for vacuum interrupters may hinder market growth.

According to the Kyoto Protocol, SF6 is one of the most potent greenhouse gases, having a global warming intensity of 23,000, and the Intergovernmental Panel on Climate Change has classified it as a highly hazardous greenhouse gas. Concurrently, SF6 is categorized as a greenhouse gas, which will be subject to green taxes. As a result, the Kyoto Protocol calls for an emissions reduction. Other gases with lesser global warming potential, such as nitrogen, dry air, and CO2, or their mixes, have far low dielectric strength than SF6.

However, specific guidelines and government rules regarding the usage of vacuum interrupters are required. Industries that are prohibited from using these enumerated greenhouse gases are shifting to air-type equipment or other gas equipment, according to reports. The use of vacuum-type interruption devices is not decreasing as a result of this. As a result, the lack of vacuum interrupter-specific rules, norms, and reforms is a key stumbling block in this scenario.

Vacuum Interrupters Market: Opportunities

Cumulative investments and funding for smart grid & power distribution in the emerging nation will provide better growth prospects for the market.

Utility companies are increasing their investments in smart grid infrastructure throughout the world. By 2027, the European Union is expected to invest almost USD 133 billion in the smart grid sector. For example, Tavrida Electric secured a series of contracts for the delivery of 25 reclosers with PKP Energetyka. A two-year period of demonstrations and testing of the delivered equipment preceded the sale.

As a consequence, approximately 50 reclosers were delivered to the latter by the end of 2017. Furthermore, Southeast Asian countries are projected to invest nearly 10 billion in smart grid infrastructure in the next 10 years, thereby driving growth avenues for the global vacuum interpreters market.

Vacuum Interrupters Market: Challenges

Accessibility to low-quality and cheap products poses a major challenge to the market.

Asia Pacific region is the greatest market for vacuum interrupters, with several emerging countries planning to install a high number of vacuum interrupters in the near future. In these emerging countries, cost takes precedence over quality. The price of electrical items is given considerable attention in major nations such as Bhutan, Bangladesh, Sri Lanka, and India. Vacuum interrupters of good quality are projected to last for roughly 30 years.

However, as the price of a product falls, so does the quality of the product. Local manufacturers face the same problems as multinational businesses in this region. These grey market firms have pricing competitiveness and a local supply network advantage over major competitors, which is tough for leading players to obtain.

Vacuum Interrupters Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Vacuum Interrupters Market |

| Market Size in 2024 | USD 2.36 Billion |

| Market Forecast in 2034 | USD 3.88 Billion |

| Growth Rate | CAGR of 5.7% |

| Number of Pages | 145 |

| Key Companies Covered | ABB, Eaton, Crompton Greaves Limited, Siemens AG, LS Industrial System, Mitsubishi Electric Corporation, Shaanxi Baoguang Vacuum Electric Device Company Limited, Toshiba Corporation, Meidensha Corporation, ACTOM, Chengdu Zuguang Electronics Company Limite, and others. |

| Segments Covered | By Rated Voltage, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vacuum Interrupters Market: Segmentation

The global vacuum interrupters market is segregated based on rated voltage, application, end-user, and region.

By rated voltage, the market is categorized into 0-15 kV, 15-30 kV, and above 30 kV.

Based on application, the global vacuum interrupters market is fragmented into circuit breakers, contactors, load break switches, tap changers, reclosers, and others. In 2021, contactors application held the largest market share. The circuit breaker is expected to be the most attractive application segment in the coming years due to the increasing investments in the power and energy sector.

The end-user segment is bifurcated into utilities, oil & gas, mining, transportation, and others. The utility segment is the leader among other end users and is estimated to hold a significant market share in the analysis period due to growing advancements in the power distribution sector along with a substantial growth in switchgear.

Recent Developments

- In August 2021, Eaton Corporation had announced ambitions to launch HYPERRIDE, a ground-breaking cooperative research initiative focused on DC power grids. The firm will design circuit breakers for an automated and efficient DC power system as part of the USD 7.5 million project.

- In 2020, ABB Electrification's facility in Ratingen, Germany, celebrated a significant milestone when it produced its seven millionth vacuum interrupter (VI).

Vacuum Interrupters Market: Regional Landscape

Asia Pacific is to lead the market over the forecast period.

Asia Pacific is estimated to lead the global vacuum interrupter market. India, China, South Korea, and Japan are among the key nations regarded to be the primary vacuum interrupter production hubs. This region has experienced remarkable economic development in recent years. According to World Economic and Financial Surveys, the economic momentum in Asia Pacific's top economies is likely to stay robust, indicating policy stimulus in Japan and China, which benefits other Asian countries.

The fast expansion of the economy would result in a rise in the electricity demand. This would need a higher level of investment in electricity-producing infrastructure. Furthermore, increasing expenditure on smart grid technologies, such as smart meters, distribution grid automation, and demand response systems, in countries such as South Korea, Japan, and Australia, would provide development prospects for the market during the projection period.

Vacuum Interrupters Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the vacuum interrupters market on a global and regional basis.

Key players operating in the global vacuum interrupters market include;

- ABB

- Eaton

- Crompton Greaves Limited

- Siemens AG

- LS Industrial System

- Mitsubishi Electric Corporation

- Shaanxi Baoguang Vacuum Electric Device Company Limited

- Toshiba Corporation

- Meidensha Corporation

- ACTOM

- Chengdu Zuguang Electronics Company Limited

- Shaanxi Joyelectric International Company Limited

- Wuhan Feite Electric Company Limited.

The global vacuum interrupters market is segmented as follows:

By Rated Voltage

- 0–15 kV

- 15–30 kV

- Above 30 kV

By Application

- Circuit Breaker

- Contactor

- Recloser

- Load Break Switch

- Tap Changer

- Others

By End User

- Utilities

- Oil & Gas

- Mining

- Transportation

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global vacuum interrupters market is expected to grow due to rising adoption of smart grid technologies, increasing demand for reliable and efficient power distribution, growing focus on renewable energy integration, and advancements in high-voltage circuit protection solutions.

According to a study, the global vacuum interrupters market size was worth around USD 2.36 Billion in 2024 and is expected to reach USD 3.88 Billion by 2034.

The global vacuum interrupters market is expected to grow at a CAGR of 5.7% during the forecast period.

Asia-Pacific is expected to dominate the vacuum interrupters market over the forecast period.

Leading players in the global vacuum interrupters market include ABB, Eaton, Crompton Greaves Limited, Siemens AG, LS Industrial System, Mitsubishi Electric Corporation, Shaanxi Baoguang Vacuum Electric Device Company Limited, Toshiba Corporation, Meidensha Corporation, ACTOM, Chengdu Zuguang Electronics Company Limite, among others.

The report explores crucial aspects of the vacuum interrupters market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed