U.S. Utility Terrain Vehicle Market Size, Share, Trends, Growth 2032

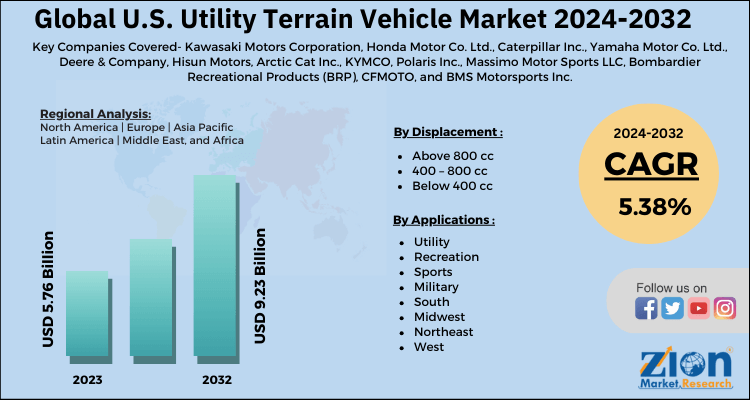

U.S. Utility Terrain Vehicle Market By Displacement (Above 800 cc, 400 - 800 cc, and Below 400 cc), By Application (Utility, Recreation, Sports, and Military), and By Region: Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecasts, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.76 Billion | USD 9.23 Billion | 5.38% | 2023 |

U.S. Utility Terrain Vehicle Market Insights

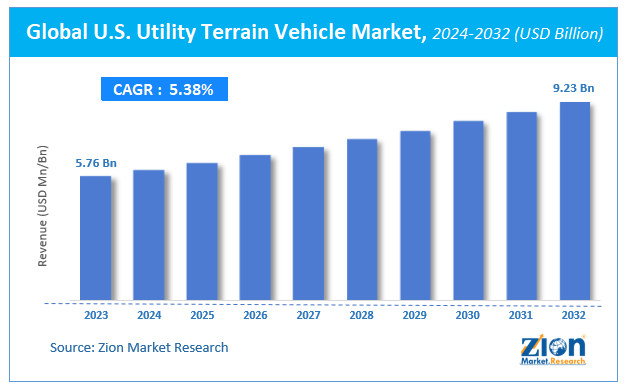

According to Zion Market Research, the global U.S. Utility Terrain Vehicle Market was worth USD 5.76 Billion in 2023. The market is forecast to reach USD 9.23 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.38% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the U.S. Utility Terrain Vehicle industry over the next decade.

This report analyzes and estimates the U.S. utility terrain vehicle market at global, regional, and country level. The research study provides historic data from 2018 to 2022 along with the forecast from 2024 to 2032 based on revenue (USD Billion). The report offers detailed insights of the U.S. utility terrain vehicle market drivers and restraints along with their impact analysis at a global level from 2015 to 2025.

U.S. Utility Terrain Vehicle Market: Overview

The report covers an in-depth analysis of the strategies adopted by major competitors in the U.S. utility terrain vehicle market. To understand the competitive landscape in the U.S. utility terrain vehicle market, an analysis of Porter’s Five Forces model is also included. The research study comprises of market attractiveness analysis, wherein all the segments are benchmarked on the basis of their market size and growth rate. The research study provides a decisive view on the U.S. utility terrain vehicle market based on displacement, application, and region. All the segments of the market have been analyzed based on the past, present, and future trends. The market is estimated from 2024 to 2032.

The key reason behind the substantial rise in the demand for the utility terrain vehicles in the U.S. is the persistent organization of sport racing events by various clubs across the region. Moreover, the clubs play a crucial role in further boosting the demand for the sports category under the utility terrain vehicle market by offering these vehicles on lease for participation. The Southern U.S. region led the regional utility terrain vehicle market by holding the largest revenue share. The southern region is recognized for temperate climatic conditions, rocky mountains, and extensive woodland areas, which makes it an ideal place for conducting recreational activities, thereby driving the utility terrain vehicle market.

U.S. Utility Terrain Vehicle Market: Segmentation

The report encompasses the comprehensive analytical study of the U.S. utility terrain vehicle market by segmenting it on the basis of displacement, application, and region.

Based on the displacement, the regional utility terrain vehicle market is segmented into above 800 cc, 400 – 800 cc, and below 400 cc.

By application, the market is bifurcated into utility, recreation, sports, and military.

U.S. Utility Terrain Vehicle Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Utility Terrain Vehicle Market |

| Market Size in 2023 | USD 5.76 Billion |

| Market Forecast in 2032 | USD 9.23 Billion |

| Growth Rate | CAGR of 5.38% |

| Number of Pages | 110 |

| Key Companies Covered | Kawasaki Motors Corporation, Honda Motor Co. Ltd., Caterpillar Inc., Yamaha Motor Co. Ltd., Deere & Company, Hisun Motors, Arctic Cat Inc., KYMCO, Polaris Inc., Massimo Motor Sports LLC, Bombardier Recreational Products (BRP), CFMOTO, and BMS Motorsports Inc |

| Segments Covered | By Displacement, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Utility Terrain Vehicle Market: Regional Landscape

The regional segmentation comprises the past, present, and estimated demand for Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

U.S. Utility Terrain Vehicle Market: Competitive Space

Some of the leading players in the global market include

- Kawasaki Motors Corporation

- Honda Motor Co. Ltd.

- Caterpillar Inc.

- Yamaha Motor Co. Ltd.

- Deere & Company

- Hisun Motors

- Arctic Cat Inc.

- KYMCO

- Polaris Inc.

- Massimo Motor Sports LLC

- Bombardier Recreational Products (BRP)

- CFMOTO

- BMS Motorsports Inc.

The U.S. utility terrain vehicle market is segmented as:

By Displacement Segmentation Analysis

- Above 800 cc

- 400 – 800 cc

- Below 400 cc

By Application Segmentation Analysis

- Utility

- Recreation

- Sports

- Military

- South

- Midwest

- Northeast

- West

By Regional Segmentation Analysis

- South

- Midwest

- Northeast

- West

Table Of Content

Methodology

FrequentlyAsked Questions

A side-by-side, which is also referred to as a U.S. utility terrain vehicle (UTV), is a form of off-road vehicle that is intended for both recreational and utility purposes. Typically, UTVs are equipped with a variety of features that are suitable for a variety of duties and have a seating arrangement that accommodates multiple passengers in a side-by-side configuration.

The demand for UTVs is being driven by the increasing popularity of outdoor recreational activities, such as hunting, camping, and off-roading.

According to Zion Market Research, the global U.S. Utility Terrain Vehicle Market was worth USD 5.76 Billion in 2023. The market is forecast to reach USD 9.23 Billion by 2032.

According to Zion Market Research, the global U.S. Utility Terrain Vehicle Market a compound annual growth rate (CAGR) of 5.38% during the forecast period 2024-2032.

The regional segmentation comprises the past, present, and estimated demand for Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

Kawasaki Motors Corporation, Honda Motor Co. Ltd., Caterpillar Inc., Yamaha Motor Co. Ltd., Deere & Company, Hisun Motors, Arctic Cat Inc., KYMCO, Polaris Inc., Massimo Motor Sports LLC, Bombardier Recreational Products (BRP), CFMOTO, and BMS Motorsports Inc

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed