U.S. Staple Gun Market Size, Share, Analysis, Trends, Growth, 2032

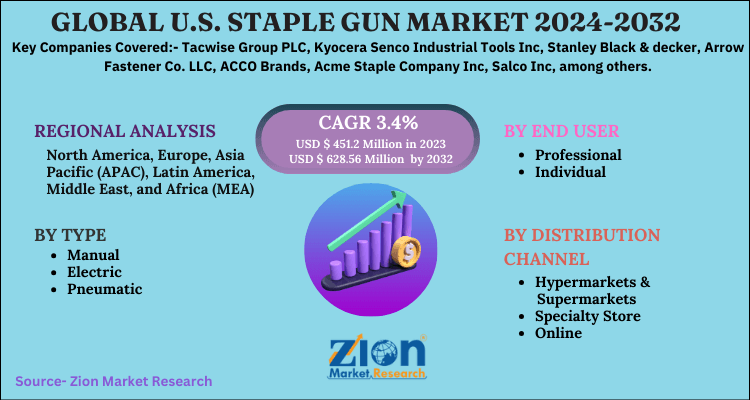

U.S. Staple Gun Market Size, Share- By Type (Manual, Electric, Pneumatic), By End User (Professional, Individual), and By Distribution Channel (Hypermarkets & Supermarkets, Specialty Store, Online, Others): U.S. Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

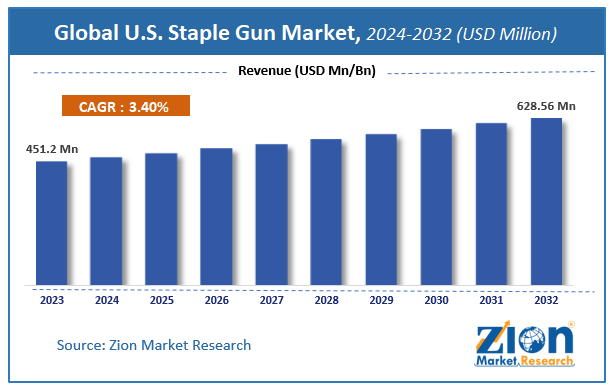

| USD 451.2 Million | USD 628.56 Million | 3.4% | 2023 |

U.S. Staple Gun Market Insights

According to Zion Market Research, the global U.S. Staple Gun Market was worth USD 451.2 Million in 2023. The market is forecast to reach USD 628.56 Million by 2032, growing at a compound annual growth rate (CAGR) of 3.4% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the U.S. Staple Gun Market industry over the next decade.

A staple gun is a hand-held machine that drives heavy staples of metal into plastic, wood, or masonry. These guns are used for various applications and to tack an array of materials, which also includes house wrap, upholstery, insulation, wiring, carpeting, roofing, and craft and hobby materials.

There are mainly three types of staple guns dignified to operate the gun by the power source used: electric (From a battery or cord), manual, and pneumatic (Compressed air). Hand-powered guns are slower as compared to Power staple guns. Power Staple gun staples at a quicker rate to some extent than hand-powered guns, but their key benefit is they can be continuously used for hours with relatively little fatigue.

Staple guns are also called as heavy-duty staplers, it basically does the work of a normal stapler, but that requires enormous power and force compared to a general stapler. Unlike staplers at office, not all staple guns have an anvil (it is a metal plate having curved slots that office staplers make use to flatten it and bend the staple against the paper.

U.S. Staple Gun Market: COVID-19 Impact Analysis

COVID-19 Pandemic hit manufacturing due to lock down and stringent policies passed by government bodies. The manufacturing was able to sustain business operations by implementing critical safety measures and wellness policies, oversight and systems. These actions proved to be highly effective in protecting critical manufacturing and operating employees in site locations and field operations. Companies also quickly transitioned its office employees around the globe to a nearly complete virtual workforce, providing the necessary technical and collaboration support to enable these employees to adjust to a virtual working environment. The Company believes the adopted hybrid work policies are likely to be a lasting result of the pandemic and will be a key enabler to support the broad needs of critical on-site to fully virtual employees.

U.S. Staple Gun Market: Growth Factors

Packaging has become an essential part of a lifecycle of a product largely because packaging preserves and protects a product from various types of harm for instance, contamination, damage, leakage, etc. during the course of consumption, transit, and storage. Accomplishing the highest degree of safety of a product at every stage of the product lifecycle is considered to be one of the biggest concerns nowadays of product manufacturers producing sensitive Products. Furthermore, sensitive products need adamant packaging made of plastic and wood.

Stapling plastic and wood has been a key pain point for a couple of decades now for the packaging industry. Staple guns are primarily used to turn metal staples of heavy-duty into plastic, wood, or another solid surface. Staple guns are also known as trigger trackers sometimes and are used in a range of applications including carpeting, upholstery, craft material, insulation, house wrap, roofing, and wiring. These staple guns are fast and give a long shelf life to a packaged product. The increasing demand from the packaging sector is expected to drive growth over the forecast period of the staple gun market.

Staple guns are used to set up carpets and helps to retack again back onto the floor. The tool even let you have a soundproof a room by fixing them onto the walls, and it comes in super accessible. Staple guns are ideal for jobs related to carpeting because they don’t take as much pressure as the other tools takes, and there’s much less chance of the carpet being messed up. Staple guns can simply allow fixing furniture by fixing fabrics onto it, without any wrinkles. They work on numerous materials such as foam, leather, wood, and fabric. With staple guns, one might even hold the option to put nails. Staple guns can make work a lot quicker and easier, pushing huge metal staples into materials. From insulation to upholstery, they can be used for a vareity of handiwork. These are some of the factors driving the growth for the market.

Type Analysis Preview

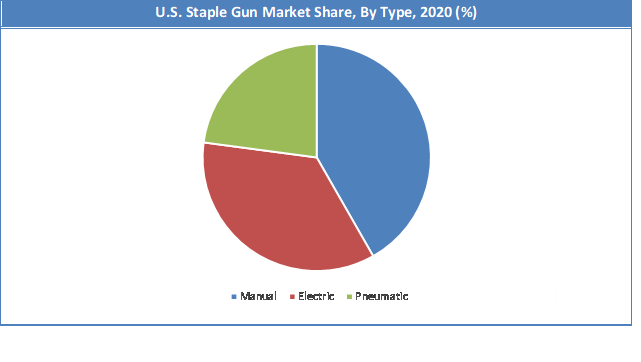

Manual segment held a share of around 41.75% in 2020. Based on type segment, the U.S. staple gun market is further bifurcated into manual, electric, and pneumatic. In 2020, the manual type was valued at USD 45.42 Million and is projected to reach USD 46.58 Million in 2028. The electric type is projected to grow at a CAGR of 5.3% to reach USD 58.11 Million in 2028.

End-User Segment Analysis Preview

The individual segment is expected to grow at a CAGR of over 1.3% from 2021 to 2028. Based on the end-user segment, the U.S. staple gun market is further bifurcated into professional and individual. In 2020, the professional segment was valued at USD 80.09 Million and is projected to reach USD 103.55 Million in 2028. The individual segment is projected to grow at a CAGR of 1.3% to reach USD 31.87 Million in 2028.

U.S. Staple Gun Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Staple Gun Market |

| Market Size in 2023 | USD 451.2 Million |

| Market Forecast in 2032 | USD 628.56 Million |

| Growth Rate | CAGR of 3.4% |

| Number of Pages | 130 |

| Key Companies Covered | Tacwise Group PLC, Kyocera Senco Industrial Tools Inc, Stanley Black & decker, Arrow Fastener Co. LLC, ACCO Brands, Acme Staple Company Inc, Salco Inc, among others |

| Segments Covered | By Type, By End User, By Distribution Channel and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Analysis Preview

As staple guns need to be long lasting, good quality and durability companies such Stanley black & decker are investing huge amounts of funds in research and development of this product. Pneumatic and electric-operated staple guns are majorly used in construction industry whereas batteries operated are used in household applications.

Heavy duty rigid packaging requires rigid staple guns which are manufactured by companies such as Stanley Black & Decker, Arrow Fasteners Inc., ACCO and various others which are continuously modifying staple gun products for better grip and durability which will indirectly grow market opportunities for this market. The majority of segment of buyers of staple guns are the movers and packer companies. Companies are developing long durable battery operated stapling guns which will grow the market in future and have bright opportunities for the manufacturing companies.

U.S. Staple Gun Market: Competitive Landscape

Some of key players in U.S. Staple Gun Market are

- Tacwise Group PLC

- Kyocera Senco Industrial Tools Inc.

- Stanley Black & decker

- Arrow Fastener co. LLC

- ACCO Brands

- Acme Staple Company Inc.

- Salco Inc.

- among others.

The U.S. Staple Gun Market is segmented as follows:

By Type

- Manual

- Electric

- Pneumatic

By End User

- Professional

- Individual

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Store

- Online

- Others

U.S. Education Market: Regional Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The U.S. Staple Gun Market size was valued at around USD 451.2 Million in 2023.

The U.S. Staple Gun Market size is expected to reach over USD 628.56 Million by 2032

Some of the key factors driving the U.S. Staple Gun Market growth is Rising demand for packaging industry, Interiors & woodworks, among others.

Some of the major companies operating in the U.S. Staple Gun Market are Tacwise Group PLC, Kyocera Senco Industrial Tools, Inc., Stanley Black & decker, Arrow Fastener co. LLC, ACCO Brands, Acme Staple Company, Inc., Salco Inc., among others.

Staple Gun market is growing at a CAGR of 3.4% between 2024 and 2032

Influencing segments growing in the Staple Gun Market is By Type (Manual, Electric, Pneumatic), By End User (Professional, Individual), And By Distribution Channel (Hypermarkets & Supermarkets, Specialty Store, Online, Others)

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed