U.S. Education Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

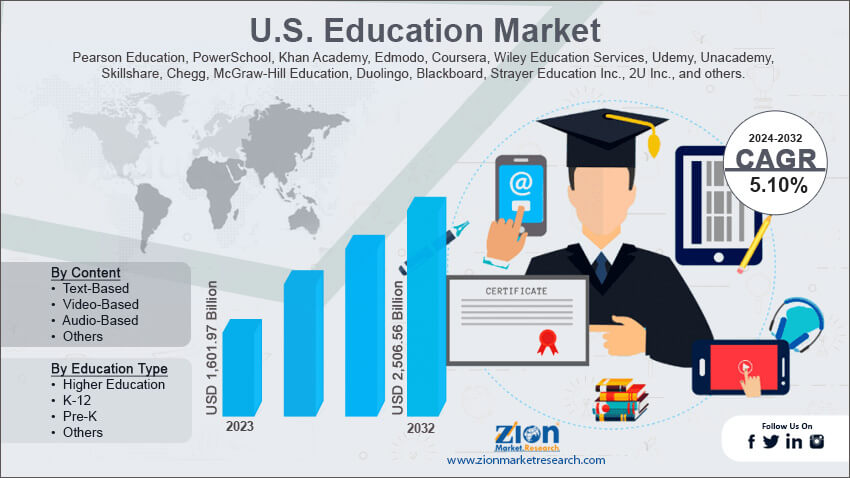

U.S. Education Market By Type (Cloud and On-Premise), By Content (Text-Based, Video-Based, Audio-Based, and Others), By Education Type (Higher Education, K-12, Pre-K, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

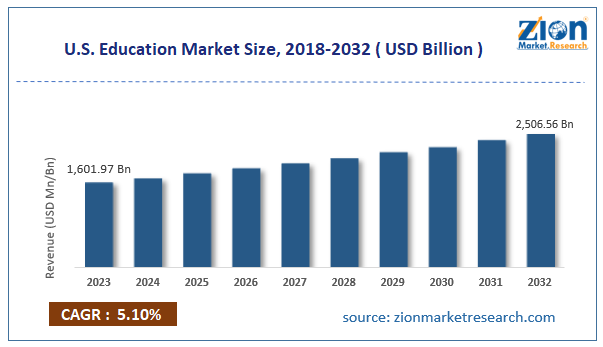

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,601.97 Billion | USD 2,506.56 Billion | 5.10% | 2023 |

U.S. Education Industry Perspective:

The U.S. education market size was worth around USD 1,601.97 billion in 2023 and is predicted to grow to around USD 2,506.56 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.10% between 2024 and 2032.

U.S. Education Market: Overview

The U.S. education system is the learning ecosystem in the country. It is characterized by the presence of several stages of learning provided by a wide variety of institutes. The US education system operates through public and private schools. State governments are responsible for the majority of decisions made regarding education standards and examinations. In addition to public or private schools, homeschooling is also widely common in the US. In recent years, the regional learning industry in the US has suffered several criticisms.

One of the most urgent matters requiring more state government input deals with student safety in schools, as the number of school shooting incidents in the country is growing at an alarming rate. Nonetheless, the US education system remains globally recognized as it attracts millions of international students for graduate and postgraduate programs. The presence of prestigious institutes across fields such as arts, science, and literature is driving the regional market growth rate. Additionally, the surge in federal and state government investments to upgrade school facilities will further promote regional market revenue.

Key Insights:

- As per the analysis shared by our research analyst, the U.S. education market is estimated to grow annually at a CAGR of around 5.10% over the forecast period (2024-2032)

- In terms of revenue, the U.S. education market size was valued at around USD 1,601.97 billion in 2023 and is projected to reach USD 2,506.56 billion by 2032.

- The U.S. education market is projected to grow at a significant rate due to the surge in the number of international students across US-based universities and colleges

- Based on the type, the on-premise segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the education type, the higher education segment is anticipated to command the largest market share

- Based on region, Northeastern states is projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

U.S. Education Market: Growth Drivers

Surge in the number of international students across US-based universities and colleges will fuel the market demand rate

The U.S. education market is expected to be driven by the rising number of international students across the country. The United States is home to some of the world’s most famous and esteemed institutes. In addition, the US graduate and postgraduate programs cover several fields ranging from literature to advanced technologies. The Massachusetts Institute of Technology (MIT), one of the globally leading institutes offering courses on technical subjects, hosted more than 3,400 international students in the 2023-2024 academic year. Students from other countries have shown greater interest in US institutes as compared to educational centers in other parts of the world since US facilities offer extensive and sophisticated research programs. The research units of US education centers are actively investing in cutting-edge research and studies. For instance, in August 2024, the National Strategic Research Institute (NSRI) at the University of Nebraska and MIT Lincoln Laboratory launched a joint student research program. The agencies aim to put together all resources for developing solutions to manage and tackle global health and agricultural security while detecting and eliminating emerging biological threats.

Use of advanced technologies for more efficient teaching and learning will drive more focus toward the market

The U.S. education industry is one of the leading sectors globally to register higher integration of modern advanced tools for more effective teaching programs. The education sector in other parts of the world is becoming more competitive, thus encouraging U.S. players to incorporate novel ideas for improving the quality of education. For instance, in July 2024, Andrej Karpathy, the founding member of OpenAI, announced the launch of a new project that is expected to combine Artificial Intelligence (AI) and education. The new project is a new company called Eureka Labs, which will leverage AI-based assistants to expand and support human teacher-designed course material. In May 2024, technology giant Microsoft announced a partnership with Khan Academy, a tutoring organization to develop a generative AI assistant without any cost for teachers across the country, thus prompting higher growth in the U.S. education market.

U.S. Education Market: Restraints

Growing criticisms over the decline in education quality as compared to global learning programs will limit the industry’s expansion rate

The U.S. industry for education is expected to be impacted by the rising criticism the educational sector is facing from domestic and international stakeholders. One of the main criticisms refers to the declining quality of education in the country. A recent study by the National Assessment of Educational Progress (NAEP) indicated that American students’ skills and knowledge were declining steadily. Additionally, the study also pointed out the gap between the lowest-scoring and highest-scoring students. According to the American Psychological Association, the country registered a significant slack in academic progress during COVID-19 and is yet to recover from the setback.

U.S. Education Market: Opportunities

Growing government-backed and private investments toward improving education quality will benefit the industry

The U.S. education market is expected to generate more growth opportunities during the projection period due to a surge in investments from state and federal governments. The investment opportunities are also backed by the growing number of private institutes investing in the region’s education industry. In April 2024, the US government launched the Strategy on International Basic Education (2024–2029) through which the official aim was to solidify its take on developing a more inclusive and quality education system in the country. In July 2024, New York Governor Kathy Hochul announced the launch of a new digital portal called ny.gov/childcare. The solution was launched in the presence of a U.S. Senator and will assist in providing low-cost or free child care for eligible families located in the state using the New York State’s Child Care Assistance Program.

U.S. Education Market: Challenges

Rising cost of education in the country along with other technical challenges limit the industry’s expansion rate

The U.S. education industry is expected to be challenged by the surging cost of education in the country. Depending on the university and program, the cost of studying in the US ranges between USD 7100 and USD 75,500 per year. In addition to this, the rising number of school shooting incidents in the country is a major area of concern for families and state officials. According to official reports, the country recorded around 350 school shootings in 2023, leading to several fatalities.

U.S. Education Market: Segmentation

The U.S. education market is segmented based on type, content, education type, and region.

Based on the type, the regional market segments are cloud and on-premise. In 2023, the highest growth was observed in the on-premise segment. It is driven by the surging number of enrollments in schools, colleges, and universities. The higher influx of international students along with a rising number of education programs across fields will further promote a segmental market growth rate. Cloud-based education is becoming less common in the country due to a lack of effectiveness in imparting knowledge. The US has more than 90,000 public schools across the country.

Based on content, the U.S. education industry is divided into text-based, video-based, audio-based, and others.

Based on the education type, the regional market divisions are higher education, K-12, pre-K, and others. In 2023, the higher education segment generated higher revenue, led by the increased cost of undergoing university and college courses. Rise in the number of advanced teaching programs, student loan facilities, and the rise in the number of global students is fueling the segmental demand. The US hosted nearly 465,700 Indian students in 2022, according to US Citizenship and Immigration Services (USCIS).

U.S. Education Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Education Market |

| Market Size in 2023 | USD 1,601.97 Billion |

| Market Forecast in 2032 | USD 2,506.56 Billion |

| Growth Rate | CAGR of 5.10% |

| Number of Pages | 230 |

| Key Companies Covered | Pearson Education, PowerSchool, Khan Academy, Edmodo, Coursera, Wiley Education Services, Udemy, Unacademy, Skillshare, Chegg, McGraw-Hill Education, Duolingo, Blackboard, Strayer Education Inc., 2U Inc., and others. |

| Segments Covered | By Type, By Content, By Education Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Education Market: Regional Analysis

Northeastern states to continue leading the market growth rate during the forecast period

The U.S. education market is expected to be led by Northeastern states during the projection period. The regional revenue will be driven by higher student density in several states located across the Eastern coast of the country. For instance, Massachusetts is one of the leading states in terms of quality of education, including prestigious institutes such as Harvard University, Massachusetts Institute of Technology, Boston University, Tufts University, Northeastern University, and others.

In addition, the surge in harboring a more research-oriented student curriculum will further promote the expansion of regional revenue. In 2023, the endowment value of Harvard ranked number 1 across the globe. The school institute generated USD 50.75 billion in endowment in 2023. In addition to this, the surge in improving public school systems will be essential to the market's overall growth trajectory. In July 2024, the Florida Department of Education (FDOE) announced new initiatives to promote quality education in the region by raising teacher’s salaries and spending on comprehensive growth in children. The agency is expected to invest nearly USD 1.25 billion to achieve its goal in the future.

U.S. Education Market: Competitive Analysis

The U.S. education market is led by players like:

- Pearson Education

- PowerSchool

- Khan Academy

- Edmodo

- Coursera

- Wiley Education Services

- Udemy

- Unacademy

- Skillshare

- Chegg

- McGraw-Hill Education

- Duolingo

- Blackboard

- Strayer Education Inc.

- 2U Inc.

The U.S. education market is segmented as follows:

By Type

- Cloud

- On-Premise

By Content

- Text-Based

- Video-Based

- Audio-Based

- Others

By Education Type

- Higher Education

- K-12

- Pre-K

- Others

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The U.S. education system is the learning ecosystem in the country.

The U.S. education market is expected to be driven by the rising number of international students across the country.

According to study, the U.S. education market size was worth around USD 1,601.97 billion in 2023 and is predicted to grow to around USD 2,506.56 billion by 2032.

The CAGR value of U.S. education market is expected to be around 5.10% during 2024-2032.

The U.S. education market is expected to be led by Northeastern states during the projection period.

The U.S. education market is led by players like Pearson Education, PowerSchool, Khan Academy, Edmodo, Coursera, Wiley Education Services, Udemy, Unacademy, Skillshare, Chegg, McGraw-Hill Education, Duolingo, Blackboard, Strayer Education, Inc., and 2U, Inc.

The report explores crucial aspects of the U.S. education market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed