Unmanned Combat Aerial Vehicle Market Size, Share, and Forecast 2034

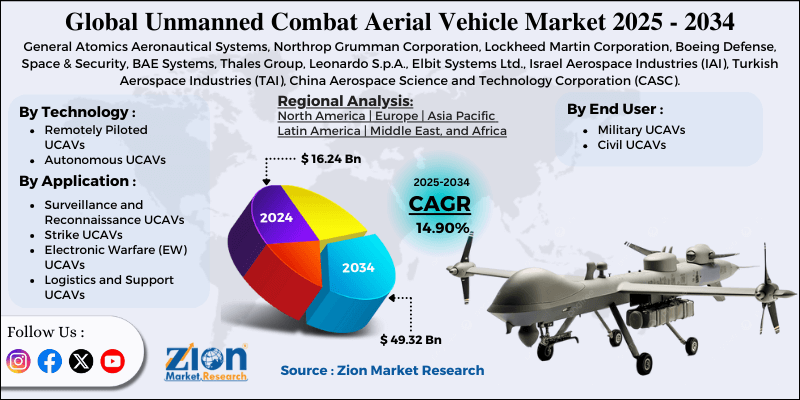

Unmanned Combat Aerial Vehicle Market By Technology (Remotely Piloted UCAVs, Autonomous UCAVs), By Application (Surveillance and Reconnaissance UCAVs, Strike UCAVs, Electronic Warfare [EW] UCAVs, Logistics and Support UCAVs), By End User (Military UCAVs, Civil UCAVs), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

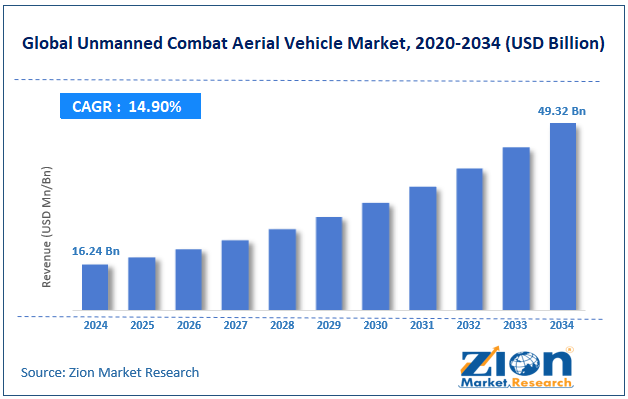

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.24 Billion | USD 49.32 Billion | 14.90% | 2024 |

Unmanned Combat Aerial Vehicle Industry Perspective:

The global unmanned combat aerial vehicle market size was worth around USD 16.24 billion in 2024 and is predicted to grow to around USD 49.32 billion by 2034, with a compound annual growth rate (CAGR) of roughly 14.90% between 2025 and 2034.

Unmanned Combat Aerial Vehicle Market: Overview

Unmanned combat aerial vehicles are advanced drones dedicated to military operations, capable of deploying and carrying precision-guided munitions without a human pilot on board. They integrate superior technologies like stealth design, AI, and real-time data links to execute surveillance, reconnaissance, and strike missions in high-risk environments. The global unmanned combat aerial vehicle market is poised for notable growth owing to the rising demand for autonomous warfare systems, heavy border security, and improvements in sensor and stealth solutions. Autonomous systems reduce operational risks and human intervention. UCAVs equipped with AI-based targeting, autonomous flight capabilities, and mission planning are gaining prominence for missions in disputed areas, where manned aircraft are susceptible.

Moreover, with increasing cross-border stresses and asymmetric warfare, UCAVs are necessary for strike and ISR missions. For instance, the United States military uses MQ-9 Reapers for counter-terrorism missions in the Middle East, while India utilizes drones for monitoring the Line of Actual Control (LAC). Modern UCAVs like the Taranis and X-47B present stealth proficiencies, electro-optical sensors, and advanced radar. Allowing penetration in area-denial/anti-access environments. This increases their effectiveness for precision without detection.

Nevertheless, the global market faces limitations due to factors such as strict regulatory architectures and vulnerability to cybersecurity threats. International treaties like MTCR (Missile Technology Control Regime) limit UCAV technology transfers, restricting the global sale and limiting industry growth for prominent producers. UCAVs depend primarily on GPS navigation and data links, making them vulnerable to electronic warfare attacks, jamming, and hacking. Incidents like the alleged Iranian cyber-hijack of a U.S. RQ-170 drone underscored the challenge. Still, the global unmanned combat aerial vehicle industry benefits from several favorable factors, including the integration of ML and AI, as well as the rise in Swarm UCAV systems for strategic missions.

AI-based UCAVs for autonomous navigation, decision-making, and target recognition are offering fresh potential for fully autonomous combat missions, decreasing pilot reliance. Swarm technology provides a cost-effective, high-impact solution for overcoming enemy air defenses, thereby enhancing its significance in future modern warfare.

Key Insights:

- As per the analysis shared by our research analyst, the global unmanned combat aerial vehicle market is estimated to grow annually at a CAGR of around 14.90% over the forecast period (2025-2034)

- In terms of revenue, the global unmanned combat aerial vehicle market size was valued at around USD 16.24 billion in 2024 and is projected to reach USD 49.32 billion by 2034.

- The unmanned combat aerial vehicle market is projected to grow significantly due to the increasing demand for precision strike capabilities, the shift towards unmanned systems for risk mitigation, and the need for cost-effective combat solutions.

- Based on technology, the remotely piloted UCAVs segment is expected to lead the market, while the autonomous UCAVs segment is expected to grow considerably.

- Based on application, the surveillance and reconnaissance UCAVs segment is the dominating segment, while the strike UCAVs segment is projected to witness sizeable revenue over the forecast period.

- Based on end user, the military UCAVs segment is expected to lead the market compared to the civil UCAVs segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Unmanned Combat Aerial Vehicle Market: Growth Drivers

How is evolving strike doctrines boosting the unmanned combat aerial vehicle market growth?

Operational lessons from conflicts like the Russia-Ukraine and the Nagorno-Karabakh have proved how UCAVs equipped with precision-guided munitions and loitering weapons can dismantle armor, air defenses, and artillery efficiently. These platforms integrate ISR and kinetic capabilities, decreasing sensor-to-shooter schedules and allowing speedy strikes on fleeting targets.

Modern SEAD/DEAD missions now prioritize expendable unmanned combat aerial vehicles to probe map emissions, defenses, and deliver anti-radiation attacks without risking pilots. The adoption of loitering munitions and swarm strategies in recent conflicts underscores their rising role, increasing UCAVs' criticality in future air combat doctrines.

How is the unmanned combat aerial vehicle market driven by export liberalization, domestic re-armament, and industrial policy?

Policy shifts in MTCR rules and relaxed United States export regulations have increased opportunities for UCAV sales worldwide. China, Turkey, and Israel have availed this to amplify exports, proving UCAVs as strategic industrial assets. 'Gulf nations' and India's 'Make in India' programs fuel joint ventures and indigenous production.

With defense re-arrangement priorities after conflict, UCAV supply chains and manufacturing gain strategic importance across the globe. These programs ultimately impact the growth of the unmanned combat aerial vehicle market.

Unmanned Combat Aerial Vehicle Market: Restraints

Lifecycle costs and high development of Advanced UCAVs hamper the market progress

Although UCAVs are less expensive than manned fighters, precision payloads, advanced models with AI, and stealth need multi-billion-dollar R&D investments. Programs like Europe's Remote Carriers and the United States' Loyal Wingman involve significant funding and lengthy timelines, thereby delaying the return on investment.

Developing economies are still struggling with these costs, frequently adopting cheaper imports in place of high-quality systems. For instance, Boeing's MQ-28 Ghost Bat program experienced a cost increase of more than 20% in 2023, due to modular upgrades and AI integration.

Unmanned Combat Aerial Vehicle Market: Opportunities

How do maritime and multi-domain operations offer advantageous conditions for the unmanned combat aerial vehicle market development?

The growth of UCAV roles in joint-force and naval operations offers a significant growth avenue in the unmanned combat aerial vehicle industry. UCAVs are primarily deployed for ISR, maritime, littoral strike operations, and anti-ship missions, where persistence and endurance are vital. For example, the United States Navy is integrating UCAV concepts into carrier strike groups for distributed maritime operations.

Unmanned Combat Aerial Vehicle Market: Challenges

Electronic warfare and cybersecurity vulnerabilities restrict the growth of the market

UCAVs depend mainly on satellite communication, secure data links, and GPS navigation, making them critical to spoofing, hacking, and signal jamming. Incidents during recent conflicts revealed successful GPS spoofing attacks, leading to UCAV mission crashes and failures. This creates reliability and trust concerns among operators and demands costly incorporation of encryption and anti-jamming solutions.

Despite improvements in secure C2 systems, adversaries are heavily investing in EW competencies, creating a constant technological arms race. A single cyber breach may compromise entire UCAV fleets.

Unmanned Combat Aerial Vehicle Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Unmanned Combat Aerial Vehicle Market |

| Market Size in 2024 | USD 16.24 Billion |

| Market Forecast in 2034 | USD 49.32 Billion |

| Growth Rate | CAGR of 14.90% |

| Number of Pages | 216 |

| Key Companies Covered | General Atomics Aeronautical Systems, Northrop Grumman Corporation, Lockheed Martin Corporation, Boeing Defense, Space & Security, BAE Systems, Thales Group, Leonardo S.p.A., Elbit Systems Ltd., Israel Aerospace Industries (IAI), Turkish Aerospace Industries (TAI), China Aerospace Science and Technology Corporation (CASC), Kratos Defense & Security Solutions, Dassault Aviation, Hindustan Aeronautics Limited (HAL), Baykar Technologies, and others. |

| Segments Covered | By Technology, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Unmanned Combat Aerial Vehicle Market: Segmentation

The global unmanned combat aerial vehicle market is segmented based on technology, application, end user, and region.

Based on technology, the global unmanned combat aerial vehicle industry is divided into remotely piloted UCAVs and autonomous UCAVs. The remotely piloted UCAVs segment registered a substantial share of the market owing to their operational reliability and established use in combat scenarios. They offer human control in real-time, decreasing risks related to autonomous decision-making and promising compliance with international engagement rules. These systems are widely adopted by leading air defense forces, such as the United States Air Force, which utilizes MQ-9 Reaper and similar platforms in APAC and Europe. The ongoing military operations propel this demand, given their proven effectiveness in precision-strike and ISR missions, as well as their low cost compared to manned aircraft.

Based on application, the global unmanned combat aerial vehicle market is segmented as surveillance and reconnaissance UCAVs, strike UCAVs, electronic warfare (EW) UCAVs, and logistics and support UCAVs. The surveillance and reconnaissance UCAVs hold a dominating share in the market since they are vital for surveillance, intelligence, and reconnaissance missions in all defense forces. These UCAVs offer real-time data, target tracking, and battlefield awareness, which are essential in combat and peacetime operations. Platforms like Heron TP and MQ-9 Reaper are widely utilized for ISR, primarily in counter-terrorism missions. Their cost-efficiency and ability to operate for long periods make them vital in modern warfare strategies.

Based on end user, the global market is segmented into military UCAVs and civil UCAVs. The military UCAVs hold leadership in the market because of their extensive deployment in combat, electronic warfare, ISR, and border surveillance missions. Governments worldwide are investing heavily in UCAV programs to enhance their air defense capabilities and reduce pilot risk in high-threat environments. The growing defense budgets and geopolitical stresses in regions like APAC, the Middle East, and Eastern Europe continue to propel the segmental dominance.

Unmanned Combat Aerial Vehicle Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is projected to maintain its dominant position in the global unmanned combat aerial vehicle market owing to the largest defense budgets, improved technological infrastructure and R&D capabilities, and high adoption for overseas operations and ISR missions. North America, dominated by the U.S., registers the maximum global defense spending, with the United States distributing USD 916 billion in 2023, according to SIPRI. A significant portion of this budget is allocated to next-generation UCAV programs to maintain air superiority.

Considerable investments in platforms boost the region's dominance in the global market. The region also benefits from advanced technology infrastructure and a strong industrial base, allowing speedy advancements in autonomous systems, AI, electronic warfare integration, and stealth. Companies like General Atomics, Northern Grumman, and Boeing are forerunners in UCAV development initiatives. Extensive research associated with defense agencies augments autonomous combat drone improvements.

Furthermore, North America deploys UCAVs broadly for surveillance, intelligence, precision strike missions, and reconnaissance in global conflict areas. The United States military operates hundreds of MQ-9 Reapers and similar systems in Africa, the Middle East, and Asia for strategic dominance and counter-terrorism. This broader operational use solidifies the region’s dominance in the market.

Asia Pacific maintains its position as the second-leading region in the global unmanned combat aerial vehicle industry due to growing defense expenditures, rising border stresses and regional conflicts, and government initiatives for indigenous UCAV development. APAC holds the second rank in the UCAV sector due to significant growth in defense spending.

According to SIPRI, India spent USD 83.6 billion on defense, and China spent USD 296 billion in 2023, holding the top military spender position. These investments are directed towards indigenous UCAV development programs to boost regional air dominance. The region also experiences geopolitical disputes, such as India-China border tensions, the South China Sea, and North Korea's activities, which fuel the demand for UCAVs for strike operations and surveillance.

Furthermore, APAC nations are pushing for self-reliance in defense solutions, leading to large-scale associations and UCAV projects. India's DRDO is working on the Ghatak UCAV, while China leads with the CH series and the Wing Loong drones for combat roles. These initiatives reduce import dependency and create a strong domestic manufacturing base, driving the industry growth.

Unmanned Combat Aerial Vehicle Market: Competitive Analysis

The leading players in the global unmanned combat aerial vehicle market are:

- General Atomics Aeronautical Systems

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Boeing Defense

- Space & Security

- BAE Systems

- Thales Group

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Israel Aerospace Industries (IAI)

- Turkish Aerospace Industries (TAI)

- China Aerospace Science and Technology Corporation (CASC)

- Kratos Defense & Security Solutions

- Dassault Aviation

- Hindustan Aeronautics Limited (HAL)

- Baykar Technologies

Unmanned Combat Aerial Vehicle Market: Key Market Trends

Growing adoption of stealth UCAVs:

Defense forces are primarily prioritizing stealth-enabled UCAVs to penetrate highly defended airspaces without detection. Programs like S-70 Okhotnik (Russia), Taranis (UK), and X-47B (U.S.) present the move towards low radar cross-section designs. This trend is fueled by the need to counter advanced air defense systems in disputed environments.

Emergence of swarm drone warfare:

Swarm technology, where multiple UCAVs operate in a coordinated manner, is gaining dominance for electronic warfare missions and saturation attacks. Economies like China, the United States, and India are investing in swarm UCAV competencies to overpower enemy defenses. This trend denotes an inclination towards cost-efficient and impactful combat tactics.

The global unmanned combat aerial vehicle market is segmented as follows:

By Technology

- Remotely Piloted UCAVs

- Autonomous UCAVs

By Application

- Surveillance and Reconnaissance UCAVs

- Strike UCAVs

- Electronic Warfare (EW) UCAVs

- Logistics and Support UCAVs

By End User

- Military UCAVs

- Civil UCAVs

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Unmanned combat aerial vehicles are advanced drones dedicated to military operations, capable of deploying and carrying precision-guided munitions without a human pilot on board. They integrate superior technologies like stealth design, AI, and real-time data links to execute surveillance, reconnaissance, and strike missions in high-risk environments.

The global unmanned combat aerial vehicle market is projected to grow due to rising geopolitical stresses and border conflicts, the development of stealth and high-precision UCAVs, and increasing demand for advanced reconnaissance and surveillance.

According to study, the global unmanned combat aerial vehicle market size was worth around USD 16.24 billion in 2024 and is predicted to grow to around USD 49.32 billion by 2034.

The CAGR value of the unmanned combat aerial vehicle market is expected to be around 14.90% during 2025-2034.

The surveillance and reconnaissance segment holds the largest share in the unmanned combat aerial vehicle market because of its critical role in target tracking, intelligence gathering, and real-time battlefield monitoring across all military operations.

The significant challenges include stringent export regulations, high development costs, and cybersecurity vulnerabilities, which limit global adoption. Additionally, legal and ethical concerns regarding autonomous lethal systems offer significant barriers to market growth.

North America is expected to lead the global unmanned combat aerial vehicle market during the forecast period.

The key players profiled in the global unmanned combat aerial vehicle market include General Atomics Aeronautical Systems, Northrop Grumman Corporation, Lockheed Martin Corporation, Boeing Defense, Space & Security, BAE Systems, Thales Group, Leonardo S.p.A., Elbit Systems Ltd., Israel Aerospace Industries (IAI), Turkish Aerospace Industries (TAI), China Aerospace Science and Technology Corporation (CASC), Kratos Defense & Security Solutions, Dassault Aviation, Hindustan Aeronautics Limited (HAL), and Baykar Technologies.

Stakeholders should invest in AI-driven autonomy, swarm capabilities, and stealth technology while forming strategic associations for joint development. Additionally, focusing on cost-effective compliance with global regulations and production will enhance competitiveness.

The report examines key aspects of the unmanned combat aerial vehicle market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed