Global Tire Material Market Size, Share, Growth Analysis Report - Forecast 2034

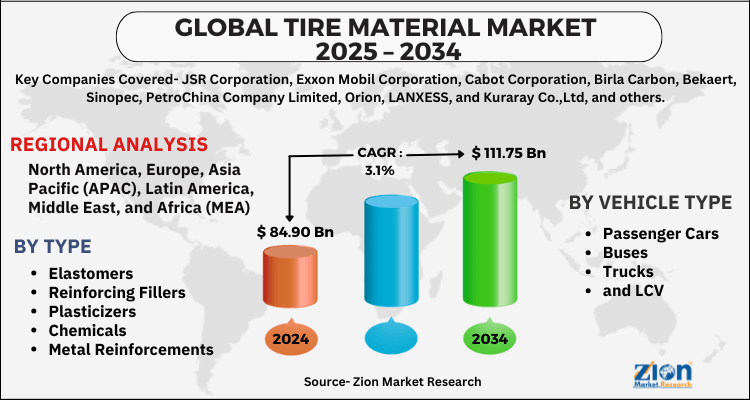

Tire Material Market By Type (Elastomers, Reinforcing Fillers, Plasticizers, Chemicals, Metal Reinforcements, and Textile Reinforcements), By Vehicle Type (Passenger Cars, Buses, Trucks, and LCV), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

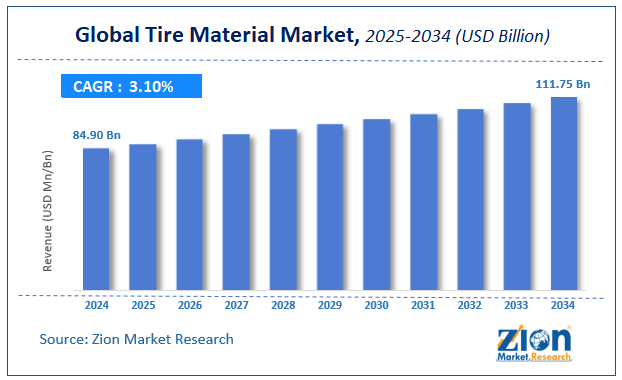

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 84.90 Billion | USD 111.75 Billion | 3.1% | 2024 |

Tire Material Market Size

The global tire material market size was worth around USD 84.90 Billion in 2024 and is predicted to grow to around USD 111.75 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.1% between 2025 and 2034.

The report analyzes the global tire material market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the tire material industry.

Tire Material Market: Overview

A tire is an essential element of a vehicle since it matches a footprint that is designed to match the vehicle's weight. The majority of tires, including those on bicycles and cars, are filled pneumatically, creating a tough cushion which engrosses shock when the tire rolls over tough terrain. Carbon black, steel wires, fabric, natural rubber, synthetic rubber, and other chemical materials are used in the manufacturing of tires. Styrene-butadiene and butadiene rubber are the two most commonly used synthetic rubber polymers in tire manufacture.

A tire is a strong, tough, flexible rubber covering attached to the rim of a wheel. Tires are used in the trucks, aircraft, tractors, buses, industrial vehicles, motorcycles, bicycles, and others. Most of the tires for vehicles are pneumatic. Pneumatic tires are designed in such a way that air is held under pressure inside the tire. The inner tube in the tires is designed to hold the air pressure. Tires are the only contact between the vehicles and ground, thus it plays a vital role in ensuring that the vehicle is in control. The designing and material composition of the tires is significant to ensure optimum performance.

Key Insights

- As per the analysis shared by our research analyst, the global tire material market is estimated to grow annually at a CAGR of around 3.1% over the forecast period (2025-2034).

- Regarding revenue, the global tire material market size was valued at around USD 84.90 Billion in 2024 and is projected to reach USD 111.75 Billion by 2034.

- The tire material market is projected to grow at a significant rate due to increasing vehicle production, rising demand for high-performance tires, and innovation in sustainable and durable tire materials.

- Based on Type, the Elastomers segment is expected to lead the global market.

- On the basis of Vehicle Type, the Passenger Cars segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Tire Material Market: Growth Drivers

Rising manufacture of automotive to spur the market growth

Increased customer preference for comfortable travel and the incorporation of new automobiles has resulted in a major increase in automotive vehicle sales, including commercial cars and passenger vehicles. As per the India Brand Equity Foundation, in 2021, 0.56 million commercial vehicles, 15.11 million two-wheelers, and 2.71 million passenger cars were sold in India. Furthermore, the rapidly expanding automobile resale market, as well as increased tires replacement and retracting operations in older cars, are boosting market development. In addition to this, an increase in disposable income in emerging countries, rising spending power, and rise in tourism have led to increase in sales of automotive. Thus, key players are majorly emphasizing the production of automotive which in turn is driving the global tire material market growth.

Increase in the automotive production is the major factor driving the market. The tire materials used in the automotive tires provide better traction, stability, and greater adhesive properties. These materials help in preventing internal damages, carry the extra load, and also offer a longer life than normal tires. Rising environmental concerns lead to the governmental regulations on emissions of vehicles. Thus, the preference for the electronic vehicles has witnessed an increase in the past years, which, in turn, is propelling the demand for tire materials. Moreover, an increase in the number of automotive vehicles and passenger vehicles leads to the rising demand for the tire materials. Therefore, such factors are anticipated to fuel the market growth during the forecast period.

Tire Material Market: Restraints

Fluctuating prices of raw materials hamper the market growth

The prime factor that is impeding the growth of the market is the volatile cost of the raw material required for the manufacture of tires. In addition to this, the rise in competition, high energy & operating cost, and market disagreement with globalization are some of the additional factors that may hinder the market growth.

Tire Material Market: Opportunities

Growing inclination towards use of biodegradable materials to fuel the market during the forecast period.

Green tires are manufactured from recyclable materials such as nylon rubber using a low-energy technique. Tires are traditionally comprised of rubber, however, with rising energy concerns, tires are increasingly being produced from –eco-friendly materials such as resins and plasticizers. Such ecologically sustainable raw materials are increasingly being preferred over traditional products due to benefits including being lighter than traditional items, resulting in a drop in the total weight of the vehicle. This also requires lesser fuel and reduces rolling resistance. Green tires are predicted to rise at a profitable pace over the forecast period, owing to benefits such as retractable tires and long life. Moreover, as energy costs rise, government restrictions tighten, and customers become more environmentally conscious about fuel use, the usage of the green tire in automobiles will rise throughout the projection period.

Tire Material Market: Challenges.

The environmental consequences of tires may pose a challenge to market growth

The massive amount of solid trash generated by the tires is a big problem. Old tire consists of heavy metals and compounds that leach into the environment as they degrade, a process called leaching. Some of these substances have been shown to be carcinogenic and mutagenic. The pollution of the soil is another threat posed by leaching. The toxic chemicals discharged into the environment can swiftly poison the soil around such old tires. Groundwater is also at danger of contamination. Furthermore, if these chemicals contaminate the water in the soil, the toxic water will come into touch with animals and humans, putting their lives in jeopardy. Moreover, one of the major concerns with the discarded tires is the elevated danger of fire. Nearly half of the recycled waste tires are utilized for making fuel. Tire fires, on the other hand, will be tougher to cope with and extinguish. All such factors act as major challenges to the global tire material market growth.

Tire Material Market: Segmentation Analysis

The global tire material market is segmented based on Type, Vehicle Type, and region.

Based on Type, the global tire material market is divided into Elastomers, Reinforcing Fillers, Plasticizers, Chemicals, Metal Reinforcements, and Textile Reinforcements.

On the basis of Vehicle Type, the global tire material market is bifurcated into Passenger Cars, Buses, Trucks, and LCV.

Tire Material Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Tire Material Market |

| Market Size in 2024 | USD 84.90 Billion |

| Market Forecast in 2034 | USD 111.75 Billion |

| Growth Rate | CAGR of 3.1% |

| Number of Pages | 166 |

| Key Companies Covered | JSR Corporation, Exxon Mobil Corporation, Cabot Corporation, Birla Carbon, Bekaert, Sinopec, PetroChina Company Limited, Orion, LANXESS, and Kuraray Co.,Ltd, and others. |

| Segments Covered | By Type, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In January 2022, the Goodyear Tire & Rubber Company unveiled a demonstration tire that contains 70% sustainable materials and has industry-leading technologies. Thirteen featured ingredients are spread over nine distinct tire components in the 70 percent sustainable-material tire.

- In February 2021, Michelin revealed that it would partner with Enviro to build the world's first tire recycling facility, which uses proprietary technology to recover gas, steel, pyrolysis oil, carbon black, and other commodities.

Tire Material Market: Regional Landscape

Asia Pacific to hold the maximum share in the market

In the global tire material market, Asia Pacific is likely to hold the highest share during the forecast period. Changing standards of living and lifestyles have increased the use of high-performance and branded tires, which is likely to have a favorable influence on the Asia Pacific tire material market. Further, the growing number of vehicle users will drive growth in both the aftermarket and OEM segments, as well as the tire material market. China is the world's largest automobile market, according to the International Trade Administration, with the Chinese government anticipating car manufacturing to reach 35 million by 2025. North America and Europe are also estimated to grow at a healthy growth rate during the forecast period.

Tire Material Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the tire material market on a global and regional basis.

The global tire material market is dominated by players like:

- JSR Corporation

- Exxon Mobil Corporation

- Cabot Corporation

- Birla Carbon

- Bekaert

- Sinopec

- PetroChina Company Limited

- Orion

- LANXESS

- and Kuraray Co.

- Ltd

The global tire material market is segmented as follows;

By Type

- Elastomers

- Reinforcing Fillers

- Plasticizers

- Chemicals

- Metal Reinforcements

- and Textile Reinforcements

By Vehicle Type

- Passenger Cars

- Buses

- Trucks

- and LCV

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global tire material market is expected to grow due to increasing vehicle production, rising demand for durable and fuel-efficient tires, and advancements in sustainable tire materials.

According to a study, the global tire material market size was worth around USD 84.90 Billion in 2024 and is expected to reach USD 111.75 Billion by 2034.

The global tire material market is expected to grow at a CAGR of 3.1% during the forecast period.

Asia-Pacific is expected to dominate the tire material market over the forecast period.

Leading players in the global tire material market include JSR Corporation, Exxon Mobil Corporation, Cabot Corporation, Birla Carbon, Bekaert, Sinopec, PetroChina Company Limited, Orion, LANXESS, and Kuraray Co.,Ltd, among others.

The report explores crucial aspects of the tire material market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed