Thermoplastic Polyurethane Market Size, Share Report, Analysis, Trends, Growth 2032

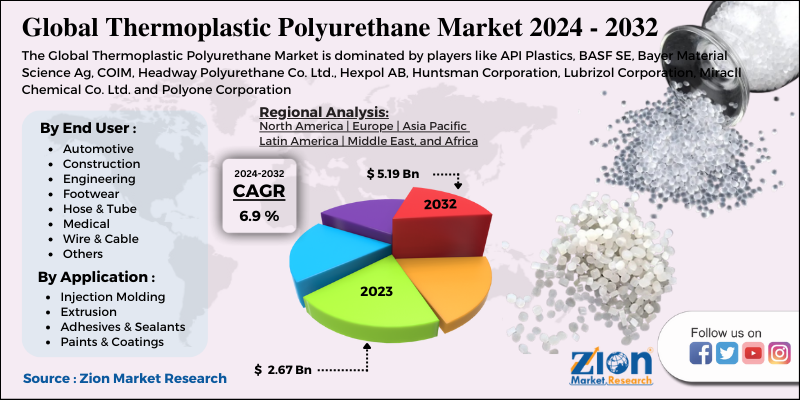

Thermoplastic Polyurethane Market By Injection Molding, Extrusion, Adhesives & Sealants And Paints & Coatings Applications For Automotive, Construction, Engineering, Footwear, Hose & Tube, Medical And Wire & Cable End-Users: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

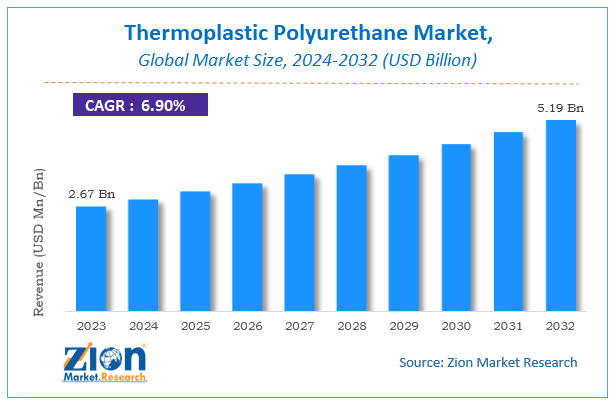

| USD 2.67 Billion | USD 5.19 Billion | 6.9% | 2023 |

Thermoplastic Polyurethane Market Insights

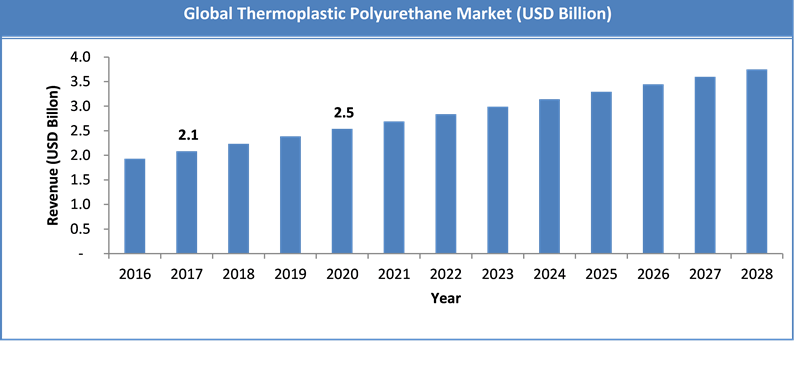

According to Zion Market Research, the global Thermoplastic Polyurethane Market was worth USD 2.67 Billion in 2023. The market is forecast to reach USD 5.19 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.9% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Thermoplastic Polyurethane Market industry over the next decade.

Market Overview

Burgeoning demand from the automotive, construction, and medical sectors will boost the expansion of the thermoplastic polyurethane market within the years ahead. Aside from this, massive product applications witnessed in extrusion, paints & coatings, injection molding, and adhesives & sealants will further augment the business sphere over the subsequent few years. Escalating global concerns associated with ecological damage as a result of the merchandise manufacture & use is predicted to obstruct the thermoplastic polyurethane market surge over the forthcoming years. Also, fluctuations within the staple costs can hamper the profitability of the business within the ensuing years. Nevertheless, the assembly of bio-based products is forecast to supply new growth opportunities for the thermoplastic polyurethane market within the near future, thereby normalizing the impact of hindrances on the market, reports the thermoplastic polyurethane market study.

Thermoplastic polyurethane market is a rapidly growing industry with demand from various regions of the world owing to its wide range of applications in various end-user industries. Polyurethanes are one of the most adaptable plastic materials. The nature of the chemistry permits polyurethanes to be molded into different shapes and to enhance industrial and consumer products. Its properties include elasticity, transparency, and resistance to oil, grease, and abrasion.

The global thermoplastic polyurethane (TPU) market is expected to witness significant growth owing to increasing demand from the automotive sector. Increasing application in footwear is also expected to propel the growth of the global thermoplastic polyurethane market within the forecast period. The leading market players have been adopting thermoplastic polyurethanes in their product to enhance the comfort of the footwear. In addition, application of thermoplastic polyurethanes in medical is also expected to boost the growth of the TPU market in the coming years. However, the growing environmental concerns with the manufacture and usage of thermoplastic polyurethanes are expected to be major restraints for the global thermoplastic polyurethane market. Furthermore, instability in the prices of raw materials could also hinder the growth of the thermoplastic polyurethane market. However, development of bio-based alternatives is expected to create more opportunities in the thermoplastic polyurethanes market in the coming years.

COVID-19 Impact Analysis

At the start of 2021, COVID-19 disease began to spread around the world, many people worldwide were infected with COVID-19 disease, and major countries around the world have implemented foot prohibitions and strike orders. COVID-19 is an incomparable global public health emergency that has affected almost every industry, and the long-term effects are projected to impact the industry growth during the forecast period.

Growth Factors

The growing demand for TPU in the automotive and Hose & Tube industries is boosting the market. Polyester TPU is widely used in major industries owing to its properties, such as high tensile strength, good shock absorption, and resistance to cut, solvent, and microbial activity. Moreover, urbanization and lifestyle, environment awareness, and consumer preferences towards a good range of quality products are the other secondary factors driving the thermoplastic polyurethane market.

Thermoplastic Polyurethane Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Thermoplastic Polyurethane Market |

| Market Size in 2023 | USD 2.67 Billion |

| Market Forecast in 2032 | USD 5.19 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 167 |

| Key Companies Covered | API Plastics, BASF SE, Bayer Material Science Ag, COIM, Headway Polyurethane Co. Ltd., Hexpol AB, Huntsman Corporation, Lubrizol Corporation, Miracll Chemical Co. Ltd. and Polyone Corporation |

| Segments Covered | By Application, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Segment Analysis Preview

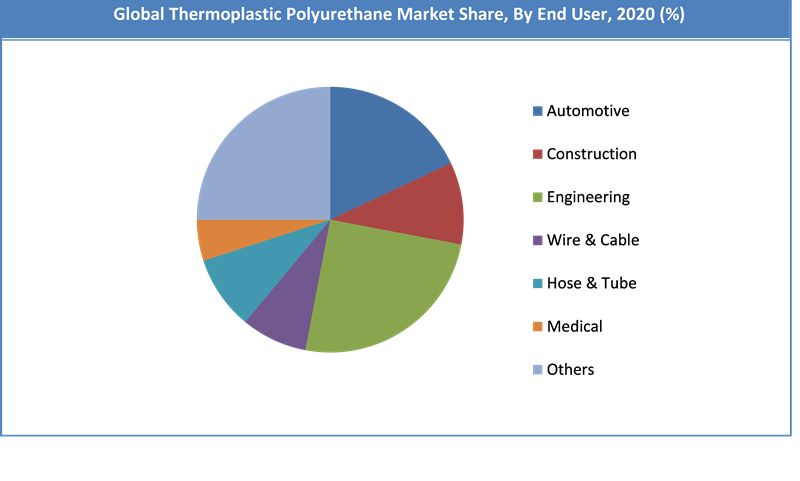

Based on applications, the global thermoplastic polyurethane market is segmented into injection molding, extrusion, adhesives & sealants, and paints & coatings. The end-user segments included in this report are automotive, construction, engineering, footwear, hose & tube, medical and wire & cable. The footwear segment was the largest consumer of TPU in 2019, whereas, the automotive industry is projected to be the fastest-growing end-use industry during the forecast period.

The global thermoplastic polyurethane market can be segmented based on their applications and end-users. Based on their applications, they are segmented into injection molding, extrusion, adhesives & sealants, and paints & coatings. The extrusion segment dominated the market in 2016 and is expected to witness significant growth within the forecast period. Injection molding and sealants & adhesives accounted for the second and third highest share respectively of the global thermoplastic polyurethanes market in 2016.

On the basis of end-users, the global thermoplastic polyurethanes market is further segmented into automotive, construction, engineering, footwear, hose & tube, medical and wire & cable. The automotive segment accounted for the largest market share among the end-users in 2016 and is expected to witness significant growth owing to the development and growth of the automotive industry across the globe. Key market players in the industry have been investing in research & development to explore more applications of thermoplastic polyurethanes. Footwear segment is also expected to grow at a significant pace owing to the adoption of TPU’s in footwear by the leading market players. For example, Adidas has begun to use thermoplastic polyurethanes in their “boost” range of products in order to improve comfort and durability. The medical end-user segment is also expected to witness significant growth within the forecast period owing to the replacement of PVC with TPU.

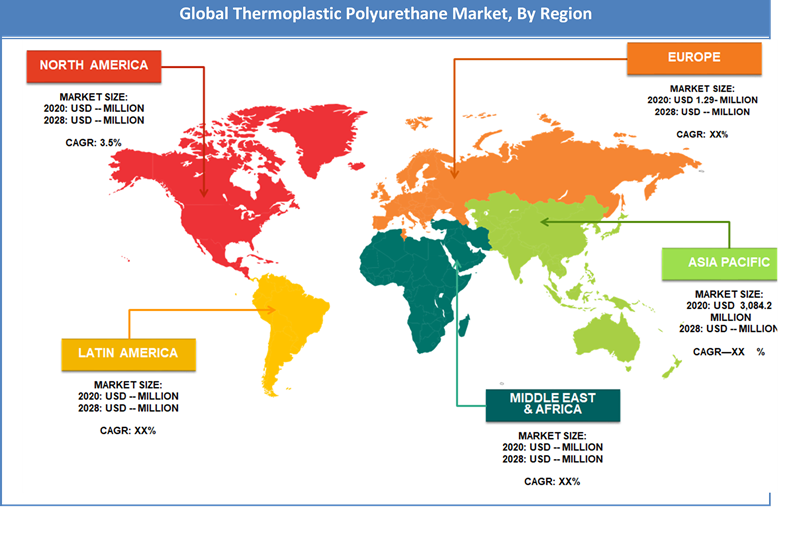

Asia Pacific accounted for most of the global market share and is expected to grow in light of rising demand from the emerging economies in the region. The cost effectiveness factor also plays a major role in global key players setting up their facilities in this region. Europe accounted for the second largest share of the global thermoplastic polyurethanes market and is expected to grow in light of demand from the automotive sector in the region.

Regional Analysis Preview

Regionally, Asia Pacific has been leading the worldwide thermoplastic polyurethane market and is anticipated to continue on the dominant position within the years to return. Increase demand for the merchandise from the developing countries within the region and the flourishing automotive sector is that the main factor behind the dominance of the Asia Pacific thermoplastic polyurethane market. The high number of market players being headquartered in the Asia Pacific is another significant factor that's supporting the expansion of this regional thermoplastic polyurethane market.

Key Market Players& Competitive Landscape

Key players profiled in the report include -

- API Plastics

- BASF SE

- Bayer Material Science Ag

- COIM

- Headway Polyurethane Co. Ltd.

- Hexpol AB

- Huntsman Corporation

- Lubrizol Corporation

- Miracll Chemical Co. Ltd.

- Polyone Corporation.

The global Thermoplastic Polyurethane Market is segmented as follows:

By Application

- Injection Molding

- Extrusion

- Adhesives & Sealants

- Paints & Coatings

By End User

- Automotive

- Construction

- Engineering

- Footwear

- Hose & Tube

- Medical

- Wire & Cable

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Thermoplastic Polyurethane Market size is set to expand from $ 2.67 Billion in 2023

Thermoplastic Polyurethane Market size is set to expand from $ 2.67 Billion in 2023 to $ 5.19 Billion by 2032, CAGR of around 6.9% from 2024 to 2032.

Some of the key factors driving the global thermoplastic polyurethane market growth are environmentally friendly properties, high consumer acceptance, high tensile strength, good shock absorption, and resistance to cut, solvent, and microbial activity.

APAC is projected to register the highest growth in the global TPU market during the forecast period. The demand for TPU is high in developing economies such as China and India.

Key players profiled in the report include API Plastics, BASF SE, Bayer Material Science Ag, COIM, Headway Polyurethane Co. Ltd., Hexpol AB, Huntsman Corporation, Lubrizol Corporation, Miracll Chemical Co. Ltd. and Polyone Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed