Thermal Storage Market Trend, Share, Growth, Size Analysis and Forecast 2032

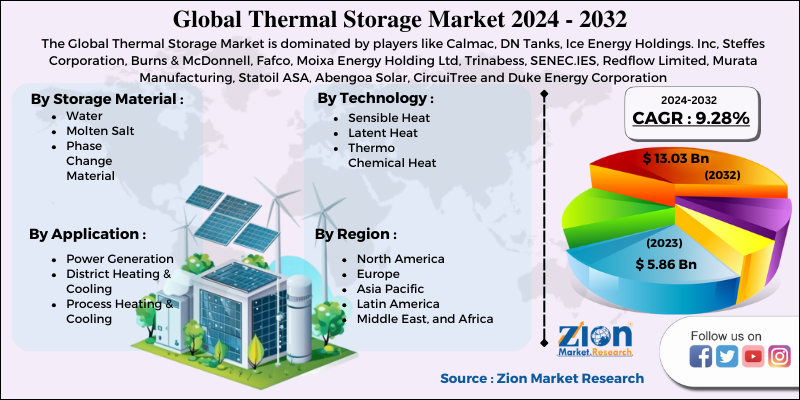

Thermal Storage Market - By Storage Material (Water, Molten Salt, And Phase Change Material), By Technology (Sensible Heat, Latent Heat, And Thermo Chemical Heat), By Applications (Power Generation, District Heating & Cooling, And Process Heating & Cooling), and By Region: Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024 - 2032

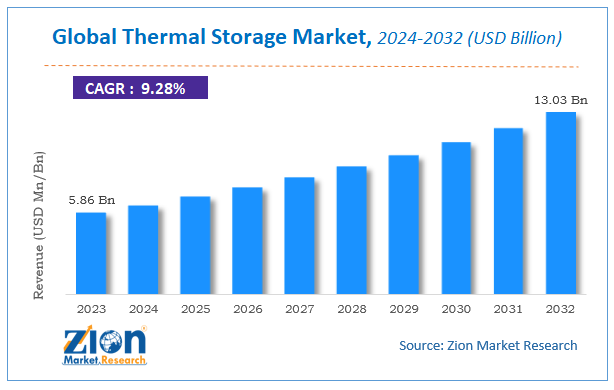

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.86 Billion | USD 13.03 Billion | 9.28% | 2023 |

Thermal Storage Market Insights

Zion Market Research has published a report on the global Thermal Storage Market, estimating its value at USD 5.86 Billion in 2023, with projections indicating that it will reach USD 13.03 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 9.28% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Thermal Storage Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Thermal Storage Market: Market Overview

Factors driving the demand for the thermal storage market are elevating demand for thermal energy storage systems in HVAC and rising acceptance of variable energy sources. The tech of thermal energy storage has been improved to a standing where it can have an interesting impact on lifestyle. The high preliminary setup price may be a limitation in the event of the thermal storage market.

The need for technical expertise and large challenges for grid interconnection are often limiting factors for the thermal storage market. The worldwide thermal storage market provides new growth avenues, owing to rising development and large requirement in concentrating solar energy within the Middle East & Africa area with high potential.

Additionally, increasing government initiatives is also one of the main boosting factors for the event of the worldwide thermal storage market. For instance, in 2018, Maryland became the primary state of the U.S. to incentivize the utilization of energy storage with tax credits, thereby boosting the worldwide thermal storage market.

Thermal Storage Market: Growth Factors

The Thermal Storage market is probably going to develop at a big pace within the near future. The development of the Thermal Storage market is elevated by the increased need for up-and-coming technologies and rapid technological advancements.

The growth of the market is backed by increasing demand for electricity during peak hours, increasing commercialization of CSP plants, and demand for heating & cooling By Applications for smart infrastructure.

Thermal Storage Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Thermal Storage Market |

| Market Size in 2023 | USD 5.86 Billion |

| Market Forecast in 2032 | USD 13.03 Billion |

| Growth Rate | CAGR of 9.28% |

| Number of Pages | 210 |

| Key Companies Covered | Calmac, DN Tanks, Ice Energy Holdings. Inc., Steffes Corporation, Burns & McDonnell, Fafco, Moixa Energy Holding Ltd, Trinabess, SENEC.IES, Redflow Limited, Murata Manufacturing, Statoil ASA, Abengoa Solar, CircuiTree and Duke Energy Corporation |

| Segments Covered | By Storage Material, By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Thermal Storage Market: Segment Analysis

The global thermal storage market is segmented by storage material, technology, application, and region.

Based on storage materials, the thermal storage market is segmented into water, molten salt, and phase change material. Molten salt technology occupied the most important revenue share of 32.4% in 2023 and is predicted to witness significant growth over the forecast period. The expansion of the segment is often attributed to its high technological efficiency, alongside its usage in several solar power projects. Molten salt is employed to store the warmth collected using solar troughs and solar towers. The warmth collected using this technology is employed to enable steam turbines by converting them to superheat steam.

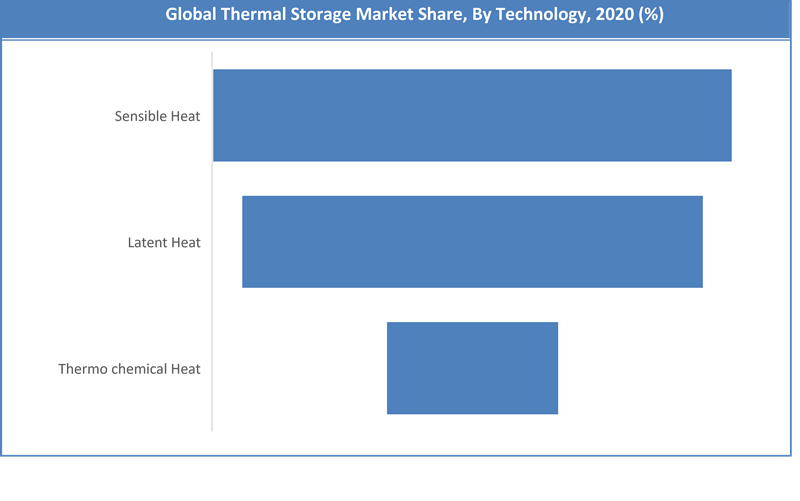

On the basis of technology, the global thermal storage market is segmented into sensible heat, latent heat, and thermal chemical heat. Sensible heat storage accounted for the most important revenue share of 43.5% in 2023. This will be attributed to the rising demand for solar thermal systems, alongside applicability across large-scale HVAC systems. The provision of a reversible charging and discharging facility for an infinite number of cycles may be a key feature of the technology that will further improve product penetration.

By Application, the global thermal storage market is divided into district heating & cooling, power generation, and process heating & cooling. The segment for district heating & cooling in the global thermal storage market is likely to add up for the biggest share among all the applications. Presently, thermal storage applications are few. District heating systems can use storage of heat production, hot water, and demand to defer air conditioning loads from peak periods.

Thermal Storage Market: Region Analysis

The MEA was the biggest and most attractive market that ruled the global thermal storage market. South Africa was the top region in the global thermal storage market. Asia Pacific region is likely to be the second top area for the thermal energy market, owing to developing nations such as China, India, South Korea, Japan, Indonesia, and Malaysia witnessing rapid growth in urbanization and population.

Thermal Storage Market: Competitive Landscape

Some of the major players involved in the global thermal storage market include:

- Calmac

- DN Tanks

- Ice Energy Holdings. Inc

- Steffes Corporation

- Burns & McDonnell

- Fafco

- Moixa Energy Holding Ltd

- Trinabess

- SENEC.IES,

- Redflow Limited

- Murata Manufacturing

- Statoil ASA

- Abengoa Solar

- CircuiTree

- Duke Energy Corporation.

The global Thermal Storage market is segmented as follows:

By Storage Material

- Water

- Molten Salt

- Phase Change Material

By Technology

- Sensible Heat

- Latent Heat

- Thermo Chemical Heat

By Application

- Power Generation

- District Heating & Cooling

- Process Heating & Cooling

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Thermal Storage market was valued at US$ 5.86 Billion in 2023.

The global Thermal Storage market is expected to reach US$ 13.03 Billion by 2032 at a CAGR of about 9.28% from 2024 to 2032.

Shifting preference towards renewable energy generation, including concentrated solar power, and rising demand for thermal energy storage (TES) systems in HVAC are among the key factors propelling the industry growth.

The Middle East and Africa has been leading the worldwide Thermal Storage market and is anticipated to continue in the dominant position in the years to come.

Some of the major players involved in the global thermal storage market include Calmac, DN Tanks, Ice Energy Holdings. Inc, Steffes Corporation, Burns & McDonnell, Fafco, Moixa Energy Holding Ltd, Trinabess, SENEC.IES, Redflow Limited, Murata Manufacturing, Statoil ASA, Abengoa Solar, CircuiTree and Duke Energy Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed