Syringe Filter Market Size, Growth, Global Trends, Forecast 2034

Syringe Filter Market By Filter Material (Nylon, Polyvinylidene Difluoride (PVDF), Polytetrafluoroethylene (PTFE), Cellulose Acetate, Nylon, and Others), By Pore Size (Microfilters and Sub-Micron Filters, and Others), By Sterility (Non-Sterile and Sterile), By Application (Biotechnology, Pharmaceuticals, Environmental Analysis, Food & Beverage, and Others), By End-User Industry (Biotechnology Companies, Research Institutions, Laboratories, Pharmaceutical Companies, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

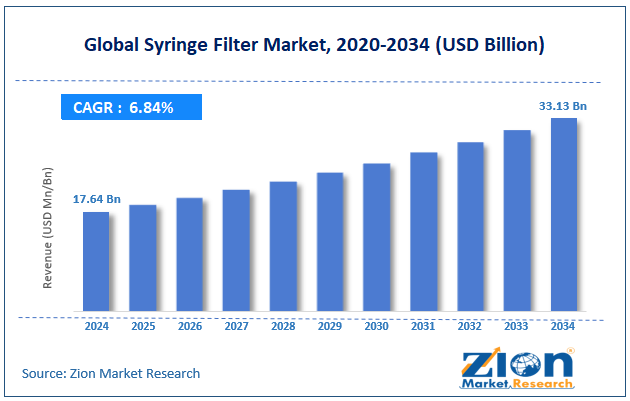

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.64 Billion | USD 33.13 Billion | 6.84% | 2024 |

Syringe Filter Industry Perspective:

What will be the size of the global syringe filter market during the forecast period?

The global syringe filter market size was worth around USD 17.64 billion in 2024 and is predicted to grow to around USD 33.13 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.84% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global syringe filter market is estimated to grow annually at a CAGR of around 6.84% over the forecast period (2025-2034)

- In terms of revenue, the global syringe filter market size was valued at around USD 17.64 billion in 2024 and is projected to reach USD 33.13 billion by 2034.

- The syringe filter market is projected to grow at a significant rate due to the rising demand in drug development.

- Based on the filter material, the polytetrafluoroethylene (PTFE) segment is growing at a high rate and will continue to dominate the global market, as per industry projections

- Based on sterility, the sterile segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Syringe Filter Market: Overview

Syringe filters are devices used in healthcare and clinical settings to remove contaminants, such as bacteria, from gases and liquids. Syringe filters are attached to the top of the syringe and are essential tools for sample filtration, preparation, and sterilization. According to industry analysis, syringe filters provide a rapid method for removing impurities from samples prior to analysis. The type of contaminant removed depends on the pore size of the filters. During the forecast period, demand for syringe filters is projected to continue growing, driven by multiple factors. For instance, increased application of the filters in the pharmaceutical industry will fuel the market demand in the coming years.

Additionally, the presence of strict quality standards governing the biotechnology and pharmaceutical sector may further aid industry expansion. One of the critical challenges that the market players are expected to face includes slow filtration rate and clogging. Moreover, increasing competition faced by syringe filters may limit industry expansion trends in the coming years.

Syringe Filter Market: Dynamics

Growth Drivers

How will increased demand for drug development procedures affect the growth rate of the syringe filter market?

The global syringe filter market is expected to grow due to the rising demand in drug development. Syringe filters are one of the most widely used medical tools in a drug research & development (R&D) facility. They are used for sterile sample preparation for further analysis. Additionally, they are used for purifying other essential solutions in laboratories. Syringe filters with a pore size of 0.2 microns are used for removing bacteria, whereas filters with a 0.45 microns pore size are applied for removing particulate matter. The ongoing advancements reported in pharmaceutical and biotechnology companies will work in favor of driving sales for syringe filters.

Some of the key innovations reported in the biotechnology sector include work on gene therapy & editing, precision medicine, biologics, and messenger ribonucleic acid (mRNA) technology, among others. The growing number of patients and rising pressure on the existing healthcare infrastructure will propel increased investment in drug development, subsequently fueling applications of syringe filters.

Strict quality requirements in the pharma sector to deliver improved revenue for the industry players

The pharmaceutical and biotech industries are heavily regulated by federal laws. They have to adhere to strict international and regional quality standards. One of the primary aspects of quality assurance parameters is maintaining sterility of the facility and ensuring the use of contamination-free processes. For instance, in December 2025, the U.S. Food and Drug Administration (FDA) issued a Warning Letter after inspecting an Active Pharmaceutical Ingredient (API) manufacturing facility in India. The agency has identified repeated failure in the accurate handling of Out-of-Specification (OOS) results. The rising number of pharmaceutical and biotechnology companies failing to meet safety standards has further intensified regulatory measures, thereby increasing demand for syringe filters in the global syringe filter market.

Restraints

How will the technical limitations of the filters affect revenue in the syringe filter market?

The global syringe filter industry is projected to be restricted due to the performance limitations of filters. For instance, reports have emerged raising concerns about frequent filter clogging. In addition, most syringe filters have slow filtration rates, which can be due to high sample viscosity and small pore size. Furthermore, syringe filters are prone to rupturing in case of application of high pressure. These performance barriers are expected to work against industry expansion trends in the future.

Opportunities

Sustained innovation is reported in the industry to offer growth opportunities to the industry players

The global syringe filter market is projected to generate growth opportunities due to sustained innovation reported in the industry. These advancements are linked to improved membrane materials for extended applications & performance and product development specific to final applications. In November 2024, GenFollower, a China-based laboratory consumables and equipment manufacturer, announced the launch of a new range of syringe filters for applications in promising medical device filtration, High-Performance Liquid Chromatography (HPLC) analysis, lab filtration, sample preparation, and environmental testing. The filters are available in 0.25 μm and 0.44 μm diameters and are made of Polyethersulfone (PES) microporous membrane.

In May 2025, Sterlitechm Corporation announced the expansion of its syringe filter portfolio by introducing new brand options. The company has launched Steripure Polytetrafluoroethylene (PTFE) syringe filters, Steripure nylon syringe filters, iPure Cellulose Acetate (CA) syringe filters, and LabExact nylon syringe filters, among others. The expansion will help the company meet evolving global demand for laboratory consumables.

Challenges

How will excessive competition challenge the expansion of the syringe filter market?

The global syringe filter industry is expected to be challenged by the excessive competition faced by the market players. Industry leaders face competition from brands in the same product category and from alternative solutions. For instance, spin or centrifugal filters, pressure-driven filtration systems, and large-scale filtration devices are some of the prominent competitors to syringe filters, limiting industry expansion trends.

Syringe Filter Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Syringe Filter Market |

| Market Size in 2024 | USD 17.64 Billion |

| Market Forecast in 2034 | USD 33.13 Billion |

| Growth Rate | CAGR of 6.84% |

| Number of Pages | 219 |

| Key Companies Covered | GE Healthcare, Merck Millipore, Thermo Fisher Scientific, Macherey-Nagel, Foxx Life Sciences, Ahlstrom, Pall Corporation, VWR International, Sartorius, Cole-Parmer, Membrane Solutions, Cytiva (Whatman), Sterlitech, Advantec, Restek, and others. |

| Segments Covered | By Filter Material, By Pore Size, By Sterility, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Syringe Filter Market: Segmentation

The global syringe filter market is segmented based on filter material, pore size, sterility, application, end-user industry, and region.

Why will the polytetrafluoroethylene (PTFE) segment dominate the syringe filter market?

Based on filter material, the global market segments are nylon, polyvinylidene difluoride (PVDF), polytetrafluoroethylene (PTFE), cellulose acetate, and others. In 2024, the highest demand was recorded in the polytetrafluoroethylene (PTFE) segment, attributable to the material's broader use in filtering various solutions. Additionally, ongoing advancements toward enhancing PTFE performance may further help the segment thrive in the coming years.

Based on pore size, the global syringe filter industry is divided into microfilters, sub-micron filters, and others.

What position will the sterile segment hold in the syringe filter industry

Based on sterility, the global market divisions are non-sterile and sterile. In 2024, the highest growth was listed in the sterile segment due to wider demand for a contamination-free environment across prominent applications such as biotechnology workflows and pharmaceutical manufacturing. The segment contributed to nearly 55% of the total revenue in 2024, and similar trends are expected in the future.

Based on application, the global market is fragmented into biotechnology, pharmaceuticals, environmental analysis, food & beverage, and others.

Why will pharmaceutical companies be the highest revenue generators in the syringe filter market?

Based on the end-user industry, the global market is divided into biotechnology companies, research institutions, laboratories, pharmaceutical companies, and others. The highest revenue-generating segment in 2024 was pharmaceutical companies. The rising development of novel vaccines and surging advancements in biotechnology will help accelerate segmental revenue in the future.

Syringe Filter Market: Regional Analysis

Why will North America lead the syringe filter market during the projection period?

The global syringe filter market is expected to be led by North America during the projection period. It is anticipated to grow at a CAGR of nearly 6.01% over the coming years, led by the presence of a robust and thriving pharmaceutical industry. According to official data, the US biotechnology sector received more than USD 25.9 billion in venture capital in 2024. Additionally, the presence of structural quality standards governing the regional biotechnology industry and pharmaceutical sector will help fuel higher growth in North America.

Why is Asia Pacific expected to emerge as the fastest-growing region in the syringe filter industry?

The Asia-Pacific region is expected to be the fastest-growing region in the syringe filter market, with a CAGR exceeding 8.01% over the projection period. The rising production of syringe filters in countries such as China and India will facilitate improved revenue in the region.

Additionally, growing pressure on the healthcare sector as patient volumes continue to rise will further drive demand for syringe filters in research laboratories and drug development facilities. The Asia-Pacific region has emerged as a prominent destination for international pharmaceutical companies to outsource drug manufacturing, including API production and formulation, thereby generating higher revenue.

Syringe Filter Market: Competitive Analysis

The global syringe filter market is led by players like:

- GE Healthcare

- Merck Millipore

- Thermo Fisher Scientific

- Macherey-Nagel

- Foxx Life Sciences

- Ahlstrom

- Pall Corporation

- VWR International

- Sartorius

- Cole-Parmer

- Membrane Solutions

- Cytiva (Whatman)

- Sterlitech

- Advantec

- Restek

Syringe Filter Market: Key Market Trends

Concerns over single-use plastic

Growing concerns about the significant environmental impact of single-use plastic may affect the expansion of plastic-based syringe filters. This, in turn, may drive demand for more sustainable syringe filters made using biodegradable or environmentally friendly materials.

Industrial applications

The rising demand for syringe filters for applications in industrial facilities is a promising trend reported in the market. It includes the use of the filtration membranes in the food & beverages industry and chemical production facilities.

The global syringe filter market is segmented as follows:

By Filter Material

- Nylon

- Polyvinylidene Difluoride (PVDF)

- Polytetrafluoroethylene (PTFE)

- Cellulose Acetate

- Nylon

- Others

By Pore Size

- Microfilters

- Sub-Micron Filters

- Others

By Sterility

- Non-Sterile

- Sterile

By Application

- Biotechnology

- Pharmaceuticals

- Environmental Analysis

- Food & Beverage

- Others

By End-User Industry

- Biotechnology Companies

- Research Institutions

- Laboratories

- Pharmaceutical Companies

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed