Substation Automation and Integration Market Size, Share, Trends, Growth and Forecast 2032

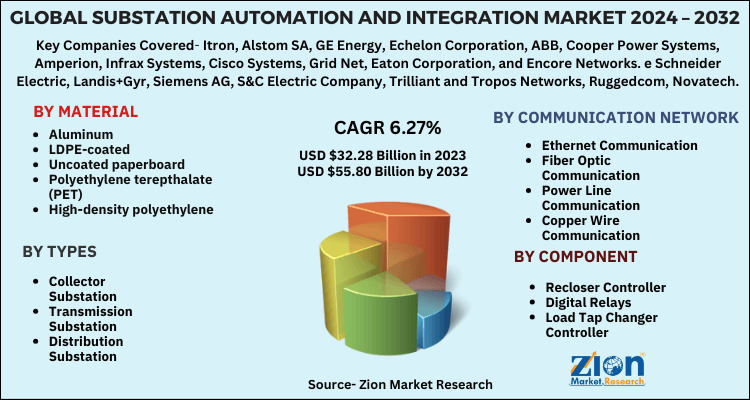

Substation Automation and Integration Market: By Substation Types (Collector Substation, Transmission Substation, And Distribution Substation), By Component (Recloser Controller, Digital Relays, Load Tap Changer Controller, Programmable Logical Controllers, Capacitor Bank Controller, And Smart Meters/Digital Transducers), By Communication Network (Ethernet Communication, Fiber Optic Communication, Power Line Communication (PLC), And Copper Wire Communication), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

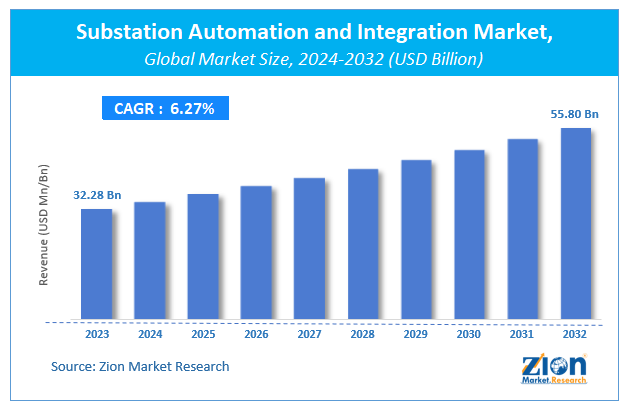

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 32.28 Billion | USD 55.80 Billion | 6.27% | 2023 |

Substation Automation and Integration Market Insights

According to a report from Zion Market Research, the global Substation Automation and Integration Market was valued at USD 32.28 Billion in 2023 and is projected to hit USD 55.80 Billion by 2032, with a compound annual growth rate (CAGR) of 6.27% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Substation Automation and Integration industry over the next decade.

Global Substation Automation and Integration Market: Overview

Substation automation has transformed the way utility management networks. It acts as a strong base for many important functions of the utilities. Currently, distribution and transmission utilities are targeting full substation automation of the partially automated or retrofit substations, which already exist. Substation automation is monitored by the automation components such as voltage controls, digital transducers, digital protection relays, recloser controls, logical programmable controllers, RTUs, and capacitor bank controls.

Global Substation Automation and Integration Market: Growth Factors

Major drivers of the global substation automation and integration markets are the old power industries and the growing influence of the smart grid infrastructure. This enables the multifunctional solution to meet advanced communication protocols. Another growth factor of the global market is intelligent electronic devices (IEDs), which are anticipated to boost the global substation automation and integration market in the future. It provides smooth control functions and monitoring across the substation.

Communication networks manage data and substation devices that fuel global market growth. Advancements in the technologies further enhance the global substation automation and integration market growth. Other factors responsible for the growth of the market include the reduction in transmission and distribution loss and cost savings.

Reliability and grid efficiency associated with substation automation and integration may fuel the global substation automation and integration market in the next few years. However, huge capital investments and the regulation issue may hinder global market growth in future

Global Substation Automation and Integration Market: Segmentation

The global substation automation and integration market are classified based on substation types, component, communication network, and geography.

The substation types are bifurcated as collector substations, transmission substations, and distribution substations.

The collector substation is where the power is collected from other sources such as wind farms.

The components segment is divided into recloser controllers, digital relays, load tap changer controllers, programmable logical controllers, capacitor bank controllers, and smart meters/digital transducers.

The communication network is categorized as ethernet communication, fiber optic communication, power line communication (PLC), and copper wire communication.

Region-wise, the global market is segregated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Substation Automation and Integration Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Substation Automation and Integration Market |

| Market Size in 2023 | USD 32.28 Billion |

| Market Forecast in 2032 | USD 55.80 Billion |

| Growth Rate | CAGR of 6.27% |

| Number of Pages | 110 |

| Key Companies Covered | Itron, Alstom SA, GE Energy, Echelon Corporation, ABB, Cooper Power Systems, Amperion, Infrax Systems, Cisco Systems, Grid Net, Eaton Corporation, and Encore Networks. Other key players influencing the global market include Schneider Electric, Landis+Gyr, Siemens AG, S&C Electric Company, Trilliant and Tropos Networks, Ruggedcom, Novatech, and Schweitzer Engineering Laboratories |

| Segments Covered | By Substation Types, By Component, By Communication Network And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Substation Automation and Integration Market: Regional Analysis

Based on the region, the global Substation Automation and Integration market can be divided into five main regions: Latin America, North America, Europe, Asia Pacific, and the Middle East and Africa. North America holds the largest market share in the global market and accounted for the largest share owing to the emergence of advanced technologies in the global substation automation and integration market. Asia-Pacific is the second largest market in the global market and is expected to grow at a higher rate in the future.

Global Substation Automation and Integration Market: Competitive Players

Some main participants of the Substation Automation and Integration market are-

- Itron

- Alstom SA

- GE Energy

- Echelon Corporation

- ABB

- Cooper Power Systems

- Amperion

- Infrax Systems

- Cisco Systems

- Grid Net

- Eaton Corporation

- Encore Networks.

- Schneider Electric

- Landis+Gyr

- Siemens AG

- S&C Electric Company

- Trilliant and Tropos Networks

- Ruggedcom

- Novatech

- Schweitzer Engineering Laboratories.

Substation Automation and Integration Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Major drivers of the global substation automation and integration market are the old power industries and growing influence of the smart grid infrastructure. This enables the multifunctional solution to meet with advanced communication protocols. Another growth factor of the global market is intelligent electronic devices (IEDs), which is anticipated to boost the global substation automation and integration market in future. It provides smooth control functions and monitoring across the substation.

global Substation Automation and Integration Market was valued at USD 32.28 Billion in 2023 and is projected to hit USD 55.80 Billion by 2032, with a compound annual growth rate (CAGR) of 6.27% during the forecast period 2024-2032.

North America holds the largest market share in the global market and accounted for largest share owing to the emergence of advanced technologies in the global substation automation and integration market.

Some main participants of the Substation Automation and Integration market are Itron, Alstom SA, GE Energy, Echelon Corporation, ABB, Cooper Power Systems, Amperion, Infrax Systems, Cisco Systems, Grid Net, Eaton Corporation, and Encore Networks. Other key players influencing the global market include Schneider Electric, Landis+Gyr, Siemens AG, S&C Electric Company, Trilliant and Tropos Networks, Ruggedcom, Novatech, and Schweitzer Engineering Laboratories, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed