Global Styrene Block Copolymers Market Size, Share, Growth Analysis Report - Forecast 2034

Styrene Block Copolymers Market By Product (Hydrogenated Styrenic Block Copolymers (HSBC), Styrene-butadiene-styrene (SBS), Styrene-isoprene-styrene (SIS)), By Application (Hydrogenated Styrenic Block Copolymers (HSBC) (Cable & Wire, Footwear, Asphalt Modifier, Adhesives, Artificial Leather), Styrene-butadiene-styrene (SBS) (Footwear, Asphalt Modification, Polymer Modification, Adhesives, Others), Styrene-isoprene-styrene (S), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.83 Billion | USD 12.02 Billion | 5.4% | 2024 |

Global Styrene Block Copolymers Market: Industry Perspective

The global styrene block copolymers market size was worth around USD 6.83 Billion in 2024 and is predicted to grow to around USD 12.02 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.4% between 2025 and 2034. The report analyzes the global styrene block copolymers market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the styrene block copolymers industry.

Global Styrene Block Copolymers Market: Overview

Styrene block copolymers (SBCs) fall in the category of thermoplastic elastomers (TPE). It means that they are a type of copolymer containing a physical mix of polymers exhibiting both elastomeric and thermoplastic properties. Styrene block copolymers are the largest-volume category of TPE and annual consumption reaches as high as 1200 metric tons. Owing to their thermoplastic elastomeric properties, they showcase the same mechanical properties as rubber and still possess superior-grade attributes of thermoplastics. The most common types of SBCs include Styrene-Ethylene-Propylene-Styrene (SEPS), Styrene-Butadiene-Styrene (SBS), Styrene-Ethylene-Butylene-Styrene (SEBS), and Styrene-Isoprene-Styrene (SIS) with each type showcasing specific applications and advantages. There is a growing demand and consumption of SBCs in the commercial market as the copolymer is extremely versatile in terms of performance and can be used for multiple applications.

Global Styrene Block Copolymers Market: Growth Drivers

Increasing application in the construction industry to drive market expansion

The global styrene block copolymers market is projected to grow owing to the increasing application of SBCs in the construction industry. These copolymers are considered ideal for use in coating, sealant, and adhesive industries due to their mechanical and physical properties. Over the years of extensive SBC application, it has been proven that derived styrene block copolymers can adhere to a wide range of surfaces and hence they have been used to produce high-quality sealants, tapes, and labels. With the increase in demand for housing units as the world population continues to rise along with surging urbanization-related projects, the construction industry has grown tremendously in the last few years.

Additionally, there are several ongoing infrastructure development projects further pushing the consumption of all products in the construction & building sector. In May 2024, it was reported that the Government of India (GoI) was planning to invest in 8 new cities to reduce the problems of rising pollution and pressure on the existing cities. Similarly, Saudi Arabia has been working on a USD 500 billion project called Neom through which it intends to build a 170-kilometer-long skyscraper. Such construction trends are visible across the globe as every nation tries to emerge as a developed country with excellent infrastructure. Styrene block copolymers will be consumed at higher levels since it is already one of the most popular TPEs for multiple end-users.

Restraints:

Changing prices of raw materials to restrict market expansion

The raw materials required to produce SBCs are subject to constant price changes. This includes polymers butadiene and styrene in specific as they are derived using natural gas and crude oil that are petrochemical feedstocks. The cost of these materials is highly sensitive to external factors including the existing state of the international trade market, geopolitical relationships, the economic conditions of the trading partners, and oil production. For instance, the ongoing war between Russia and Ukraine has resulted in a serious price hike of crude oil thus impacting the production rate of SBCs. Such rapid changes can impact the operations of small businesses which affects the overall supply chain of SBCs.

Opportunities:

Growing demand for high-performance SBCs to create growth opportunities

The styrene block copolymers industry’s end-consumers have been demanding high-performance SBCs that can withstand even higher external conditions such as temperature and mechanical stress resulting in higher investments in the production of SBCs. In April 2023, Hainan Baling Chemical New Material Co., Ltd., a subsidiary of China Petroleum & Chemical Corp. announced the addition of SBC production at its facility with an annual production capacity of 170,000 tons. The move will allow Sinopec to be called the largest producer of SBC plants with a total investment of USD 279 million. Apart from the increase in overall output, several research projects are funded globally to develop new and efficient SBC synthesis processes, further pushing the styrene block copolymers market toward higher revenue.

Rising demand for reducing pollution from the chemical industry to provide greater opportunities

Styrene block copolymers are considered environmentally friendly TPE since the production of the chemical leads to less wastage and the high durability of the products derived from it. In many cases, they are considered as the exact replacement to natural rubber which can be a severely environmentally-polluting agent. As the chemical industry is under pressure to reduce environmental pollution and carbon footprint, SBCs could provide the chemical industry players with the answer to the problem.

Challenges:

High initial production cost to create challenging situations

The initial cost of producing styrene block polymers is exceptionally high. Specialized equipment is required to produce SBCs including large production facilities. This attribute makes the entry of new players difficult as the final profitability is also extremely sensitive to the changing world order. In addition to this, SBCs are not perfect in all aspects as there are certain associated performance limitations. This includes limited resistance to heat and a slight risk of flammability further raising questions over return on investment.

Key Insights

- As per the analysis shared by our research analyst, the global styrene block copolymers market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2025-2034).

- Regarding revenue, the global styrene block copolymers market size was valued at around USD 6.83 Billion in 2024 and is projected to reach USD 12.02 Billion by 2034.

- The styrene block copolymers market is projected to grow at a significant rate due to growing demand for lightweight, flexible materials in automotive, footwear, adhesives, and medical device industries.

- Based on Product, the Hydrogenated Styrenic Block Copolymers (HSBC) segment is expected to lead the global market.

- On the basis of Application, the Hydrogenated Styrenic Block Copolymers (HSBC) (Cable & Wire segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Global Styrene Block Copolymers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Styrene Block Copolymers Market |

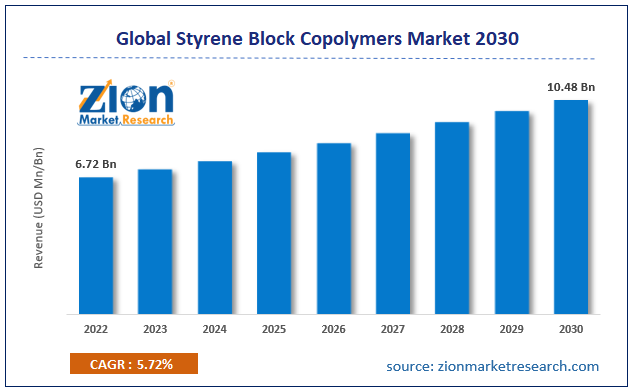

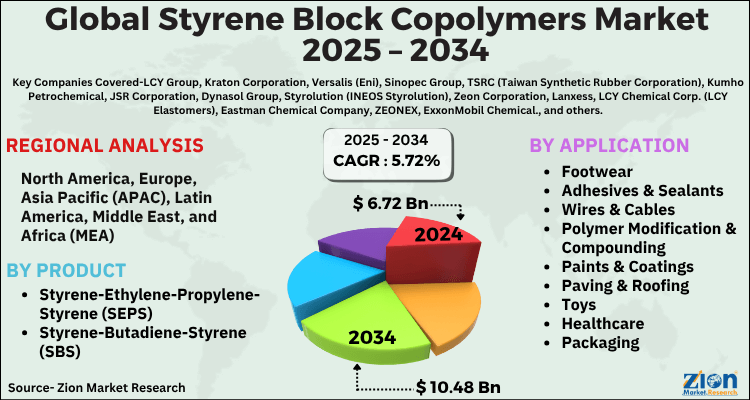

| Market Size in 2022 | USD 6.72 Billion |

| Market Forecast in 2030 | USD 10.48 Billion |

| Growth Rate | CAGR of 5.72% |

| Number of Pages | 220 |

| Key Companies Covered | LCY Group, Kraton Corporation, Versalis (Eni), Sinopec Group, TSRC (Taiwan Synthetic Rubber Corporation), Kumho Petrochemical, JSR Corporation, Dynasol Group, Styrolution (INEOS Styrolution), Zeon Corporation, Lanxess, LCY Chemical Corp. (LCY Elastomers), Eastman Chemical Company, ZEONEX, ExxonMobil Chemical., and others. |

| Segments Covered | By Application, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Styrene Block Copolymers Market: Segmentation

The global styrene block copolymers market is segmented based on application, production, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on application, the global market segments are footwear, adhesives & sealants, wires & cables, polymer modification & compounding, paints & coatings, paving & roofing, toys, healthcare, packaging, and others. In 2024, the highest growth rate was observed in the adhesives & sealants segment which controlled over 21.1% of the market revenue. SBC-derived adhesives have been used extensively for the production of baby hygiene products such as diapers. Since they are lightweight and yet effective in terms of performance, their application in diaper production has increased with time. Additionally, they are also used in the process of pavement construction since SBC use allows a reduction in evaporation of Volatile Organic Compounds (VOCs). Rising application in the growing infrastructure development projects is likely to push segmental growth.

Based on product, the styrene block copolymers industry is divided into Styrene-Ethylene-Propylene-Styrene (SEPS), Styrene-Butadiene-Styrene (SBS), Styrene-Ethylene-Butylene-Styrene (SEBS), and Styrene-Isoprene-Styrene (SIS). In 2024, SBS was the leading segment with total accountability for over 34.01% of the market share due to the extensive use of the variants in several applications. For instance, SBS is highly effective in asphalt modification which is an essential activity in road construction. Moreover, SBS is one of the main content of several adhesives and sealants brands. It is also used in consumer goods such as food wear and other everyday items driving the segmental growth.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Styrene Block Copolymers Market: Regional Analysis

The Styrene Block Copolymers (SBC) market shows diverse regional dynamics, with Asia-Pacific leading due to strong demand in footwear, adhesives, and packaging applications, fueled by rapid industrialization and a robust manufacturing base in countries like China and India. North America and Europe follow closely, driven by high consumption in automotive parts, consumer goods, and advanced medical applications, alongside a focus on sustainable and lightweight materials. Meanwhile, Latin America, the Middle East, and Africa are witnessing steady growth as infrastructure development and consumer industries expand, though market penetration remains comparatively lower. Overall, regional demand is shaped by industrial development, regulatory environments, and evolving end-use applications across diverse sectors.

Global Styrene Block Copolymers Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the styrene block copolymers market on a global and regional basis.

The global styrene block copolymers market is dominated by players like:

- LCY Group

- Kraton Corporation

- Versalis (Eni)

- Sinopec Group

- TSRC (Taiwan Synthetic Rubber Corporation)

- Kumho Petrochemical

- JSR Corporation

- Dynasol Group

- Styrolution (INEOS Styrolution)

- Zeon Corporation

- Lanxess

- LCY Chemical Corp. (LCY Elastomers)

- Eastman Chemical Company

- ZEONEX

- ExxonMobil Chemical.

- Others.

Styrene Block Copolymers Market: Segmentation Analysis

The global styrene block copolymers market is segmented as follows;

By Application

- Footwear

- Adhesives & Sealants

- Wires & Cables

- Polymer Modification & Compounding

- Paints & Coatings

- Paving & Roofing

- Toys

- Healthcare

- Packaging

- Others

By Product

- Styrene-Ethylene-Propylene-Styrene (SEPS)

- Styrene-Butadiene-Styrene (SBS)

- Styrene-Ethylene-Butylene-Styrene (SEBS)

- Styrene-Isoprene-Styrene (SIS)

Styrene Block Copolymers Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Styrene block copolymers (SBCs) fall in the category of thermoplastic elastomers (TPE). It means that they are a type of copolymer containing a physical mix of polymers exhibiting both elastomeric and thermoplastic properties. Styrene block copolymers are the largest-volume category of TPE and annual consumption reaches as high as 1200 metric tons. Owing to their thermoplastic elastomeric properties, they showcase the same mechanical properties as rubber and still possess superior-grade attributes of thermoplastics.

The global styrene block copolymers market is expected to grow due to growing demand for lightweight, flexible materials in automotive, footwear, adhesives, and medical device industries.

According to a study, the global styrene block copolymers market size was worth around USD 6.83 Billion in 2024 and is expected to reach USD 12.02 Billion by 2034.

The global styrene block copolymers market is expected to grow at a CAGR of 5.4% during the forecast period.

Asia-Pacific is expected to dominate the styrene block copolymers market over the forecast period.

Leading players in the global styrene block copolymers market include LCY Group, Kraton Corporation, Versalis (Eni), Sinopec Group, TSRC (Taiwan Synthetic Rubber Corporation), Kumho Petrochemical, JSR Corporation, Dynasol Group, Styrolution (INEOS Styrolution), Zeon Corporation, Lanxess, LCY Chemical Corp. (LCY Elastomers), Eastman Chemical Company, ZEONEX, ExxonMobil Chemical., and others., among others.

The report explores crucial aspects of the styrene block copolymers market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed