Storage Area Network (SAN) Market Size, Share, Trends, Growth & Forecast 2034

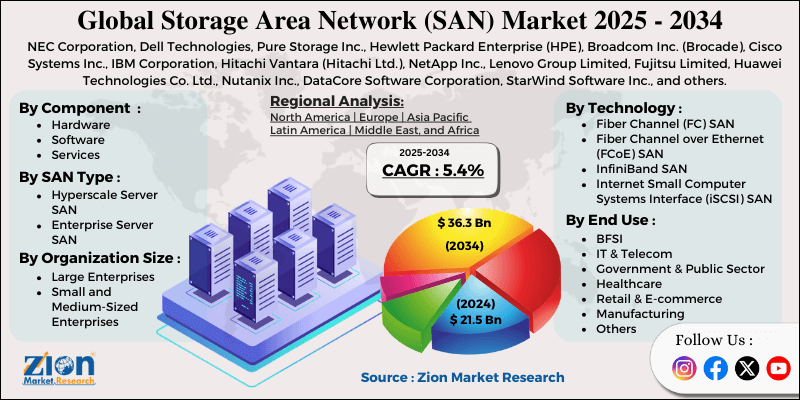

Storage Area Network (SAN) Market By Component (Hardware, Software, and Services), By SAN Type (Hyperscale Server SAN and Enterprise Server SAN), By Technology (Fiber Channel (FC) SAN, Fiber Channel over Ethernet (FCoE) SAN, InfiniBand SAN, and Internet Small Computer Systems Interface (iSCSI) SAN), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), By End-Use (BFSI, IT & Telecom, Government & Public Sector, Healthcare, Retail & E-commerce, Manufacturing, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

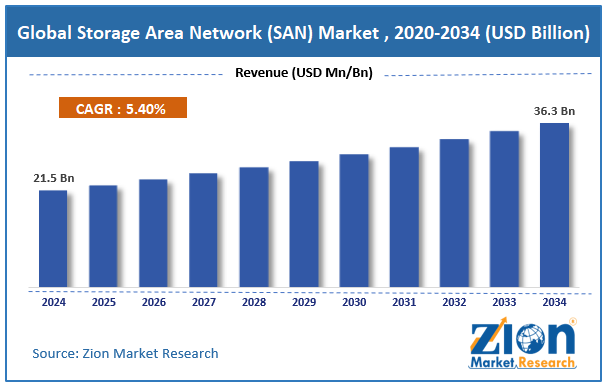

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.5 Billion | USD 36.3 Billion | 5.4% | 2024 |

Storage Area Network (SAN) Industry Perspective:

The global storage area network (SAN) market size was worth around USD 21.5 billion in 2024 and is predicted to grow to around USD 36.3 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.4% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global Storage Area Network (SAN) market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2025-2034).

- In terms of revenue, the global Storage Area Network (SAN) market size was valued at around USD 21.5 billion in 2024 and is projected to reach USD 36.3 billion by 2034.

- The rapid growth in data volumes and workloads is expected to drive the Storage Area Network (SAN) market over the forecast period.

- Based on the component, the hardware segment is expected to hold the largest market share over the forecast period.

- Based on the SAN type, the Enterprise Server SAN segment is expected to dominate the market over the projected period.

- Based on the technology, the Fiber Channel (FC) SAN segment is expected to dominate the market over the projected period.

- Based on the organization size, the large enterprises segment is expected to dominate the market over the projected period.

- Based on the end-use, the BFSI segment is expected to dominate the market over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Storage Area Network (SAN) Market: Overview

A Storage Area Network (SAN) is a high-speed network that connects storage devices. SANs are often made up of hosts, switches, storage elements, and storage devices that are linked together utilizing a range of technologies, topologies, and protocols. SANs can span numerous locations. A SAN provides storage devices to a host in a manner that makes them appear to be locally attached. This streamlined storage presentation to a host is performed via several methods of virtualization. SANs are critical to an organization's Business Continuity Management (BCM) efforts. SANs are usually built on switched fabric technology.

Examples include Fiber Channel (FC), Ethernet, and InfiniBand. Gateways can be used to transfer data across various SAN technologies. The Storage Area Network (SAN) market is being driven by the rapid growth in data volume & workloads, the need for higher performance (Flash, NVMe, Low Latency Networks), digital transformation, IoT, edge computing, and demand from enterprises, data centers & hyperscalers. However, the high initial capital & operating costs pose a major challenge to the industry expansion.

Storage Area Network (SAN) Market: Growth Drivers

Why does the growing digitalization and data rise among organizations drive the storage area network market growth?

The storage area network (SAN) sector is rising swiftly because businesses all over the world are generating more and more data. Businesses across various industries have to deal with more data than ever before because of the emergence of new technologies like IoT, AI, and big data analytics, as well as the rise of digital devices and internet traffic. It requires a robust storage system that can process, store, and retrieve massive amounts of data in real-time, given the sheer volume of it. SAN systems make it easy for enterprises to add more storage space by providing centralized storage structures. This helps people do the most important things they need to do and attain their long-term goals. This makes sure that the data is always available, reliable, and effective.

Companies are also pushing for SAN technology because they want to change their businesses into more digital operations. To improve their IT systems, make the most of their resources, and stay competitive in the digital age, these companies require storage solutions that can grow and change as needed.

Storage Area Network (SAN) Market: Restraints

How high initial capital & operating costs hinder the storage area network market growth?

The Storage Area Network (SAN) market faces numerous challenges due to the significant costs associated with setting up and operating it. To set up a SAN, one needs to buy an array of specialized hardware, like storage arrays, fiber channel switches, host bus adapters, and SAN administration software. These hardware parts can be very expensive, which makes the initial capital expenditure (CapEx) a significant obstacle to adoption, especially for small and medium-sized enterprises (SMEs) that lack sufficient funds.

Also, setting up SAN infrastructure requires trained staff who know how to manage storage and set up networks. This raises the initial price because people with that kind of knowledge get paid more or charge more for their services. After the initial setup, SAN systems have ongoing expenditures like maintenance, upgrades, license fees, and hiring people to keep an eye on them all the time. Qualified personnel must constantly monitor performance, fix bugs, and optimize systems in order to manage SAN settings. This raises operating expenses, which poses a major restraining factor for market growth.

Storage Area Network (SAN) Market: Opportunities

How does the growing product launch offer a potential opportunity for the storage area network industry growth?

The growing number of product launches is expected to offer a lucrative opportunity for the Storage Area Network (SAN) market. For instance, in February 2025, NetApp®, the intelligent data infrastructure business, announced enhancements to its enterprise storage portfolio, expanding the NetApp ASA A-Series with additional systems geared to speed and consolidate block workloads for organizations of all sizes.

Along with the release of new cyber resiliency capabilities, these solutions allow clients to build a silo-free data architecture that is both powered by and designed for intelligence. The new high-performance NetApp ASA A20, A30, and A50 systems enable enterprises of all sizes to use block storage for mission-critical applications such as databases and virtual machines. They are suited for smaller deployments, including remote or branch offices, with beginning prices as low as $25,000.

Storage Area Network (SAN) Market: Challenges

Why does the competition from alternative architectures pose a major challenge to market expansion?

The Storage Area Network (SAN) business is facing competition from a number of alternative storage designs and technologies that are emerging as viable or complementary solutions. For instance, when it comes to file-level storage, NAS solutions are simpler and less expensive than SANs. Many firms select NAS for less complex storage needs because it is easier to implement and manage.

Furthermore, HCI combines computing, storage, and networking into a unified system managed by software, frequently utilizing software-defined storage (SDS). It competes with traditional SAN systems by providing easier scaling, less hardware dependency, and frequently lower total cost of ownership. Thus, the availability of these alternative platforms presents a significant obstacle to market expansion.

Storage Area Network (SAN) Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Storage Area Network (SAN) Market |

| Market Size in 2024 | USD 21.5 Billion |

| Market Forecast in 2034 | USD 36.3 Billion |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 212 |

| Key Companies Covered | NEC Corporation, Dell Technologies, Pure Storage Inc., Hewlett Packard Enterprise (HPE), Broadcom Inc. (Brocade), Cisco Systems Inc., IBM Corporation, Hitachi Vantara (Hitachi Ltd.), NetApp Inc., Lenovo Group Limited, Fujitsu Limited, Huawei Technologies Co. Ltd., Nutanix Inc., DataCore Software Corporation, StarWind Software Inc., and others. |

| Segments Covered | By Component, By SAN Type, By Technology, By Organization Size, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Storage Area Network (SAN) Market: Segmentation

The global Storage Area Network (SAN) industry is segmented based on component, SAN type, technology, organization size, end-use, and region.

Based on the component, the global Storage Area Network (SAN) market is bifurcated into hardware, software, and services. The hardware is expected to capture the largest market share over the projected period. The rapid growth of both structured and unstructured business data will help the hardware industry grow in the years to come. The fast pace of digital transformation, the growth of AI and ML applications, the spread of the Internet of Things (IoT), and the rise of big data analytics all create a lot of data that needs to be stored and accessed promptly. Companies need high-capacity, high-performance SAN infrastructure, including storage arrays, SAN switches, and host adapters to handle this data flow. These hardware solutions have the speed, reliability, and scalability needed for operations that are vital to the mission. As data grows, businesses are pushed to update or expand their SAN infrastructure, which keeps the demand for new hardware solutions high.

Based on the SAN type, the global Storage Area Network (SAN) industry is bifurcated into Hyperscale Server SAN and Enterprise Server SAN. The Enterprise Server SAN segment holds the major market share. Enterprise Server SAN systems are primarily aimed at large-scale companies and data centers, offering low-latency data access, high availability, and smooth scaling required for mission-critical applications. These SAN systems are widely used in industries including banking, financial services, and insurance (BFSI), healthcare, telecommunications, and information technology (IT) for data redundancy, storage optimization, and business continuity. Thus, driving the segment expansion.

Based on the technology, the global Storage Area Network (SAN) market is bifurcated into Fiber Channel (FC) SAN, Fiber Channel over Ethernet (FCoE) SAN, InfiniBand SAN, and Internet Small Computer Systems Interface (iSCSI) SAN. The Fiber Channel (FC) SAN segment is growing significantly. Fiber Channel SANs are well-known for their reliable performance, ultra-low latency, and high throughput, making them the ideal storage networking solution for mission-critical enterprise applications. The protocol's dedicated storage network architecture enables reliable, uninterrupted data transport while minimizing congestion and maximizing fault tolerance. Its ability to enable large-scale, high-speed data mobility without sacrificing security or performance has cemented its place as a reliable alternative for enterprises that require a strong, enterprise-grade storage infrastructure for important business functions.

Based on the organization size, the global Storage Area Network (SAN) market is bifurcated into large enterprises and small & medium-sized enterprises. The large enterprises segment is expected to capture the largest market share over the forecast period. The segment expansion is attributed to the growing demand to manage an extensive amount of data.

Based on the end-use, the global Storage Area Network (SAN) industry is bifurcated into BFSI, IT & telecom, government & public sector, healthcare, retail & e-commerce, manufacturing, and others. The BFSI segment is expected to capture the largest market share over the projected period. BFSI is a major end-user market for SAN systems, with significant investments in data integrity, business continuity, and effective administration of massive volumes of transactional data, all of which are crucial for real-time analytics and fraud detection.

Storage Area Network Market: Regional Analysis

Why does North America dominate the global storage area network market over the projected period?

North America is expected to dominate the market over the projected period. There is a big and well-established data center ecosystem in the area, which means that there is a considerable need for high-performance SAN systems. Businesses and hyperscalers in the area rely on modern SAN infrastructure to handle crucial workloads, big data processing, and storage-heavy applications across a number of industries and cloud platforms.

The US is also home to some of the world's leading hyperscalers, including Amazon Web Services, Microsoft Azure, and Google Cloud. This makes it an important place for cloud and hyperscale data centers. These suppliers are making more people want advanced SAN infrastructure to support AI workloads, large-scale cloud services, and high-performance, multi-tenant data processing environments.

Storage Area Network (SAN) Market: Competitive Analysis

The global Storage Area Network (SAN) market is dominated by players like:

- NEC Corporation

- Dell Technologies

- Pure Storage Inc.

- Hewlett Packard Enterprise (HPE)

- Broadcom Inc. (Brocade)

- Cisco Systems Inc.

- IBM Corporation

- Hitachi Vantara (Hitachi Ltd.)

- NetApp Inc.

- Lenovo Group Limited

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- Nutanix Inc.

- DataCore Software Corporation

- StarWind Software Inc.

The global Storage Area Network (SAN) market is segmented as follows:

By Component

- Hardware

- Software

- Services

By SAN Type

- Hyperscale Server SAN

- Enterprise Server SAN

By Technology

- Fiber Channel (FC) SAN

- Fiber Channel over Ethernet (FCoE) SAN

- InfiniBand SAN

- Internet Small Computer Systems Interface (iSCSI) SAN

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By End Use

- BFSI

- IT & Telecom

- Government & Public Sector

- Healthcare

- Retail & E-commerce

- Manufacturing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A Storage Area Network (SAN) is a high-speed network that connects storage devices. SANs are often made up of hosts, switches, storage elements, and storage devices that are linked together utilizing a range of technologies, topologies, and protocols.

The Storage Area Network (SAN) market is being driven by the rapid growth in data volume & workloads, need for higher performance (Flash, NVMe, Low Latency Networks), digital transformation, IoT, edge computing, and demand from enterprises, data centers & hyperscalers..

The high initial capital & operating costs pose a major challenge to the industry expansion.

Based on the end use, the BFSI segment is expected to dominate the industry growth during the projected period.

The increasing digital transformation among enterprises is a major impacting factor for the storage area network industry growth over the projected period.

According to the report, the global Storage Area Network (SAN) market size was worth around USD 21.5 billion in 2024 and is predicted to grow to around USD 36.3 billion by 2034.

The global Storage Area Network (SAN) market is expected to grow at a CAGR of 5.4% during the forecast period.

The global Storage Area Network (SAN) industry growth is expected to be driven by the North American region. It is currently the world’s highest revenue-generating market due to the big IT infrastructures and the increasing number of data centers.

The global Storage Area Network (SAN) market is dominated by players like NEC Corporation, Dell Technologies, Pure Storage, Inc., Hewlett Packard Enterprise (HPE), Broadcom Inc. (Brocade), Cisco Systems, Inc., IBM Corporation, Hitachi Vantara (Hitachi Ltd.), NetApp, Inc., Lenovo Group Limited, Fujitsu Limited, Huawei Technologies Co., Ltd., Nutanix, Inc., DataCore Software Corporation, and StarWind Software Inc., among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed