Stevia Market Trend, Share, Growth, Size and Forecast 2032

Stevia Market By Extract Type (Liquid, Powder and Leaf) and by Application (Dairy Products, Bakery and Confectionery Products, Dietary Supplements, Packaged Food Products, Beverages, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

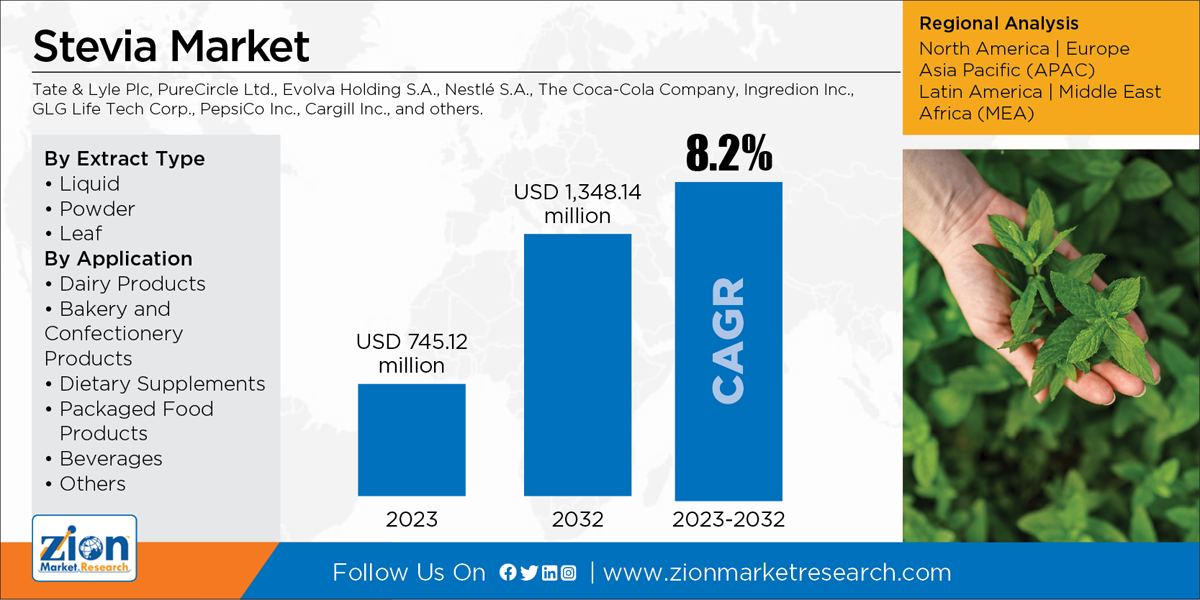

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 745.12 million | USD 1,348.14 million | 8.2% | 2023 |

The global Stevia market size accrued earnings worth approximately USD 745.12 Million in 2023 and is predicted to gain revenue of about USD 1,348.14 Million by 2032, is set to record a CAGR of nearly 8.2% over the period from 2024 to 2032.

Stevia Market Overview

Stevia is a small perennial plant which grows almost 50 to 85 cm tall and has oppositely arranged sessile and leaves. The plant is semi-humid and subtropical that can be grown easily like any other vegetable or crop, even in the kitchen garden. There are diverse species of stevia which have imminent sweetening compounds, among which stevia rebaudiana is the sweetest of all. Saline soils are avoided while cultivating this plant. Stevia has been successfully cultivated in recent years in many areas of the Indian states. The increasing demand for natural sweeteners is driving the farmers towards large-scale stevia cultivation globally. Stevia is a small perennial plant growing almost 60 to 80 cm tall, with oppositely arranged leaves and sessile. It is a semi-humid subtropical plant that can be grown easily like any other vegetable or crop, even in the kitchen garden. Diverse species of stevia contain imminent sweetening compounds, but stevia rebaudiana is the sweetest of all. Saline soils need to be avoided while cultivating this plant. Stevia has been successfully cultivated in recent years in many areas of the Indian states. The increasing demands for natural sweeteners have driven the farmers towards large-scale stevia cultivation globally.

Stevia Market Drivers and Restraints

The study includes drivers and restraints for the stevia market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the stevia market on a global level.

In order to give the users of this report a comprehensive view on the stevia market, we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein extract type, and application segments are benchmarked based on their market size, growth rate, and general attractiveness.

Stevia Market Growth

Currently, the global stevia market is witnessing growth due to raising awareness of the low-calorie consumable products and health benefits. Even the government is taking initiatives to grow consumer awareness and encouraging people which are further augmenting positive signs for the growth of stevia market. The introduction of various stevia-based products is also supporting the market growth and also is being appreciated by consumers. Furthermore, the demand for the antioxidants natural ingredients and the product is adding as an additional factor, expected to increase the market growth. Health organizations are advocating the use of low-calorie sugar substitutes, calling for higher production of stevia. Stevia is viewed favorably by consumers since it has earned the tag of being a healthy consumable product. Currently, the global stevia market is witnessing growth owing to increasing awareness of the health benefits and low-calorie consumable products.

Also, the government is encouraging and taking initiatives to grow consumer awareness which is further auguring positive signs of the growth of stevia market. The introduction of various stevia-based products is certainly supporting the overall market growth and has also been appreciated by consumers. Further, demand for antioxidants and natural ingredient products are additional factors expected to supplement the market growth. Health organizations also advocate the use of low-calorie sugar substitutes, while calling for higher production of stevia. By earning the tag of being a healthy consumable product, stevia is viewed favorably by consumers.

Stevia Market Share Analysis

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research & development, technology, and regional expansion of major participants involved in the market on the global and regional basis. Moreover, the study covers price trend analysis, extract type portfolio of various companies according to the region.

Request Free Sample

Request Free Sample

Stevia Market Segmentation Analysis

The study provides a decisive view on the stevia market by segmenting the market based on extract type, application, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2017 to 2024.

Based on extract type, the market is segmented into liquid, powder, and leaf. The liquid extract segment is anticipated to grow at a robust CAGR during the forecast period. The growth is supported by the widespread use of stevia consumption in liquid form as a tabletop sweetener together with various stevia-based liquid products globally.

Based on application, the market is segmented into dairy products, bakery and confectionery products, dietary supplements, packaged food products, beverages, and others. The bakery and dairy food product segments are expected to grow significantly in terms of revenue contribution, during the forecast period.

Based on the product, the market is segmented into liquid, powder, and leaf. Liquid extracts segment is experiencing a robust CAGR during the forecast period. This growth is supported by widespread use of stevia liquid in consumption as tabletop sweeteners coupled with varied stevia-based liquid products globally.

Stevia Market Regional Analysis

The Asia Pacific is the leading market for stevia. It has a broad recognition and acceptance in the region particularly in countries like such as India, Japan, China, and South Korea, since stevia-based natural sweeteners are likely to be a significant part of their diet for several people in these countries. Emerging economies such as Thailand, Indonesia, and Malaysia are also expected to be the key markets for the product owing to the growing food & beverage industry. North America and Europe are also expected to witness sizeable volume growth. A recent approval by the FDA related to the product is likely to have a positive impact on the overall industry and therefore improving the penetration levels of stevia in the market. Also, the rising consumer demand for organic products is playing an important role in propelling the overall market growth globally.

Some of the key players in stevia market include as

- Tate & Lyle Plc

- PureCircle Ltd.

- Evolva Holding S.A.

- Nestlé S.A.

- The Coca-Cola Company

- Ingredion Inc.

- GLG Life Tech Corp.

- PepsiCo Inc.

- Cargill Inc., and others.

This report segments the global stevia market as follows:

By Extract Type Segments

- Liquid

- Powder

- Leaf

By Application Segments

- Dairy Products

- Bakery and Confectionery Products

- Dietary Supplements

- Packaged Food Products

- Beverages

- Others

By Regional Segments

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed