Sterilized Packaging Market Size, Share, And Growth Report 2032

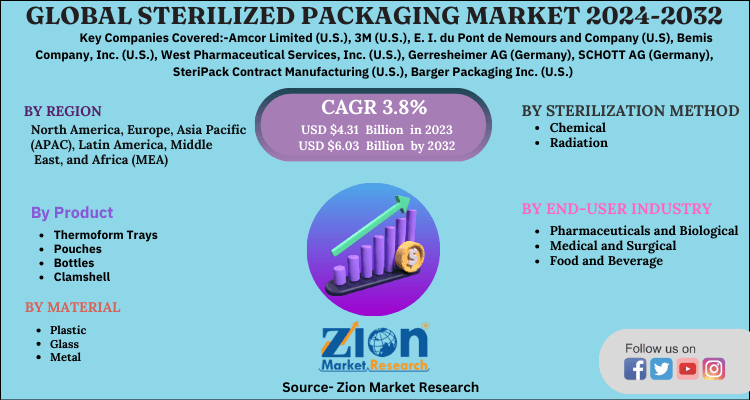

Sterilized Packaging Market by Product (Thermoform Trays, Pouches, Bottles, Clamshell), Material (Plastic, Glass, Metal), Sterilization Method (Chemical, Radiation), End-user Industry (Pharmaceuticals and Biological, Medical and Surgical, Food and Beverage): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

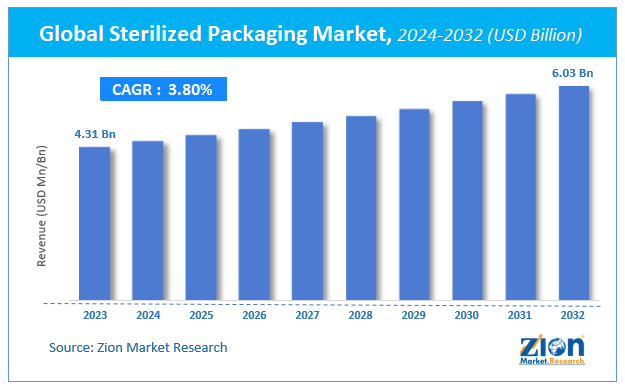

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.31 Billion | USD 6.03 Billion | 3.8% | 2023 |

Sterilized Packaging Market Size

Zion Market Research has published a report on the global Sterilized Packaging Market, estimating its value at USD 4.31 Billion in 2023, with projections indicating that it will reach USD 6.03 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 3.8% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Sterilized Packaging Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Sterilized Packaging Market: Overview

Sterilization is defined as a process of removing, killing, or deactivating the microorganisms such as bacteria, fungi, and viruses present on any surface, food, or fluid. The majority of medical and surgical devices used in hospitals are made of heat-stable materials that are sterilized with heat, primarily steam. Packaging is essential for preserving and protecting a product against damage or contamination. Sterilized packaging is required for some critical products, not only to protect the product but also to avoid reactions with packaging solutions and air. Packaging also helps in reducing contamination, and any sort of leakage during transportation or storage.

COVID-19 Impact Analysis

COVID-19's recent outbreak and rapid spread around the world have caused economic disruption. The rising prevalence of infectious and communicable diseases and viruses such as COVID-19, flu, tuberculosis, and SARS has prompted medical device manufacturers to improve hygiene in order to prevent disease contamination and spread in patients. As a result, the demand for sterile medical packaging rises. Medical supplies, masks, devices, syringes, and other items are in higher demand, resulting in increased demand for their primary and secondary packaging.

Sterilized Packaging Market: Growth Factors

The healthcare industry is driving growth in the sterile medical packaging market. Plastics and paper & paperboard have several advantages, including low weight, recyclability, and durability. Sterile medical packaging also protects against environmental damage, such as moisture during transit, which has led to an increase in demand from the medical industry. Sterile medical packaging is ideal for the packaging of medical devices and pharmaceutical products in the healthcare industry due to properties such as microbial barriers. Because of rising health awareness and concerns about infection control, the sterile medical packaging market is expected to grow.

The demand for sterile medical packaging products is driven by the ease with which they can be handled. Consumer preferences will shift toward increased spending on healthcare services as income levels rise, supporting the growth of sterilized medical packaging products. To withstand moisture and other environmental influences that may affect pharmaceutical products, these products require sterile packaging.

The global aging population is increasing, resulting in health issues that necessitate medical assistance, driving the demand for sterile medical packaging. Diabetes and high blood pressure are common diseases in the elderly population. To provide a better quality of life, the healthcare industry advances technology, which necessitates sterile medical packaging to prevent further infection, which could result in consumer health deterioration.

Sterilized Packaging Market: Segmentation

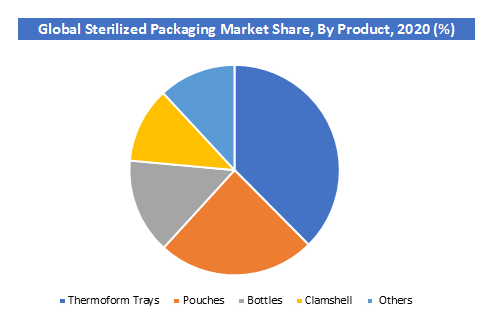

Product Segment Analysis Preview

The thermoform trays segment is expected to have the highest CAGR by type. Because of their lightweight, they are versatile and easy to transport. Thermoformed trays are made of plastic and are available in a variety of shapes and sizes. They are also equipped for internal use. Because the plastics used in trays can be molded into various shapes using the thermoforming process, plastic trays are a highly versatile style of packaging design. Because of their adaptability, they are useful in a variety of situations. The thermoform trays used in the healthcare industry are semi-rigid and flexible Packaging. Pouches, Bottles, and clamshells form the other product segments.

Material Segment Analysis Preview

During the forecast period, the plastic segment is expected to hold the largest share of the sterile medical packaging market. The sterile medical packaging market is expected to be led by the plastic sterile medical packaging segment. This expansion can be attributed to its high consumption and rising end-user demand. In the sterile medical packaging market, plastic polymers such as HDPE, polyester, and polypropylene are widely used in the production of bottles, vials & ampoules, and pre-filled syringes. Glass and metal forms other types of the material segment.

Sterilization Material Segment Analysis Preview

Chemical sterilization, radiation sterilization, and high temperature/pressure sterilization are the three types of sterilization methods used in the market. Chemical sterilization is further divided into three categories: ethylene oxide (ETO), hydrogen peroxide, and others. Similarly, the radiation sterilization segment is divided into gamma, e-beam, and other sub-segments. The steam autoclave and dry heat sterilization segments are also separated in the high-temperature/pressure sterilization segment. Chemical sterilization is the fastest-growing method in the market, with ethylene oxide being the most commonly used chemical for sterilization. It's an alkylating agent that messes with microorganisms' reproductive processes and cellular metabolism. Furthermore, it is well-suited for many materials that degrade due to radiation or heat sterilization, such as plastics and glass.

The second-largest method is radiation sterilization, with gamma radiation being the largest sub-segment. This method sterilizes and decontaminates by using cobalt-60 as a radiation source that decomposes to release high-energy gamma rays. Gamma rays kill contaminating microorganisms by breaking down bacterial DNA and inhibiting bacterial division during the sterilization process.

Sterilized Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sterilized Packaging Market |

| Market Size in 2023 | USD 4.31 Billion |

| Market Forecast in 2032 | USD 6.03 Billion |

| Growth Rate | CAGR of 3.8% |

| Number of Pages | 120 |

| Key Companies Covered | Amcor Limited (U.S.), 3M (U.S.), E. I. du Pont de Nemours and Company (U.S), Bemis Company, Inc. (U.S.), West Pharmaceutical Services, Inc. (U.S.), Gerresheimer AG (Germany), SCHOTT AG (Germany), SteriPack Contract Manufacturing (U.S.), Barger Packaging Inc. (U.S.) and North American Sterilization & Packaging Company (U.S.), among others |

| Segments Covered | By Product, By Material, By Sterilization Method, By End-user Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sterilized Packaging Market: Regional Analysis Preview

North America has the largest market share for sterile medical packaging. The United States is the region's largest contributor. The rising pharmaceutical industry and rising consumer healthcare spending are both contributing to this region's growth. The pharmaceutical industry has grown as the number of patients has increased due to the rapid spread of contagious diseases such as coronavirus. This region's demand for such packaging will be fueled by these factors.

Europe is the market's second-largest contributor. The increase is due to the increased use of medical equipment in various medical applications, such as thermoform trays, sterile bottles and containers, vials and ampoules, and pre-fillable syringes. China, Japan, and India are the leading contributors to market growth in the Asia Pacific. The healthcare industry in this region has benefited from the growing population and consumer awareness of healthcare needs. Furthermore, sterile packaging systems will be in high demand due to the high demand for in-vitro diagnostic products and medical implants. The Middle East and Africa will grow due to rising product demand from medical implants and in-vitro diagnostic applications. South America's product adoption will be boosted by increased infrastructure development and product innovation.

The fastest-growing region will be Asia-Pacific at a CAGR of 10.2% in the forecast period. The sterilized packaging market in Asia-Pacific has seen positive growth and is expected to grow significantly over the forecast period. Consumers' disposable income in the region has increased significantly, raising the region's standard of living. The growing urban populations in India and China, which account for 33% and 51% of the population, respectively, are driving up the demand for high-quality medical care. In 2018, India and China together accounted for more than 70% of the total Asia-Pacific share. Due to the rise in viral infections and various stringent regulations, medical device manufacturing industries, diagnostic centers, and hospitals are now focusing more on the sterile and disinfected packaging of medical devices.

In the next ten years, ISRO plans to launch seven mega missions. The second moon mission, for example, will launch in July 2019, as will the next missions to Mars and Venus. As a result of these trends, sterilized packaging in spacecraft and space missions will become more important.

Request Free Sample

Request Free Sample

Request Free Sample

Sterilized Packaging Market: Key Players & Competitive Landscape

Some of the key players in the sterilized packaging market are:

- Amcor Limited (U.S.)

- 3M (U.S.)

- E. I. du Pont de Nemours and Company (U.S)

- Bemis Company Inc. (U.S.)

- West Pharmaceutical Services Inc. (U.S.)

- Gerresheimer AG (Germany)

- SCHOTT AG (Germany)

- SteriPack Contract Manufacturing (U.S.)

- Barger Packaging Inc. (U.S.)

- North American Sterilization & Packaging Company (U.S.)

The competitive landscape of the market currently depicts a semi-consolidated industry, with the top 15 companies controlling the majority of the market share. The market's major players have spent a significant amount of money on the research and development of a variety of products and technologies. Market leaders' growth strategies include a diverse product portfolio supported by superior operational efficiency, as well as safe and novel technology development for sterile medical packaging applications. To expand their regional presence and product portfolio, these companies have used expansion, new product development, and acquisition strategies.

The global sterilized packaging market is segmented as follows:

By Product

-

Thermoform Trays

- Pouches

- Bottles

- Clamshell

By Material

-

Plastic

- Glass

- Metal

By Sterilization Method

-

Chemical

- Radiation

By End-user Industry

-

Pharmaceuticals and Biological

- Medical and Surgical

- Food and Beverage

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed