Specialty Silica Market Size, Share, Growth Report 2032

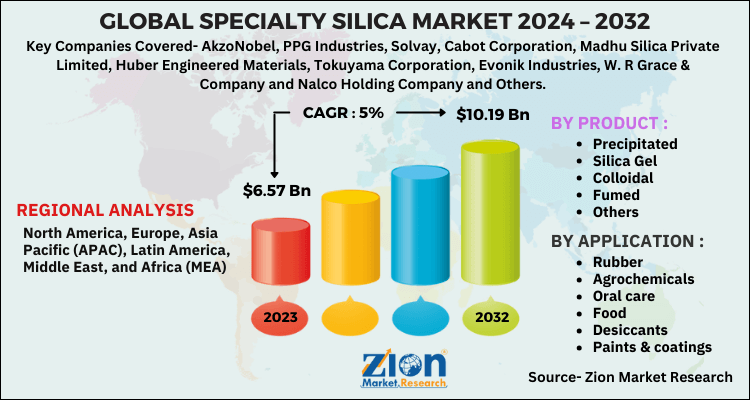

Global Specialty Silica Market By Product (Precipitated, Silica Gel, Colloidal, Fumed, and Others), By Application (Rubber, Agrochemicals, Oral care, Food, Desiccants, Paints & coatings, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.57 Billion | USD 10.19 Billion | 5% | 2023 |

Global Specialty Silica Market Insights

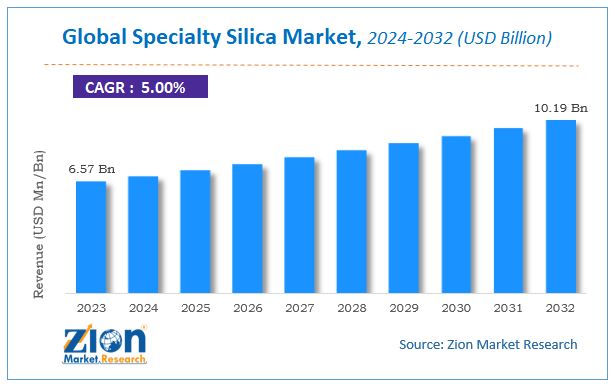

Zion Market Research has published a report on the global Global Specialty Silica Market, estimating its value at USD 6.57 Billion in 2023, with projections indicating that it will reach USD 10.19 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Global Specialty Silica Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Industry Perspective:

Electronics, aerospace, personal care devices, latex, paints, cosmetics, healthcare, inks, coatings, and other industries use specialty silica as an additive in the formulation process of different materials and components. The interaction of alkaline silicate with hydrochloric or sulphuric acid produces it as a by-product. In the next step of the reaction, sulphuric acid solution and sodium silicate are both added to the bath. It comes in the shape of gritty circular pebbles.

Since specialty silica has a low rolling resistance, it is used in the tyre industry as a performance additive. The use of specialty silica as a matting agent will eliminate the glossy effect on the skin caused by the application of cosmetics. It may also be used as a clarifying agent, polishing agent, and abrasive. Anti-blocking agents, such as specialty silica, may be used to keep polymer layers from binding together during polymerization.

To know more about this report, request a sample copy.

Growth Factors

One of the major growth drivers for the Global Specialty Silica Market is Focus on Energy-efficiency. A major development in the global specialty silica industry is an increased emphasis on green and energy-friendly tires, which is expected to boost the specialty silica market. The development of green processes for processing high-grade silica is receiving a lot of attention. Deriving silica from rice husk ash, for example, will help businesses achieve a strategic advantage in terms of end product while also attracting government funding.

Another factor for the growth in this market is the Regulatory Impact on the Usage and Sales of Specialty Silica. The Occupational Safety and Health Act of 1970, which was enacted by the Occupational Safety and Health Administration, established a number of requirements for the production, storage, and use of specialty silica (OSHA). This organization established guidelines for safe working conditions for employees who handle silica. Furthermore, specialist silica is used as a performance additive in the manufacture of environmentally friendly and energy-efficient tyres. The demand for specialized silica is expected to grow in the near future as controls on tyres and carbon emissions become more stringent.

Global Specialty Silica Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Global Specialty Silica Market |

| Market Size in 2023 | USD 6.57 Billion |

| Market Forecast in 2032 | USD 10.19 Billion |

| Growth Rate | CAGR of 5% |

| Number of Pages | 150 |

| Key Companies Covered | AkzoNobel, PPG Industries, Solvay, Cabot Corporation, Madhu Silica Private Limited, Huber Engineered Materials, Tokuyama Corporation, Evonik Industries, W. R Grace & Company and Nalco Holding Company and Others |

| Segments Covered | By Product, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Product Segment Analysis Preview

The specialty silica demand was dominated by precipitated silica. In green tires, the amount of product consumed is twice that of regular tires. Due to the demand for car manufacturers to meet rising fuel-economy goals and reduce automotive emissions, the latest trend shows that manufacturers are focused on increasing green tire production. For example, Evonik Industries invested around USD 120 million in October 2018 to start a precipitated silica plant for the tyre industry in South Carolina, United States.

Silica gel has a very high affinity for water and outperforms other liquids in terms of adsorption. As a result, it's widely used in a variety of industries for applications requiring a high-capacity desiccant or selective adsorbent. The market is expected to be driven by increased use as a thickening agent and cleaning ingredient in the oral care industry.

Product Segment Analysis Preview

The specialty silica demand was dominated by precipitated silica. In green tires, the amount of product consumed is twice that of regular tires. Due to the demand for car manufacturers to meet rising fuel-economy goals and reduce automotive emissions, the latest trend shows that manufacturers are focused on increasing green tire production. For example, Evonik Industries invested around USD 120 million in October 2018 to start a precipitated silica plant for the tire industry in South Carolina, United States.

Silica gel has a very high affinity for water and outperforms other liquids in terms of adsorption. As a result, it's widely used in a variety of industries for applications requiring a high-capacity desiccant or selective adsorbent. The market is expected to be driven by increased use as a thickening agent and cleaning ingredient in the oral care industry.

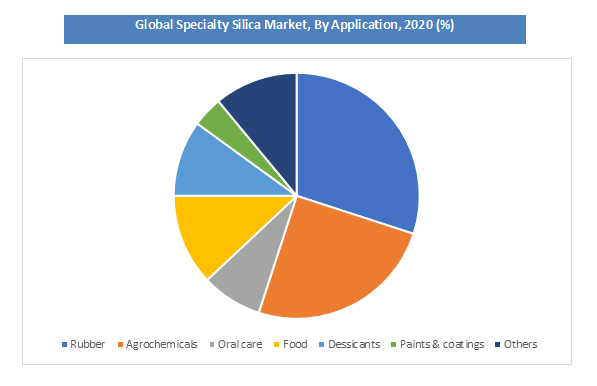

Application Segment Analysis Preview

Rubber had the highest market share of 29.2% in 2020 in terms of sales. The global rubber industry has grown rapidly over the last decade, and this situation is likely over the forecast era, thanks to rising customer satisfaction with increased gas mileage. Rubber's use in non-tire applications is expected to grow at a modest rate in the near future. Silicone rubber, footwear soles, and synthetic rubber are examples of non-tire applications. Over the projected era, these applications are predicted to continue to drive the market. To resist rust and corrosion, fumed silica is mainly used in coatings as a thixotropic and anti-settling agent. The major factors driving the growth of the coatings industry are widespread urbanization, major infrastructure improvements, and a growing population combined with disposable income. This is expected to boost commodity demand in the coatings industry.

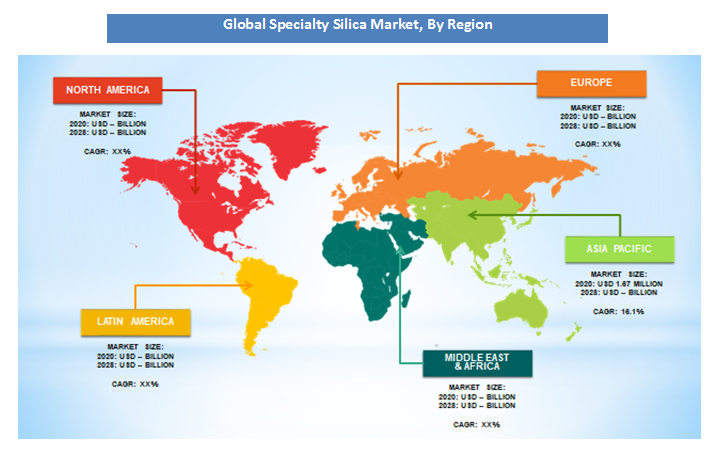

Regional Segment Analysis Preview

The Global Specialty Silica Market is divided into five regions, North America, Europe, Asia Pacific, Latin America, and Middle East Africa. Asia Pacific dominated the industry with 35% CAGR. Furthermore, over the projection period, it is expected to be the fastest-growing regional sector. The main countries China, Japan, and India that is driving the growth. Rubber was the most common application in Asia Pacific, owing to increased demand from tyre manufacturers. Tire manufacturers' aggressive expansion is expected to have a positive impact on regional development.

Over the projected timeframe, European regulations aimed at reducing VOC emissions in the paints and coatings industry are likely to boost demand for environmentally friendly specialty silica. Because of the increased construction products in the country, the paints and coatings industry is expected to expand at a moderate pace. Furthermore, Germany's large automotive industry is a major growth engine for the European economy.

Key Market Players and Competitive Landscape

Some of the key players in the Global Specialty Silica Market include

- AkzoNobel

- PPG Industries

- Solvay

- Cabot Corporation

- Madhu Silica Private Limited

- Huber Engineered Materials

- Tokuyama Corporation

- Evonik Industries

- W. R Grace & Company

- Nalco Holding Company

The world leader is Evonik Industries, led by Solvay, PPG Industries, and Cabot Corporation. Evonik has embarked on a number of strategic expansion initiatives in order to capitalise on increased product demand, especially from tyre manufacturers. For example, the company announced in September 2018 that it intends to increase capacity for the development of hydrophobic fumed silica in Rheinfelden, Germany, in order to expand its silica market for specialty applications.

The Global Specialty Silica Market is segmented as follows:-

Product

- Precipitated

- Silica Gel

- Colloidal

- Fumed

- Others

Application

- Rubber

- Agrochemicals

- Oral care

- Food

- Desiccants

- Paints & coatings

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global Specialty Silica Market was valued at US$ 6.57 Billion in 2023.

The Global Specialty Silica Market is expected to reach US$ 10.19 Billion by 2032 at a CAGR of about 5% from 2024 to 2032.

Focus on Energy-efficiency and Regulatory Impact on Usage and Sales of Specialty Silica are the major key factors in driving the Global Specialty Silica Market.

The Asia Pacific is currently the largest market share in Global Specialty Silica Market and a key region in the advances in Specialty Silica Market, followed by North America and Europe.

Some of the key players in the Global Specialty Silica Market include AkzoNobel, PPG Industries, Solvay, Cabot Corporation, Madhu Silica Private Limited, Huber Engineered Materials, Tokuyama Corporation, Evonik Industries, W. R Grace & Company and Nalco Holding Company and Others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed