Soy Protein Ingredients Market Size, Share Report, Analysis, Trends, Growth 2032

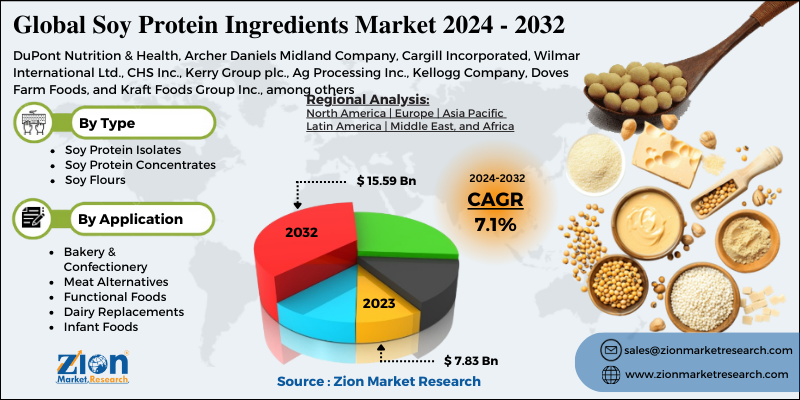

Soy Protein Ingredients Market by Type (Soy Protein Isolates, Soy Protein Concentrates, and Soy Flours) and Application (Bakery & Confectionery, Meat Alternatives, Functional Foods, Dairy Replacements, and Infant Foods): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

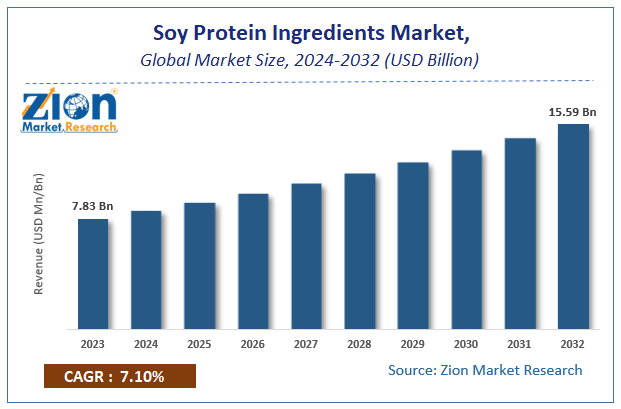

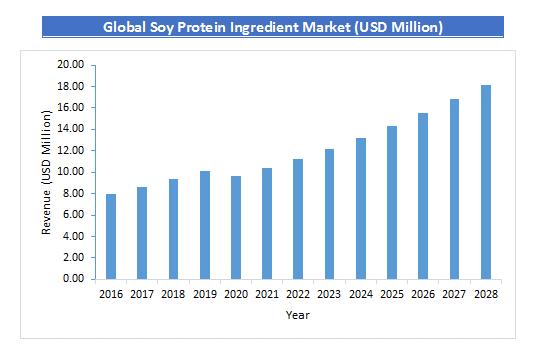

| USD 7.83 Billion | USD 15.59 Billion | 7.1% | 2023 |

Soy Protein Ingredients Market Insights

According to Zion Market Research, the global Soy Protein Ingredients Market was worth USD 7.83 Billion in 2023. The market is forecast to reach USD 15.59 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.1% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Soy Protein Ingredients Market industry over the next decade.

Soy Protein Ingredients Market: Overview

Protein is a necessary component of human cells that aids in the repair and healing of the body. The human body, on the other hand, is incapable of producing the 9 essential amino acids required for cell healing. As a result, it is critical that proteins be consumed through diet. Proteins can be obtained from either an animal or a plant source, referred to as Dairy Proteins and Soy Proteins, respectively. Fish, milk, meat, egg, and gelatin are common sources of animal protein. Plant Protein, on the other hand, comes from rice, pea, soy, canola, and wheat. Because milk and soy contain a significant amount of protein, they are preferred by people of all ages. Because of advancements in extraction techniques, the various types of protein ingredients obtained from milk and soy are referred to as concentrates, isolates, and hydrolysates, with isolates accounting for roughly 90% of the protein content.

Soy Protein Ingredients Market: Growth Factors

The global soy protein ingredients market is being driven by a growing trend toward vegan diets, as well as the functional efficiency, cost competitiveness, and increasing use of such plant protein products in a wide range of processed foods, particularly in the ready-to-eat product category. The most eminent forms of soy protein are isolates and concentrate, which contain 90 % and 70 % protein, respectively. Soy protein's high functional properties and natural health benefits are propelling its market growth. Because of its high sustainability, soy protein is becoming more popular in a variety of end-user industries. The strong scientific evidence supporting health benefits is one of the key drivers for market growth. Scientists' ongoing research has proven that protein ingredients are the best source for keeping the body fit. Cancer patients can also benefit from whey proteins. In recent years, increasing consumer awareness, particularly of functional foods and dietary supplements, has been a critical factor in market growth. Plant and dairy proteins are expected to see increased demand over the next six years, as egg proteins face market penetration challenges due to high prices and increased sensitivity to wheat glucans, particularly in the United States.

Soy proteins are one of the most popular meats and dairy protein substitutes, which has helped food manufacturers reduce costs and increase product profitability. Due to their functional and nutritional properties, they are used in a variety of food applications such as bakery, confectionery, emulsion-type sausages, dairy replacers, functional beverages and nutritional bars, and breakfast cereals. They're also used in livestock feed, aquaculture, and pet food as nutritional ingredients. Soy protein is a good substitute for meat and dairy proteins because it has several nutritional benefits. As the cost of meat and dairy proteins has risen, manufacturers and consumers alike have turned to it as a less expensive alternative that provides the same nutritional benefits.

Soy Protein Ingredients Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Soy Protein Ingredients Market |

| Market Size in 2023 | USD 7.83 Billion |

| Market Forecast in 2032 | USD 15.59 Billion |

| Growth Rate | CAGR of 7.1% |

| Number of Pages | 130 |

| Key Companies Covered | DuPont Nutrition & Health, Archer Daniels Midland Company, Cargill Incorporated, Wilmar International Ltd., CHS Inc., Kerry Group plc., Ag Processing Inc., Kellogg Company, Doves Farm Foods, and Kraft Foods Group Inc., among others. |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Type Segment Analysis Preview

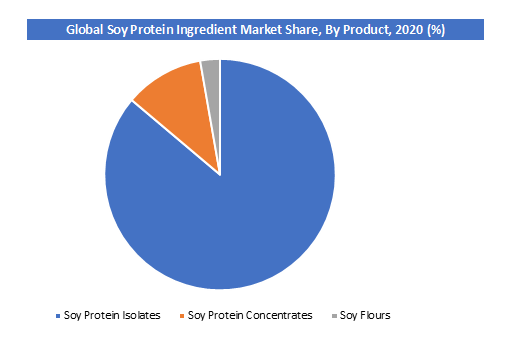

Among the various types of soy protein ingredients, soy protein isolates contain the most protein (nearly 90%). These are considered premium ingredients and are used in milk beverages because of their high dispersibility. The bland taste, low-fat content, oligosaccharides, and fiber content of soy protein isolates are also advantages. Soy Protein Concentrates and Soy Flours form other types in this segment.

Application Segment Analysis Preview

During the forecast period, the infant foods segment is expected to grow at a CAGR of 7.7%. Because of the growing demand for soy protein ingredients in infant foods, readymade and packaged food products, the infant foods segment have the most market potential in the soy protein ingredients market. Furthermore, an increase in demand for efficient and cost-effective meat alternatives among infants is another major factor driving global demand for soy protein ingredients. Due to rising demand for soy protein ingredients and constant growth in per capita disposable income, the use of soy protein ingredients in infant foods has seen significant growth. Bakery & Confectionery, Meat Alternatives, Functional Foods, and Dairy Replacements forms the application segment.

Soy Protein Ingredients Market: Regional Analysis Preview

Because of factors such as changing lifestyles, a lack of balanced dietary intake, and global manufacturers' increased focus on R&D to develop new types of soy-protein-enriched products, the soy protein ingredient market in North America is growing rapidly. The United States continues to dominate the soy protein ingredient market, followed by Canada and Mexico.

Due to increased awareness for healthy and plant-based products and an increase in the number of counterfeit products on the market, consumers in the region are switching to other alternative products, such as green-label food products. Also owing to increased awareness of the health benefits associated with the consumption of organic products, particularly plant-based ones.

Due to rising exports and domestic demand, Asia Pacific is expected to grow at the fastest rate, with a CAGR of 12.1% over the forecast period. The market for soy protein ingredients in Asia-Pacific has grown rapidly in both developed and developing countries, owing to the huge potential for increased protein consumption through packaged foods and beverages. The entire region's consumption pattern is determined by the population's income and spending patterns. High-income countries, such as Japan, have a significant share of the soy protein ingredients market due to low prices and slow growth. Developing countries, such as India, also have a lot of potential in the soy protein ingredients market, thanks to rising disposable income and increased health awareness. The Asia-Pacific region's growing population presents a huge opportunity in the form of a large consumer base that is moving toward a healthier lifestyle. Increased information sources are assisting in the spread of awareness about the health benefits of soy, resulting in the rapid adoption of soy ingredients in people's daily lives.

Soy Protein Ingredients Market: Key Players & Competitive Landscape

Some of the key players in the soy protein ingredient market are:

- DuPont Nutrition & Health

- Archer Daniels Midland Company

- Cargill Incorporated

- Wilmar International Ltd.

- CHS Inc.

- Kerry Group plc.

- Ag Processing Inc.

- Kellogg Company

- Doves Farm Foods

- Kraft Foods Group Inc., among others.

New product development and mergers and acquisitions of small players are common strategies used by companies to gain a foothold in the market. Existing businesses have a lot of room to grow in the soy protein ingredients market. For instance, The Archer Daniels Midland Company expanded its non-GMO soy protein concentrate production capacity at its factory in Europoort, the Netherlands, in February 2020, in order to meet the growing demand for plant-based proteins. Soy protein concentrate, which is available in powdered form and can be used in a variety of food applications, has recently begun production at the Europoort production site.

The global soy protein ingredient market is segmented as follows:

By Type

- Soy Protein Isolates

- Soy Protein Concentrates

- Soy Flours

By Application

- Bakery & Confectionery

- Meat Alternatives

- Functional Foods

- Dairy Replacements

- Infant Foods

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global soy protein ingredient market was valued at $ 7.83 Billion in 2023.

The Global soy protein ingredient market is expected to reach $ 15.59 Billion by 2032, with CAGR of around 7.1% from 2024 to 2032.

Some of the key factors driving the Global soy protein ingredient market growth are growing trend toward vegan diets, as well as the functional efficiency, cost competitiveness, and increasing use of such plant protein products in a wide range of processed foods, particularly in the ready-to-eat product category

North America region held a substantial share of the soy protein ingredient market in 2020. This is attributable to the changing lifestyles, a lack of balanced dietary intake, and Global manufacturers' increased focus on R&D to develop new types of soy-protein-enriched products.

Some of the major companies operating in the soy protein ingredient market are DuPont Nutrition & Health, Archer Daniels Midland Company, Cargill Incorporated, Wilmar International Ltd., CHS Inc., Kerry Group plc., Ag Processing Inc., Kellogg Company, Doves Farm Foods, and Kraft Foods Group Inc., among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed