Sodium Sulfate Market Size, Share, Growth, And Forecast To 2032

Sodium Sulfate Market By Source (Synthetic And Natural), By Application (Detergents & Soaps, Carpet Cleaners, Textiles, Kraft Pulping, Glass, and Others (Oil Recovery, Food Preservatives)), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

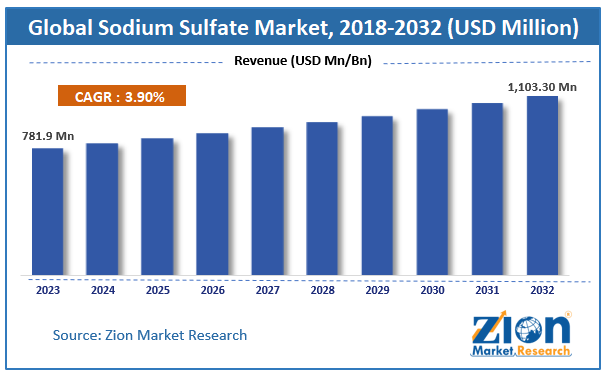

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 781.9 Million | USD 1,103.30 Million | 3.90% | 2023 |

The global Sodium Sulfate market size was worth around and is predUSD 781.9 million in 2023icted to grow to around USD 1,103.30 million by 2032 with a compound annual growth rate (CAGR) of roughly 3.90% between 2024 and 2032.

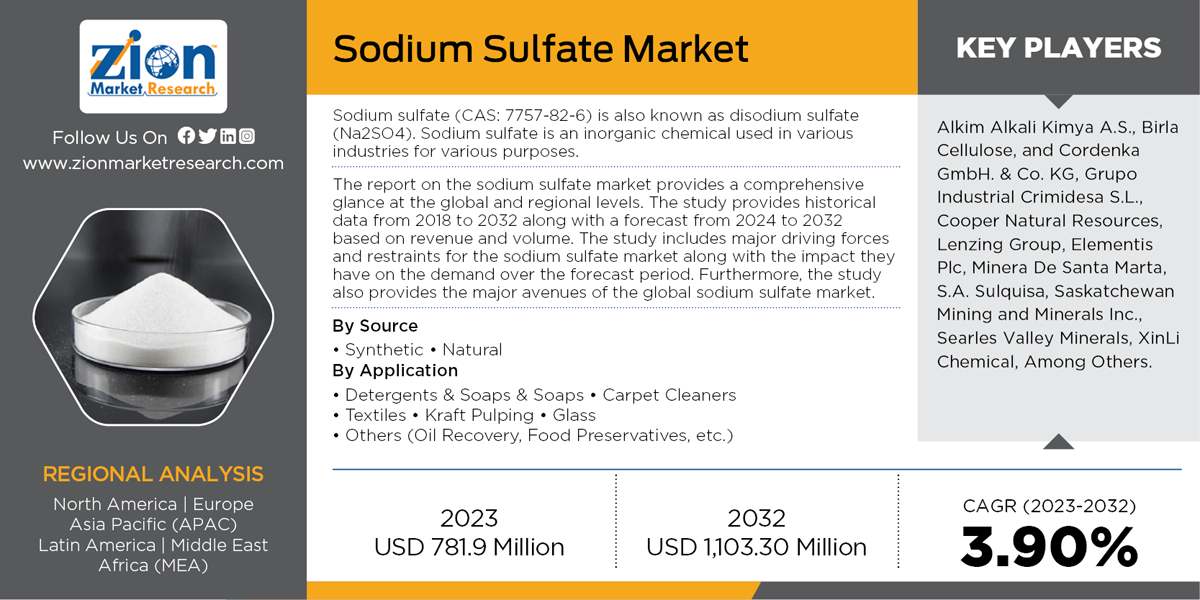

The report on the sodium sulfate market provides a comprehensive glance at the global and regional levels. The study provides historical data from 2018 to 2032 along with a forecast from 2024 to 2032 based on revenue and volume. The study includes major driving forces and restraints for the sodium sulfate market along with the impact they have on the demand over the forecast period. Furthermore, the study also provides the major avenues of the global sodium sulfate market.

Sodium Sulfate Market: Overview

Sodium sulfate (CAS: 7757-82-6) is also known as disodium sulfate (Na2SO4). Sodium sulfate is an inorganic chemical used in various industries for various purposes.

The global sodium sulfate market is expected to grow at a substantial rate in the forecast period. The growing demand for detergents and soaps from emerging economies fuels the market growth. The increased use of sodium sulfate was widely observed in powdered detergents, soaps, carpet cleaners, and textiles in most of the regions. The increased demand in the textile industry for dyeing application is expected to be the major driver for the global sodium sulfate market within the forecast period. Acceptance and increased use of sodium sulfate as a fining agent in glass manufacturing industries is expected to fuel the global sodium sulfate market growth in the forecast period. However, the harmful effect associated with excessive consumption of sodium sulfate may hinder the market in the coming years.

Excessive use of sodium sulfate can cause stomach and spleen disorders related ailments. Lack of warning labels by the manufacturer on products containing sodium sulfate may limit the growth of the global sodium sulfate market. Nonetheless, product innovation and emerging market in the Asia Pacific is likely to open new avenues for the major players of the market during the years to come.

Sodium Sulfate Market: Growth Drivers

The usage of sodium sulfate is expected to increase in the automobile and construction industry since it is mainly used as a fluxing agent in glass products. Sodium sulfate helps in removing defect during the casting and blowing processes. The increased demand for sodium sulfate as a fluxing agent to enhance the structure in the expanding automobile and construction industries across the globe is expected to be the major driver for the growth of the sodium sulfate market. Rising government initiatives encouraging infrastructure development, high disposable income, and population growth are some factors aiding the growth of the sodium sulfate market.

Sodium Sulfate Market: Segmentation

The study provides a significant view of the global sodium sulfate market by classifying it into source, application, and region segmentation. These segments have been estimated and forecasted with the future and past trends.

On the basis of source, the sodium sulfate market is classified into synthetic and natural. Natural sodium sulfate is the most dominant type, accounting for a major market share in 2023. Solid sodium sulfate is widely used in detergents & soap industry.

Based on various applications, the global sodium sulfate market is mainly segmented into detergents & soaps, carpet cleaners, textiles, kraft pulping, glass, and others (oil recovery, food preservatives, etc.). In terms of value, kraft pulping is expected to grow at highest CAGR in the forecast period owing to increasing environmental concerns. Detergents & soaps were the leading application segment of the global sodium sulfate market in 2023.

Sodium Sulfate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sodium Sulfate Market Research Report |

| Market Size in 2023 | USD 781.9 Million |

| Market Forecast in 2032 | USD 1,103.30 Million |

| Growth Rate | CAGR of 3.90% |

| Number of Pages | 110 |

| Key Companies Covered | Alkim Alkali Kimya A.S., Birla Cellulose, and Cordenka GmbH. & Co. KG, Grupo Industrial Crimidesa S.L., Cooper Natural Resources, Lenzing Group, Elementis Plc, Minera De Santa Marta, S.A. Sulquisa, Saskatchewan Mining and Minerals Inc., Searles Valley Minerals, XinLi Chemical, Among Others./td> |

| Segments Covered | By Source, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sodium Sulfate Market: Regional Analysis

The regional segmentation includes the Middle East & Africa, Asia Pacific, Europe, Latin America, and North America. Furthermore, it is bifurcated into major countries such as the U.S., the UK, Germany, France, China, Japan, India, and Brazil.

In terms of geographies, the sodium sulfate market has been studied for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, Asia Pacific is estimated to be the largest market for sodium sulfate. This growth is mainly attributed to the rising demand for sodium sulfate from various countries such as China, India, Japan, and South Korea. Moreover, Asia Pacific is predicted to be the fastest growing market of sodium sulfate within the forecast period owing to the increasing demand for the textile industry in the region. The Asia Pacific was followed by North America and Europe in the same year. The market growth rate in North America and Europe is expected to stay higher in the forecast period.

Sodium Sulfate Market: Competitive Space

- Alkim Alkali Kimya A.S.

- Birla Cellulose

- and Cordenka GmbH. & Co. KG

- Grupo Industrial Crimidesa S.L.

- Cooper Natural Resources

- Lenzing Group

- Elementis Plc

- Minera De Santa Marta

- S.A. Sulquisa

- Saskatchewan Mining and Minerals Inc.

- Searles Valley Minerals

- XinLi Chemical

- Among Others

This report segments the global sodium sulfate market as follows:

By Source

- Synthetic

- Natural

By Application

- Detergents & Soaps & Soaps

- Carpet Cleaners

- Textiles

- Kraft Pulping

- Glass

- Others (Oil Recovery, Food Preservatives, etc.)

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

sodium sulfate (CAS: 7757-82-6) is also known as disodium sulfate (Na2SO4). sodium sulfate is an inorganic chemical used in various industries for various purposes.

According to study, the global sodium sulfate market size was worth around USD 781.9 million in 2023 and is predicted to grow to around USD 1,103.30 million by 2032.

The CAGR value of sodium sulfate market is expected to be around 3.90% during 2024-2032.

Asia Pacific has been leading the global sodium sulfate market and is anticipated to continue on the dominant position in the years to come.

The global sodium sulfate market is led by players like Alkim Alkali Kimya A.S., Birla Cellulose, Cordenka GmbH. & Co. KG, Grupo Industrial Crimidesa S.L., Cooper Natural Resources, Lenzing Group, Elementis Plc, Minera De Santa Marta, S.A. Sulquisa, Saskatchewan Mining and Minerals Inc., Searles Valley Minerals, and XinLi Chemical, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed