Smart Wearable Fitness And Sports Devices Market Size, Share, Trends, Growth 2034

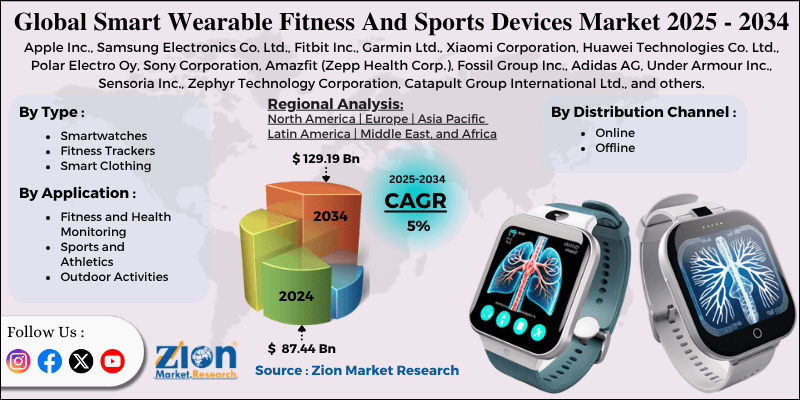

Smart Wearable Fitness And Sports Devices Market By Type (Smartwatches, Fitness Trackers, Smart Clothing), By Application (Fitness and Health Monitoring, Sports and Athletics, Outdoor Activities), By Distribution Channel (Online, Offline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

------------------------------------------------------------------------------------------------------------------------------------------------------------------

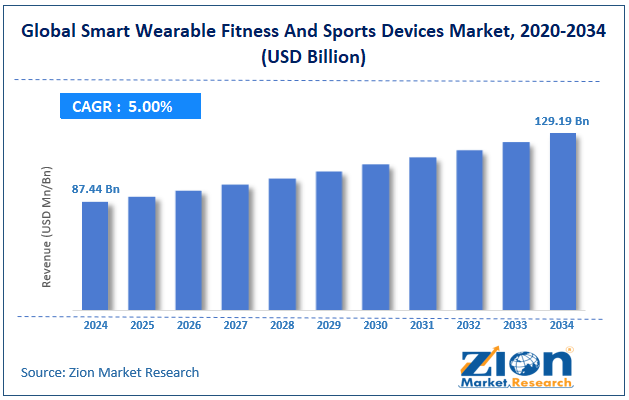

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 87.44 Billion | USD 129.19 Billion | 5.0% | 2024 |

Smart Wearable Fitness And Sports Devices Industry Perspective:

The global smart wearable fitness and sports devices market size was approximately USD 87.44 billion in 2024 and is projected to reach around USD 129.19 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global smart wearable fitness and sports devices market is estimated to grow annually at a CAGR of around 5% over the forecast period (2025-2034)

- In terms of revenue, the global smart wearable fitness and sports devices market size was valued at around USD 87.44 billion in 2024 and is projected to reach USD 129.19 billion by 2034.

- The smart wearable fitness and sports devices market is projected to grow significantly due to increasing health and fitness awareness among consumers, technological advancements in data analytics, sensors, and connectivity, as well as the broader IoT ecosystem and the integration of wearables with smartphones.

- Based on type, the smartwatches segment is expected to lead the market, while the fitness trackers segment is expected to grow considerably.

- Based on application, the fitness and health monitoring segment is the largest, while the sports and athletics segment is projected to experience substantial revenue growth over the forecast period.

- Based on the distribution channel, the online segment is expected to lead the market, surpassing the offline segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Smart Wearable Fitness And Sports Devices Market: Overview

Smart wearable fitness and sports devices are advanced technologies designed to monitor and enhance health, physical activity, and performance. Devices such as fitness bands, smartwatches, and sports trackers collect real-time data on metrics including calories burned, heart rate, steps, oxygen levels, and sleep quality. The global smart wearable fitness and sports devices market is expected to expand rapidly, driven by rising health and wellness awareness, technological advancements, and the increasing adoption of personalization and data-driven coaching. Growing concern over lifestyle diseases and obesity is compelling individuals to use fitness tracking devices. Consumers are increasingly seeking real-time insights into their physical activity and becoming more health-conscious. This awareness drives continuous demand for smart wearables.

Moreover, modern wearables feature longer battery life, advanced sensors, and better connectivity through Bluetooth, 5G, and Wi-Fi. These advancements improve device functionality and data accuracy. As technology progresses, wearables become more reliable and appealing. Furthermore, users are increasingly preferring devices that offer personalized insights over generic statistics. AI-powered analytics help customize workouts and recovery plans to personal needs. This personal touch majorly supports user engagement and satisfaction.

Despite the growth, the global market is hindered by factors such as high costs, price sensitivity, and issues related to battery life and charging. Premium trackers and smartwatches are costly for many users. The high cost restricts adoption, especially in price-sensitive regions. Manufacturers experience challenges balancing affordability and innovation. Likewise, frequent charging reduces convenience for active individuals. Features like continuous heart monitoring and GPS drain batteries quickly. Poor battery performance can deter consistent use.

Nonetheless, the global smart wearable fitness and sports devices industry stands to gain from several key opportunities, including healthcare & remote monitoring integration, as well as sports-specific devices for professionals. Wearables are entering healthcare for disease management and remote patient monitoring. Insurers and hospitals use them for preventive care programs. This builds clinical healthcare with fitness technology. Additionally, custom wearables designed for swimmers, runners, or cyclists offer sport-specific metrics. Athletes depend on data for injury prevention and training optimization. This niche creates high-value product segments.

Smart Wearable Fitness And Sports Devices Market Dynamics

Growth Drivers

How is the shift towards preventive healthcare & remote monitoring driving the smart wearable fitness and sports devices market?

Wearables are advancing beyond fitness tracking to encompass health monitoring, telehealth integration, and preventive care, with collaborations in healthcare and remote patient monitoring driving their adoption. Consumers are progressively viewing them as solutions for tracking heart rate, stress, sleep, and chronic conditions, thereby improving their perceived value. This convergence of fitness and medical functionalities augments consumer willingness to invest. Hence, the distinction between health-tech devices and consumer wearables is blurring, backing the overall growth of the smart wearable fitness and sports devices market.

How is the smart wearable fitness and sports devices market augmented by technological advancements & sensor innovation?

Improvements in connectivity, sensors, and data analytics have made wearables more appealing and accurate. More than 58% of manufacturers now offer real-time data, predictive health alerts, and personalized exercise suggestions. Modern devices can track ECG, SpO2, sleep, recovery, and skin temperature, extending beyond basic step counting. This technology narrows the gap between clinical monitoring and consumer fitness, widening device functionality and industry appeal.

Restraints

Limited battery life and charging convenience unfavorably impact the market growth

Despite advances in connectivity and sensors, several wearables still experience battery-life restrictions, requiring frequent recharging or feature compromises. Continuous tracking, such as that used in endurance multi-day sports, is particularly affected, negatively impacting the user experience. These issues may lead to device abandonment and low engagement, ultimately affecting retention and hindering industry growth. Moreover, the power and battery consumption trade-off remains a significant design and technical challenge.

Opportunities

How do new form factors & segments (rings, smart garments, smart glasses) create promising avenues for the growth of the smart wearable fitness and sports devices industry?

Beyond new devices, wrist-wear categories are progressing, for instance, smart clothing/textile sensors, smart eyewear, and smart rings – creating new growth avenues. A recent report highlights that shipments of smart rings have doubled, and sales of smart garments are surging at nearly 22% in some regions. This diversification enables brands to reach new use-cases (recovery/sleep, discreet monitoring, fashion-integrated wearables) and appeal to consumers who may not prefer wrist devices. For innovators, these new form factors offer an opportunity to hold new segments and leapfrog competitors still focused on wrist-only models, thus propelling the smart wearable fitness and sports devices industry.

Challenges

Market saturation & consumer fatigue restrict the market growth

In several developed regions, the entry-level fitness tracker and smartwatch segments are already heavily penetrated, which slows growth and forces device makers to depend on upgrades or premium segments. With high competition and diminishing novelty, consumer fatigue sets in – users may stop using wearables consistently, or skip upgrades. For vendors, this means slower unit growth, elevated pressure on innovation and differentiation, and potential pricing pressures.

Smart Wearable Fitness And Sports Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Wearable Fitness And Sports Devices Market |

| Market Size in 2024 | USD 87.44 Billion |

| Market Forecast in 2034 | USD 129.19 Billion |

| Growth Rate | CAGR of 5% |

| Number of Pages | 216 |

| Key Companies Covered | Apple Inc., Samsung Electronics Co. Ltd., Fitbit Inc., Garmin Ltd., Xiaomi Corporation, Huawei Technologies Co. Ltd., Polar Electro Oy, Sony Corporation, Amazfit (Zepp Health Corp.), Fossil Group Inc., Adidas AG, Under Armour Inc., Sensoria Inc., Zephyr Technology Corporation, Catapult Group International Ltd., and others. |

| Segments Covered | By Type, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smart Wearable Fitness And Sports Devices Market: Segmentation

The global smart wearable fitness and sports devices market is segmented based on type, application, distribution channel, and region.

Based on type, the global smart wearable fitness and sports devices industry is divided into smartwatches, fitness trackers, and smart clothing. The smartwatch segment holds a leading share of the market, accounting for nearly 40-45% of worldwide revenues, according to recent data. Their broader appeal stems from their multifunctionality, which combines fitness/sports tracking, connectivity, smart features, and health monitoring in one device. With leading brands continuously advancing wellness apps, including those that track SpO2, GPS, and ECG, smartwatches remain the premium go-to wearable device for sports and fitness markets.

Based on application, the global smart wearable fitness and sports devices market is segmented into fitness and health monitoring, sports and athletics, and outdoor activities. The fitness and health monitoring segment held a dominant share of the market, as most users adopt wearables primarily to track their daily heart rate, activity, general wellness, and sleep. Its broader appeal spans both casual users and fitness enthusiasts, fueling its leading share of device usage. The accessible value proposition of continuous health and wellness insights contributes to the growth of this foundational application segment.

Based on the distribution channel, the global market is segmented into online and offline. The online segment holds a leadership position in the market, driven by the rapid growth of direct-to-consumer and e-commerce platforms. Consumers are increasingly preferring online purchases due to broader product availability, easy comparison, competitive pricing, and doorstep delivery. The convenience of frequent digital promotions and online shopping makes it the dominant sales avenue globally.

Smart Wearable Fitness And Sports Devices Market: Regional Analysis

What gives North America a competitive edge in the global Smart Wearable Fitness and Sports Devices Market?

North America is expected to maintain its leading position in the global smart wearable fitness and sports devices market due to high consumer adoption and technology readiness, higher disposable income, a preference for premium products, and a strong presence of major technology players, as well as innovative infrastructure.

North America presents a strong consumer willingness to adopt wearable devices, with nearly 39% of the worldwide market share attributed to the region. With broader smartphone penetration, mature e-commerce/retail infrastructure, and a tech-savvy population, the region offers ideal conditions for the adoption of wearables. This readiness enhances both initial adoption and the frequency of upgrades/replacements.

Moreover, consumers in the region have higher average spending power and are more willing to spend on premium wearables that comprise advanced sensors (SpO2, ECG, GPS) and smart features. For instance, the region's smartwatch industry alone reached $17 billion in 2022. This supports not only high-volume sales, but also high-value device sales, driving revenue share. North America is home to prominent wearable brands and technology ecosystems that fuel product innovation, consumer awareness, and marketing. The region benefits from frequent new product launches, strong brand influence worldwide, and ecosystem integrations (health services, apps). Hence, the region enjoys dominance and is a region of choice for the majority of wearable manufacturers.

Europe ranks as the second-largest region in the global smart wearable fitness and sports devices industry, driven by a strong regional market share and size, high consumer health awareness and fitness culture, a sophisticated technology infrastructure, and a willingness to adopt premium features. Europe holds a remarkable share of the global smart wearable sector, indicating a well-developed online distribution and retail network, which facilitates broader adoption. This significant industry presence promises that Europe will maintain a second-leading competitive rank globally.

Moreover, European consumers are highly conscious of wellness, preventive health, and fitness. A majority of individuals actively use wearable devices to monitor their sleep, heart rate, activity, and overall well-being. This health-focused mindset fuels consistent demand for sports devices and fitness.

Additionally, high smartphone penetration and advanced network infrastructure support the adoption of wearable devices. Consumers are receptive to premium devices with enhanced features, such as sports analytics, SpO2, and ECG. This motivates manufacturers to introduce high-class models, augmenting industry growth and revenue.

Smart Wearable Fitness And Sports Devices Market: Competitive Analysis

The leading players in the global smart wearable fitness and sports devices market are:

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Fitbit Inc.

- Garmin Ltd.

- Xiaomi Corporation

- Huawei Technologies Co. Ltd.

- Polar Electro Oy

- Sony Corporation

- Amazfit (Zepp Health Corp.)

- Fossil Group Inc.

- Adidas AG

- Under Armour Inc.

- Sensoria Inc.

- Zephyr Technology Corporation

- Catapult Group International Ltd.

Smart Wearable Fitness And Sports Devices Market: Key Market Trends

Expanded health & biometric monitoring:

Beyond calories and steps, modern devices now monitor metrics such as blood-oxygen saturation (SpO₂), heart-rate variability, hydration levels, and stress indicators. This broader biometric scope expands wearables into preventive health tools, not just fitness gadgets. These capabilities attract everyday users and athletes who prefer deeper insights.

Smart clothing & non‑wrist form factors:

Smart clothing, alternative wearables such as patches and rings, and sensor-embedded apparel, including shoes, shirts, and socks, are gaining prominence as alternative or complementary devices to traditional wristwear. These form factors allow for more specialized and less intrusive monitoring of posture, muscle activity, and sports-specific movements. This diversification expands the industry beyond typical fitness bands and watches.

The global smart wearable fitness and sports devices market is segmented as follows:

By Type

- Smartwatches

- Fitness Trackers

- Smart Clothing

By Application

- Fitness and Health Monitoring

- Sports and Athletics

- Outdoor Activities

By Distribution Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Smart wearable fitness and sports devices are advanced technologies designed to monitor and enhance health, physical activity, and performance. Devices such as fitness bands, smartwatches, and sports trackers collect real-time data on metrics including calories burned, heart rate, steps, oxygen levels, and sleep quality.

The global smart wearable fitness and sports devices market is projected to grow due to rising participation in sports and fitness activities worldwide, the growth of chronic diseases, demand for preventive health monitoring, and increased athlete endorsements and professional sports adoption of wearables.

According to study, the global smart wearable fitness and sports devices market size was worth around USD 87.44 billion in 2024 and is predicted to grow to around USD 129.19 billion by 2034.

The CAGR value of the smart wearable fitness and sports devices market is expected to be approximately 5% from 2025 to 2034.

The significant challenges restraining market growth include limited battery life, high device costs, privacy/security issues, concerns over data accuracy, and a lack of interoperability.

Market trends and consumer preferences are evolving toward AI-driven, personalized coaching; advanced biometric monitoring; sleek, non-wrist form factors; and seamless ecosystem integration.

North America is expected to lead the global smart wearable fitness and sports devices market during the forecast period.

The key players profiled in the global smart wearable fitness and sports devices market include Apple Inc., Samsung Electronics Co., Ltd., Fitbit Inc., Garmin Ltd., Xiaomi Corporation, Huawei Technologies Co., Ltd., Polar Electro Oy, Sony Corporation, Amazfit (Zepp Health Corp.), Fossil Group, Inc., Adidas AG, Under Armour, Inc., Sensoria Inc., Zephyr Technology Corporation, and Catapult Group International Ltd.

Leading players are adopting strategies like partnerships, product innovation, subscription services, market expansion, and ecosystem integration to strengthen their market presence.

The report examines key aspects of the smart wearable fitness and sports devices market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed