Smart Vending Machines Market Size, Share, Value and Forecast 2034

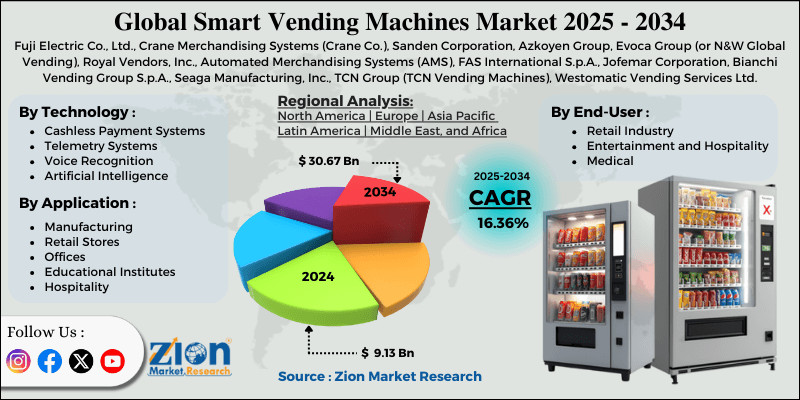

Smart Vending Machines Market By Technology (Cashless Payment Systems, Telemetry Systems, Voice Recognition, Artificial Intelligence), By Application (Manufacturing, Retail Stores, Offices, Educational Institutes, Hospitality), By End-User (Retail Industry, Entertainment and Hospitality, Medical), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025-2034

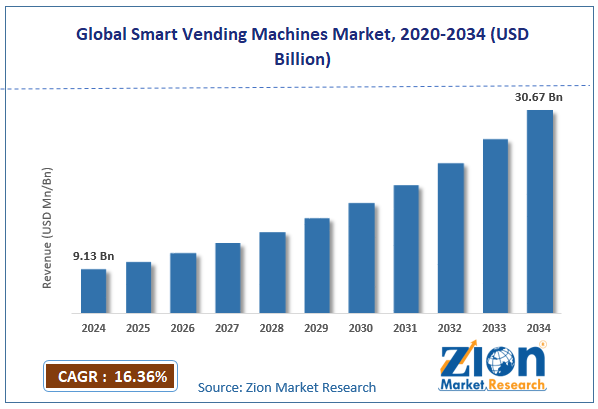

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.13 Billion | USD 30.67 Billion | 16.36% | 2024 |

Smart Vending Machines Industry Perspective:

The global smart vending machines market size was around USD 9.13 billion in 2024 and is projected to reach USD 30.67 billion by 2034, with a compound annual growth rate (CAGR) of roughly 16.36% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global smart vending machines market is estimated to grow annually at a CAGR of around 16.36% over the forecast period (2025-2034)

- In terms of revenue, the global smart vending machines market size was valued at around USD 9.13 billion in 2024 and is projected to reach USD 30.67 billion by 2034.

- The smart vending machines market is projected to grow significantly owing to the adoption of cashless and mobile payments, rising labor costs prompting automation, and the need for 24/7 consumer access.

- Based on technology, the cashless payment systems segment is expected to lead the market, while the telemetry systems segment is expected to grow considerably.

- Based on application, the retail stores segment is the dominating segment, while the offices segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the retail industry segment is expected to lead the market, followed by the entertainment and hospitality segment.

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Smart Vending Machines Market: Overview

Smart vending machines are improved, connected dispensers that use touchscreens, sensors, and cashless payment systems to deliver a more personalized, faster buying experience. Unlike traditional machines, they enable real-time inventory tracking, recommend products, dynamically adjust pricing, and provide operators with data on customer preferences. The global smart vending machines market is projected to witness substantial growth, driven by the growing demand for on-the-go shopping and convenience, the proliferation of cashless and digital payments, and labor cost pressures and labor shortages.

Busy lifestyles and urbanization are driving the need for 24/7, quick access to food and essentials. Smart vending machines offer easy access without staff interference. This convenience fuels consumer adoption worldwide. Moreover, contactless cards, QR payments, and mobile wallets streamline transactions. Machines accepting payment methods gain broader consumer acceptance. Digital payments improve hygiene and speed. Staff shortages and rising labor costs are driving businesses toward automation. Vending machines decrease dependency on manual service. This makes them cost-effective for schools, public spaces, and offices.

Although drivers exist, the global market is challenged by factors such as high upfront investment and maintenance costs, technical complexity and reliability issues, and dependence on connectivity and infrastructure. Touchscreens, advanced sensors, and IoT modules raise initial expenditure. Maintenance needs technical expertise. Small operators may struggle with deployment costs. Payment failures or dispensing jams may harm customer trust. Machines need regular monitoring and updates. Technical issues increase operational risk. Likewise, IoT and digital payments require stable power and an internet connection. Unreliable infrastructure reduces machine performance. Remote management is restricted to low-connectivity regions. Even so, the global smart vending machine industry is well-positioned due to AI-driven upselling and personalization, diversification into specialty and fresh products, and digital advertising and interactive promotions.

AI can suggest products based on weather, time, or past purchases. Machines can bundle offers or dynamically price products. This enhances revenue per customer. Growing demand for specialty or healthy items opens new segments. Machines can offer salads, hygiene products, or organic snacks. Diversification raises overall appeal. Touchscreens allow coupons, ads, and cross-sell offers. This creates a secondary revenue stream. Engagement improves customer experience.

Smart Vending Machines Market Dynamics

Growth Drivers

How are evolving consumer preferences driving the smart vending machine market?

Consumer habits are changing – people are expecting speed, flexibility, convenience, and a wider variety of products, even in vending formats. Smart vending operators are responding by stocking more than just chips or sodas – offering bottled water, wellness items, fresh food, healthy snacks, and non-food essentials. Since several machines are remotely manageable and modular, operators can modify product assortments to the location. This flexibility meets the growing demand for more diverse, convenient, and healthier consumption, making vending a relevant retail channel for modern, busy lifestyles.

How is the smart vending machines market driven by technological improvements & integration into broader smart‑retail/smart‑city ecosystems?

Improvements in software, electronics, energy-efficient designs, and cloud infrastructure are transforming vending machines into fully-featured ‘smart retail nodes’. New machines may comprise touch-screen, app-based interfaces, remote diagnostics, dynamic pricing or promotions, sensor-based freshness monitoring, or multimedia advertising. Integration with supply chain systems, urban digital infrastructure, or data analytics platforms makes vending part of a wider retail and services infrastructure. As retail and public infrastructure become more intelligent, vending machines become increasingly attractive as low-footprint, flexible retail outlets, thereby fueling growth in the smart vending machine market.

Restraints

Limited product variety, storage capacity & perceived value unfavorably impact the market progress

Physical storage and space limitations restrict the quantities and types of products a machine can offer. Machines may struggle to consistently provide a diverse selection of snacks, fresh foods, or specialty items. Frequent restocking is required to maintain inventory levels, thereby increasing operational complexity. Consumers may perceive vending-dispensed items as low quality. These restrictions reduce the machine’s appeal in regions demanding freshness and variety. It also limits expansion into high-end or premium product segments.

Opportunities

How is the growing adoption of mobile wallets and cashless payments creating favorable conditions for the growth of the smart vending machines market?

The worldwide shift toward NFC, digital wallets, and QR-based payments is driving smart vending adoption. Cashless systems increase hygiene, transaction speed, and convenience. Impulse purchases tend to rise when digital payments are available. Integration with mobile apps or loyalty programs may improve consumer engagement. The trend also streamlines operations and decreases cash-handling risks. Expanding mobile payment penetration directly fuels the growth in the smart vending machines industry.

Challenges

Infrastructure limitations in certain regions restrict the market growth

Machines depend on stable electricity, backend support, and internet connectivity. Weak infrastructure may offer downtime, operational disturbances, and transaction failures. Semi-urban or remote areas may lack space, parts, or technical failures. These restrictions limit market expansion outside well-connected urban regions. Machine reliability is vital to building consumer trust. Operators may need extra investment to overcome infrastructure gaps.

Smart Vending Machines Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Vending Machines Market Research Report |

| Market Size in 2024 | USD 9.13 Billion |

| Market Forecast in 2034 | USD 30.67 Billion |

| Growth Rate | CAGR of 16.36% |

| Number of Pages | 215 |

| Key Companies Covered | Fuji Electric Co., Ltd., Crane Merchandising Systems (Crane Co.), Sanden Corporation, Azkoyen Group, Evoca Group (or N&W Global Vending), Royal Vendors, Inc., Automated Merchandising Systems (AMS), FAS International S.p.A., Jofemar Corporation, Bianchi Vending Group S.p.A., Seaga Manufacturing, Inc., TCN Group (TCN Vending Machines), Westomatic Vending Services Ltd., Micron Smart Vending (Guangzhou-based vendor), and Rheavendors Group (Rhea Vendors S.p.A.). |

| Segments Covered | By Technology, By Application, By End-User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smart Vending Machines Market: Segmentation

The global smart vending machines market is segmented based on technology, application, end-user industry, and region.

Based on technology, the global smart vending machines industry is divided into cashless payment systems, telemetry systems, voice recognition, and artificial intelligence. The cashless payment systems segment holds a substantial market share, as a majority of smart vending machines currently accept mobile wallets, QR codes, contactless cards, and other digital payment methods. They improve speed, hygiene, and convenience, making them crucial in nearly all modern deployments. This broader adoption has made cashless payment technology the backbone of the market.

Based on application, the global smart vending machines market is segmented into manufacturing, retail stores, offices, educational institutes, and hospitality. The retail stores segment captures a leading market share. It comprises convenience stores, high-traffic commercial areas, and malls, collectively representing the largest application segment. Smart vending machines in retail offer 24/7 access to beverages, snacks, and essential products, extending availability beyond store hours and reducing labor costs. Constant demand and high consumer traffic make this segment widely adopted and most profitable worldwide.

Based on end-user, the global market is segmented into the retail industry, entertainment and hospitality, and medical. The retail industry segment dominates the market due to high foot traffic and constant consumer demand worldwide. The retail industry leads the market, with machines deployed in malls, supermarkets, and convenience stores. Smart vending provides 24/7 access to snacks, essential items, and beverages, reducing staff reliance while maximizing sales opportunities.

Smart Vending Machines Market: Regional Analysis

What gives the Asia Pacific a competitive edge in the global Smart Vending Machines Market?

Asia Pacific is likely to sustain its leadership in the smart vending machines market due to speedy urbanization and high population density, broader adoption of digital/cashless payment infrastructure, and deep cultural and market acceptance of automated/vending retail. Asia Pacific’s dense population and rapid urbanization create a large, concentrated customer base that is ideally suited to automated retail solutions, such as smart vending machines. With millions living in crowded cities, vending units offer convenient access to essential goods and food in high-traffic areas such as malls, offices, and transit hubs. This demographic scale places intense demands relative to less-populated regions.

Moreover, the region has experienced a speedy proliferation of digital payments – QR payments, mobile wallets, NFC, thus making cashless transactions progressively trusted and common. Smart vending machines that integrate cashless systems align with this shift, enabling smooth, contactless purchases across the Asia Pacific. This compatibility has remarkably augmented the deployment of modernized smart vending units. Furthermore, APAC nations, particularly South Korea, China, and Japan, have long used vending machines, where automated retail is common. For example, dense networks of vending machines offering snacks, beverages, and even non-food items make smart vending a natural evolution. This acceptance decreases consumer resistance and streamlines adoption.

North America continues to hold the second-highest share in the Smart Vending Machines industry, driven by strong market share and revenue scale, high technology adoption, robust digital payment infrastructure, and diverse deployment in end-use and locations. North America accounts for a remarkable share of the global market, making it the second-largest region. The region holds a broader network of machines in retail stores, public spaces, and offices, generating major revenue. This established base provides both steady growth opportunities and a high adoption rate for operators.

The region benefits from advanced digital infrastructure, comprising widespread contactless and cashless payment systems. This allows smooth transactions at smart vending machines. Integration of telemetry, remote management, and IoT allows operators to effectively monitor and control large machine networks. This technological readiness enhances adoption, making scaling across multiple sectors more practical. Additionally, smart vending machines in North America are deployed in a variety of settings, comprising offices, retail outlets, transit hubs, universities, and public spaces. This diversification decreases reliance on any single sector, assuring stable demand even if one area slows. Wide application also improves returns for vending operators and maximizes consumer reach.

Smart Vending Machines Market: Competitive Analysis

The leading players in the global smart vending machines market are

- Fuji Electric Co., Ltd.

- Crane Merchandising Systems (Crane Co.)

- Sanden Corporation

- Azkoyen Group

- Evoca Group (or N&W Global Vending)

- Royal Vendors, Inc.

- Automated Merchandising Systems (AMS)

- FAS International S.p.A.

- Jofemar Corporation, Bianchi Vending Group S.p.A.

- Seaga Manufacturing, Inc.

- TCN Group (TCN Vending Machines)

- Westomatic Vending Services Ltd.

- Micron Smart Vending (Guangzhou-based vendor)

- Rheavendors Group (Rhea Vendors S.p.A.).

Smart Vending Machines Market: Key Market Trends

AI & IoT integration for smart operations

Modern machines are integrating AI-powered software and IoT sensors to monitor inventory, detect malfunctions in real-time, and predict restocking needs. AI also enables personalized product recommendations based on location-specific demand and consumer preferences. These technologies enhance operational efficiency, improve the overall user experience, and reduce waste.

Sustainability & energy-efficient designs

Energy-efficient refrigeration, smart energy management, and LED lighting are becoming standard in new vending machines. Operators are also focusing on environmentally-friendly packaging and reducing food waste through improved inventory control. Sustainability practices appeal to ecologically conscious individuals and help decrease operational costs.

The global smart vending machines market is segmented as follows:

By Technology

- Cashless Payment Systems

- Telemetry Systems

- Voice Recognition

- Artificial Intelligence

By Application

- Manufacturing

- Retail Stores

- Offices

- Educational Institutes

- Hospitality

By End-User

- Retail Industry

- Entertainment and Hospitality

- Medical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed