Singapore Bunker Fuel Market Size, Share, Trends, Growth and Forecast 2034

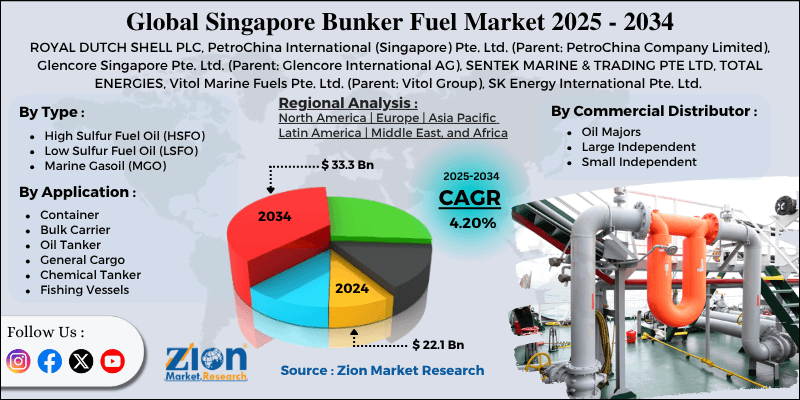

Singapore Bunker Fuel Market By Type (High Sulfur Fuel Oil (HSFO), Low Sulfur Fuel Oil (LSFO), Marine Gasoil (MGO), and Others), By Commercial Distributor (Oil Majors, Large Independent, and Small Independent), By Application (Container, Bulk Carrier, Oil Tanker, General Cargo, Chemical Tanker, Fishing Vessels, Gas Tanker, and Others), and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.1 Billion | USD 33.3 Billion | 4.2% | 2024 |

Singapore Bunker Fuel Industry Perspective:

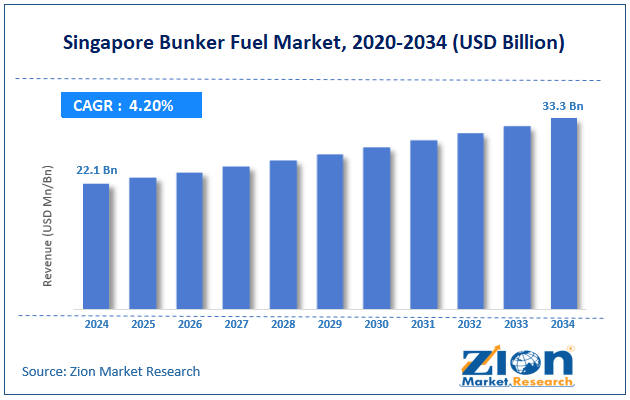

Singapore bunker fuel market size was worth around USD 22.1 billion in 2024 and is predicted to grow to around USD 33.3 billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.2% between 2025 and 2034.

Singapore Bunker Fuel Market: Overview

Marine vessels use bunker petroleum as a fuel oil. To power the ship's engines, it is dumped into the bunkers. Diesel oil, low-sulfur fuel oil, and high-sulfur fuel oil are the three primary marine fuel types used by ships. These days, it's anticipated that stricter government laws and more awareness of the need to reduce environmental pollution would open up prospects for fuels like LNG, gasoil, LPG, and others to replace the aforementioned bunker fuels. The need for bunker fuel and bunkering services has grown as a result of the expansion of maritime traffic.

As many bunker fuel suppliers have shifted their operations to these offshore resource sites, the market for bunker fuel is growing as a result of an increase in oil and gas exploration activities in developing oil regions. Additionally, the shipping industry's efforts to reduce fuel use are anticipated to impede market expansion.

Key Insights

- As per the analysis shared by our research analyst, the Singapore Bunker Fuel market is estimated to grow annually at a CAGR of around 4.2% over the forecast period (2025-2034).

- In terms of revenue, the Singapore Bunker Fuel market size was valued at around USD 22.1 billion in 2024 and is projected to reach USD 33.3 billion by 2034.

- The growing maritime trade is expected to drive the Singapore Bunker Fuel market over the forecast period.

- Based on the type, the Low Sulfur Fuel Oil (LSFO) segment is expected to hold the largest market share over the forecast period.

- Based on the commercial distributor, the oil majors segment is expected to dominate the market expansion over the projected period.

- Based on the application, the container segment is expected to dominate the market expansion over the projected period.

Singapore Bunker Fuel Market: Growth Drivers

Increasing maritime trade and its strategic location drive market growth

Singapore is situated on a major global trade route and is the leading bunker fuel supply hub. About 40% of the world's bunker fuel is sold there, making it a crucial refueling location for ships traveling between the Pacific and Indian Oceans.

As the volume of international trade increases, shipping companies also rely more on Singapore's efficient refueling operations, making the city-state a popular place to bunker. The need for reliable and economically effective marine fuel options is driven by the expansion of trade, import, and export activities by major economies like China, India, and Japan.

Additionally, the growth of containerized trade, brought about by the burgeoning manufacturing in Southeast Asia, has increased the number of ships stopping in Singapore. The growing popularity of supply chain logistics and e-commerce, particularly as it relates to mega-container ships, keeps increasing fuel use, which in turn keeps bunker fuel demand high.

Singapore Bunker Fuel Market: Restraints

Volatility in crude oil prices hinders market growth

Changes in the price of crude oil have a direct impact on bunker fuel prices, which should worry shipping companies and fuel suppliers alike. Global crude oil price fluctuations, which are influenced by supply disruptions, production quotas, and geopolitical tensions, continue to have a significant impact on the long-term dynamics of Singapore's bunker market. This is where OPEC+'s major production decisions are important because any changes in supply will be quickly reflected in changes in bunker fuel prices.

A significant portion of this loading will probably be passed on to enterprises through ongoing freight price reductions, fuel usage reductions, or investments in alternative energy sources, as shipping operational expenses are heavily reliant on fuel prices. Therefore, the volatility in crude oil prices might be hindering the Singapore bunker fuel market.

Singapore Bunker Fuel Market: Opportunities

Rising expansion by the key market players offers a lucrative opportunity for market growth

The growing expansion by key market players in the country is expected to offer a lucrative opportunity for the Singapore bunker fuel market to grow over the projected period.

For instance, in August 2024, in support of the worldwide shipping industry's decarbonization objectives, TotalEnergies Marine Fuels significantly expanded its low-carbon fuels offering on August 5th in Singapore by supplying its first B100 biofuel bunker. 700 metric tons (mt) of 100% Used Cooking Oil Methyl Ester (UCOME-based) biofuel were transported by TotalEnergies Marine Fuels via an IMO Type II chemical bunker tanker, MAPLE, owned by Global Energy Group, to Glovis Cosmos, a Pure Car and Truck Carrier (PCTC) owned by Hyundai Glovis. Southeast Asia is the source of the second-generation, waste-based fuel known as UCOME biodiesel.

This circular economy strategy is approved by the International Sustainability & Carbon Certification (ISCC) standard and reduces competition with agricultural land. VLSFO (Very Low Sulfur Fuel Oil) blended with up to 30% UCOME-based biofuel was distributed globally by TotalEnergies Marine Fuels' prior biofuel bunkering activities. It has the potential to reduce greenhouse gas (GHG) emissions by 80% to 90% on a well-to-wake basis, as this is the first time the entire amount delivered has been composed of biofuel.

Singapore Bunker Fuel Market: Challenges

Technological shift and energy transition pose a major challenge to market expansion

It's getting harder to use traditional bunker fuel because of new technologies in ship design and propulsion systems that try to make ships more energy-efficient and cut down on emissions. As ships consume less fuel and the marine industry looks more closely at LNG, biofuels, and other energy sources to fulfill stricter emissions requirements, the market is under pressure to shift.

Businesses in the industry need to invest in cleaner fuel technologies and innovative ways to distribute their products to customers in order to stay competitive as things change. Therefore, the technological shift and energy transition pose a major challenge for the industry expansion.

Singapore Bunker Fuel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Singapore Bunker Fuel Market |

| Market Size in 2024 | USD 22.1 Billion |

| Market Forecast in 2034 | USD 33.3 Billion |

| Growth Rate | CAGR of 4.20% |

| Number of Pages | 211 |

| Key Companies Covered | ROYAL DUTCH SHELL PLC, PetroChina International (Singapore) Pte. Ltd. (Parent: PetroChina Company Limited), Glencore Singapore Pte. Ltd. (Parent: Glencore International AG), SENTEK MARINE & TRADING PTE LTD, TOTAL ENERGIES, Vitol Marine Fuels Pte. Ltd. (Parent: Vitol Group), SK Energy International Pte. Ltd. (Parent: SK INNOVATION, CO. LTD.), EXXON MOBIL CORPORATION, EQUATORIAL MARINE FUEL MANAGEMENT SERVICES PTE LTD, BP P.L.C, and others. |

| Segments Covered | By Type, By Commercial Distributor, By Application, and By Region |

| Countries Covered | Singapore |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Singapore Bunker Fuel Market: Segmentation

Singapore Bunker Fuel industry is segmented based on type, commercial distributor, application, and region.

Based on the type, the market is bifurcated into High Sulfur Fuel Oil (HSFO), Low Sulfur Fuel Oil (LSFO), Marine Gasoil (MGO), and Others. The Low Sulfur Fuel Oil (LSFO) segment is expected to hold the largest market share over the forecast period. Low Sulfur Fuel Oil (LSFO) is the main marine fuel in Singapore's bunker fuel market, owing to the introduction of IMO 2020 regulations that limit the sulfur content of marine fuels to 0.5%. Singapore, the world's largest bunkering hub, has played a key role in aiding this change.

Based on the commercial distributors, the Singapore Bunker Fuel industry is bifurcated into oil majors, large independent, and small independent. The oil majors segment is expected to dominate the market over the projected period. Owing to the dominance of oil companies in the crude oil tanker chartering market worldwide.

Furthermore, innovations by oil majors in the bunker fuel business, such as product launches, agreements, and so on, are expected to boost market expansion during the analyzed timeframe.

Based on the application, the Singapore Bunker Fuel market is bifurcated into container, bulk carrier, oil tanker, general cargo, chemical tanker, fishing vessels, gas tanker, and others. The container segment is expected to hold a prominent market share during the forecast period. This is due to an increase in demand for cargo transportation via ships and a growth in trade-related agreements.

Furthermore, the increasing number of manufacturing units and factories in the region, particularly in Asia-Pacific, is expected to support the expansion of the Singapore bunker fuel market for container shipping in the coming years.

Singapore Bunker Fuel Market: Competitive Analysis

Singapore bunker fuel market is dominated by players like:

- ROYAL DUTCH SHELL PLC

- PetroChina International (Singapore) Pte. Ltd. (Parent: PetroChina Company Limited)

- Glencore Singapore Pte. Ltd. (Parent: Glencore International AG)

- SENTEK MARINE & TRADING PTE LTD

- TOTAL ENERGIES

- Vitol Marine Fuels Pte. Ltd. (Parent: Vitol Group)

- SK Energy International Pte. Ltd. (Parent: SK INNOVATION CO. LTD.)

- EXXON MOBIL CORPORATION

- EQUATORIAL MARINE FUEL MANAGEMENT SERVICES PTE LTD

- BP P.L.C

Singapore Bunker Fuel market is segmented as follows:

By Type

- High Sulfur Fuel Oil (HSFO)

- Low Sulfur Fuel Oil (LSFO)

- Marine Gasoil (MGO)

- Others

By Commercial Distributor

- Oil Majors

- Large Independent

- Small Independent

By Application

- Container

- Bulk Carrier

- Oil Tanker

- General Cargo

- Chemical Tanker

- Fishing Vessels

- Gas Tanker

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Marine vessels use bunker petroleum as a fuel oil. To power the ship's engines, it is dumped into the bunkers. Diesel oil, low-sulfur fuel oil, and high-sulfur fuel oil are the three primary marine fuel types used by ships.

A number of factors, such as the expansion of international trade, technological advancements, increasing expansion by the key market players, and others, influence the Singapore bunker fuel market.

According to the report, Singapore's market size was worth around USD 22.1 billion in 2024 and is predicted to grow to around USD 33.3 billion by 2034.

The Singapore Bunker Fuel market is expected to grow at a CAGR of 4.2% during the forecast period.

Singapore Bunker Fuel market is dominated by players like ROYAL DUTCH SHELL PLC, PetroChina International (Singapore) Pte. Ltd. (Parent: PetroChina Company Limited), Glencore Singapore Pte. Ltd. (Parent: Glencore International AG), SENTEK MARINE & TRADING PTE LTD, TOTAL ENERGIES, Vitol Marine Fuels Pte. Ltd. (Parent: Vitol Group), SK Energy International Pte. Ltd. (Parent: SK INNOVATION, CO. LTD.), EXXON MOBIL CORPORATION, EQUATORIAL MARINE FUEL MANAGEMENT SERVICES PTE LTD, and BP P.L.C, among others.

The Singapore bunker fuel market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed