Silage Film Market Size, Share, Trends, Growth 2034

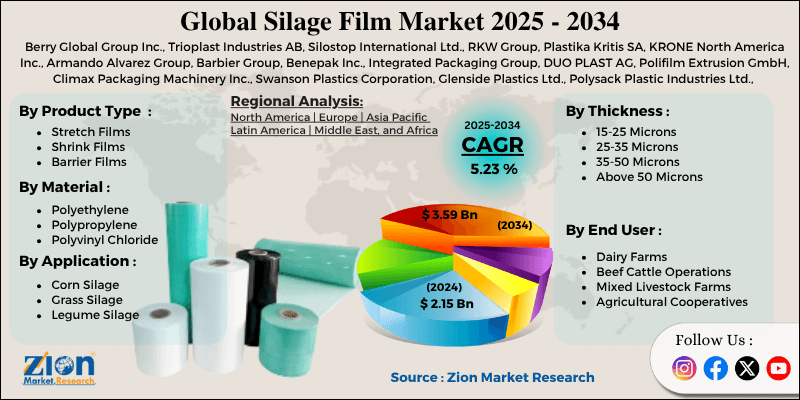

Silage Film Market By Product Type (Stretch Films, Shrink Films, Barrier Films, and Biodegradable Films), By Material (Polyethylene, Polypropylene, Polyvinyl Chloride, and Bio-based Materials), By Application (Corn Silage, Grass Silage, Legume Silage, and Other Crops), By End-User (Dairy Farms, Beef Cattle Operations, Mixed Livestock Farms, and Agricultural Cooperatives), By Thickness (15-25 Microns, 25-35 Microns, 35-50 Microns, and Above 50 Microns), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

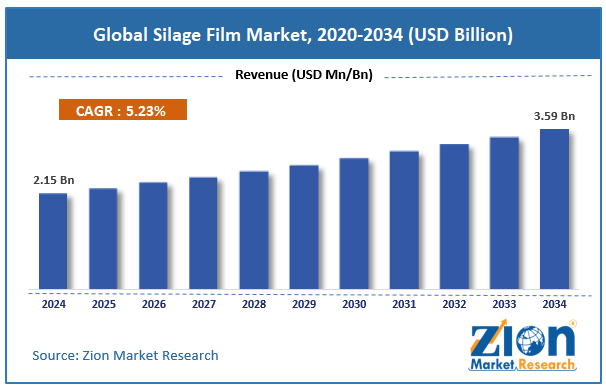

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.15 Billion | USD 3.59 Billion | 5.23% | 2024 |

Silage Film Industry Perspective:

The global silage film market was valued at approximately USD 2.15 billion in 2024 and is expected to reach around USD 3.59 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 5.23% between 2025 and 2034.

Silage Film Market: Overview

Silage films are specially made to protect and preserve fermented livestock feed in airtight, anaerobic conditions. They seal chopped and compacted crops to allow proper fermentation while blocking moisture, oxygen, and UV rays. The silage film market supports dairy farms that need high-quality feed, beef ranchers managing seasonal supplies, mixed farms aiming to cut feed costs, and cooperatives that serve many producers.New silage films offer better puncture resistance, cling, stretch, and weather protection for reliable long-term storage. They help maintain feed quality over time, making them essential for farms that want steady nutrition, less waste, and year-round efficiency.

The growing global demand for high-quality animal protein and increasing focus on sustainable livestock feeding practices are expected to drive significant growth in the silage film market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global Silage Film market is estimated to grow annually at a CAGR of around 5.23% over the forecast period (2025-2034)

- In terms of revenue, the global Silage Film market size was valued at around USD 2.15 billion in 2024 and is projected to reach USD 3.59 billion by 2034.

- The silage film market is projected to grow significantly due to the increasing livestock population, rising demand for quality animal feed preservation, expansion of commercial dairy operations, and growing awareness of feed waste reduction benefits.

- Based on product type, stretch films lead the segment and will continue to dominate the global market.

- Based on material, polyethylene is expected to lead the market.

- Based on application, corn silage is anticipated to command the largest market share.

- Based on end-user, dairy farms are expected to lead the market during the forecast period.

- Based on region, Europe is projected to lead the global market during the forecast period.

Silage Film Market: Growth Drivers

Increasing global livestock population and meat consumption demand

The silage film market is growing fast due to the rising global livestock population and strong demand for animal protein in both developed and developing countries. In emerging markets, growing populations and higher incomes are increasing demand for dairy, beef, and other animal-based products.To meet this demand, livestock producers are expanding and need reliable ways to store feed that retains its nutritional value and reduces waste year-round. Commercial dairy farms and cattle ranches use silage films to secure a steady feed supply during bad weather and seasonal changes.

As farms aim for higher milk output, better meat quality, and healthier animals, preserving feed quality becomes more important. Silage films help producers store large amounts of feed, reduce outside feed dependence, and manage costs while keeping animals well-nourished.

Technological advancement in film manufacturing and material science

The silage film industry is growing with ongoing technology innovations that improve film strength, performance, and ease of use for storing livestock feed. New manufacturing methods have created multi-layer films with stronger barriers, better puncture resistance, and improved cling, offering stronger feed protection.Advances in polymer science have made films more stretchable, tear-resistant, and weather-stable, which increases their storage life and reduces the frequency of replacement.

Additives like UV stabilizers, anti-static agents, and antimicrobial features help films work better in different weather conditions. Better production techniques have also cut costs while improving film quality, making them easier for smaller farms to afford. These improvements help livestock producers store feed more effectively, reduce losses, and get better value from their feed storage systems.

Silage Film Market: Restraints

Environmental concerns and plastic waste management challenges

The silage film market is facing pressure from environmental regulations and growing concerns about plastic waste in agriculture. Used silage films create a large amount of waste that must be recycled or thrown away, adding cost and logistics issues for farmers.

Many regions do not have proper recycling systems for farm plastics, so a lot of waste ends up polluting the environment. Bans on single-use plastics and plastic taxes are increasing costs and could slow market growth.

Environmental groups and eco-conscious consumers are calling for less plastic use in agriculture, which could hurt the image of farmers who rely on these films. These concerns may limit market growth in places with strict regulations or strong green movements.

Silage Film Market: Opportunities

Development of biodegradable and sustainable film alternatives

The silage film market has opportunities through biodegradable and eco-friendly film options that tackle environmental concerns while preserving feed. Bio-based polymers made from renewable sources help reduce reliance on fossil fuels and lower environmental impact. Research is focused on compostable films that break down in the soil, solving disposal problems while still protecting the feed.

Government incentives and sustainability programs can promote eco-friendly film use by offering subsidies or tax breaks. Consumer and business focus on sustainability is pushing demand for products that are responsible across the supply chain.

Silage Film Market: Challenges

Seasonal demand fluctuations and inventory management complexity

The silage film market sees seasonal demand patterns that create inventory and cash flow challenges for manufacturers and distributors. During harvest seasons, demand spikes sharply, followed by long, low-demand periods, making production and storage difficult. Companies must stock enough inventory for peak seasons while keeping carrying costs low in off-seasons.

Weather changes and shifting harvest schedules can suddenly affect demand, causing supply chain issues and delays. Differences in regional crops and growing seasons make forecasting and distribution more complex.

Fluctuations in raw material and energy prices during the year also affect pricing and profit margins. Managing seasonal labor and production levels adds to the difficulty. Dealing with these seasonal issues needs better forecasting, flexible production, and smart inventory planning.

Silage Film Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Silage Film Market |

| Market Size in 2024 | USD 2.15 Billion |

| Market Forecast in 2034 | USD 3.59 Billion |

| Growth Rate | CAGR of 5.23% |

| Number of Pages | 213 |

| Key Companies Covered | Berry Global Group Inc., Trioplast Industries AB, Silostop International Ltd., RKW Group, Plastika Kritis SA, KRONE North America Inc., Armando Alvarez Group, Barbier Group, Benepak Inc., Integrated Packaging Group, DUO PLAST AG, Polifilm Extrusion GmbH, Climax Packaging Machinery Inc., Swanson Plastics Corporation, Glenside Plastics Ltd., Polysack Plastic Industries Ltd., Polystar Plastics Ltd., Flexsol Packaging Corporation, Ginegar Plastic Products Ltd., Aspla Packaging Solutions, and others. |

| Segments Covered | By Product Type, By Material, By Application, By End User, By Thickness, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Silage Film Market: Segmentation

The global silage film market is segmented into product type, material, application, end-user, thickness, and region.

Based on product type, the market is segregated into stretch films, shrink films, barrier films, and biodegradable films. Stretch films lead the market due to their superior application ease, excellent cling properties, and widespread adoption across various livestock operations for effective feed preservation.

Based on material, the silage film industry is classified into polyethylene, polypropylene, polyvinyl chloride, and bio-based materials. Polyethylene holds the largest market share due to its excellent barrier properties, cost-effectiveness, processing versatility, and proven performance in diverse agricultural applications.

Based on application, the silage film market is divided into corn silage, grass silage, legume silage, and other crops. Corn silage is expected to lead the market during the forecast period due to its high nutritional value, widespread cultivation, and importance as a primary feed source for dairy and beef operations.

Based on end-users, the market is segmented into dairy farms, beef cattle operations, mixed livestock farms, and agricultural cooperatives. Dairy farms lead the market share due to their intensive feed requirements, focus on consistent milk production, and need for high-quality preserved feed throughout the year.

Silage Film Market: Regional Analysis

Europe to lead the market

Europe leads the silage film market due to intensive farming, advanced agricultural technology, and strong sustainability regulations. The region makes up around 35% of the global market, with Germany, France, and the Netherlands being top consumers.

European dairy farms are well-developed and need reliable feed preservation to meet efficiency and animal welfare standards. The region’s focus on innovation and sustainability boosts demand for high-tech and eco-friendly silage films.

Strong cooperative farming systems and government backing for modern methods support ongoing demand. EU rules on animal care and feed quality help drive market growth. The presence of top agricultural film producers and research centers builds a strong base for new product development and market expansion.

North America is expected to show strong growth

North America is seeing growth in the silage film market as farms expand and modernize to meet both domestic and export demand for dairy and meat. Large-scale farms need feed preservation solutions that manage high volumes and maintain feed quality.

Government support for agricultural productivity and sustainability encourages silage film use. Precision agriculture and data-driven farming are raising awareness about reducing feed waste. The rise of organic and sustainable farming creates demand for certified silage film products.

Higher feed costs and unpredictable weather are pushing farmers to adopt preservation technologies that reduce losses and improve feed efficiency. The region’s strong agricultural infrastructure and wide distribution networks support steady growth and product access.

Recent Market Developments:

- In May 2025, Silostop launched a new line of biodegradable silage films made from renewable bio-based polymers, targeting environmentally conscious livestock producers seeking sustainable feed preservation solutions.

Silage Film Market: Competitive Analysis

The global silage film market is led by players like:

- Berry Global Group Inc.

- Trioplast Industries AB

- Silostop International Ltd.

- RKW Group

- Plastika Kritis SA

- KRONE North America Inc.

- Armando Alvarez Group

- Barbier Group

- Benepak Inc.

- Integrated Packaging Group

- DUO PLAST AG

- Polifilm Extrusion GmbH

- Climax Packaging Machinery Inc.

- Swanson Plastics Corporation

- Glenside Plastics Ltd.

- Polysack Plastic Industries Ltd.

- Polystar Plastics Ltd.

- Flexsol Packaging Corporation

- Ginegar Plastic Products Ltd.

- Aspla Packaging Solutions

The global silage film market is segmented as follows:

By Product Type

- Stretch Films

- Shrink Films

- Barrier Films

- Biodegradable Films

By Material

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Bio-based Materials

By Application

- Corn Silage

- Grass Silage

- Legume Silage

- Other Crops

By End User

- Dairy Farms

- Beef Cattle Operations

- Mixed Livestock Farms

- Agricultural Cooperatives

By Thickness

- 15-25 Microns

- 25-35 Microns

- 35-50 Microns

- Above 50 Microns

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Silage films are specially made to protect and preserve fermented livestock feed in airtight, anaerobic conditions.

The silage film market is expected to be driven by the increasing global livestock population, rising demand for quality animal feed preservation, expansion of commercial dairy operations, technological advancement in film manufacturing, and growing awareness of feed waste reduction benefits.

According to our study, the global silage film market was worth around USD 2.15 billion in 2024 and is predicted to grow to around USD 3.59 billion by 2034.

The CAGR value of the silage film market is expected to be around 5.23% during 2025-2034.

The global Silage Film market will register the highest revenue contribution from Europe during the forecast period.

Key players in the silage film market include Berry Global Group Inc., Trioplast Industries AB, Silostop International Ltd., RKW Group, Plastika Kritis SA, KRONE North America Inc., Armando Alvarez Group, Barbier Group, Benepak Inc., Integrated Packaging Group, DUO PLAST AG, Polifilm Extrusion GmbH, Climax Packaging Machinery Inc., Swanson Plastics Corporation, Glenside Plastics Ltd., Polysack Plastic Industries Ltd., Polystar Plastics Ltd., Flexsol Packaging Corporation, Ginegar Plastic Products Ltd., and Aspla Packaging Solutions.

The report provides a comprehensive analysis of the silage film market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines competitive dynamics, technological innovations, application requirements, and agricultural practices that shape the livestock feed preservation market ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed