Sales Tax Software Market Size, Share, Growth Report 2032

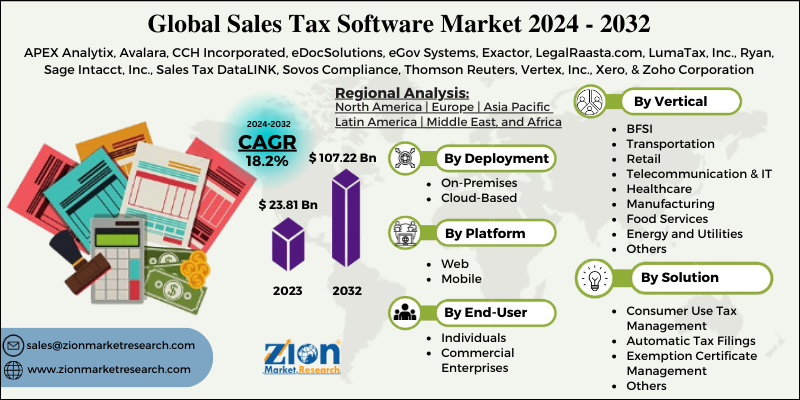

Sales Tax Software Market By Solution (Consumer Use Tax Management, Automatic Tax Filings, Exemption Certificate Management, and Others), By Deployment (On-Premises and Cloud-Based), By Platform Type (Web and Mobile), By Vertical (Banking, Financial Services, and Insurance (BFSI), Transportation, Retail, Telecommunication & IT, Healthcare, Manufacturing, Food Services, Energy and Utilities, and Others), and BY End-User (Individuals and Commercial Enterprises): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

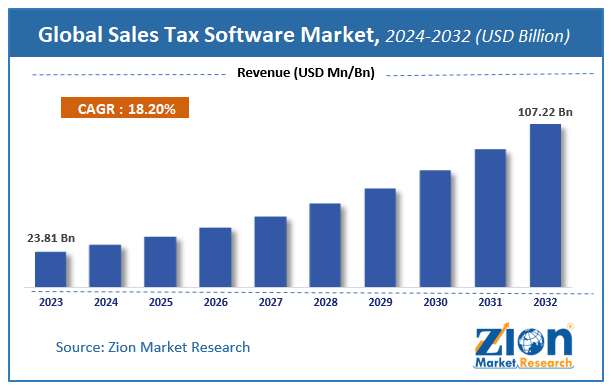

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.81 Billion | USD 107.22 Billion | 18.2% | 2023 |

Sales Tax Software Market: Size

The global Sales Tax Software market size was worth around USD 23.81 billion in 2023 and is predicted to grow to around USD 107.22 billion by 2032 with a compound annual growth rate (CAGR) of roughly 18.2% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the Sales Tax Software market on a global and regional level.

Sales Tax Software Market: Overview

Sales tax software helps businesses by utilizing consumer transactions and put them on the appropriate local and national rules and rates to collect accurate taxes. These systems are often incorporated with ERP systems and accounting software to ensure profits, projections, and budgets are exact across the group, e-commerce, and POS tools so that the taxes are correctly presented to customers and collected in transactions. This software helps in the elimination of tax-rate errors with automated VAT and sales-tax calculations. It also ensures compliance in all jurisdictions through automatic tax-law updates. It helps in the reduction of costs by increasing efficiency and eliminating error-prone spreadsheets, reliable tax calculations, and detailed reporting. It is used in various industries like BFSI, transportation, healthcare, retails, IT and telecommunication, etc.

The global sales tax software market is likely to be driven by the increasing demand for sales process automation in the years ahead. Manual work leads to various errors that cause miss-calculation of taxes, which has increased the demand for sales process automation over the estimated timeline. Furthermore, the increasing penetration of the internet, developing technologies, and rising software awareness among people are also driving the global sales tax software market. The use of IoT devices is increasing rapidly as it helps in improving efficiency and reducing human errors. The increasing penetration of IoT will be a major growth driver for the sales tax software market globally. However, huge initial investments for sales tax software installation and the need for skilled professionals to use this software may hamper the global sales tax software market.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, agreements, partnerships, collaborations & joint ventures, R&D, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis and product portfolio of various companies according to regions.

Sales Tax Software Market: Segmentation

The study provides a decisive view of the sales tax software market based on solution, deployment, platform, vertical, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

The solution segment includes consumer use tax management, automatic tax filings, exemption certificate management, and others.

The deployment segment includes on-premises and cloud-based. The platform type includes web and mobile.

The vertical segment includes banking, financial services, and insurance (BFSI), transportation, retail, telecommunication & it, healthcare, manufacturing, food services, energy and utilities, and others.

The end-users of this market are individuals and commercial enterprises.

Sales Tax Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sales Tax Software Market |

| Market Size in 2023 | USD 23.81 Billion |

| Market Forecast in 2032 | USD 107.22 Billion |

| Growth Rate | CAGR of 18.2% |

| Number of Pages | 110 |

| Key Companies Covered | APEX Analytix, Avalara, CCH Incorporated, eDocSolutions, eGov Systems, Exactor, LegalRaasta.com, LumaTax, Inc., Ryan, Sage Intacct, Inc., Sales Tax DataLINK, Sovos Compliance, Thomson Reuters, Vertex, Inc., Xero, and Zoho Corporation |

| Segments Covered | By solution, By deployment, By platform, By vertical, By end-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sales Tax Software Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further classification into major countries including the U.S., Canada, Germany, UK, Brazil, China, Japan, India, and Brazil.

By region, North America is expected to dominate the global sales tax software market in terms of revenue in 2023. The Asia Pacific is expected to show tremendous market growth over the forecast time period. Europe is expected to follow North America in terms of market share.

Sales Tax Software Market: Competitive Players

Some major players of the global sales tax software market are:

- APEX Analytix

- Avalara

- CCH Incorporated

- eDocSolutions

- eGov Systems

- Exactor

- LegalRaasta.com

- LumaTax Inc.

- Ryan

- Sage Intacct Inc.

- Sales Tax DataLINK

- Sovos Compliance

- Thomson Reuters

- Vertex Inc.

- Xero

- Zoho Corporation

The Global Sales Tax Software Market is segmented as follows:

Global Sales Tax Software Market: Solution Analysis

- Consumer Use Tax Management

- Automatic Tax Filings

- Exemption Certificate Management

- Others

Global Sales Tax Software Market: Deployment Analysis

- On-Premises

- Cloud-Based

Global Sales Tax Software Market: Platform Type Analysis

- Web

- Mobile

Global Sales Tax Software Market: Vertical Analysis

- BFSI

- Transportation

- Retail

- Telecommunication and IT

- Healthcare

- Manufacturing

- Food Services

- Energy and Utilities

- Others

Global Sales Tax Software Market: End-User Analysis

- Individuals

- Commercial Enterprises

Global Sales Tax Software Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sales tax software helps businesses by utilizing consumer transactions and put them on the appropriate local and national rules and rates to collect accurate taxes.

According to study, the Sales Tax Software Market size was worth around USD 23.81 billion in 2023 and is predicted to grow to around USD 107.22 billion by 2032.

The CAGR value of Sales Tax Software Market is expected to be around 18.2% during 2024-2032.

North America has been leading the Sales Tax Software Market and is anticipated to continue on the dominant position in the years to come.

The Sales Tax Software Market is led by players like APEX Analytix, Avalara, CCH Incorporated, eDocSolutions, eGov Systems, Exactor, LegalRaasta.com, LumaTax Inc., Ryan, Sage Intacct Inc., Sales Tax DataLINK, Sovos Compliance, Thomson Reuters, Vertex Inc., Xero, and Zoho Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed