Rx Medical Food Market Size, Share, Trends, Growth & Forecast 2034

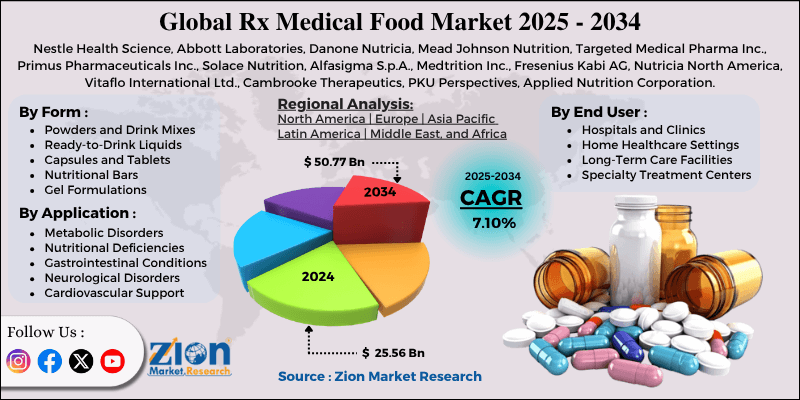

Rx Medical Food Market By Application (Metabolic Disorders, Nutritional Deficiencies, Gastrointestinal Conditions, Neurological Disorders, Cardiovascular Support, Immune System Enhancement), By Form (Powders and Drink Mixes, Ready-to-Drink Liquids, Capsules and Tablets, Nutritional Bars, Gel Formulations, Liquid Concentrates), By End-User (Hospitals and Clinics, Home Healthcare Settings, Long-Term Care Facilities, Specialty Treatment Centers, Rehabilitation Units, Outpatient Care Centers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

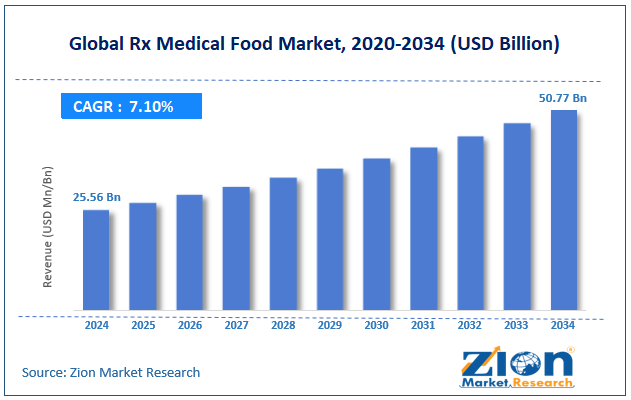

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.56 Billion | USD 50.77 Billion | 7.10% | 2024 |

Rx Medical Food Market: Industry Size

The global Rx medical food market size was worth approximately USD 25.56 billion in 2024 and is projected to grow to around USD 50.77 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.10% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global Rx medical food market is estimated to grow annually at a CAGR of around 7.10% over the forecast period (2025-2034).

- In terms of revenue, the global Rx medical food market size was valued at approximately USD 25.56 billion in 2024 and is projected to reach USD 50.77 billion by 2034.

- The Rx medical food market is projected to grow significantly due to the expansion of chronic disease management programs and the rise of personalized nutrition therapy initiatives.

- Based on application, the metabolic disorders segment is expected to lead the market, while the neurological disorders segment is anticipated to experience significant growth.

- Based on form, the powders and drink mixes segment is the dominating segment, while the capsules and tablets segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the hospitals and clinics segment is expected to lead the market compared to the outpatient care centers segment.

- Based on region, North America is projected to dominate the global Rx medical food market during the estimated period, followed by Europe.

Rx Medical Food Market: Overview

Rx medical food refers to specially formulated nutritional products created to meet unique dietary needs for the management of diseases or medical conditions under the supervision of a physician. These products are designed with scientifically proven ingredients, targeted nutrient blends, and bioavailable compounds to address specific metabolic or physiological requirements. Developing effective medical foods requires a strong understanding of disease mechanisms, nutritional science, and patient compliance. Current approaches include condition-focused formulations, carefully balanced nutrient ratios, and user-friendly delivery systems that combine therapeutic effectiveness with acceptable taste and ease of use.

To maintain safety, manufacturers follow strict quality control procedures, perform clinical validation studies, and adhere to standardized production methods. In addition, comprehensive regulations guide medical food manufacturing to ensure nutritional adequacy, proper safety testing, and the need for medical supervision.

The growing prevalence of chronic diseases requiring nutritional intervention is expected to drive substantial growth in the Rx medical food market throughout the forecast period.

Rx Medical Food Market Dynamics

Growth Drivers

How is the rising chronic disease burden and aging population demographics propelling the Rx medical food market growth?

The Rx medical food market is growing steadily as healthcare systems respond to rising cases of chronic conditions that require specialized nutritional management. Patients with metabolic syndromes, inherited disorders, and age-related conditions often need targeted nutritional support that works alongside standard medical treatments. Healthcare providers recognize that effective dietary therapy can enhance patient outcomes, decrease hospitalizations, and improve the quality of life for individuals managing complex health conditions.

Medical professionals and nutrition experts are adding evidence-based medical foods into full treatment plans to achieve better therapeutic results. Important features such as accurate nutrient dosing, standardized formulations, and proven scientific ingredients have improved patient adherence and clinical success. Ongoing research and clinical trials continue to demonstrate that medical nutrition therapy is a cost-effective approach to managing various diseases. This approach highlights the growing role of medical foods in integrated care systems, patient compliance, and better overall health outcomes.

Advancements in nutritional science and personalized medicine

The global Rx medical food market is expanding as advances in nutritional genomics, metabolic profiling, and personalized therapy gain momentum. Medical foods are designed to correct biochemical imbalances, support key metabolic processes, and deliver targeted nutritional care tailored to patient-specific needs. Research institutions, pharmaceutical companies, and nutrition-focused firms are actively creating condition-specific formulations, supported by clinical studies and scientific understanding.

Collaborative research programs and healthcare partnerships are driving innovation in medical food development, ensuring products align with therapeutic goals and patient requirements. Hospital nutrition units and specialized clinics are also increasing the demand for physician-supervised medical foods, strengthening treatment effectiveness and patient satisfaction.

Restraints

How are regulatory classification complexity and reimbursement coverage limiting the growth of the Rx medical food market?

A major challenge for the Rx medical food industry is the complex regulatory definitions that separate medical foods from dietary supplements, pharmaceuticals, and regular foods. Many healthcare systems do not have clear reimbursement policies for medical foods, which creates financial difficulties for patients who need long-term nutritional therapy.

To overcome these issues, manufacturers must navigate various regulatory frameworks, provide comprehensive clinical documentation, and establish clear standards for medical necessity. Despite these efforts, coverage limitations remain, especially for patients needing continuous nutritional support or those with rare metabolic conditions that require highly specialized and costly formulations. Differences in insurance policies and the structure of healthcare systems across regions create additional barriers.

Opportunities

How is integration with digital health platforms and outcome monitoring creating opportunities in the Rx medical food market?

The Rx medical food market is expanding with innovations in connected health tools, remote monitoring systems, and data-driven nutrition management, which support the changing model of healthcare delivery. Companies are designing smart packaging, mobile health apps, and digital tracking systems to improve treatment adherence while ensuring therapeutic effectiveness. Patient-focused solutions, including personalized flavors, convenient delivery options, and subscription-based services, are gaining popularity.

At the same time, manufacturers are creating condition-specific product lines, with targeted formulations, age-appropriate products, and culturally adapted versions that appeal to diverse patient groups. To add further value, developers are combining medical foods with telehealth services, virtual nutrition counseling, and educational platforms, allowing patients to understand both benefits and correct usage. These advancements make medical foods easier to access for people with complex health needs and more effective in delivering measurable health improvements.

Challenges

Clinical validation requirements and physician awareness gaps

The Rx medical food industry faces challenges because of strict clinical evidence requirements and limited awareness among healthcare providers about medical nutrition therapy. Standards for proving the effectiveness of medical foods are not consistent across different therapeutic areas, making it difficult for manufacturers to create products with uniform clinical claims. This affects product formulation, clinical trial design, and evidence generation, which often extends development timelines for both manufacturers and healthcare institutions.

Another barrier is the limited focus on nutrition in medical education, which can influence how often medical foods are prescribed and how well they are integrated into treatment plans. These issues highlight the need for better medical training, standardized clinical protocols, and stronger collaboration in research. Creating unified evidence standards and prescribing guidelines will build confidence in medical foods, reduce uncertainty in therapy, and support steady market growth. It also protects patients and genuine manufacturers from unproven or ineffective products.

Rx Medical Food Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rx Medical Food Market |

| Market Size in 2024 | USD 25.56 Billion |

| Market Forecast in 2034 | USD 50.77 Billion |

| Growth Rate | CAGR of 7.10% |

| Number of Pages | 215 |

| Key Companies Covered | Nestle Health Science, Abbott Laboratories, Danone Nutricia, Mead Johnson Nutrition, Targeted Medical Pharma Inc., Primus Pharmaceuticals Inc., Solace Nutrition, Alfasigma S.p.A., Medtrition Inc., Fresenius Kabi AG, Nutricia North America, Vitaflo International Ltd., Cambrooke Therapeutics, PKU Perspectives, Applied Nutrition Corporation, and others. |

| Segments Covered | By Application, By Form, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rx Medical Food Market: Segmentation

The global Rx medical food market is segmented based on application, form, end-user, and region.

Based on application, the global Rx medical food industry is categorized into metabolic disorders, nutritional deficiencies, gastrointestinal conditions, neurological disorders, cardiovascular support, and immune system enhancement. Metabolic disorders lead the market due to the high prevalence of inherited metabolic diseases and established clinical protocols requiring nutritional management.

Based on form, the global Rx medical food market is classified into powders and drink mixes, ready-to-drink liquids, capsules and tablets, nutritional bars, gel formulations, and liquid concentrates. Powders and drink mixes are expected to lead the market during the forecast period due to their versatile preparation options, cost-effectiveness for long-term use, and superior nutrient stability.

Based on end-user, the global market is divided into hospitals and clinics, home healthcare settings, long-term care facilities, specialty treatment centers, rehabilitation units, and outpatient care centers. Hospitals and clinics hold the largest market share due to their central role in diagnosis and treatment initiation, as well as the continuous need for physician-supervised nutritional interventions to support complex patient care.

Rx Medical Food Market: Regional Analysis

North America leads the global market

North America leads the global Rx medical food market due to its advanced healthcare infrastructure, strong use of evidence-based nutrition therapy, and well-developed medical nutrition programs. Nearly 40% of worldwide medical food innovation comes from this region, with the United States contributing the most progress because of its sophisticated healthcare system and focus on integrated disease management. Healthcare providers in North America rely on scientifically validated medical foods that deliver measurable outcomes, improve patient compliance, and offer comprehensive nutritional support, boosting both therapeutic effectiveness and care coordination. The region also benefits from top research institutions, skilled clinical investigators, and a wide network of physicians and registered dietitians. Clear regulatory guidelines and established definitions for medical foods further build confidence in prescribing nutritional solutions.

Market growth is supported by rising chronic disease rates, an aging population, and greater recognition of nutrition as an essential part of medicine. North American companies are leaders in developing condition-specific formulations, evidence-based products, and patient-centered delivery systems. In recent years, manufacturers have increased investment in clinical validation studies, real-world evidence collection, and outcome-driven product design. The integration of digital health tools, telehealth nutrition services, and remote monitoring systems is also expanding medical food programs, improving patient access and long-term treatment adherence.

How is Europe expected to show strong growth in the global Rx medical food market?

The Rx medical food market in Europe is expanding as healthcare systems adopt integrated nutrition therapy, preventive medicine, and value-based care models. Medical foods are widely used in metabolic clinics, specialized treatment centers, and disease management programs because they improve patient outcomes, lower healthcare costs, and raise quality of life. The European Union has introduced stringent medical food regulations that harmonize standards across member states, ensuring patient safety and supporting consistent market growth. As clinical evidence of the effectiveness of medical food grows, its adoption is spreading from specialized metabolic clinics to general hospitals, primary care settings, and home healthcare programs.

European manufacturers are also focusing on sustainability and ethical sourcing to meet expectations for environmentally responsible and transparently produced ingredients. Rising demand for organic-certified and clean-label medical foods reflects patient interest in product quality and ingredient clarity. Government healthcare programs and medical societies are promoting evidence-based nutrition, strengthening trust in therapeutic medical foods. Providers are integrating medical nutrition therapy into care pathways for metabolic disorders, gastrointestinal diseases, and neurological conditions. Leading European healthcare institutions are also partnering with global researchers to improve formulations, expand access, and build stronger clinical evidence.

Recent Market Developments

- In May 2025, Danone acquired a majority stake in Kate Farms, a U.S. maker of plant-based organic nutritional formulas for individuals with medical feeding needs, expanding Danone’s portfolio in specialized nutrition.

- In June 2025, Abbott published results from its Healthy Food Rx “food-is-medicine” program, showing that participants with diabetes improved diet quality and reported better health status through home-delivered healthy food boxes plus nutrition education.

Rx Medical Food Market: Competitive Analysis

The leading players in the global Rx medical food market are:

- Nestle Health Science

- Abbott Laboratories

- Danone Nutricia

- Mead Johnson Nutrition

- Targeted Medical Pharma Inc.

- Primus Pharmaceuticals Inc.

- Solace Nutrition

- Alfasigma S.p.A.

- Medtrition Inc.

- Fresenius Kabi AG

- Nutricia North America

- Vitaflo International Ltd.

- Cambrooke Therapeutics

- PKU Perspectives

- Applied Nutrition Corporation

The global Rx medical food market is segmented as follows:

By Application

- Metabolic Disorders

- Nutritional Deficiencies

- Gastrointestinal Conditions

- Neurological Disorders

- Cardiovascular Support

- Immune System Enhancement

By Form

- Powders and Drink Mixes

- Ready-to-Drink Liquids

- Capsules and Tablets

- Nutritional Bars

- Gel Formulations

- Liquid Concentrates

By End User

- Hospitals and Clinics

- Home Healthcare Settings

- Long-Term Care Facilities

- Specialty Treatment Centers

- Rehabilitation Units

- Outpatient Care Centers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Rx medical food consists of specially formulated nutritional products and therapeutic food systems designed to manage specific diseases or medical conditions under physician supervision while providing targeted nutrients, maintaining dietary compliance, and supporting clinical treatment protocols throughout therapy duration.

The global Rx medical food market is projected to grow due to increasing chronic disease prevalence, rising awareness of nutrition-based therapies, and growing emphasis on personalized medicine approaches and evidence-based nutritional interventions.

According to a study, the global Rx medical food market size was worth around USD 25.56 billion in 2024 and is predicted to grow to around USD 50.77 billion by 2034.

The CAGR value of the Rx medical food market is expected to be around 7.10% during 2025-2034.

North America is expected to lead the global Rx medical food market during the forecast period.

The major players profiled in the global Rx medical food market include Nestle Health Science, Abbott Laboratories, Danone Nutricia, Mead Johnson Nutrition, Targeted Medical Pharma Inc., Primus Pharmaceuticals Inc., Solace Nutrition, Alfasigma S.p.A., Medtrition Inc., Fresenius Kabi AG, Nutricia North America, Vitaflo International Ltd., Cambrooke Therapeutics, PKU Perspectives, and Applied Nutrition Corporation.

The report examines key aspects of the Rx medical food market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges impacting the market.

The growth of the Rx medical food market is influenced by regulatory standards, including medical food definitions, physician supervision requirements, manufacturing quality standards, and labeling regulations. Environmental factors, including sustainable ingredient sourcing, ethical manufacturing practices, and considerations for packaging waste, also shape market expansion by driving innovation in responsible production methods, promoting transparency in ingredient origins, and meeting patient demand for environmentally conscious healthcare products.

The growth of the Rx medical food market is impacted by regulatory and quality factors such as clinical validation requirements, nutrient bioavailability standards, manufacturing consistency controls, and therapeutic claim substantiation, promoting safe and effective medical nutrition solutions.

Macroeconomic factors such as healthcare spending patterns, insurance coverage policies, ingredient cost fluctuations, and demographic aging trends will significantly influence the Rx medical food market growth through demand patterns, reimbursement structures, and market expansion across different therapeutic segments.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed