Rigid Food Container Market Size, Share, Trends, Growth 2032

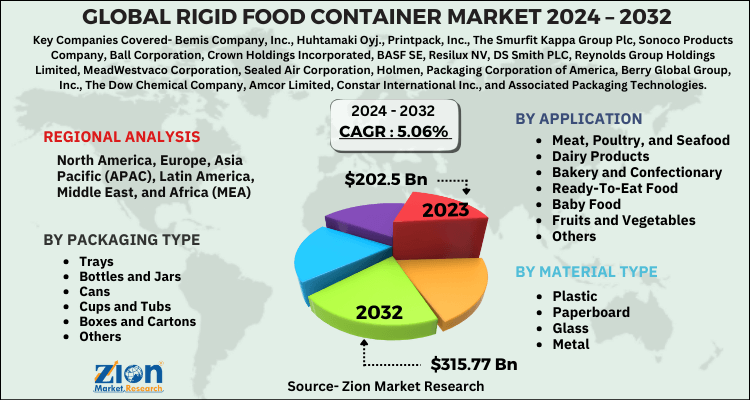

Rigid Food Container Market By Material Type (Plastic, Paperboard, Glass, and Metal), By Packaging Type (Trays, Bottles & Jars, Cans, Cups & Tubs, Boxes & Cartons, and Others), and By Application (Meat, Poultry, & Seafood, Dairy Products, Bakery & Confectionary, Ready-To-Eat Food, Baby Food, Fruits & Vegetables, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

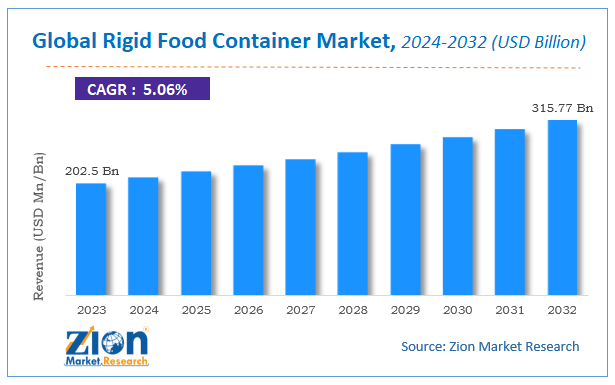

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 202.5 Billion | USD 315.77 Billion | 5.06% | 2023 |

Rigid Food Container Industry Perspective:

The global rigid food container market size was worth around USD 202.5 billion in 2023 and is predicted to grow to around USD 315.77 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.06% between 2024 and 2032.

In order to give the users of this report a comprehensive view of the rigid food container market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Rigid Food Container Market: Growth Drivers

Packaging is used to preserve and enclose products for numerous purposes, such as distribution, sales, and storage. Rigid containers are generally used in the food and beverage industry for preventing damage and handling various consumable items. Rigid food containers have gained popularity in recent years, owing to their supreme rigidity, high impact strength, etc. Food containers are majorly used for storage and preservation and transportation for increasing the shelf-life of products.

The primary factor that is likely to drive the rigid food container market in the upcoming years is the rising consumer awareness about environmental, sustainability, and packaging of food issues. Growing population, rapid urbanization, and lifestyle-related changes have resulted in changing food habits of consumers along with the rising need for ready-to-eat, packaged, and non-packaged food products that require prolong storage capacity.

The food and beverage industry is increasingly using rigid food containers due to enhanced packaging options. Food products that are stored at room temperature might give rise to fungal or bacterial growth and can lead to food poisoning. These risks can be avoided by using rigid food containers. Thus, these are some factors that are expected to drive the rigid food container market over the forecast timeframe.

The report provides company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers the product portfolio of various companies according to the region.

Rigid Food Container Market: Segmentation

The study provides a decisive view of the rigid food container market by segmenting the market based on material type, packaging type, application, and region.

Based on the material type, the rigid food container market is segmented into plastic, paperboard, glass, and metal.

By packaging type, the rigid food container market is segmented into cans, cups and tubs, trays, boxes and cartons, bottles and jars, and others.

By application, this market is divided into meat, baby food, dairy products, bakery and confectionary, ready-to-eat food, poultry and seafood, fruits and vegetables, and others.

Rigid Food Container Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rigid Food Container Market |

| Market Size in 2023 | USD 202.5 Billion |

| Market Forecast in 2032 | USD 315.77 Billion |

| Growth Rate | CAGR of 5.06% |

| Number of Pages | 110 |

| Key Companies Covered | Bemis Company, Inc., Huhtamaki Oyj., Printpack, Inc., The Smurfit Kappa Group Plc, Sonoco Products Company, Ball Corporation, Crown Holdings Incorporated, BASF SE, Resilux NV, DS Smith PLC, Reynolds Group Holdings Limited, MeadWestvaco Corporation, Sealed Air Corporation, Holmen, Packaging Corporation of America, Berry Global Group, Inc., The Dow Chemical Company, Amcor Limited, Constar International Inc., and Associated Packaging Technologies, Inc., among others |

| Segments Covered | By material type, By packaging type, By application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rigid Food Container Market: Regional Analysis

The regional segmentation includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

By region, the global rigid food container market includes North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa. The Asia Pacific is expected to dominate the global rigid food container market over the forecast timeline. This regional growth can be attributed to the increasing demand for rigid food containers, rapid industrialization, the rising disposable income of the middle-class population, improved standard of living, and growing need for canned foods. The North American rigid food container market is expected to contribute notably to the global market growth over the forecast timespan, owing to the thriving food and beverages sector in the region.

Rigid Food Container Market: Competitive Analysis

The global rigid food container market is led by players like:

- Bemis Company, Inc

- Huhtamaki Oyj

- Printpack, Inc

- The Smurfit Kappa Group Plc

- Sonoco Products Company

- Ball Corporation

- Crown Holdings Incorporated

- BASF SE

- Resilux NV

- DS Smith PLC

- Reynolds Group Holdings Limited

- MeadWestvaco Corporation

- Sealed Air Corporation

- Holmen

- Packaging Corporation of America

- Berry Global Group, Inc

- The Dow Chemical Company

- Amcor Limited

- Constar International Inc

- Associated Packaging Technologies, Inc

This report segments the global rigid food container market into:

Global Rigid Food Container Market: Material Type Analysis

- Plastic

- Paperboard

- Glass

- Metal

Global Rigid Food Container Market: Packaging Type Analysis

- Trays

- Bottles and Jars

- Cans

- Cups and Tubs

- Boxes and Cartons

- Others

Global Rigid Food Container Market: Application Analysis

- Meat, Poultry, and Seafood

- Dairy Products

- Bakery and Confectionary

- Ready-To-Eat Food

- Baby Food

- Fruits and Vegetables

- Others

Global Rigid Food Container Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A rigid food container is a form of packaging that is specifically designed to safeguard and store food products. These containers are constructed from materials that offer durability and protection for the contents within, resulting in a solid, inflexible structure. A diverse array of food items, such as frozen foods, snacks, dairy products, and ready-to-eat meals, are frequently packaged in rigid food receptacles.

The demand for durable and protective rigid food containers is being driven by the increasing demand for convenient, ready-to-eat, and on-the-go food products. This trend is influenced by the growing urbanization and the hectic lifestyles of many individuals. This is a critical factor for both consumers and manufacturers, as rigid food containers provide exceptional protection against contamination, moisture, and air, thereby preserving the freshness and extending the shelf life of food products.

The global rigid food container market size was worth around USD 202.5 billion in 2023 and is predicted to grow to around USD 315.77 billion by 2032.

The global rigid food container market a compound annual growth rate (CAGR) of roughly 5.06% between 2024 and 2032.

The regional segmentation includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Some key players of the global rigid food container market include Bemis Company, Inc., Huhtamaki Oyj., Printpack, Inc., The Smurfit Kappa Group Plc, Sonoco Products Company, Ball Corporation, Crown Holdings Incorporated, BASF SE, Resilux NV, DS Smith PLC, Reynolds Group Holdings Limited, MeadWestvaco Corporation, Sealed Air Corporation, Holmen, Packaging Corporation of America, Berry Global Group, Inc., The Dow Chemical Company, Amcor Limited, Constar International Inc., and Associated Packaging Technologies, Inc., among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed