RFID Equipment Market Size, Share, Analysis, Trends, Growth, 2032

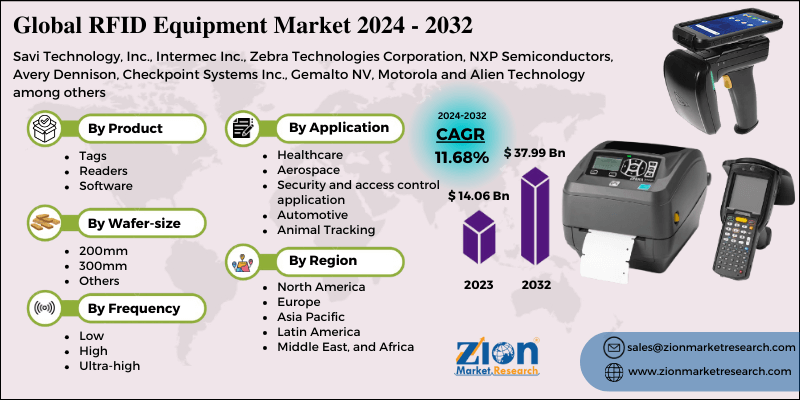

RFID Equipment Market By Product Type (Tags, Readers, and Software), Wafer-size Type (200mm, 300mm, and Others) By Frequency Type (Low, High, and Ultra-high), and By Application (Healthcare, Aerospace, Defense, Logistics and transportation, Retail, Security and access control application, Automotive, and Animal Tracking): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

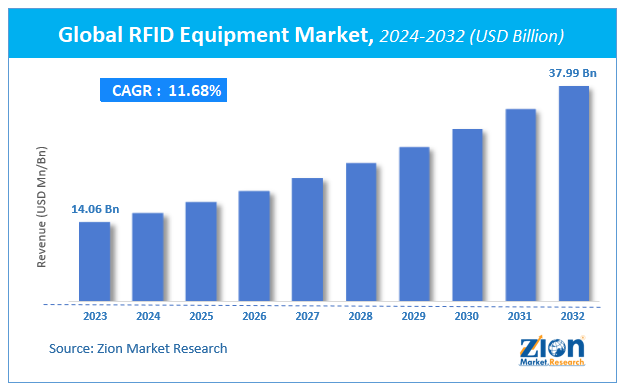

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.06 Billion | USD 37.99 Billion | 11.68% | 2023 |

RFID Equipment Market Insights

According to a report from Zion Market Research, the global RFID Equipment Market was valued at USD 14.06 Billion in 2023 and is projected to hit USD 37.99 Billion by 2032, with a compound annual growth rate (CAGR) of 11.68% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the RFID Equipment Market industry over the next decade.

RFID Equipment Market: Overview

Radio Frequency Identification (RFID) is a small electronic device consisting of a small chip, antenna and a two-way transmitter-receiver called interrogator. Radio waves are used to read the electronically stored information on the tags or objects. The technological advancements in RFIDs have resulted in real-time tracking of objects, animals, and other things by using electromagnetic fields. There are two types of RFID tags namely passive and active. The passive RFID tag does not contain a battery and the power is supplied by the reader.

RFID Equipment Market: Growth Factors

RFIDs are used widely in various industries such as healthcare, logistics and transportation, security and access control, automotive, sports, retail, animal tracking, aerospace, defense and others. Due to its widened use, the market is anticipated to witness a significant growth in forecast horizon. Further, the increasing use of RFID technology in various verticals and low cost of RFIDs are expected to be the major factors driving the growth of this market. In addition, use of RFID technology in inventory management is expected to boost the growth of RFID equipment market in coming years. Inventory management involves keeping track of products or objects, storage of components required for production and monitoring the quantity of finished products. This is considered as one of the important drivers of this market because a slight negligence in inventory management can lead to a substantial financial loss. Furthermore, several governments have made animal tagging mandatory in order to track and monitor the animals using their unique Animal Identification Number (AIN).

However, high installation cost and maintenance cost of RFIDs are expected to be the factors restraining the growth of this market. Device inoperability away from the hostile environment is a major challenge for the market. In coming years, the wide use of RFIDs in public transportation, healthcare, animal tracking is expected to provide major potential opportunities for RFID equipment manufacturers.

RFID Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | RFID Equipment Market |

| Market Size in 2023 | USD 14.06 Billion |

| Market Forecast in 2032 | USD 37.99 Billion |

| Growth Rate | CAGR of 11.68% |

| Number of Pages | 150 |

| Key Companies Covered | Savi Technology, Inc., Intermec Inc., Zebra Technologies Corporation, NXP Semiconductors, Avery Dennison, Checkpoint Systems Inc., Gemalto NV, Motorola and Alien Technology among others |

| Segments Covered | By Product Type, By Wafer-size Type, By Frequency Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

RFID Equipment Market: Segmentation

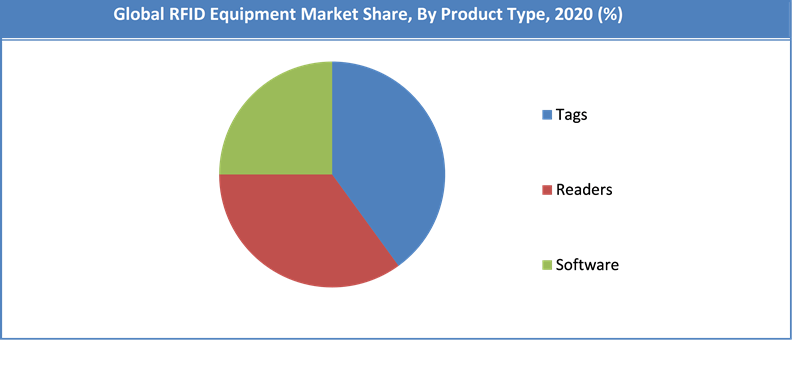

The segmentation of RFID equipment market is made on the basis of product, wafer-size, frequency, applications, and region. On a product basis, the segmentation is tags, reader, and software. Whereas, on the basis of wafer-size RFID equipment market is categorized as 200mm, 300m, and others. Further, frequency wise the classifications are low, high, and ultra-high frequencies. Furthermore, on an application basis, they are divided into aerospace and defense, healthcare, animal tracking, retail, sports, security and access control, transportation and others.

On the basis of product type, RFID tags segment is expected to dominate the global market owing to the increasing demand for RFID tags in the healthcare sector for the tracking and classification of medical instruments. In addition to this, upsurge in penetration of advanced technologies such as RAIN RFID tag in various industry verticals drives growth of this segment. Moreover, the aerospace and automotive industry is adopting the RFID technologies for inventory management of spare parts, the tracking of vehicles, and visibility in logistics operations. However, software segment is expected to witness highest growth rate during the forecast period.

Regional Analysis Preview

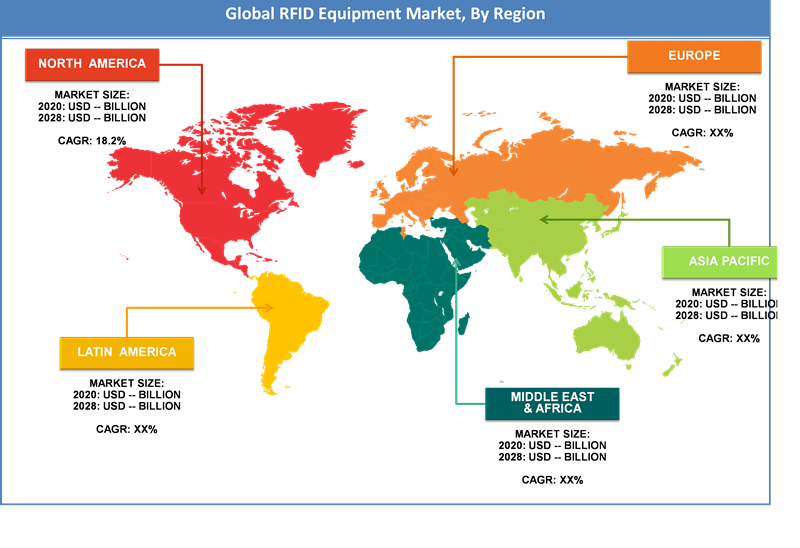

The region that is having an influential share in the Global RFID Equipment Market is North America region. Owing to the huge developments and a higher rate of adoption, North America RFID Equipment market contributes the highest market in 2020. In addition, the large RFID Equipment market in the region drives growth of the market.

Whereas huge demand for the RFID devices from retail and consumer goods industry verticals are like to boost the RFID Equipment market in the Asia Pacific. The RFID Equipment market in this region is likely to grow at a highest CAGR over the forecast period.

RFID Equipment Market: Competitive Landscape

Some of key players in RFID Equipment Market are

- Savi Technology Inc.

- Intermec Inc.

- Zebra Technologies Corporation

- NXP Semiconductors

- Avery Dennison

- Checkpoint Systems Inc.

- Gemalto NV

- Motorola

- Alien Technology

- among others.

The global RFID Equipment Market is segmented as follows:

By Product Type

- Tags

- Readers

- Software

By Wafer-size Type

- 200mm

- 300mm

- Others

By Frequency Type

- Low

- High

- Ultra-high

By Application

- Healthcare

- Aerospace

- Defense, Logistics and transportation, and Retail

- Security and access control application

- Automotive

- Animal Tracking

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global RFID Equipment Market was valued at USD 14.06 Billion in 2023.

The global RFID Equipment Market is expected to reach USD 37.99 Billion by 2032, growing at a CAGR of 11.68% between 2024 to 2032.

The key factor driving the global RFID Equipment Market growth is increasing use of RFID technology in various verticals and low cost of RFIDs.

North America ruled the RFID Equipment with a significant share for the year 2020 in terms of income followed by Asia Pacific and Europe.

Some of the major companies operating in RFID Equipment Market are Savi Technology, Inc., Intermec Inc., Zebra Technologies Corporation, NXP Semiconductors, Avery Dennison, Checkpoint Systems Inc., Gemalto NV, Motorola and Alien Technology among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed