Medical Device Outsourced Manufacturing Market Size, Share, Growth and Value 2032

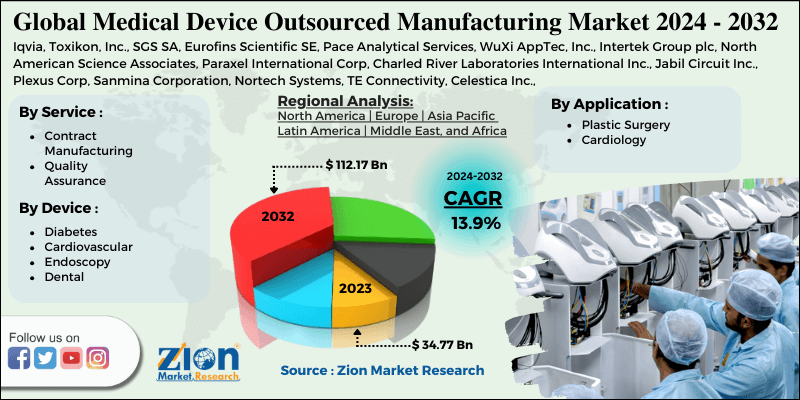

Medical Device Outsourced Manufacturing Market By Service (Contract Manufacturing, Quality Assurance and others), By Application (Plastic Surgery, Cardiology and others), By Device Type (Diabetes, Cardiovascular, Endoscopy, Dental and others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

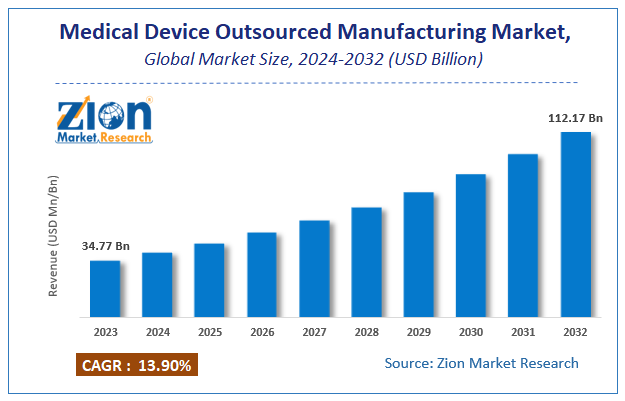

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34.77 Billion | USD 112.17 Billion | 13.9% | 2023 |

Medical Device Outsourced Manufacturing Market Insights

Zion Market Research has published a report on the global Medical Device Outsourced Manufacturing Market, estimating its value at USD 34.77 Billion in 2023, with projections indicating that it will reach USD 112.17 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 13.9% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Medical Device Outsourced Manufacturing Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Medical Device Outsourced Manufacturing Market: Overview

Therefore, outsourcing the manufacturing of medical devices has been helpful for the industry as it takes into account all the factors right from the development of the device to bringing it to the market. The market is primarily driven by the increasing demand for medical devices along with the rising price competition. The number of healthcare providers offering telemedicine services during the COVID-19 pandemic has increased in order to reduce unnecessary in-person visits. Also, manufacturers are increasingly adopting robotics and automated solutions to help manage increasing labor costs and difficulties in recruiting medical manufacturing workers.

Medical Device Outsourced Manufacturing Market: Growth Factors

The increasing demand for medical devices along with the rising price competition is one of the major reasons for the demand for the Medical Device Outsourced Market. The rising number of manufacturers and the growing difficulties in product engineering are the factors fueling the demand.

The rising prevalence of chronic diseases is increasing the demand for Medical devices. This is helping the market as Implantable Medical Devices (IMDs) are used widely to improve patients’ medical outcomes. This makes the designers of IMDs balance reliability, power consumption, costs, and complexity. This has led to companies shifting towards innovation and manufacturing well-designed medical devices. The changes in the ISO standards are expected to increase the demand for quality assurance and regulatory affairs across the globe while manufacturing Medical devices.

Medical Device Outsourced Manufacturing Market: Segmentation Analysis

This is estimated to dominate the market due to the increasing focus on decreasing the cost of production. The increasing complexity in manufacturing is also contributing to the contract manufacturing segment. Medical device manufacturers concentrate on manufacturing high-quality and safe devices for patient care. The increasing layers of standards and regulations combined with a high level of inspection in developing medical devices have created the demand for manufacturing devices.

The availability of competent outsourcing firms who are capable of manufacturing medical devices for surgery and their compliance with the regulatory requirements has boosted the demand for this segment. Also, there has been the introduction of various invasive and non-invasive procedures which has increased the number of surgeries performed every year. Due to this, there has been a rising demand for innovative and procedure-specific devices.

The high prevalence of cardiovascular conditions is boosting the demand for the increased outsourcing of cardiovascular devices. There is also a great need for technical expertise in cardiovascular devices, which has led to the increasing outsourcing of this kind of device. Also, the associated complexity of cardiovascular devices has increased its overall outsourcing. The increasing diabetic population and the rising awareness of diabetes treatment are major drivers for this segment. Also, there have been favorable national healthcare strategies that have been promoting the use of such devices. The growing technological innovations and connected diabetes care devices are also the factors responsible to boost the demand for Medical devices for the diabetes segment.

Medical Device Outsourced Manufacturing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Device Outsourced Manufacturing Market |

| Market Size in 2023 | USD 34.77 Billion |

| Market Forecast in 2032 | USD 112.17 Billion |

| Growth Rate | CAGR of 13.9% |

| Number of Pages | 140 |

| Key Companies Covered | Iqvia, Toxikon, Inc., SGS SA, Eurofins Scientific SE, Pace Analytical Services, WuXi AppTec, Inc., Intertek Group plc, North American Science Associates, Paraxel International Corp, Charled River Laboratories International Inc., Jabil Circuit Inc., Plexus Corp, Sanmina Corporation, Nortech Systems, TE Connectivity, Celestica Inc., Flextronics International Ltd, Onex Corporation, West Pharmaceutical Services, Inc. and Cardinal Health Inc among others |

| Segments Covered | By Service, By Application, By Device Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

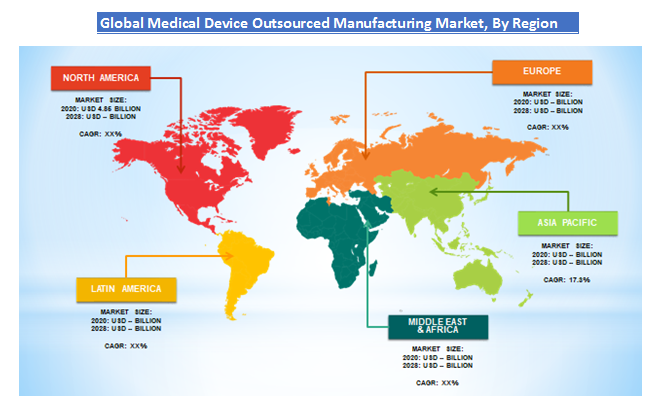

Medical Device Outsourced Manufacturing Market: Regional Analysis Preview

This is due to the factors such as well-established manufacturing hubs for complex medical devices and the technologically developed electronic sector. There are also many medical device companies present in this region that are outsourcing part of their regulatory functions to regulatory service providers, thus increasing the overall demand of the market.

The demand is due to the easy availability of skilled human resources. Also, there are many key companies present in this region also the competitive pricing factor is contributing to the high demand in this market in this region. The increasing number of chronic diseases is also fueling the overall demand in this region. The increasing inclination towards home care and the growing expenditure on healthcare infrastructure are also factors contributing to the growth in this region.

Medical Device Outsourced Manufacturing Market: Key Players & Competitive Landscape

Some of the key players in the Medical Device Outsourced Manufacturing market include

- Iqvia

- Toxikon Inc.

- SGS SA

- Eurofins Scientific SE

- Pace Analytical Services

- WuXi AppTec Inc.

- Intertek Group plc

- North American Science Associates

- Paraxel International Corp

- Charled River Laboratories International Inc.

- Jabil Circuit Inc.

- Plexus Corp

- Sanmina Corporation

- Nortech Systems

- TE Connectivity

- Celestica Inc.

- Flextronics International Ltd

- Onex Corporation

- West Pharmaceutical Services Inc.

- Cardinal Health Inc

The Global Medical Device Outsourced Manufacturing Market is segmented as follows:

By Service

- Contract Manufacturing

- Quality Assurance

By Application

- Plastic Surgery

- Cardiology

By Device Type

- Diabetes

- Cardiovascular

- Endoscopy

- Dental

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Zion Market Research has published a report on the global Medical Device Outsourced Manufacturing Market, estimating its value at USD 34.77 Billion in 2023, with projections indicating that it will reach USD 112.17 Billion by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 13.9% over the forecast period 2024-2032.

Some of the key factors driving the Global Medical Device Outsourced Manufacturing Market growth are the increasing demand for the medical devices along with the rising price competition , the rising number of manufacturers and the growing difficulties in the product engineering.

Asia-Pacific is expected to have the CAGR of 17.3% from 2021 to 2028. The demand is due to the easy availability of skilled human resources. Also, there are many key companies present in this region also the competitive pricing factor is contributing to high demand of this market in this region. The increasing number of chronic diseases is also fueling the overall demand in this region. The increasing inclination towards homecare and the growing expenditure towards healthcare infrastructure are the also factors contributing the growth in this region.

Some of the key players in the Medical Device Outsourced Manufacturing market include Iqvia, Toxikon, Inc., SGS SA, Eurofins Scientific SE, Pace Analytical Services, WuXi AppTec, Inc., Intertek Group plc, North American Science Associates, Paraxel International Corp, Charled River Laboratories International Inc., Jabil Circuit Inc., Plexus Corp, Sanmina Corporation, Nortech Systems, TE Connectivity, Celestica Inc., Flexitronics International Ltd, Onex Corporation, West Pharmaceutical Services, Inc. and Cardinal Health Inc among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed