Global Retrovirus Testing Market Size, Share, Growth Analysis Report - Forecast 2034

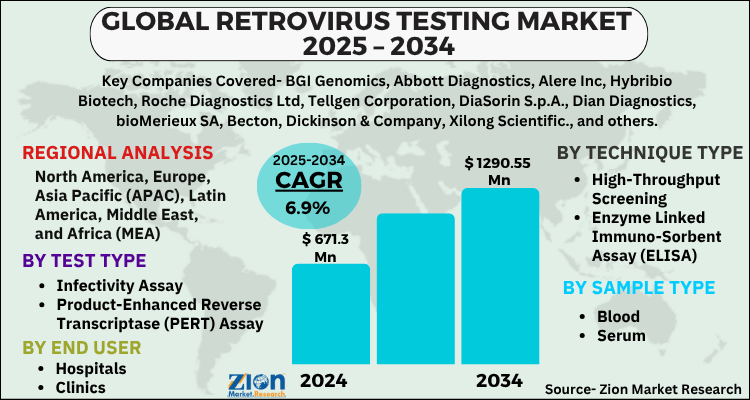

Retrovirus Testing Market By Test Type (Infectivity Assay, Product-Enhanced Reverse Transcriptase (PERT) Assay, Co-Cultivation Assay, Transmission Electron Microscopy, Radio-Immune Assay, Western Blot Analysis, Immunofluorescence, Serological Tests), By Technique Type (High-Throughput Screening, Enzyme-Linked Immuno-Sorbent Assay (ELISA), Polymerase Chain Reaction (PCR)), Sample Type (Blood, Serum, Body Fluids, Cells), End-User (Hospitals, Clinics, Diagnostic Laboratories & Centers), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

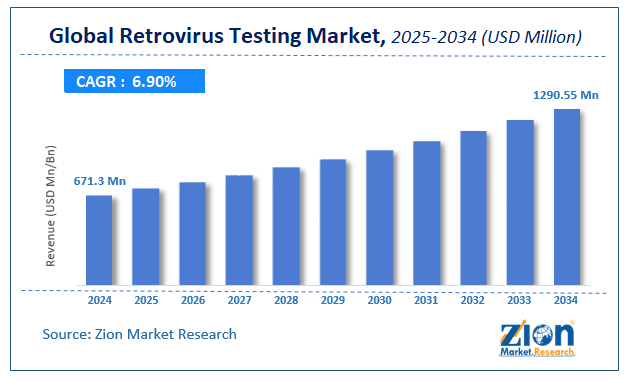

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 671.3 Million | USD 1290.55 Million | 6.9% | 2024 |

Retrovirus Testing Market: Industry Perspective

The global retrovirus testing market size was worth around USD 671.3 Million in 2024 and is predicted to grow to around USD 1290.55 Million by 2034 with a compound annual growth rate (CAGR) of roughly 6.9% between 2025 and 2034. The report analyzes the global retrovirus testing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the retrovirus testing industry.

Retrovirus Testing Market: Overview

A retrovirus is a single-stranded RNA virus that contains the reverse transcriptase enzyme. Once a retrovirus enters a host cell, reverse transcriptase helps the retroviral RNA be converted into retroviral DNA. The retrovirus then permits the chromosomal DNA of the host cell to incorporate the retroviral DNA. This integration facilitates retrovirus replication into the host genome, resulting in viral expression. HIV (Human Immunodeficiency Virus) is the most common retrovirus in humans. Other retroviruses that cause human infection involve Human T-cell Lymphotropic Virus-1 (HTLV-1), Human T-cell Lymphotropic Virus-2 (HTLV-2), HIV-1, HIV-2, and others. The rising incidence of HIV and increased awareness about HIV diagnosis drive the global retrovirus testing market. Retrovirus testing tools are one of the most effective tools for disease identification. These tools provide rapid results with high efficacy, enhancing the retrovirus testing industry.

The introduction of quick and technologically sophisticated methods for detecting retroviral infections, rising awareness of diagnostic tests, and rising expenditure associated with retrovirus screening are anticipated to drive the global market during the forecast period. The shortage of trained professionals to conduct the assays and the huge costs of retrovirus laboratory testing assay methods and diagnostic kits are expected to impede the market over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global retrovirus testing market is estimated to grow annually at a CAGR of around 6.9% over the forecast period (2025-2034).

- Regarding revenue, the global retrovirus testing market size was valued at around USD 671.3 Million in 2024 and is projected to reach USD 1290.55 Million by 2034.

- The retrovirus testing market is projected to grow at a significant rate due to increasing need for viral screening in blood transfusions and diagnostics.

- Based on Test Type, the Infectivity Assay segment is expected to lead the global market.

- On the basis of Technique Type, the High-Throughput Screening segment is growing at a high rate and will continue to dominate the global market.

- Based on the Sample Type, the Blood segment is projected to swipe the largest market share.

- By End-User, the Hospitals segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Retrovirus Testing Market: Growth Drivers

Rising government initiatives to increase the number of retrovirus tests to drive market growth

According to WHO, approximately 38 million people worldwide were infected with HIV in 2019. 68% of adults and 53% of children who have contracted the virus are receiving lifetime antiretroviral therapy (ART) as a result of various initiatives by the government and international organizations. Reimbursement policies and supportive government initiatives are additional major factors influencing global retrovirus testing market revenue growth. For instance, the Egyptian government announced in 2020 that it would provide confidential and free HIV diagnostics tests at examination and counseling centers in all 27 governorates. The introduction of rapid and technologically sophisticated methods for detecting retroviral infections, rising awareness of diagnostic tests, and rising costs associated with retrovirus screening are anticipated to drive the global market for retrovirus testing during the forecast period.

Retrovirus Testing Market: Restraints

The lack of skilled professionals to perform the assays and the high cost of retrovirus testing kits hinder the market growth

The lack of trained professionals to perform sensitive assays related to retrovirus testing and the high cost of assay methods & diagnostic kits are factors limiting the growth of the global retrovirus testing market. HIV stigma and the absence of adequate HIV reagents & kits may also limit the growth of the global market.

Retrovirus Testing Market: Segmentation

The global retrovirus testing market has been segmented into test type, technique type, sample type, and end-user.

Based on test type, the market is divided into infectivity assay, product-enhanced reverse transcriptase (PERT) assay, co-cultivation assay, transmission electron microscopy, radio-immune assay, western blot analysis, immunofluorescence, and serological tests. Among these, infectivity assays are the most frequently used method for retrovirus testing in the global market due to the rapid and accurate results obtained from these assays.

Based on technique type, the market is classified into high-throughput screening, enzyme-linked immunosorbent assay (ELISA), and polymerase chain reaction (PCR). In 2021, the high-throughput techniques and PCR category dominated the global market. High-throughput techniques and PCR-based amplification are primarily used in retrovirus testing to detect retrovirus infectious diseases in the target genome with high sensitivity.

Based on sample type, the market is classified into blood, serum, body fluids, and cells. The blood segment dominated the market in 2021, owing to the increased blood transfusions and donations.

Based on end-user, the global retrovirus testing market is segmented into hospitals, clinics, and diagnostic laboratories & centers. The diagnostic laboratories & centers are anticipated to have the highest share in this market. The increased entry of outpatient tests for retroviral testing in early HIV-AIDS diagnosis is fueling the global market growth. High R&D investment and technological advancements also contribute to the diagnostic laboratories segment's revenue growth.

Retrovirus Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Retrovirus Testing Market |

| Market Size in 2024 | USD 671.3 Million |

| Market Forecast in 2034 | USD 1290.55 Million |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 254 |

| Key Companies Covered | BGI Genomics, Abbott Diagnostics, Alere Inc, Hybribio Biotech, Roche Diagnostics Ltd, Tellgen Corporation, DiaSorin S.p.A., Dian Diagnostics, bioMerieux SA, Becton, Dickinson & Company, Xilong Scientific., and others. |

| Segments Covered | By Test Type, By Technique Type, By Sample Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Retrovirus Testing Market: Regional Landscape

North America dominated the retrovirus testing market in 2021

Due to the increased awareness about retrovirus diagnosis, the existence of well-established healthcare infrastructure, and an increase in investments in activities of research & development, North America dominates the market for retrovirus testing. Moreover, according to HIV.gov statistics published in June 2021, nearly 2 million individuals in the United States have HIV. This suggests that the prevalence of HIV in the nation is high, which will increase demand for its diagnosing products and further propel the regional market. High investment in HIV rapid testing kits research and development contributes significantly to the regional market revenue growth.

Recent Developments

- November 2020: The U.S. FDA approved Hologic Inc. for its Retroviral viral load monitoring assay. This has enabled the company to broaden its product offering in the HIV diagnostics market.

- May 2020: OraSure Technologies Inc. purchased UrSure Inc., a well-known laboratory testing company. This acquisition has expanded the company's HIV diagnostic product offerings.

Retrovirus Testing Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the retrovirus testing market on a global and regional basis.

The global retrovirus testing market is dominated by players like:

- BGI Genomics

- Abbott Diagnostics

- Alere Inc

- Hybribio Biotech

- Roche Diagnostics Ltd

- Tellgen Corporation

- DiaSorin S.p.A.

- Dian Diagnostics

- bioMerieux SA

- Becton

- Dickinson & Company

- Xilong Scientific.

Global Retrovirus Testing Market is segmented as follows:

By Test Type

- Infectivity Assay

- Product-Enhanced Reverse Transcriptase (PERT) Assay

- Co-Cultivation Assay

- Transmission Electron Microscopy

- Radio-Immune Assay

- Western Blot Analysis

- Immunofluorescence

- Serological Tests

By Technique Type

- High-Throughput Screening

- Enzyme Linked Immuno-Sorbent Assay (ELISA)

- Polymerase Chain Reaction (PCR)

By Sample Type

- Blood

- Serum

- Body Fluids

- Cells

By End User

- Hospitals

- Clinics

- Diagnostic Laboratories & Centers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A retrovirus is a single-stranded RNA virus that contains the reverse transcriptase enzyme.

The global retrovirus testing market is expected to grow due to rising prevalence of retroviral infections, growing demand for early disease detection, and advancements in molecular diagnostic techniques.

According to a study, the global retrovirus testing market size was worth around USD 671.3 Million in 2024 and is expected to reach USD 1290.55 Million by 2034.

The global retrovirus testing market is expected to grow at a CAGR of 6.9% during the forecast period.

North America is expected to dominate the retrovirus testing market over the forecast period.

Leading players in the global retrovirus testing market include BGI Genomics, Abbott Diagnostics, Alere Inc, Hybribio Biotech, Roche Diagnostics Ltd, Tellgen Corporation, DiaSorin S.p.A., Dian Diagnostics, bioMerieux SA, Becton, Dickinson & Company, Xilong Scientific., among others.

The report explores crucial aspects of the retrovirus testing market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed