U.S. Residential Air Purifiers Market Size, Share, Trends 2032

U.S. Residential Air Purifiers Market by Type (HEPA, Ion and Ozone Generators, Electrostatic Precipitators, and Others): Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

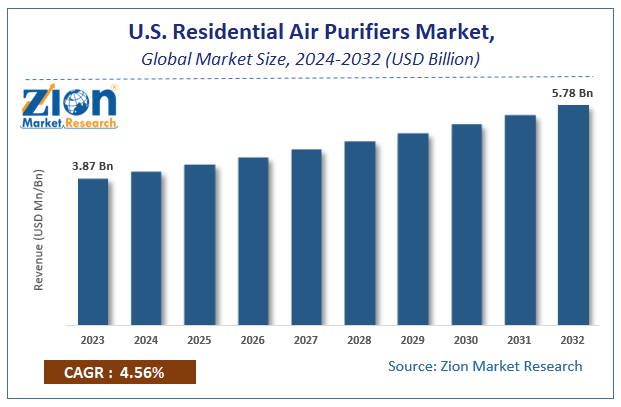

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.87 Billion | USD 5.78 Billion | 4.56% | 2023 |

U.S. Residential Air Purifiers Market Size

According to Zion Market Research, the global U.S. Residential Air Purifiers Market was worth USD 3.87 Billion in 2023. The market is forecast to reach USD 5.78 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.56% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the U.S. Residential Air Purifiers Market industry over the next decade.

Residential Air Purifiers Market Market Overview

An air purifier is a device based on advance technology used to purify the indoor air and remove unwanted dust and microbes. Residential air purifiers absorb and decompose different air pollutants such as allergens, decoration pollution PM2.5, odors, bacteria, and dust among others. Most common types of air purifier typically contain a filtering material, sealant, frame, faceguard, and gasket. Different type of air purifiers includes high-efficiency particulate air (HEPA), ion and ozone generators, electrostatic purifiers, UV technology, activated carbon technology among others.

COVID-19 Impact Analysis:

The U.S. Residential Air Purifiers market has witnessed a decline during the pandemic as the restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the markets are slowly opening to their full potential and theirs a surge in demand.

The market would remain lucrative in upcoming year. The decrease in the U.S. Residential Air Purifiers market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

U.S. Residential Air Purifiers Market : Growth Factors

The residential air purifiers market is expected to witness significant growth due to the increasing air pollution and health-related issues such as asthma and allergies. The major driving factor for residential air purifiers market is increasing disposable income in U.S. that simultaneously increases the demand of luxurious lifestyle. In addition, the demand from growing construction activities is expected to have a positive impact on residential air purifiers market. The high demand of low range residential air purifiers from price conscious people is also expected to develop a potential growth in key players of this market. Product innovations and vertical integration to improve affordability is likely to open new market avenues in the near future.

However, some restraints like low profit margins due to augmented competition and volatile prices of raw materials used in manufacturing of residential air purifiers may hamper the growth of this market.

An air purifier is a device generally used to clean the indoor air by removing unwanted dust and microbes. Growing importance of better indoor air quality and rising concerns over health-related issues such as asthma and allergies has propelled the demand for air purifiers in the U.S. Most common types of air purifier typically involve a filtering material, sealant, frame, faceguard, and gasket. Most common type of air purifiers are high-efficiency particulate air (HEPA), ion and ozone generators, electrostatic purifiers, UV technology, activated carbon technology among others.

The major driving factor for residential air purifier market is growing awareness about air pollution and other health related issues created due to the increasing use of vehicles, urbanization etc. Increasing construction activities in U.S. over the past couple of years increases the demand of residential air purifiers rapidly. Moreover, government regulations on environmental protection, especially by the EPA (The United States Environmental Protection Agency) fueled the residential air purifier market. However, this market is experiencing low-profit margins due to increased competition and volatile prices of raw materials.

U.S. Residential Air Purifiers Market: Segmentation

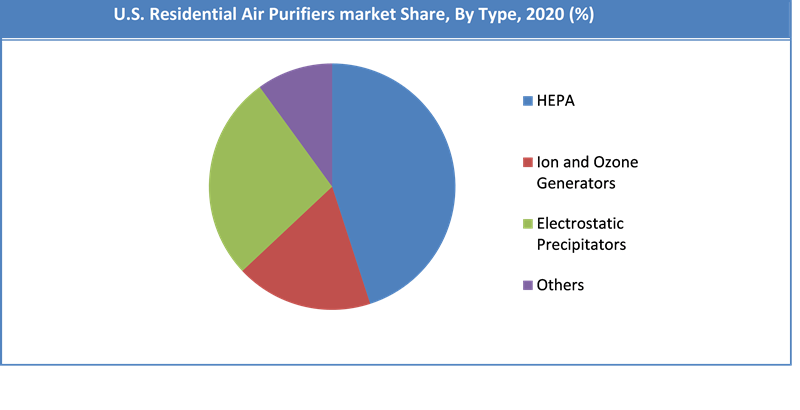

On the basis of types, the U.S. residential air purifiers market is divided into HEPA, Ion and ozone generators, electrostatic precipitators and others. The different types of air purifiers are categorized based on the technologies used in their manufacturing. HEPA was a major type segment of residential air purifiers market and constituted around 45% share of the U.S. demand in 2020. It is expected to continue its dominance in U.S. market over the forecast period due to the high effectiveness of trapping airborne particles and widespread adoption in residential applications. Electrostatic precipitators are the second largest type segment of the residential air purifiers market.

U.S. Residential Air Purifiers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Residential Air Purifiers Market |

| Market Size in 2023 | USD 3.87 Billion |

| Market Forecast in 2032 | USD 5.78 Billion |

| Growth Rate | CAGR of 4.56% |

| Number of Pages | 144 |

| Key Companies Covered | Austin Air, Blueair, Honeywell, IQAir, Sharp |

| Segments Covered | By Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Residential Air Purifiers Market: Regional Analysis

The U.S. residential air purifier market is segmented into four major regions includes South, West, Midwest and Northeast. The demand for residential air purifier was highest in South region accounted for over 40% of the total market share in 2020. However, Northeast region is expected to witness highest growth rate during the forecast period.

The U.S. residential air purifier market is segmented into four major regions including South, West, Midwest, and Northeast. The demand for residential air purifier was highest in South region and accounted for more than 30% of the total market share in 2015.

U.S. Residential Air Purifiers Market: Competitive Players

The major players operating in the U.S. Residential Air Purifiers market are

- Austin Air

- Blueair

- Honeywell

- IQAir

- Sharp

The U.S. Residential Air Purifiers market is segmented as follows:

By Type

- HEPA

- Ion and Ozone Generators

- Electrostatic Precipitators

- Others (including activated carbon, ozone etc.)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Residential air purifiers are devices designed to improve indoor air quality by removing pollutants, allergens, odors, and contaminants from the air in homes. They typically use filters, such as HEPA or activated carbon, or technologies like UV light or ionization to clean the air.

According to study, the U.S. Residential Air Purifiers Market size was worth around USD 3.87 billion in 2023 and is predicted to grow to around USD 5.78 billion by 2032.

The CAGR value of U.S. Residential Air Purifiers Market is expected to be around 4.56% during 2024-2032.

South region has been leading the U.S. Residential Air Purifiers Market and is anticipated to continue on the dominant position in the years to come.

The U.S. Residential Air Purifiers Market is led by players like Austin Air, Blueair, Honeywell, IQAir, and Sharp amongst others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed