Refurbished IT Asset Disposition Market Size, Share, Trends, Growth 2034

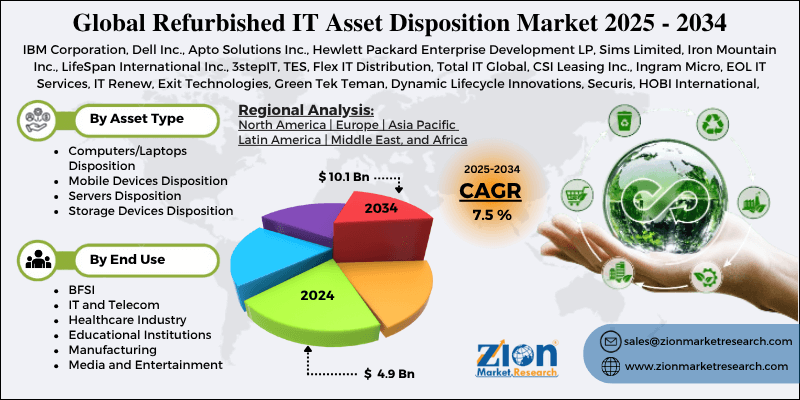

Refurbished IT Asset Disposition Market By Asset Type (Computers/Laptops Disposition, Mobile Devices Disposition, Servers Disposition, and Storage Devices Disposition), By End-User (Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Healthcare Industry, Educational Institutions, Manufacturing, Media and Entertainment, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.9 Billion | USD 10.1 Billion | 7.5% | 2024 |

Refurbished IT Asset Disposition Industry Perspective:

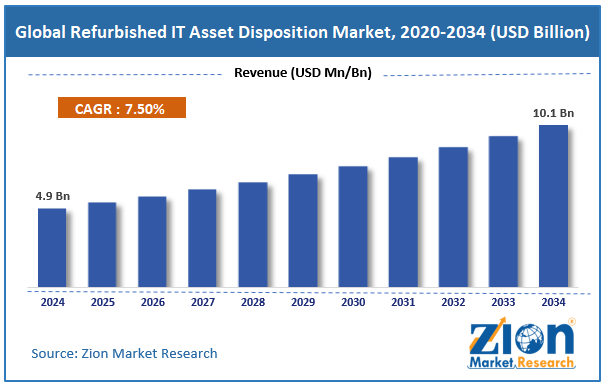

The global refurbished IT asset disposition market size was worth around USD 4.9 billion in 2024 and is predicted to grow to around USD 10.1 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.5% between 2025 and 2034.

Refurbished IT Asset Disposition Market: Overview

Refurbished IT Asset Disposition (ITAD) is the process of securely managing and responsibly disposing of end-of-life or undesired IT equipment, including the refurbishment of and resale of usable assets, while maintaining data security and environmental compliance. It goes beyond disposal and focuses on optimizing asset value through reuse and remarketing whenever possible. Refurbished ITAD is a more sustainable and cost-effective way to manage the end-of-life of IT assets than simply discarding them. It enables organizations to responsibly manage old equipment while also contributing to a more sustainable future.

Key Insights

- As per the analysis shared by our research analyst, the global Refurbished IT Asset Disposition market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2025-2034).

- In terms of revenue, the global Refurbished IT Asset Disposition market size was valued at around USD 4.9 billion in 2024 and is projected to reach USD 10.1 billion by 2034.

- Strict e-waste regulation is expected to drive the Refurbished IT Asset Disposition industry over the forecast period.

- Based on the asset type, the computers/laptops disposition segment is expected to hold the largest market share over the forecast period.

- Based on the end-user, the Banking, Financial Services, and Insurance (BFSI) segment is expected to dominate the market expansion over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Refurbished IT Asset Disposition Market: Growth Drivers

Stringent regulation regarding e-waste drives market growth

The rising implementation of rigorous environmental regulations requiring appropriate disposal and recycling of electronic waste is driving enterprises to use ITAD services to meet legal requirements. Billions of dollars in critically valuable resources were lost and discarded. E-waste recycling meets precisely 1% of the need for rare earth elements.

The UN's fourth Global E-waste Monitor (GEM) has indicated that global electronic trash generation is growing at a rate five times faster than documented e-waste recycling rates. According to the ITU and UNITAR, the 62 million tons of e-waste produced in 2022 would fill 1.55 million 40-ton trucks, which is about enough to form a bumper-to-bumper line encircling the equator.

Currently, less than one-quarter (22.3%) of the year's e-waste mass was recorded as having been adequately collected and recycled in 2022, leaving USD 62 billion in recoverable natural resources unexplained and increasing pollution threats to communities worldwide. Worldwide, e-waste development is increasing by 2.6 million tons per year, on track to reach 82 million tons by 2030, a 33% increase over 2022. Thus, the aforementioned statistics propel the refurbished IT asset disposition market.

Refurbished IT Asset Disposition Market: Restraints

The high cost of certified ITAD services hinders market growth

The high price of certified IT Asset Disposition (ITAD) services is an important issue for the refurbished ITAD sector. Certified ITADs need to comply with strict rules, paperwork, and environmental and data security regulations. Costs go up in several areas, such as data deletion and sanitization, logistics and secure transit, testing and refurbishment, compliance and certification, and more.

For instance, certified data wiping (such as NIST 800-88 or DoD 5220.22-M) needs certain software and people to do it. Degaussing and shredding storage media physically costs capital for both equipment and people. So, the high cost of certified ITAD services is a major barrier to market growth, especially for smaller enterprises and areas that are still growing.

Refurbished IT Asset Disposition Market: Opportunities

The growing trend of the circular economy offers a potential opportunity in the market

The global transition to a circular economy is having an impact on the refurbished IT asset disposition industry. Companies and governments are increasingly prioritizing the reuse, refurbishment, and recycling of IT equipment to reduce e-waste and environmental issues. For instance, Hewlett-Packard Enterprise (HPE) conducts a refurbishing program in which IT equipment is resold to assist consumers in saving money and reducing their carbon footprints, thus contributing to a circular economy. These activities align with global sustainability policies, attracting environmentally conscious customers and businesses.

Furthermore, implementing common methods improves corporate efficiency and resource use while also ensuring compliance with tougher e-waste regulations. This phenomenon demonstrates that ITAD services are being recognized as a more sustainable strategy for managing IT assets, hence perpetuating long-term market development in the sector.

Refurbished IT Asset Disposition Market: Challenges

Limited standardization in refurbishment quality poses a major challenge to market expansion

The inadequate uniformity of refurbishing quality is a major constraint in the Refurbished IT Asset Disposition (Refurbished ITAD) business, affecting buyer trust, resale value, and market scalability. Refurbishment quality varies significantly between vendors and areas due to the lack of standardized criteria for diagnostic testing processes, cosmetic grading (scratches, wear, etc.), replacement part quality (OEM vs. third-party), and other factors.

Buyers (particularly in B2B or governmental procurement) cannot accurately estimate the condition or functionality of reconditioned equipment. One vendor's "Grade A" may differ significantly from another's, leading to misunderstandings and disappointment. Furthermore, bad refurbishing by unqualified vendors lowers the general perception of reconditioned products. Thus, posing a major challenge to the industry's expansion.

Refurbished IT Asset Disposition Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Refurbished IT Asset Disposition Market |

| Market Size in 2024 | USD 4.9 Billion |

| Market Forecast in 2034 | USD 10.1 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 211 |

| Key Companies Covered | IBM Corporation, Dell Inc., Apto Solutions Inc., Hewlett Packard Enterprise Development LP, Sims Limited, Iron Mountain Inc., LifeSpan International Inc., 3stepIT, TES, Flex IT Distribution, Total IT Global, CSI Leasing Inc., Ingram Micro, EOL IT Services, IT Renew, Exit Technologies, Green Tek Teman, Dynamic Lifecycle Innovations, Securis, HOBI International, and others. |

| Segments Covered | By Asset Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Refurbished IT Asset Disposition Market: Segmentation

The global Refurbished IT Asset Disposition industry is segmented based on asset type, end user, and region.

Based on the asset type, the global Refurbished IT Asset Disposition market is bifurcated into computers/laptops disposition, mobile devices disposition, servers disposition, and storage devices disposition. The computers/laptops disposition segment is expected to hold the largest market share over the forecast period. Enterprises and large enterprises often upgrade their PCs and laptops every 3-5 years to keep up with performance, security, and operating system requirements. This continual turnover results in a steady influx of retired devices for ITAD services. Organizations are incorporating device refurbishment into their ESG and circular economy plans to reduce e-waste and promote sustainability, leading to increased use of ITAD services for laptops and PCs.

Based on the end-user, the global Refurbished IT Asset Disposition industry is bifurcated into Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Healthcare Industry, Educational Institutions, Manufacturing, Media and Entertainment, and Others. The Banking, Financial Services, and Insurance (BFSI) segment is expected to dominate the market over the projected period. BFSI institutions manage a large number of computers, laptops, servers, ATMs, POS systems, and mobile devices. Regular technology upgrades and digital transformation result in regular asset refresh cycles, which increase the volume of assets entering ITAD pipelines.

In addition, as the demand for decreasing IT expenses while maintaining regulatory compliance grows, BFSI organizations are increasingly turning to the refurbishment and resale of outdated assets, as well as the internal redeployment of refurbished technology. These strategies contribute to value recovery and sustainability goals.

Refurbished IT Asset Disposition Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global Refurbished IT Asset Disposition market. The market's regional expansion is driven by severe e-waste restrictions (for instance, U.S. state laws such as California's SB 20) and strong corporate sustainability pledges. The region's established IT infrastructure, frequent technology renewal cycles, and significant emphasis on data security compliance (e.g., HIPAA, CCPA) all contribute to demand for certified refurbished ITAD services.

Furthermore, the circular economy movement and corporate ESG goals drive companies to implement ITAD solutions that enhance asset recovery while minimizing environmental impact.

Refurbished IT Asset Disposition Market: Competitive Analysis

The global Refurbished IT Asset Disposition market is dominated by players like:

- IBM Corporation

- Dell Inc.

- Apto Solutions Inc.

- Hewlett Packard Enterprise Development LP

- Sims Limited

- Iron Mountain Inc.

- LifeSpan International Inc.

- 3stepIT

- TES

- Flex IT Distribution

- Total IT Global

- CSI Leasing Inc.

- Ingram Micro

- EOL IT Services

- IT Renew

- Exit Technologies

- Green Tek Teman

- Dynamic Lifecycle Innovations

- Securis

- HOBI International

The global Refurbished IT Asset Disposition market is segmented as follows:

By Asset Type

- Computers/Laptops Disposition

- Mobile Devices Disposition

- Servers Disposition

- Storage Devices Disposition

By End User

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare Industry

- Educational Institutions

- Manufacturing

- Media and Entertainment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Refurbished IT Asset Disposition (ITAD) is the process of securely managing and responsibly disposing of end-of-life or undesired IT equipment, including refurbishing and resale of useable assets, while maintaining data security and environmental compliance.

The Refurbished IT Asset Disposition industry is being driven by several factors such as the growing trend of circular economy, regulatory and data security compliance, increasing focus on sustainability, technological advancements, and others.

According to the report, the global Refurbished IT Asset Disposition market size was worth around USD 4.9 billion in 2024 and is predicted to grow to around USD 10.1 billion by 2034.

The global Refurbished IT Asset Disposition market is expected to grow at a CAGR of 7.5% during the forecast period.

The global Refurbished IT Asset Disposition industry growth is expected to be driven by the North America region. It is currently the world’s highest revenue-generating market due to the strict e-waste regulations and high corporate sustainability commitments.

The global Refurbished IT Asset Disposition market is dominated by players like IBM Corporation, Dell Inc., Apto Solutions Inc., Hewlett Packard Enterprise Development LP, Sims Limited, Iron Mountain Inc., LifeSpan International Inc., 3stepIT, TES, Flex IT Distribution, Total IT Global, CSI Leasing Inc., Ingram Micro, EOL IT Services, IT Renew, Exit Technologies, Green Tek Teman, Dynamic Lifecycle Innovations, Securis, and HOBI International, among others.

The Refurbished IT Asset Disposition market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed