Refurbished Fitness Equipment Market Size, Share, Trends, Growth 2034

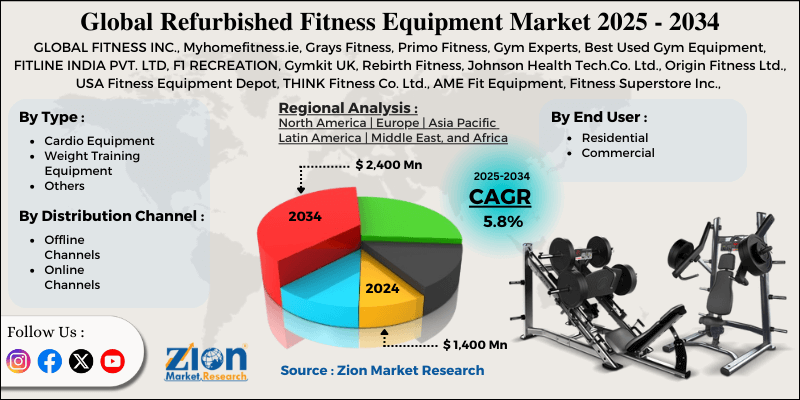

Refurbished Fitness Equipment Market By Type (Cardio Equipment, Weight Training Equipment, and Others), By End-User (Residential and Commercial), By Distribution Channel (Offline Channels and Online Channels), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

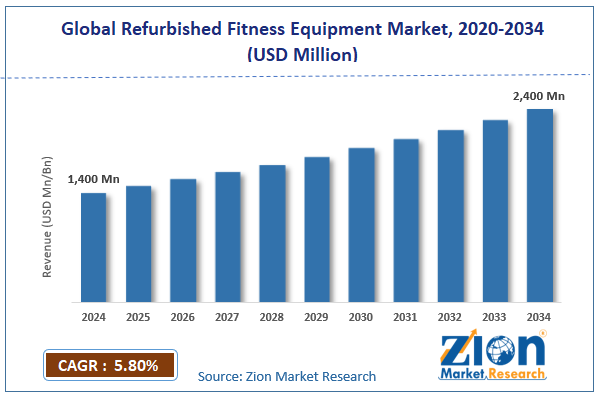

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,400 Million | USD 2,400 Million | 5.8% | 2024 |

Refurbished Fitness Equipment Industry Perspective:

The global refurbished fitness equipment market size was worth around USD 1,400 million in 2024 and is predicted to grow to around USD 2,400 million by 2034 with a compound annual growth rate (CAGR) of roughly 5.8% between 2025 and 2034.

Refurbished Fitness Equipment Market: Overview

Fitness equipment that has been refurbished offers customers nearly new features and functions for about half the cost. These machines are painted or coated to give them a new look, and their worn-out parts are replaced with authorized new ones. The machines' numerous rods and beams have the majority of their rust, dents, abrasions, and spots polished to enhance the machinery's appearance.

The cost of fixing the equipment is inexpensive because just a few key components need to be replaced, which helps draw in more customers by making refurbished exercise equipment 50%–75% less expensive to buy than new.

Key Insights

- As per the analysis shared by our research analyst, the global refurbished fitness equipment market is estimated to grow annually at a CAGR of around 5.8% over the forecast period (2025-2034).

- In terms of revenue, the global refurbished fitness equipment market size was valued at around USD 1,400 million in 2024 and is projected to reach USD 2,400 million by 2034.

- The growing awareness regarding health is expected to drive the refurbished fitness equipment market over the forecast period.

- Based on the type, the weight training equipment segment is expected to hold the largest market share over the forecast period.

- Based on the end user, the commercial segment is expected to dominate the market expansion over the projected period.

- Based on the distribution channel, the offline channels segment is expected to hold the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Refurbished Fitness Equipment Market: Growth Drivers

Increasing health and fitness awareness drives market growth

Customers'increasing interest in fitness and health is largely driving the considerable expansion in the refurbished fitness equipment market. This movement revolutionizes the fitness industry and creates fresh commercial and consumer opportunities.

As more individuals prioritize their health, the number of gyms and fitness centers has significantly grown. Cities notably show this rise since individuals search for simple methods to include exercise in their daily routines.

To cut costs, many of these companies decide to make use of old equipment, which offers capability comparable to that of new gadgets for a fraction of the price. The rising occurrence of lifestyle-related diseases, including obesity and cardiovascular diseases, has also raised public knowledge of the need for consistent exercise. This knowledge drives the demand for easily available exercise solutions; refurbished equipment is a reasonably priced approach to support good living.

Refurbished Fitness Equipment Market: Restraints

Perceived quality concerns hinder market growth

In the refurbished fitness equipment industry, perceived quality issues pose a serious barrier that affects consumer trust and buying patterns. These issues are caused by several variables that influence the reliable, durable, and secure people believe used or refurbished goods to be. One factor contributing to uneven product quality is the absence of uniform refurbishment protocols among vendors.

While some sellers completely remove and replace damaged parts, others just do superficial or aesthetic repairs. Customers might not want to take the chance if the restoration procedure is opaque.

Additionally, reconditioned equipment usually has a shorter warranty than new equipment or none at all. This heightens worries about possible maintenance expenses and long-term reliability. Customers may choose less expensive new equipment if they are concerned that they may have to spend more on repairs.

Refurbished Fitness Equipment Market: Opportunities

Expansion of home gyms offers a lucrative opportunity for market growth

The growing number of home gyms has led to an increase in the popularity of refurbished exercise equipment. As more people place a higher priority on their health and fitness, especially in the wake of the COVID-19 pandemic, creating personalized exercise areas at home has become essential. Repurposed exercise equipment offers a cost-effective and ecologically friendly solution to meet this growing demand.

Because restored machinery is less expensive than new equipment, a wider range of buyers may afford it. This affordability, which allows individuals to continue their workout routines without having to spend outrageous amounts of money on new equipment, has been especially tempting during hard economic times.

The reconditioned market also offers a range of fitness equipment, including cardio machines like treadmills and stationary bikes, as well as strength training equipment. Because of this adaptability, customers may tailor their home gyms to fit their training goals and preferences.

Refurbished Fitness Equipment Market: Challenges

Higher maintenance requirements pose a major challenge to market expansion

One major barrier to the refurbished fitness equipment market is the higher maintenance needs, especially when contrasted with those of new equipment. These increasing maintenance requirements can impact customer satisfaction, operating expenses (particularly in commercial contexts), and perceptions of long-term reliability.

A combination of original, repaired, and replaced parts can be found in certain refurbished devices. Compatibility problems may result from this, particularly if the parts are from different manufacturers or model years.

Additionally, to maintain performance and safety standards, owners may need to service refurbished equipment more frequently. This is especially true in commercial gyms where business operations may be impacted by downtime due to high utilization.

Refurbished Fitness Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Refurbished Fitness Equipment Market |

| Market Size in 2024 | USD 1,400 Million |

| Market Forecast in 2034 | USD 2,400 Million |

| Growth Rate | CAGR of 5.8% |

| Number of Pages | 212 |

| Key Companies Covered | GLOBAL FITNESS INC., Myhomefitness.ie, Grays Fitness, Primo Fitness, Gym Experts, Best Used Gym Equipment, FITLINE INDIA PVT. LTD, F1 RECREATION, Gymkit UK, Rebirth Fitness, Johnson Health Tech.Co. Ltd., Origin Fitness Ltd., USA Fitness Equipment Depot, THINK Fitness Co. Ltd., AME Fit Equipment, Fitness Superstore Inc., Pro Gym Supply Inc., UK Gym Equipment Ltd., Brunswick Corporation, FitKit UK Ltd., and others. |

| Segments Covered | By Type, By End User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Refurbished Fitness Equipment Market: Segmentation

The global refurbished fitness equipment industry is segmented based on type, end user, distribution channel, and region.

Based on the type, the global refurbished fitness equipment market is bifurcated into cardio equipment, weight training equipment, and others. The weight training equipment segment is expected to hold the largest market share over the forecast period. The demand for strength training equipment has increased as a result of a greater focus on fitness and health. The market for refurbished choices is growing as consumers are more likely to include weight training in their routines.

Additionally, the quality and dependability of secondhand equipment have improved due to contemporary refurbishment procedures. Refurbished weight training equipment satisfies high-performance criteria due to upgrades and thorough testing.

Based on the end user, the global refurbished fitness equipment industry is bifurcated into residential and commercial. The commercial segment is expected to dominate the market expansion over the projected period. The market is expanding significantly, and one of the main drivers of this expansion is the commercial sector, which includes hotels, health clubs, gyms, and corporate wellness initiatives. This trend is especially noteworthy in places like India, where developing fitness infrastructure requires affordable solutions.

Based on the distribution channel, the global market is bifurcated into offline channels and online channels. The offline channels segment is expected to hold the largest market share over the forecast period. This expansion is driven by the increasing number of fitness centers and the need for affordable equipment solutions.

Refurbished Fitness Equipment Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global refurbished fitness equipment market. This is because the area boasts the most manufacturers of renovated fitness equipment globally.

Among the largest businesses in the refurbished fitness equipment industry in North America are Life Exercise, Matrix Fitness, and Johnson Health Tech. The area is established as the hub for the manufacturing and refurbishment of fitness equipment, which has driven commercial development and expansion. Because of its large user population and high degree of disposable means,

North America is a sought-after market for manufacturers of renovated exercise equipment. This has resulted in higher sales of refurbished exercise equipment in the area as at-home exercises become more and more popular and demand for reasonably priced equipment options grows.

Moreover, North America is expected to keep controlling the market for renovated fitness equipment; this is expected to be especially true given the trend toward building home gyms and fitness centers, increasing demand for reasonably priced exercise equipment, and growing awareness of health issues.

Refurbished Fitness Equipment Market: Competitive Analysis

The global refurbished fitness equipment market is dominated by players like:

- GLOBAL FITNESS INC.

- Myhomefitness.ie

- Grays Fitness

- Primo Fitness

- Gym Experts

- Best Used Gym Equipment

- FITLINE INDIA PVT. LTD

- F1 RECREATION

- Gymkit UK

- Rebirth Fitness

- Johnson Health Tech.Co. Ltd.

- Origin Fitness Ltd.

- USA Fitness Equipment Depot

- THINK Fitness Co. Ltd.

- AME Fit Equipment

- Fitness Superstore Inc.

- Pro Gym Supply Inc.

- UK Gym Equipment Ltd.

- Brunswick Corporation

- FitKit UK Ltd.

The global refurbished fitness equipment market is segmented as follows:

By Type

- Cardio Equipment

- Weight Training Equipment

- Others

By End User

- Residential

- Commercial

By Distribution Channel

- Offline Channels

- Online Channels

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fitness equipment that has been refurbished offers customers nearly new features and functions for about half the cost. To give them a new look, these machines are painted or coated, and their worn-out parts are replaced with authorized new ones.

The refurbished fitness equipment market is driven by several factors such as its cost-effective nature, sustainability, environmental concerns, growing demand in emerging markets, advancements in technology, expansion in home gyms, and many others.

According to the report, the global refurbished fitness equipment market size was worth around USD 1,400 million in 2024 and is predicted to grow to around USD 2,400 million by 2034.

The global refurbished fitness equipment market is expected to grow at a CAGR of 5.8% during the forecast period.

The global refurbished fitness equipment market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players and the high disposable income.

The global refurbished fitness equipment market is dominated by players like GLOBAL FITNESS, INC., Myhomefitness.ie, Grays Fitness, Primo Fitness, Gym Experts, Best Used Gym Equipment, FITLINE INDIA PVT. LTD, F1 RECREATION, Gymkit UK, Rebirth Fitness, Johnson Health Tech. Co, Ltd., Origin Fitness Ltd., USA Fitness Equipment Depot, THINK Fitness Co., Ltd., AME Fit Equipment, Fitness Superstore, Inc., Pro Gym Supply, Inc., UK Gym Equipment Ltd., Brunswick Corporation, and FitKit UK Ltd, among others.

The refurbished fitness equipment market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed