Railroad Tie Market Size, Share, Trends, Growth and Forecast 2034

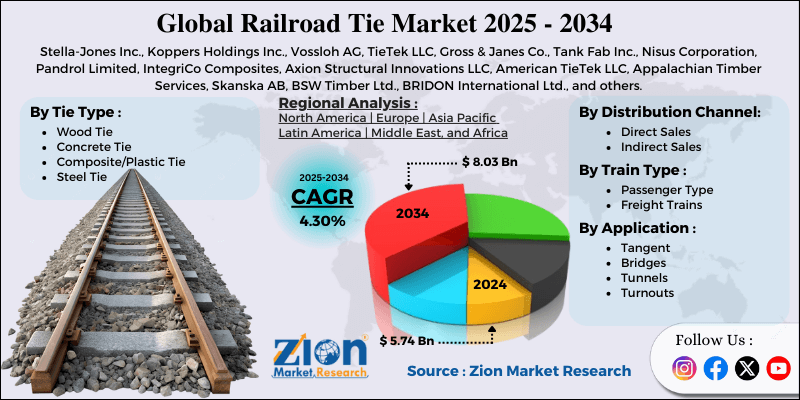

Railroad Tie Market By Tie Type (Wood Tie, Concrete Tie, Composite/Plastic Tie, Steel Tie), By Train Type (Passenger Type, Freight Trains), By Application (Tangent, Bridges, Tunnels, Turnouts), By Distribution Channel (Direct Sales, Indirect Sales), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

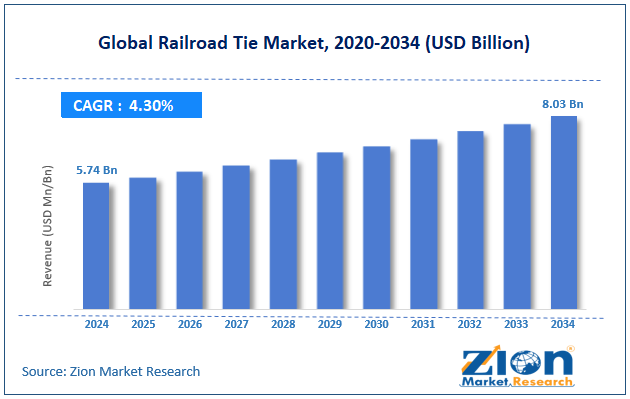

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.74 Billion | USD 8.03 Billion | 4.30% | 2024 |

Railroad Tie Industry Perspective:

The global railroad tie market size was approximately USD 5.74 billion in 2024 and is projected to reach around USD 8.03 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global railroad tie market is estimated to grow annually at a CAGR of around 4.30% over the forecast period (2025-2034)

- In terms of revenue, the global railroad tie market size was valued at around USD 5.74 billion in 2024 and is projected to reach USD 8.03 billion by 2034.

- The railroad tie market is projected to grow significantly due to increasing demand for freight transportation, advancements in tie materials, and the expansion of metro rail systems and urbanization.

- Based on the tie type, the concrete tie segment is expected to lead the market, while the wood tie segment is expected to grow considerably.

- Based on train type, the freight trains segment is the dominant segment, while the passenger trains segment is projected to witness sizable revenue growth over the forecast period.

- Based on the application, the tangent segment holds a leading position, while the turnout segment is expected to experience considerable growth over the forecast period.

- Based on the distribution channel, the direct sales segment is expected to lead the market compared to the indirect sales segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Railroad Tie Market: Overview

Railroad ties, also known as sleepers, are rectangular support structures laid upright on the rails of a railway track to stabilize them in place and maintain the correct gauge. Traditionally made from wood, they are also manufactured from concrete, composite materials, and steel to enhance resistance to weathering and increase durability. The global railroad tie market is poised for notable growth, driven by increasing freight transportation needs, a preference for durable materials, and supportive government initiatives in green transportation. Railways are the most eco-friendly and cost-efficient modes for transporting bulk goods.

Growing trade volumes, intermodal logistics, and industrial growth are driving the demand for strong railway systems, increasing the use of railroad ties. The adoption of steel, concrete, and composite ties is growing as alternatives to conventional wooden ties. These materials offer enhanced strength, low lifecycle costs, and weather resistance. This move is fueling the advancements and industry growth. Governments are prioritizing low-emission transport systems as a part of their sustainability objectives. Rail networks, being energy-efficient, obtain significant funding for advancement. This leads to novel tie installation projects and rising replacement.

Nevertheless, the global market faces limitations due to factors such as concerns over deforestation from wooden ties and supply chain disruptions. The continued use of wooden railroad ties raises ecological worries due to the large-scale consumption of timber. Stringent global forestry norms are restricting supply and making wooden ties less sustainable, adversely impacting sectors highly reliant on wood. Furthermore, worldwide shortages of raw materials, such as steel, cement, and timber, impact production. Disturbances caused by pandemic restrictions and geopolitical conflicts have highlighted the industry's susceptibility, leading to delays in infrastructure projects.

Still, the global railroad tie industry benefits from several favorable factors, including the adoption of eco-friendly materials, digitalization, and smart maintenance. Recycled and composite plastic ties offer robust opportunities for sustainable development. They decrease dependency on timber and provide long service life with low maintenance. Growing green initiatives will support their adoption. Moreover, the growth of predictive analytics and IoT in railway management offers prospects for tie producers. Smart monitoring can lengthen tie life and decrease costs, fueling the demand for advanced tie designs. Producers offering tech-integrated solutions will gain from this.

Railroad Tie Market: Growth Drivers

How is the increasing adoption of high-speed rail networks driving the growth of the railroad tie market?

The rise in high-speed rail (HSR) projects is another key driver of the industry. Nations like China, Japan, Spain, and France are pioneers, but now economies like India and the U.S. are also catching up. High-speed rail needs highly durable and specialized ties to manage stability, vibration, and load at extreme speeds. India's first bullet train project, anticipated to be completed by 2028, is projected to drive domestic demand for advanced concrete ties.

How is the expansion of freight transportation needs considerably driving the railroad tie market growth?

The worldwide rise in freight transportation by rail is majorly fueling the demand, significantly impacting the global railroad tie market. According to reports, rail freight volumes in Asia and North America increased by 6% in 2023, driven by bulk commodities such as agricultural goods, minerals, and coal. Strong ties are essential for withstanding the heavy axle loads from freight trains. The United States Federal Railroad Administration has also reported that freight railroads carry nearly 40% of the nation's long-distance freight volume, increasing the necessity for durable ties. This growth directly impacts the demand for tie replacements and new installations.

Railroad Tie Market: Restraints

Competition from alternative transport modes unfavorably impacts the market progress

The growing investments in air, road, and pipeline transport in several regions present challenges to rail expansion, indirectly limiting the demand for ties. In emerging economies, governments usually prioritize airport and road infrastructure over railway upgrades. This trend has recently been observed in Brazil, where the 2024 budget allocations favored road networks over rail. A reduced emphasis on railway development translates into sluggish growth in railroad tie demand.

Railroad Tie Market: Opportunities

How do advancements in composite tie technology present favorable prospects for the railroad tie market expansion?

The development of composite ties made of recycled resins and plastics presents significant opportunities in the railroad tie industry. Composite ties are resistant to pests, rot, and weather damage, increasing their eco-friendliness and durability.

According to 2024 reports, composite tie adoption is growing at a CAGR of more than 7%, mainly in Europe and North America. Recent projects in the United States have begun using composite ties on tunnels and bridges, where moisture resistance is a crucial factor. This advancement supports the global sustainability goals and offers fresh markets for advanced tie materials.

Railroad Tie Market: Challenges

Environmental challenges and climate change restrict the market growth

Extreme weather conditions, such as wildfires, heatwaves, and flooding, significantly damage rail infrastructure, including ties. Wooden ties are mainly susceptible to fire and rot, while concrete ties may crack due to thermal stress. According to the OECD (2024), worldwide climate-related rail damages are projected to increase by 20% by 2030.

In July 2023, heatwaves in Italy and Spain led to speed limitations on high-speed lines due to track stress, underscoring the susceptibility of tie materials to extreme temperatures. Climate uncertainty makes long-term durability planning a vital challenge.

Railroad Tie Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Railroad Tie Market |

| Market Size in 2024 | USD 5.74 Billion |

| Market Forecast in 2034 | USD 8.03 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 215 |

| Key Companies Covered | Stella-Jones Inc., Koppers Holdings Inc., Vossloh AG, TieTek LLC, Gross & Janes Co., Tank Fab Inc., Nisus Corporation, Pandrol Limited, IntegriCo Composites, Axion Structural Innovations LLC, American TieTek LLC, Appalachian Timber Services, Skanska AB, BSW Timber Ltd., BRIDON International Ltd., and others. |

| Segments Covered | By Tie Type, By Train Type, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Railroad Tie Market: Segmentation

The global railroad tie market is segmented based on tie type, train type, application, distribution channel, and region.

Based on type, the global railroad tie industry is divided into wood tie, concrete tie, composite/plastic tie, and steel tie. The concrete tie segment held a dominant share of the market, as it offers optimal durability, a longer service life, and a high-load bearing capacity, thereby increasing its preference for heavy-haul and high-speed railway projects.

On the other hand, the wood tie segment holds a second-leading share due to its low initial installation cost, ease of replacement for existing tracks, and continued use in maintenance, primarily in developing regions.

Based on train type, the global market is segmented into passenger and freight trains. The freight trains segment holds a leadership position in the market, as they require more durable and stronger ties to withstand heavy axle loads and continuous use, particularly in long-haul bulk goods transportation.

Conversely, the passenger type segment holds a second rank, fueled by investments in light rail, metro, and high-speed rail projects, which demand modernized tie design for speed, safety, and comfort.

Based on application, the global railroad tie market is segmented into tangent, bridges, tunnels, and turnouts. The tangent segment holds a substantial share, as it covers the maximum railway networks globally and requires a large volume of ties for both regular maintenance and new construction.

Nonetheless, the turnout segment holds a second-leading position, as these junction points experience more wear and stress, demanding durable and specialized ties to ensure safe switching operations and network efficacy.

Based on the distribution channel, the global market is segmented into direct sales and indirect sales. The direct sales segment captures the maximum market share, as large railway operators and government agencies prefer to deal directly with manufacturers for bulk orders, ensuring cost-effectiveness and quality control.

However, the second-largest share is held by the indirect sales segment, which is fueled by contractors and distributors that cater to maintenance services, smaller projects, and areas where manufacturers have a limited direct presence.

Railroad Tie Market: Regional Analysis

What gives North America a competitive edge in the global Railroad Tie Market?

North America is projected to maintain its dominant position in the global railroad tie market due to its extensive rail network, the dominance of freight rail, and high maintenance and replacement cycles. North America, led by the U.S, holds the leading rail networks worldwide. This vast infrastructure needs a continuous supply of railroads for new construction and replacements. The size of the ecosystem promises continuous and high-volume demand.

Moreover, the U.S. railroad carries approximately 40% of the long-distance freight volume and moves around 1.7 billion tons of goods annually. Heavy freight movement needs durable railroad ties to manage the high axle loads. This dominance is a key propeller of tie consumption in North America. Additionally, on average, 10-20 million ties are replaced every year in the United States to maintain track safety and efficacy. Heavy train use and aging infrastructure augment replacement demand. This recurring need supports regional dominance worldwide.

The Asia Pacific region maintains its position as the second-largest in the global railroad tie industry, driven by expanding rail infrastructure, high-speed rail development, and rapid urban transit expansion. Asia Pacific has been heavily investing in novel rail networks to support urbanization and economic growth. China alone operates the world's leading rail network, surpassing 150,000 km, with the ongoing development of passenger and freight lines. These large-scale projects fuel the demand for these ties.

Furthermore, Japan and China are global leaders in high-speed rail, with China operating over 45,000 kilometers of high-speed rail lines as of 2023. Southeast Asian countries and India are also using bullet train projects. These developments require composite ties and premium-quality concrete, driving industry growth. Additionally, megacities in the APAC region, such as Delhi, Tokyo, Jakarta, and Beijing, are expanding their light rail and metro systems. This urban transit growth raises demand for specialized railroad ties.

Railroad Tie Market: Competitive Analysis

The leading players in the global railroad tie market are:

- Stella-Jones Inc.

- Koppers Holdings Inc.

- Vossloh AG

- TieTek LLC

- Gross & Janes Co.

- Tank Fab Inc.

- Nisus Corporation

- Pandrol Limited

- IntegriCo Composites

- Axion Structural Innovations LLC

- American TieTek LLC

- Appalachian Timber Services

- Skanska AB

- BSW Timber Ltd.

- BRIDON International Ltd.

Railroad Tie Market: Key Market Trends

Shift toward composite and concrete ties:

Rail operators are primarily using composite/plastic and concrete ties due to their high load-bearing capacity, longer lifespan, and lower maintenance requirements compared to wood. For instance, concrete lasts up to 50 years, almost double that of wood, transforming procurement tactics worldwide.

Integration of smart monitoring technologies:

Digitization is entering track management via predictive analytics and IoT sensors integrated into railway infrastructure. These systems help to monitor tie performance, extend service life, and detect wear. The adoption of smart maintenance solutions presents key opportunities for value-added services and advanced tie designs.

The global railroad tie market is segmented as follows:

By Tie Type

- Wood Tie

- Concrete Tie

- Composite/Plastic Tie

- Steel Tie

By Train Type

- Passenger Type

- Freight Trains

By Application

- Tangent

- Bridges

- Tunnels

- Turnouts

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Railroad ties, also known as sleepers, are rectangular support structures laid upright on the rails of a railway track to stabilize them in place and maintain the correct gauge. Traditionally made from wood, they are also manufactured from concrete, composite materials, and steel to enhance resistance to weathering and increase durability.

The global railroad tie market is projected to grow due to the replacement and maintenance of aging rail infrastructure, the use of eco-friendly materials, and a focus on sustainability, as well as the rise of high-speed rail projects.

According to study, the global railroad tie market size was worth around USD 5.74 billion in 2024 and is predicted to grow to around USD 8.03 billion by 2034.

The CAGR value of the railroad tie market is expected to be approximately 4.30% from 2025 to 2034.

The tangent application area is expected to offer significant growth opportunities in the railroad tie market, as it comprises a substantial share of rail networks, requiring large-scale maintenance and continuous installation.

The value chain of the global railroad tie industry includes manufacturing, raw material sourcing, distribution, treatment/processing, installation, and maintenance/replacement services.

North America is expected to lead the global railroad tie market during the forecast period.

The key players profiled in the global railroad tie market include Stella-Jones Inc., Koppers Holdings Inc., Vossloh AG, TieTek LLC, Gross & Janes Co., Tank Fab, Inc., Nisus Corporation, Pandrol Limited, IntegriCo Composites, Axion Structural Innovations LLC, American TieTek LLC, Appalachian Timber Services, Skanska AB, BSW Timber Ltd., and BRIDON International Ltd.

Leading players in the railroad tie market are adopting strategic initiatives, including capacity expansions, mergers & acquisitions, investments in eco-friendly materials, partnerships with rail operators, and the modernization of smart monitoring and advanced composite tie solutions.

The report examines key aspects of the railroad tie market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed